english,

... could deduct the interest from their taxable income. This implied that all homeowners incurred a financial risk. The risk was shared by more than 22 million Americans, who in the period 2005-2007 bought new or old homes and lost a significant part of their initial investment, after “housing bubble” ...

... could deduct the interest from their taxable income. This implied that all homeowners incurred a financial risk. The risk was shared by more than 22 million Americans, who in the period 2005-2007 bought new or old homes and lost a significant part of their initial investment, after “housing bubble” ...

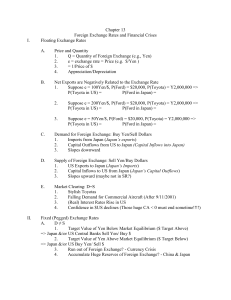

Chapter 13 - Montana State University

... High interest rates in US (Volcker disinflation) LDCs burdened by high oil import costs Plunging (other) commodity prices Widespread defaults: Negotiations; repay 30 cents on the dollar ...

... High interest rates in US (Volcker disinflation) LDCs burdened by high oil import costs Plunging (other) commodity prices Widespread defaults: Negotiations; repay 30 cents on the dollar ...

ARE INVESTORS MORE HOMO SAPIENS RATHER

... Bobbin put in an article in Forex Trading Currency “The housing market began to collapse in 2005 and 2006 when defaults started to increase on subprime and adjustable rate mortgages. When hedge funds went belly-up and banks started to report large write-downs, it turned into a Wall Street crisis in ...

... Bobbin put in an article in Forex Trading Currency “The housing market began to collapse in 2005 and 2006 when defaults started to increase on subprime and adjustable rate mortgages. When hedge funds went belly-up and banks started to report large write-downs, it turned into a Wall Street crisis in ...

9.2. International Financial Management

... How professional you are, and how much care and attention you give to what you do. To answer a question effectively, address the question directly, bring important related issues into the discussion, refer to sources, and indicate how principles from the course materials apply. You must also be able ...

... How professional you are, and how much care and attention you give to what you do. To answer a question effectively, address the question directly, bring important related issues into the discussion, refer to sources, and indicate how principles from the course materials apply. You must also be able ...

FRBSF E L CONOMIC

... developing country). If the two countries are precluded from trading in international capital markets, the country with weaker contract enforcement has a larger amount of precautionary savings than the other.The large supply of these savings tends to depress the developing country’s interest rate re ...

... developing country). If the two countries are precluded from trading in international capital markets, the country with weaker contract enforcement has a larger amount of precautionary savings than the other.The large supply of these savings tends to depress the developing country’s interest rate re ...

Strategic Considerations

... The perilous fiscal position of the world’s major economies is well known and, to varying degrees remedial measures are being applied; though whether they can all be applied in unison is extremely doubtful. Nowhere is the need for structural reform more acute than in the Euro-Zone. It is highly like ...

... The perilous fiscal position of the world’s major economies is well known and, to varying degrees remedial measures are being applied; though whether they can all be applied in unison is extremely doubtful. Nowhere is the need for structural reform more acute than in the Euro-Zone. It is highly like ...

Neoliberalism and the global financial crisis - Research Online

... decimated. The aim was for governments to be responsible for little more than law and order and national defence (Williamson 1994, 17). Nations following IMF prescriptions did not prosper: ‘the majority of those nations that have followed the IMF’s advice have experienced profound economic crises: l ...

... decimated. The aim was for governments to be responsible for little more than law and order and national defence (Williamson 1994, 17). Nations following IMF prescriptions did not prosper: ‘the majority of those nations that have followed the IMF’s advice have experienced profound economic crises: l ...

MS Word Version

... The recent items by Foster that I’ve read about the current crisis (including the last chapter of his recent book on the crisis, written with Fred Magdoff) do focus mostly on its financial aspects. I think this is already wrong, because the financial crisis—though the most prominent aspect of the o ...

... The recent items by Foster that I’ve read about the current crisis (including the last chapter of his recent book on the crisis, written with Fred Magdoff) do focus mostly on its financial aspects. I think this is already wrong, because the financial crisis—though the most prominent aspect of the o ...

The International Spillover effects of pension finance in an EMU

... idiosyncratic risk also show a more positive value tilt ...

... idiosyncratic risk also show a more positive value tilt ...

1 The Crisis ‐Herman E. Daly The current financial debacle is really

... assets have grown by a large multiple of the real economy—paper exchanging for paper is now 20 times greater than exchanges of paper for real commodities. It should be no surprise that the relative value of the vastly more abundant financial assets has fallen in terms of real assets. Real wealth ...

... assets have grown by a large multiple of the real economy—paper exchanging for paper is now 20 times greater than exchanges of paper for real commodities. It should be no surprise that the relative value of the vastly more abundant financial assets has fallen in terms of real assets. Real wealth ...

Financial literacy in aiwan

... 2013 GDP: US$20,958 per capita 2013 CPI Change Rate: 0.79% 2014 Jan. Unemployment Rate: 4.02% 2014 Jan. Foreign Exchange Reserve: US$ 416.94 Billion, Ranked 4th Worldwide ...

... 2013 GDP: US$20,958 per capita 2013 CPI Change Rate: 0.79% 2014 Jan. Unemployment Rate: 4.02% 2014 Jan. Foreign Exchange Reserve: US$ 416.94 Billion, Ranked 4th Worldwide ...

Overview of Financial Planning

... a. your personal/family balance sheet: Assets - Liabilities = Net Worth > the critical first step > exceedingly difficult for some b. an honest assessment of how money is earned and spent in the personal/family setting over a short- and long-term basis. c. realistic expectations regarding job securi ...

... a. your personal/family balance sheet: Assets - Liabilities = Net Worth > the critical first step > exceedingly difficult for some b. an honest assessment of how money is earned and spent in the personal/family setting over a short- and long-term basis. c. realistic expectations regarding job securi ...

Safeguarding Financial Stability in a Diverging Global Economy Joon-Ho Hahm Bank of Korea

... 2-A Corporate Credit/GDP ...

... 2-A Corporate Credit/GDP ...

Country Risk Analysis and Managing Crises: Tower Associates

... Country D is a large developing economy, well-endowed with natural resources but lacking the economic infrastructure needed to capitalize on its wealth efficiently. The economy is moving in the direction of a market economy and is very entrepreneurial with wide disparity in income distribution. Cons ...

... Country D is a large developing economy, well-endowed with natural resources but lacking the economic infrastructure needed to capitalize on its wealth efficiently. The economy is moving in the direction of a market economy and is very entrepreneurial with wide disparity in income distribution. Cons ...

Lecture 11

... • Inflation expectations – some argue that QE may result in higher inflation in future (but not as yet) • Financial cycle – prolonged QE and low interest rates may sow the seeds for the next asset bubble • Excess reserves – during crisis and due to QE banks hold large excess reserves in the CB, this ...

... • Inflation expectations – some argue that QE may result in higher inflation in future (but not as yet) • Financial cycle – prolonged QE and low interest rates may sow the seeds for the next asset bubble • Excess reserves – during crisis and due to QE banks hold large excess reserves in the CB, this ...