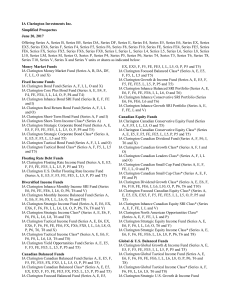

IA Clarington Investments Inc. Simplified Prospectus June 20, 2017

... Series T10, Series V, Series X and Series Y units or shares as indicated below: Money Market Funds IA Clarington Money Market Fund (Series A, B, DA, DF, F, I, L, O and X) Fixed Income Funds IA Clarington Bond Fund (Series A, F, I, L, O and X) IA Clarington Core Plus Bond Fund (Series A, E, E4, F, F4 ...

... Series T10, Series V, Series X and Series Y units or shares as indicated below: Money Market Funds IA Clarington Money Market Fund (Series A, B, DA, DF, F, I, L, O and X) Fixed Income Funds IA Clarington Bond Fund (Series A, F, I, L, O and X) IA Clarington Core Plus Bond Fund (Series A, E, E4, F, F4 ...

TETRA TECHNOLOGIES INC (Form: 10-K, Received

... The Fluids Division provides both stock and custom-blended CBFs based on our customers’ specific needs and the proposed application. We also provide a broad range of associated services, including onsite fluids filtration, handling and recycling; wellbore cleanup; fluid engineering consultation; fl ...

... The Fluids Division provides both stock and custom-blended CBFs based on our customers’ specific needs and the proposed application. We also provide a broad range of associated services, including onsite fluids filtration, handling and recycling; wellbore cleanup; fluid engineering consultation; fl ...

words - Nasdaq`s INTEL Solutions

... We are a specialty finance company that provides debt and equity growth capital to technology-related and life sciences companies at all stages of development. We primarily finance privately-held companies backed by leading venture capital and private equity firms and also may invest in select publi ...

... We are a specialty finance company that provides debt and equity growth capital to technology-related and life sciences companies at all stages of development. We primarily finance privately-held companies backed by leading venture capital and private equity firms and also may invest in select publi ...

Zvi Wiener slide 1

... A bond is a contract, paid up-front that yields a known amount at a known date (maturity). The bond may pay a dividend (coupon) at fixed times during the life. ...

... A bond is a contract, paid up-front that yields a known amount at a known date (maturity). The bond may pay a dividend (coupon) at fixed times during the life. ...

The Malta Alternative Investment Funds

... such purpose by the manager and the custodian of such an AIF. They are not deemed to be a separate legal entity since they are established through a contractual obligation and can be licensed as a multi-fund or multi-class AIF. A contractual fund may set up one or more special purpose vehicle, which ...

... such purpose by the manager and the custodian of such an AIF. They are not deemed to be a separate legal entity since they are established through a contractual obligation and can be licensed as a multi-fund or multi-class AIF. A contractual fund may set up one or more special purpose vehicle, which ...

pinnacle foods finance llc form 10-k

... projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs and projections will result or be achieved and actual results may vary materially from what is expressed in or indicated by the forw ...

... projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs and projections will result or be achieved and actual results may vary materially from what is expressed in or indicated by the forw ...

Mind the gap: the arms length principle and MNE value

... MNE economic rent. The paper looks at the sources of economic rent in general, and then examines in detail the impact on economic rent of operating as a MNE by way of controlled subsidiaries rather than through independent or uncontrolled entities. The paper then examines the impact of the recent wo ...

... MNE economic rent. The paper looks at the sources of economic rent in general, and then examines in detail the impact on economic rent of operating as a MNE by way of controlled subsidiaries rather than through independent or uncontrolled entities. The paper then examines the impact of the recent wo ...

JP Morgan Structured Products BV JPMorgan Chase Bank, National

... This document includes particulars given in compliance with the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the Stock Exchange’s Listing Rules) for the purpose of giving information with regard to the issuer, the guarantor and the warrants referred to in thi ...

... This document includes particulars given in compliance with the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the Stock Exchange’s Listing Rules) for the purpose of giving information with regard to the issuer, the guarantor and the warrants referred to in thi ...

Managerial Risk-Taking and CEO Excess Compensation

... stream of literature discussed above by identifying a new determinant of CEO excess compensation and by explaining the impacts of CEO risk taking on their compensation. To the best of our knowledge, this is the first study conducting an in-depth examination of CEO compensation in general and excess ...

... stream of literature discussed above by identifying a new determinant of CEO excess compensation and by explaining the impacts of CEO risk taking on their compensation. To the best of our knowledge, this is the first study conducting an in-depth examination of CEO compensation in general and excess ...

NEWMONT MINING CORP /DE/ (Form: 10-K/A

... Merchant Banking manages Newmont’s royalty portfolio. Royalties generally offer a natural hedge against lower gold prices by providing free cash flow from assets with limited operating, capital or environmental risk, while retaining upside exposure to further exploration discoveries and reserve expa ...

... Merchant Banking manages Newmont’s royalty portfolio. Royalties generally offer a natural hedge against lower gold prices by providing free cash flow from assets with limited operating, capital or environmental risk, while retaining upside exposure to further exploration discoveries and reserve expa ...

Common KIM Old File January 2017.cdr

... information, which a prospective investor ought to know before investing. For further details of the scheme/Mutual Fund, due diligence certificate by the AMC, Key Personnel, Investor’s rights & services, risk factors, penalties & pending litigations etc. investors should, before investment, refer to ...

... information, which a prospective investor ought to know before investing. For further details of the scheme/Mutual Fund, due diligence certificate by the AMC, Key Personnel, Investor’s rights & services, risk factors, penalties & pending litigations etc. investors should, before investment, refer to ...

In Re The Bear Stearns Companies, Inc. Securities, Derivative, And

... AAG: AICPA Industry Audit and Accounting Guides. AAM: AICPA’s annual Audit and Accounting Manual. ABS: Asset-backed securities. ABS CDOs: Asset-backed collateralized debt obligations-related investments. ABX: An index that tracked synthesized subprime mortgage performance, refinancing opportunities, ...

... AAG: AICPA Industry Audit and Accounting Guides. AAM: AICPA’s annual Audit and Accounting Manual. ABS: Asset-backed securities. ABS CDOs: Asset-backed collateralized debt obligations-related investments. ABX: An index that tracked synthesized subprime mortgage performance, refinancing opportunities, ...

AON CORP (Form: 10-K, Received: 03/11/2004 16

... Insurance Underwriting provides specialty insurance products, including supplemental accident, health and life insurance; credit life, accident and health insurance; extended warranty products, and select property and casualty insurance products and services. Our clients include corporations and bus ...

... Insurance Underwriting provides specialty insurance products, including supplemental accident, health and life insurance; credit life, accident and health insurance; extended warranty products, and select property and casualty insurance products and services. Our clients include corporations and bus ...

QIS4 Technical Specifications

... Study (QIS4), which the European Commission has asked CEIOPS to run between April and July 2008 in the frame of the development of potential future level 2 implementing measures for the Solvency II Directive Proposal. The reporting date to be used by all participants should be end December 2007. Whe ...

... Study (QIS4), which the European Commission has asked CEIOPS to run between April and July 2008 in the frame of the development of potential future level 2 implementing measures for the Solvency II Directive Proposal. The reporting date to be used by all participants should be end December 2007. Whe ...

ONCOR ELECTRIC DELIVERY CO LLC (Form: 10-K

... FERC. We are not a seller of electricity, nor do we purchase electricity for resale. The company is managed as an integrated business; consequently, there are no reportable segments. Our transmission and distribution assets are located principally in the north-central, eastern and western parts of T ...

... FERC. We are not a seller of electricity, nor do we purchase electricity for resale. The company is managed as an integrated business; consequently, there are no reportable segments. Our transmission and distribution assets are located principally in the north-central, eastern and western parts of T ...

pennantpark investment corporation

... SBA-eligible businesses that meet the investment selection criteria used by PennantPark Investment. Our Investment Adviser and Administrator We utilize the investing experience and contacts of PennantPark Investment Advisers in developing what we believe is an attractive and diversified portfolio. T ...

... SBA-eligible businesses that meet the investment selection criteria used by PennantPark Investment. Our Investment Adviser and Administrator We utilize the investing experience and contacts of PennantPark Investment Advisers in developing what we believe is an attractive and diversified portfolio. T ...

Information effect of entry into credit ratings market

... sufficient to discipline CRAs only when a large fraction of their incomes come from rating simple assets. Benabou and Laroque (1992) analyze the incentives of an intermediary to manipulate information when the intermediary also acts as a speculator on the market. When intermediaries compete for client ...

... sufficient to discipline CRAs only when a large fraction of their incomes come from rating simple assets. Benabou and Laroque (1992) analyze the incentives of an intermediary to manipulate information when the intermediary also acts as a speculator on the market. When intermediaries compete for client ...

united states securities and exchange commission - corporate

... References in this report to “we,” “our,” “us” and “the company” are to Oncor and or/its subsidiary as apparent in the context. See “Glossary” on page 3 for definition of terms and abbreviations. Overview of Oncor We are a regulated electricity transmission and distribution company that provides the ...

... References in this report to “we,” “our,” “us” and “the company” are to Oncor and or/its subsidiary as apparent in the context. See “Glossary” on page 3 for definition of terms and abbreviations. Overview of Oncor We are a regulated electricity transmission and distribution company that provides the ...

Amended Complaint

... Evidence from the Bank’s review of loan files further indicates that EMC Mortgage Corporation and Bear Stearns Residential Mortgage abandoned their stated underwriting guidelines.......................................... 145 ...

... Evidence from the Bank’s review of loan files further indicates that EMC Mortgage Corporation and Bear Stearns Residential Mortgage abandoned their stated underwriting guidelines.......................................... 145 ...