Market Insights - Quarterly outlook

... The first quarter was a remarkable one for equities. After solid returns in 2016, global equities continued to rally, rising by almost 7%. Even more unusually, these returns have been delivered with record low volatility. Starting in October, the S&P 500 saw not a single day with a decline greater t ...

... The first quarter was a remarkable one for equities. After solid returns in 2016, global equities continued to rally, rising by almost 7%. Even more unusually, these returns have been delivered with record low volatility. Starting in October, the S&P 500 saw not a single day with a decline greater t ...

Banking - comuf.com

... then lending out this money in order to earn a profit. • Is the engaging in the business of keeping money for savings and checking accounts or for exchange or for issuing loans and credit. ...

... then lending out this money in order to earn a profit. • Is the engaging in the business of keeping money for savings and checking accounts or for exchange or for issuing loans and credit. ...

official - Government Printing Press

... (b) branches oUhe State Bank of India and its Associates as per -II. In case,for any particular issue, the receiving office/s is/are restricted to centres, irwill be armouncedas part of SpeCific Loan Notification. Oi) FIls, NRIs and Qverseas Corporate bodies predominantly owned should submit their a ...

... (b) branches oUhe State Bank of India and its Associates as per -II. In case,for any particular issue, the receiving office/s is/are restricted to centres, irwill be armouncedas part of SpeCific Loan Notification. Oi) FIls, NRIs and Qverseas Corporate bodies predominantly owned should submit their a ...

Fixed Income Municipal Bonds

... municipal securities must be included in calculating the tax. In most states, interest income from securities issued by governmental entities within the state is also exempt from state and local taxes for residents of that state. In addition, interest income from securities issued by U.S. territorie ...

... municipal securities must be included in calculating the tax. In most states, interest income from securities issued by governmental entities within the state is also exempt from state and local taxes for residents of that state. In addition, interest income from securities issued by U.S. territorie ...

Decision of the HDAT Council Management No 70/27.2.2015

... authorised to bind it (together with the authorisation documents and any professional certification documents of relevant staff). 5. Financial information on the applicant (capital adequacy data, together with the balance sheets for at least the last two years). 6. A document stating the Clearing Sy ...

... authorised to bind it (together with the authorisation documents and any professional certification documents of relevant staff). 5. Financial information on the applicant (capital adequacy data, together with the balance sheets for at least the last two years). 6. A document stating the Clearing Sy ...

Form: 6-K, Received: 02/26/2016 18:51:31

... or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding the anticipated effect of the Financing transactions on the Company’s operations and financial condition) are forward-looking statements. These forwa ...

... or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding the anticipated effect of the Financing transactions on the Company’s operations and financial condition) are forward-looking statements. These forwa ...

- SlideBoom

... DP’s office at least 24 hours before the pay-in, failing which, DP will accept the instruction only at the BO’s risk. ETF An ETF is a basket of securities that is traded on the stock exchange, akin to a stock. So, unlike conventional mutual funds, ETFs are listed on a recognised stock exchange. Thei ...

... DP’s office at least 24 hours before the pay-in, failing which, DP will accept the instruction only at the BO’s risk. ETF An ETF is a basket of securities that is traded on the stock exchange, akin to a stock. So, unlike conventional mutual funds, ETFs are listed on a recognised stock exchange. Thei ...

table of contents - Napa County

... BENCHMARK: A comparative base for measuring the performance or risk tolerance of the investment portfolio. A benchmark should represent a close correlation to the level of risk and the average duration of the portfolio’s investments. BID: The price offered by a buyer of securities (when you are sell ...

... BENCHMARK: A comparative base for measuring the performance or risk tolerance of the investment portfolio. A benchmark should represent a close correlation to the level of risk and the average duration of the portfolio’s investments. BID: The price offered by a buyer of securities (when you are sell ...

Political economy of debt

... (in the hands of professional investors, highly volatile, increasingly speculative, bent on high yields) – plus corollaries DSWs • Public credit (hence: money in circulation and in reserve) has become dependent upon contemporary financial markets • The stable cornerstone of the financial markets as ...

... (in the hands of professional investors, highly volatile, increasingly speculative, bent on high yields) – plus corollaries DSWs • Public credit (hence: money in circulation and in reserve) has become dependent upon contemporary financial markets • The stable cornerstone of the financial markets as ...

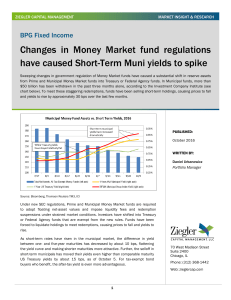

Changes In Money Market Fund Regulations

... short-term municipals has moved their yields even higher than comparable maturity US Treasury yields by about 15 bps, as of October 5. For tax-exempt bond buyers who benefit, the after-tax yield is even more advantageous. ...

... short-term municipals has moved their yields even higher than comparable maturity US Treasury yields by about 15 bps, as of October 5. For tax-exempt bond buyers who benefit, the after-tax yield is even more advantageous. ...

RBC Dain Rauscher Inc

... method over estimated useful lives of two to eight years. Leasehold improvements are amortized over the lesser of the estimated useful life of the improvement or the term of the lease. Construction in process is not depreciated until the project is complete, at which time the amounts are transferred ...

... method over estimated useful lives of two to eight years. Leasehold improvements are amortized over the lesser of the estimated useful life of the improvement or the term of the lease. Construction in process is not depreciated until the project is complete, at which time the amounts are transferred ...

T7- Bonds

... •Bonds are also called fixed-income securities because the cash flow from them is fixed. •Stocks are equity; bonds are debt. •The key reason to purchase bonds is to diversify your portfolio. •The issuers of bonds are governments and corporations. •A bond is characterized by its face value, coupon ra ...

... •Bonds are also called fixed-income securities because the cash flow from them is fixed. •Stocks are equity; bonds are debt. •The key reason to purchase bonds is to diversify your portfolio. •The issuers of bonds are governments and corporations. •A bond is characterized by its face value, coupon ra ...

Supervisor title - BC Public Service

... To monitor the performance and risk of the province’s debt portfolio utilizing current resources/procedures as well as investigating new risk measurement techniques for liability management. Provide recommendations for the development and monitoring of risk initiatives; assess and make recommendatio ...

... To monitor the performance and risk of the province’s debt portfolio utilizing current resources/procedures as well as investigating new risk measurement techniques for liability management. Provide recommendations for the development and monitoring of risk initiatives; assess and make recommendatio ...

Liquidity Coverage Ratio Completion Guide

... Where derivative payments are collateralized by eligible liquid assets, outflows should be calculated net of any corresponding inflows that would result from contractual obligations for collateral to be provided to the credit union; this is conditioned on the credit union being legally entitled and ...

... Where derivative payments are collateralized by eligible liquid assets, outflows should be calculated net of any corresponding inflows that would result from contractual obligations for collateral to be provided to the credit union; this is conditioned on the credit union being legally entitled and ...

Investments: Analysis and Management, Second Canadian

... • Designed to protect a bond (fixed income) portfolio against interest rate risk, both (1) Reinvestment risk and (2) Price Risk • Match your desired holding period with the duration (not maturity) of your bond portfolio. • Note: Duration (portfolio) is the weighted average of the individual bond’s d ...

... • Designed to protect a bond (fixed income) portfolio against interest rate risk, both (1) Reinvestment risk and (2) Price Risk • Match your desired holding period with the duration (not maturity) of your bond portfolio. • Note: Duration (portfolio) is the weighted average of the individual bond’s d ...

Montshire Advisors` Federal Home Loan Bank Program White Paper

... FHLB stock is nonmarketable and redeemed at par by each regional bank. Members may redeem excess activity stock or terminate membership by redeeming all of their membership stock after a notice period, which is typically five years. Historically, the FHLBs would redeem excess stock without regard to ...

... FHLB stock is nonmarketable and redeemed at par by each regional bank. Members may redeem excess activity stock or terminate membership by redeeming all of their membership stock after a notice period, which is typically five years. Historically, the FHLBs would redeem excess stock without regard to ...

Investment Portfolio

... Liabilities hedge - continue • The gap between assets and liabilities - 2 If liabilities duration is longer than assets’, and if effective duration matters, the duration gap will cause HUGE under-reserve. • Derivative will help – for example, receive fixed IRS could extend assets duration • However ...

... Liabilities hedge - continue • The gap between assets and liabilities - 2 If liabilities duration is longer than assets’, and if effective duration matters, the duration gap will cause HUGE under-reserve. • Derivative will help – for example, receive fixed IRS could extend assets duration • However ...