Presentation on Unsecured Personal Loan (UPL) Market

... Terms of reference: The objective of the research undertaken is to determine the factors that are causing the increase in unsecured personal loans (from both the supply and demand side perspectives) and the implications thereof for consumers, credit providers and the credit industry. This was design ...

... Terms of reference: The objective of the research undertaken is to determine the factors that are causing the increase in unsecured personal loans (from both the supply and demand side perspectives) and the implications thereof for consumers, credit providers and the credit industry. This was design ...

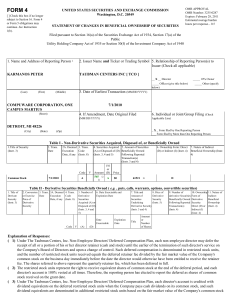

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... and the number of restricted stock units received equals the deferred retainer fee divided by the fair market value of the Company's common stock on the business day immediately before the date the director would otherwise have been entitled to receive the retainer fee. The shares referred to above ...

... and the number of restricted stock units received equals the deferred retainer fee divided by the fair market value of the Company's common stock on the business day immediately before the date the director would otherwise have been entitled to receive the retainer fee. The shares referred to above ...

Factor: corporate indebtedness and lack of equity

... Despite of low IR and adequate banks liquidity and funding condition, there is still slow recovery in creditworthiness credit demands of corporate sector: – In 2015 the IR for corporate loans up to € 1 mil converge to EA average value. – However, the structure of credit demand was still modestly und ...

... Despite of low IR and adequate banks liquidity and funding condition, there is still slow recovery in creditworthiness credit demands of corporate sector: – In 2015 the IR for corporate loans up to € 1 mil converge to EA average value. – However, the structure of credit demand was still modestly und ...

securities trading policy

... one of the 4 week periods specified in paragraph 4.1; and ii) where the exercise price of options is being provided by a margin loan or other form of lending arrangement, then there may be a risk that the employee or Director may need to sell shares to avoid providing additional capital or security ...

... one of the 4 week periods specified in paragraph 4.1; and ii) where the exercise price of options is being provided by a margin loan or other form of lending arrangement, then there may be a risk that the employee or Director may need to sell shares to avoid providing additional capital or security ...

Community Development Bank Peer Group Analysis Methodology

... are tracked over time. The peer group analysis is conducted annually and incorporates data from 2005 to the date of the analysis. The peer group of CDBs consists of banks that were in existence from the start date of the analysis and continue to be in existence as of the end date. For example, the 2 ...

... are tracked over time. The peer group analysis is conducted annually and incorporates data from 2005 to the date of the analysis. The peer group of CDBs consists of banks that were in existence from the start date of the analysis and continue to be in existence as of the end date. For example, the 2 ...

DEBT - Association for Financial Professionals of Arizona

... is an affiliate within the UMB Financial Corporation. This report is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. Statements in this report are based on the opinions of UMB Capital Markets and the information av ...

... is an affiliate within the UMB Financial Corporation. This report is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. Statements in this report are based on the opinions of UMB Capital Markets and the information av ...

AIF_Sponsor Based Leveraged Acquisition June 2010

... This information has been prepared solely for informational purposes and is not intended to provide or should not be relied upon for accounting, legal, tax, or investment advice. The factual statements herein have been taken from sources believed to be reliable, but such statements are made without ...

... This information has been prepared solely for informational purposes and is not intended to provide or should not be relied upon for accounting, legal, tax, or investment advice. The factual statements herein have been taken from sources believed to be reliable, but such statements are made without ...

countrywide financial corporation and the subprime mortgage

... Freddie Mac which combined conforming loans with Mortgage Backed Securities and sold shares to those portfolios ...

... Freddie Mac which combined conforming loans with Mortgage Backed Securities and sold shares to those portfolios ...

EIB GEEREF and REPIN ppt

... and index-linked cash flows from operational RE projects Regulatory changes (Basel III & Solvency II) should lead to shorter debt tenors and earlier RE refinancing requirements ...

... and index-linked cash flows from operational RE projects Regulatory changes (Basel III & Solvency II) should lead to shorter debt tenors and earlier RE refinancing requirements ...

Slices - personal.kent.edu

... major component of finance companies’ assets • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt expense and administrative costs of home equity loans a ...

... major component of finance companies’ assets • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt expense and administrative costs of home equity loans a ...

SECURITIES TRADING POLICY

... written clearance has been provided in accordance with procedures set out in this Policy. ...

... written clearance has been provided in accordance with procedures set out in this Policy. ...

Module C - Treasury Management

... foreign exchange by the bank. In other words, the nostro account of the bank would already have been credited. The rate is calculated by deducting from the inter-bank buying rate the exchange margin as determined by the Bank. ...

... foreign exchange by the bank. In other words, the nostro account of the bank would already have been credited. The rate is calculated by deducting from the inter-bank buying rate the exchange margin as determined by the Bank. ...

Brokers raise price targets following major new

... Proactive Investors is a publisher and is not registered with or authorised by the Financial Services Authority (FSA). You understand and agree that no content published constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitabl ...

... Proactive Investors is a publisher and is not registered with or authorised by the Financial Services Authority (FSA). You understand and agree that no content published constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitabl ...

Cash Flow Statement for the year ended 31st March, 2016

... OF ARRANGEMENT CLOSING CASH AND CASH EQUIVALENTS ...

... OF ARRANGEMENT CLOSING CASH AND CASH EQUIVALENTS ...

Business Department Course Choices

... field trip to Chester Country • Recommended for students who are interested in careers in law, criminal justice, public policy, and business-related careers ...

... field trip to Chester Country • Recommended for students who are interested in careers in law, criminal justice, public policy, and business-related careers ...

LIHTC Investor-Yield Opportunities and Obstacles

... September 8, 2010 and before January 1, 2012. Qualified property typically includes furniture, equipment (five-year tax life) and land improvements (15-year tax life). The ability to totally write off an asset that would otherwise be depreciated over five or 15 years significantly increases the Internal ...

... September 8, 2010 and before January 1, 2012. Qualified property typically includes furniture, equipment (five-year tax life) and land improvements (15-year tax life). The ability to totally write off an asset that would otherwise be depreciated over five or 15 years significantly increases the Internal ...

Vulnerabilities and Cyclical Macroprudential Policies

... Outline of paper We characterize the time series of measures of vulnerability and plausible macroprudential tools We estimate VAR models of the macroeconomy and monetary policy, augmented with our proxies for vulnerability and macroprudential policies We analyze the economy's response to shock ...

... Outline of paper We characterize the time series of measures of vulnerability and plausible macroprudential tools We estimate VAR models of the macroeconomy and monetary policy, augmented with our proxies for vulnerability and macroprudential policies We analyze the economy's response to shock ...

Housing Finance

... • Pre-building approval contract: is the sale which is carried out before the definitive building approval by the city government (Municipality). This contract is a legal promise that involves some form of a down payment by the buyer for the right to close the purchase and have the property title wh ...

... • Pre-building approval contract: is the sale which is carried out before the definitive building approval by the city government (Municipality). This contract is a legal promise that involves some form of a down payment by the buyer for the right to close the purchase and have the property title wh ...

Math 113A – Exam Review – Consumer Math

... The difference between what a person pays using an in store credit plan and what they could have paid with cash is called a ______________________________. All earnings is called _________________________. A government plan that pays people some money when they retire is called ____________________. ...

... The difference between what a person pays using an in store credit plan and what they could have paid with cash is called a ______________________________. All earnings is called _________________________. A government plan that pays people some money when they retire is called ____________________. ...