WB Credentials (Nov 09)

... Credit Derivatives (CDS) currently disallowed but in the process of being introduced with appropriate ...

... Credit Derivatives (CDS) currently disallowed but in the process of being introduced with appropriate ...

High earnings growth on low interest rates

... Loan-to-value did not continue to increase (56% in Q3) The second derivatives for value revisions have improved. In Q3, the value drop was only SEK 284m or 0.4%. Also, the value is down 4.5% YTD. We believe it is too early to say that values have reached a trough, but the risk of a 5%+ value drop fr ...

... Loan-to-value did not continue to increase (56% in Q3) The second derivatives for value revisions have improved. In Q3, the value drop was only SEK 284m or 0.4%. Also, the value is down 4.5% YTD. We believe it is too early to say that values have reached a trough, but the risk of a 5%+ value drop fr ...

Pilot Provisions on the Formation of Subsidiary Companies by

... 1. for the latest 12 months, all its risk control indicators have reached the prescribed standards and its net capital has been 120 million yuan or more; 2. it has a relatively strong operation and management capability, and, if it has set up a subsidiary company to operate securities brokerage, sec ...

... 1. for the latest 12 months, all its risk control indicators have reached the prescribed standards and its net capital has been 120 million yuan or more; 2. it has a relatively strong operation and management capability, and, if it has set up a subsidiary company to operate securities brokerage, sec ...

Looking Beyond the Fed for Clues on Interest Rates TH E

... for higher-income households. Tax cuts should help lower interest rates. The deductibility of interest paid on ...

... for higher-income households. Tax cuts should help lower interest rates. The deductibility of interest paid on ...

ConsumerMan Video for LifeSmarts 3: YOUR CREDIT REPORT

... Lesson Objective(s) Understand credit reporting agencies and the use of credit reports. Time 1 class period Background Credit bureaus store and sell data about your financial transactions. There are three big credit reporting agencies – Experian, Equifax and TransUnion. All sorts of companies send t ...

... Lesson Objective(s) Understand credit reporting agencies and the use of credit reports. Time 1 class period Background Credit bureaus store and sell data about your financial transactions. There are three big credit reporting agencies – Experian, Equifax and TransUnion. All sorts of companies send t ...

19 - Commercial Real Estate Analysis and Investment

... Thus, banks (depository institutions) seek short term assets (e.g., construction loans, consumer debt, S.T. business loans, lines of credit, comm.paper, etc.), or: • Assets that behave like S.T. assets regarding interest-rate risk (e.g., ARMs, long-term loans with adjustable rates such that ΔPV/ΔYT ...

... Thus, banks (depository institutions) seek short term assets (e.g., construction loans, consumer debt, S.T. business loans, lines of credit, comm.paper, etc.), or: • Assets that behave like S.T. assets regarding interest-rate risk (e.g., ARMs, long-term loans with adjustable rates such that ΔPV/ΔYT ...

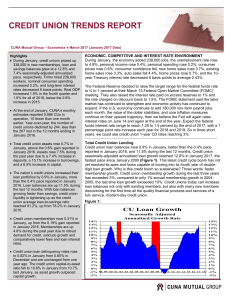

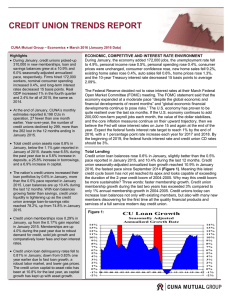

credit union trends report

... expand. If the U.S. economy continues to add 180,000 non-farm payroll jobs each month, the value of the dollar stabilizes, and core inflation measures continue on their upward trajectory, then we believe the Fed will again raise interest rates on June 14 and again at the end of the year. Expect the ...

... expand. If the U.S. economy continues to add 180,000 non-farm payroll jobs each month, the value of the dollar stabilizes, and core inflation measures continue on their upward trajectory, then we believe the Fed will again raise interest rates on June 14 and again at the end of the year. Expect the ...

Document

... Importance & benefits of international investors We estimate int’l investors account for 30-70% of the volume of the TA25 and TA100 Stocks with large int’l following typically trade on higher multiples Companies who consistently meet int’l investors are able to reduce risk of stock ...

... Importance & benefits of international investors We estimate int’l investors account for 30-70% of the volume of the TA25 and TA100 Stocks with large int’l following typically trade on higher multiples Companies who consistently meet int’l investors are able to reduce risk of stock ...

Helpful Comments: Excel Financial functions perform common

... b) How many years if interest is compounded yearly? c) How many years if interest is compounded quarterly? Problem #2: Sandra places $1000 in a savings account today and plans to invest $300 at the end of each quarter. Assume the bank pays 7.0% interest, compounded quarterly. a) How many quarters wi ...

... b) How many years if interest is compounded yearly? c) How many years if interest is compounded quarterly? Problem #2: Sandra places $1000 in a savings account today and plans to invest $300 at the end of each quarter. Assume the bank pays 7.0% interest, compounded quarterly. a) How many quarters wi ...

Synopsis - The Cordova Tutorial

... the American credit industry, and highlights the importance of both knowledge and behavior when it comes to managing money. Chapter 2. Saving Emphasizes the importance of saving and explains the three reasons to save: emergencies, large purchases, and wealth building. Chapter 3. Budgeting ...

... the American credit industry, and highlights the importance of both knowledge and behavior when it comes to managing money. Chapter 2. Saving Emphasizes the importance of saving and explains the three reasons to save: emergencies, large purchases, and wealth building. Chapter 3. Budgeting ...

March

... (Figure 10), below the 1% long run average. A three basis point increase in net interest margins was more than offset by a six basis point increase in loan loss provision expense. Credit unions with $1 billion in assets or greater increased their loan loss provisions by 9 basis points, moving from 0 ...

... (Figure 10), below the 1% long run average. A three basis point increase in net interest margins was more than offset by a six basis point increase in loan loss provision expense. Credit unions with $1 billion in assets or greater increased their loan loss provisions by 9 basis points, moving from 0 ...

Panel_2_-_Leslie_Seidman

... – Proposed clarifications of shortcut issues: – Trade date/settlement date differences: OK – Market conventions (rounding coupons) that result in slight premiums and discounts: OK – Hedges of other debt instruments whose carrying amount ≠ par (a.k.a. “late hedging”): NOT OK – Zero-coupon instruments ...

... – Proposed clarifications of shortcut issues: – Trade date/settlement date differences: OK – Market conventions (rounding coupons) that result in slight premiums and discounts: OK – Hedges of other debt instruments whose carrying amount ≠ par (a.k.a. “late hedging”): NOT OK – Zero-coupon instruments ...

Pricing models of covered bonds—a Nordic study

... practitioners, but they approach the default mechanism from different viewpoints. Structural models assume that the default is triggered when the assets of the company are less than the liabilities of the company, whereas the reduced form models take into account the probability of the default and t ...

... practitioners, but they approach the default mechanism from different viewpoints. Structural models assume that the default is triggered when the assets of the company are less than the liabilities of the company, whereas the reduced form models take into account the probability of the default and t ...

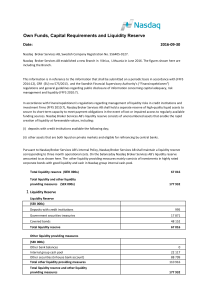

Own Funds, Capital Requirements and Liquidity Reserve

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

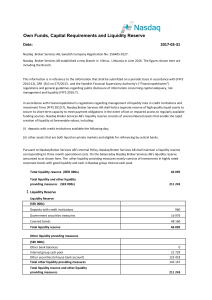

Own Funds, Capital Requirements and Liquidity Reserve

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

Luminis Credit Assessment Information

... Each prospective counterparty must provide to Luminis certain data and information as required to complete the credit assessment. Generally speaking, this includes all related legal documents, financial information, investment/portfolio details, and management/operating policies. For a complete li ...

... Each prospective counterparty must provide to Luminis certain data and information as required to complete the credit assessment. Generally speaking, this includes all related legal documents, financial information, investment/portfolio details, and management/operating policies. For a complete li ...