Las Vegas Valley Water District Investment Policy

... investments shall be marked-to-market on a weekly basis and maintained by a custodian bank at an amount greater than a market value of 102 percent. Repos are acceptable using any of the authorized investments in this section as collateral, as long as such investment is negotiable, has a viable tradi ...

... investments shall be marked-to-market on a weekly basis and maintained by a custodian bank at an amount greater than a market value of 102 percent. Repos are acceptable using any of the authorized investments in this section as collateral, as long as such investment is negotiable, has a viable tradi ...

JPM Cazenove Conference Title Slide “Building the New Economy

... Risk-adjusted returns are typically higher for real assets as they capture the illiquidity premium. Historical rating agency data also tells us that the risk of default is lower than for corporate bonds of the same credit rating. And recovery is enhanced… For example, if we consider one of our stude ...

... Risk-adjusted returns are typically higher for real assets as they capture the illiquidity premium. Historical rating agency data also tells us that the risk of default is lower than for corporate bonds of the same credit rating. And recovery is enhanced… For example, if we consider one of our stude ...

An intangible asset

... (i) Cash and cash equivalents (Chapter 4) (j) Assets classified as held for sale (k) Trade and other payables (assumed knowledge) (l) Provisions (m) Financial liabilities (n) Current tax liabilities and assets (Chapter 8) (o) Deferred tax liabilities and assets (Chapter 8) ...

... (i) Cash and cash equivalents (Chapter 4) (j) Assets classified as held for sale (k) Trade and other payables (assumed knowledge) (l) Provisions (m) Financial liabilities (n) Current tax liabilities and assets (Chapter 8) (o) Deferred tax liabilities and assets (Chapter 8) ...

14-June-Property-buyers-face-new-threat-from

... This is regularly resulting in maximum loans offered being reduced by 10 per cent. Other lenders are not taking into account certain types of income. For example, overtime, bonuses, commission payments are either being excluded, or only a percentage considered in calculating eligibility. Some lender ...

... This is regularly resulting in maximum loans offered being reduced by 10 per cent. Other lenders are not taking into account certain types of income. For example, overtime, bonuses, commission payments are either being excluded, or only a percentage considered in calculating eligibility. Some lender ...

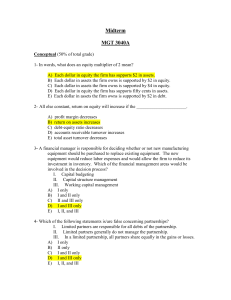

FREE Sample Here

... D. has been enhanced due the recent misuse and negative publicity regarding these instruments E. is worthless today Of the factors cited above, only a affects the value of the derivative and/or is a true statement. ...

... D. has been enhanced due the recent misuse and negative publicity regarding these instruments E. is worthless today Of the factors cited above, only a affects the value of the derivative and/or is a true statement. ...

Working Capital

... Since World War II there have been five reconfigurations of the UK speculative commercial property development, including two major boom/bust cycles. With each iteration, the actors involved adjusted their processes and relationships, attempting to reduce exposure to risk while securing access to ca ...

... Since World War II there have been five reconfigurations of the UK speculative commercial property development, including two major boom/bust cycles. With each iteration, the actors involved adjusted their processes and relationships, attempting to reduce exposure to risk while securing access to ca ...

ADDITIONAL RISK OF TRADING IN RENMINBI (RMB) SECURITIES

... banks in Hong Kong is subject to certain restrictions. It may be difficult for investors to convert RMB into Hong Kong dollars or other currencies or vice versa at any specific time, and conversion will be subject to conversion costs. In addition, the value of RMB against Hong Kong dollars or other ...

... banks in Hong Kong is subject to certain restrictions. It may be difficult for investors to convert RMB into Hong Kong dollars or other currencies or vice versa at any specific time, and conversion will be subject to conversion costs. In addition, the value of RMB against Hong Kong dollars or other ...

solve(A*m^NR*(m^N-1)/(m

... applied to interest on the outstanding principal amount, P, and some of the payment is applied to reduce the principal owed. The total amount, R, of the monthly payment, remains constant over the life of the loan. So if J denotes the monthly interest rate, we have R = JP + (amount applied to princi ...

... applied to interest on the outstanding principal amount, P, and some of the payment is applied to reduce the principal owed. The total amount, R, of the monthly payment, remains constant over the life of the loan. So if J denotes the monthly interest rate, we have R = JP + (amount applied to princi ...

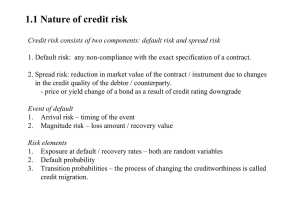

Banking and FIs 10

... Banks have Special Asset Management units which do nothing but manage defaulted or near defaulted customers Once in default, banks will often take control of the company as “senior creditors”, sell all remaining company assets and use the proceeds to repay “creditors” in order of seniority If a bank ...

... Banks have Special Asset Management units which do nothing but manage defaulted or near defaulted customers Once in default, banks will often take control of the company as “senior creditors”, sell all remaining company assets and use the proceeds to repay “creditors” in order of seniority If a bank ...

2005 Market Street Philadelphia, PA 19103-7094

... Under normal market conditions, the Fund will invest: (1) at most 60% of its net assets in securities of U.S. issuers; and (2) at least 40% of its net assets in securities of non-U.S. issuers, unless market conditions are not deemed favorable by the Manager, in which case, the Fund would invest at l ...

... Under normal market conditions, the Fund will invest: (1) at most 60% of its net assets in securities of U.S. issuers; and (2) at least 40% of its net assets in securities of non-U.S. issuers, unless market conditions are not deemed favorable by the Manager, in which case, the Fund would invest at l ...

Status of Bond Markets in Africa

... Non-government bonds definition: – The term “non-government” is used to encompass bonds and asset-backed securities issued by entities other than the federal government, including corporations, municipalities, as well as project finance companies created for specific infrastructure projects. ...

... Non-government bonds definition: – The term “non-government” is used to encompass bonds and asset-backed securities issued by entities other than the federal government, including corporations, municipalities, as well as project finance companies created for specific infrastructure projects. ...

Higher mortgage rates, lower housing affordability

... Wells Fargo Securities Economics Group publications are produced by Wells Fargo Securities, LLC, a U.S. broker-dealer registered with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority, and the Securities Investor Protection Corp. Wells Fargo Securities, LLC, di ...

... Wells Fargo Securities Economics Group publications are produced by Wells Fargo Securities, LLC, a U.S. broker-dealer registered with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority, and the Securities Investor Protection Corp. Wells Fargo Securities, LLC, di ...

form 31-103f1 calculation of excess working capital

... Form 31-103F1 Calculation of Excess Working Capital must be prepared using the accounting principles that you use to prepare your financial statements in accordance with National Instrument 52-107 Acceptable Accounting Principles and Auditing Standards. Section 12.1 of Companion Policy 31-103CP Regi ...

... Form 31-103F1 Calculation of Excess Working Capital must be prepared using the accounting principles that you use to prepare your financial statements in accordance with National Instrument 52-107 Acceptable Accounting Principles and Auditing Standards. Section 12.1 of Companion Policy 31-103CP Regi ...

31-103F1 [F], January 11, 2015

... Form 31-103F1 Calculation of Excess Working Capital must be prepared using the accounting principles that you use to prepare your financial statements in accordance with National Instrument 52-107 Acceptable Accounting Principles and Auditing Standards. Section 12.1 of Companion Policy 31-103CP Regi ...

... Form 31-103F1 Calculation of Excess Working Capital must be prepared using the accounting principles that you use to prepare your financial statements in accordance with National Instrument 52-107 Acceptable Accounting Principles and Auditing Standards. Section 12.1 of Companion Policy 31-103CP Regi ...

![31-103F1 [F], January 11, 2015](http://s1.studyres.com/store/data/021286480_1-c986ef7bfcd613a4eda28487f5276795-300x300.png)