Revision: Sources of finance

... money because it makes a monthly payment. Businesses often lease cars or machinery but they never get to own them. However, they do get free upgrades and maintenance so the business’ cash flow may be more predictable. ...

... money because it makes a monthly payment. Businesses often lease cars or machinery but they never get to own them. However, they do get free upgrades and maintenance so the business’ cash flow may be more predictable. ...

Circular of the State Council Concerning Further Strengthening the

... issuing of shares without authorization. Persons in charge of the competent departments held responsible for such violations shall be given administrative sanctions by the department concerned. Persons in charge of a violating unit and other persons directly responsible shall be removed from their p ...

... issuing of shares without authorization. Persons in charge of the competent departments held responsible for such violations shall be given administrative sanctions by the department concerned. Persons in charge of a violating unit and other persons directly responsible shall be removed from their p ...

Question: Marks: 10

... Now we will calculate the for the above date using Dupont Approach; ROE = ROA x Equity Multiplier ROE = ...

... Now we will calculate the for the above date using Dupont Approach; ROE = ROA x Equity Multiplier ROE = ...

Subprime mortgage lending has grown tremendously

... risk, prepayment risk. Prepayment is a risk because the lender must reinvest the prepaid funds, which had been anticipated to yield a certain return, at an uncertain, and possibly lower, interest rate. The risk of prepayment is probably higher in the subprime mortgage market than in the prime mortga ...

... risk, prepayment risk. Prepayment is a risk because the lender must reinvest the prepaid funds, which had been anticipated to yield a certain return, at an uncertain, and possibly lower, interest rate. The risk of prepayment is probably higher in the subprime mortgage market than in the prime mortga ...

US Treasury Securities

... called the face value, or par value, which is paid back at maturity. With bills, however, your initial investment is less than par. This is known as buying at a discount. At maturity, you’re paid the face value, so the interest you’ve received is equivalent to the discount you got when you first bou ...

... called the face value, or par value, which is paid back at maturity. With bills, however, your initial investment is less than par. This is known as buying at a discount. At maturity, you’re paid the face value, so the interest you’ve received is equivalent to the discount you got when you first bou ...

Reorganizing and Evolving Corporate Structures of

... • Only one class of shares, with full voting rights: one share, one vote • Full tag along rights – Higher disclosure Standards • Annual financial statements in IFRS or US GAAP • Improved Quarterly Reports (ITRs), including an English version, consolidated financial statements and cash flow statement ...

... • Only one class of shares, with full voting rights: one share, one vote • Full tag along rights – Higher disclosure Standards • Annual financial statements in IFRS or US GAAP • Improved Quarterly Reports (ITRs), including an English version, consolidated financial statements and cash flow statement ...

The Backing Ratio - Hong Kong Monetary Authority

... when Hong Kong dollar interest rates fall below US dollar rates. Marking the value of securities to market, there may be an increase in the Monetary Base relative to the Backing Portfolio. The second is when the Hong Kong dollar strengthens, however slightly, against the US dollar, so that the US do ...

... when Hong Kong dollar interest rates fall below US dollar rates. Marking the value of securities to market, there may be an increase in the Monetary Base relative to the Backing Portfolio. The second is when the Hong Kong dollar strengthens, however slightly, against the US dollar, so that the US do ...

australian government monthly financial

... monthly financial statements to be consistent with the budget estimates. Accordingly and pursuant to the Charter of Budget Honesty Act 1998, this presentation covers the general government sector only. This publication does not include full note disclosures. With the introduction of Business Activit ...

... monthly financial statements to be consistent with the budget estimates. Accordingly and pursuant to the Charter of Budget Honesty Act 1998, this presentation covers the general government sector only. This publication does not include full note disclosures. With the introduction of Business Activit ...

Diapositiva 1 - Inter-American Development Bank

... Structuring of an ABS financing mechanism for commodity inventory financing has been a key factor for financial innovation as well as for market and institutional development • Alliance with world-class partners, with right expertise • Warehousing sector development • Creation of risk assessment ca ...

... Structuring of an ABS financing mechanism for commodity inventory financing has been a key factor for financial innovation as well as for market and institutional development • Alliance with world-class partners, with right expertise • Warehousing sector development • Creation of risk assessment ca ...

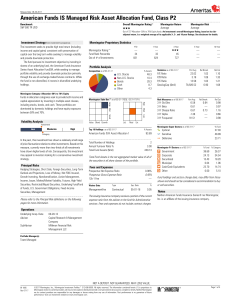

American Funds IS Managed Risk Asset Allocation Fund

... The Morningstar Return rates a fund's performance relative to other managed products in its Morningstar Category. It is an assessment of a product's excess return over a risk-free rate (the return of the 90-day Treasury Bill) in comparison with the products in its Morningstar category. In each Morni ...

... The Morningstar Return rates a fund's performance relative to other managed products in its Morningstar Category. It is an assessment of a product's excess return over a risk-free rate (the return of the 90-day Treasury Bill) in comparison with the products in its Morningstar category. In each Morni ...

Urgent Notice for non-EU issuers of Securities

... Question 8: What types of activities could ‘accidentally’ lock an issuer into a particular home Member State? As examples, here are some types of issuance that could trigger a ‘lock in’ to an unintended Member State. There are many other types of issuance that could trigger a ‘lock in’. ...

... Question 8: What types of activities could ‘accidentally’ lock an issuer into a particular home Member State? As examples, here are some types of issuance that could trigger a ‘lock in’ to an unintended Member State. There are many other types of issuance that could trigger a ‘lock in’. ...

Audit of Non Banking Financial Companies

... should ascertain whether the valuation reports and installation reports are called for. In case of some high value items, he should also physically verify the asset in possession of the hirers, particularly in a situation where he has any doubts as regards the genuineness of the transaction. (iv) If ...

... should ascertain whether the valuation reports and installation reports are called for. In case of some high value items, he should also physically verify the asset in possession of the hirers, particularly in a situation where he has any doubts as regards the genuineness of the transaction. (iv) If ...

IFC Russia Capitalization Fund

... Extent of problems in “restructured” loans not clear, but likely high Credit deterioration will continue to put pressure on bank balance sheets, as writedowns and loan loss provisions rise over the next few years ...

... Extent of problems in “restructured” loans not clear, but likely high Credit deterioration will continue to put pressure on bank balance sheets, as writedowns and loan loss provisions rise over the next few years ...

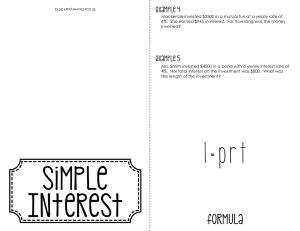

I = prt - SWMStbradford

... Interest is the amount of money Interest: _____________________________ charged for borrowing or using money. ______________________________________ (Examples: Car loans, home loans, student loans, ______________________________________ Investments, savings accounts) _______________________________ ...

... Interest is the amount of money Interest: _____________________________ charged for borrowing or using money. ______________________________________ (Examples: Car loans, home loans, student loans, ______________________________________ Investments, savings accounts) _______________________________ ...