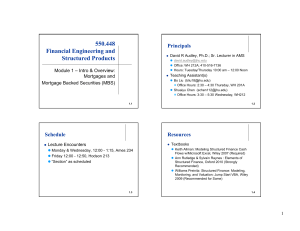

550.448 Financial Engineering and Structured Products

... The MBS assumes the same characteristics as the collateral that secure the principal and interest payments. Bonds that are based on collateral with fixed rates are called fixed rate MBS. Bonds that are based on collateral with floating rates are called adjustable rate mortgage backed securitie ...

... The MBS assumes the same characteristics as the collateral that secure the principal and interest payments. Bonds that are based on collateral with fixed rates are called fixed rate MBS. Bonds that are based on collateral with floating rates are called adjustable rate mortgage backed securitie ...

Part III. Project Description

... Total Debt should include: Bank overdrafts and short term loans + Current portion of long term debt + Long term bank loans + Subordinated / Shareholder loans + CFC loan/ Enhanced equity 3) Interest Cover Ratio (ICR): EBITDA / Interest expenses Interest expenses should include all interest and other ...

... Total Debt should include: Bank overdrafts and short term loans + Current portion of long term debt + Long term bank loans + Subordinated / Shareholder loans + CFC loan/ Enhanced equity 3) Interest Cover Ratio (ICR): EBITDA / Interest expenses Interest expenses should include all interest and other ...

BRAZIL IN THE 2000`S: FINANCIAL REGULATION AND

... between October 1997 and February 1999. Investment, doubly hit by the rise of interest rates and by the increase in the level of uncertainty surrounding future prospects for the Brazilian economy, stagnated until the third quarter of 1998, after which it fell rapidly, down by 11% in the next four qu ...

... between October 1997 and February 1999. Investment, doubly hit by the rise of interest rates and by the increase in the level of uncertainty surrounding future prospects for the Brazilian economy, stagnated until the third quarter of 1998, after which it fell rapidly, down by 11% in the next four qu ...

Capital Requirements Directive - Pillar 3 Disclosures as at May 2017

... Due to the Firm’s size and nature of our activities the assessment has identified no additional risk- based capital requirements under pillar 2. Stress testing has shown that unless there is an exceptional down turn in economic conditions the Firm will continue to be able to meet its pillar 1 financ ...

... Due to the Firm’s size and nature of our activities the assessment has identified no additional risk- based capital requirements under pillar 2. Stress testing has shown that unless there is an exceptional down turn in economic conditions the Firm will continue to be able to meet its pillar 1 financ ...

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Adjustments to reconcile net income to net cash provided by operating activities: Amortization of net deferred loan origination fees, discounts and premiums Provision for loan and real estate losses Depreciation and amortization Net gain on sales of securities and loans Amortization of goodwill Allo ...

... Adjustments to reconcile net income to net cash provided by operating activities: Amortization of net deferred loan origination fees, discounts and premiums Provision for loan and real estate losses Depreciation and amortization Net gain on sales of securities and loans Amortization of goodwill Allo ...

Longevity risk transfer markets: market structure, growth drivers and

... While to date they have been less used than other types of transaction, they are an important instrument for longevity risk and could have a wider use in the future. Chapter 2 It would be helpful to highlight within this chapter the legal risk associated with longevity risk hedging contracts. These ...

... While to date they have been less used than other types of transaction, they are an important instrument for longevity risk and could have a wider use in the future. Chapter 2 It would be helpful to highlight within this chapter the legal risk associated with longevity risk hedging contracts. These ...

FRONT STREET TACTICAL BOND FUND Interim Management

... In December of 2015, the U.S. Federal Reserve raised interest rates 25 basis points, with an outlook of three to four more hikes in 2016. As the new year began, market sentiment deteriorated on concerns that China’s economy was slowing faster than anticipated, and amid rumours of large portfolio rea ...

... In December of 2015, the U.S. Federal Reserve raised interest rates 25 basis points, with an outlook of three to four more hikes in 2016. As the new year began, market sentiment deteriorated on concerns that China’s economy was slowing faster than anticipated, and amid rumours of large portfolio rea ...

Horizontal Analysis

... Income before income tax a. Add interest expense b. Amount available to meet interest charges Number of times interest charges earned (b ÷ a) ...

... Income before income tax a. Add interest expense b. Amount available to meet interest charges Number of times interest charges earned (b ÷ a) ...

Advancing the Credit Channel and Credit Rationing in the

... lender believes there is no chance that it will be repaid, and L = 1.00 means the payoff is believed to be certain), and, the interest rate on the loan (r).7 It is important to be clear that the r specified by the model is nothing more than the rate that would be charged on the single loan being con ...

... lender believes there is no chance that it will be repaid, and L = 1.00 means the payoff is believed to be certain), and, the interest rate on the loan (r).7 It is important to be clear that the r specified by the model is nothing more than the rate that would be charged on the single loan being con ...

Untitled

... rate to be established after receiving competitive bids from prospective purchasers. It is estimated that the Senior Bonds will provide interest rates between 5 percent and 6 percent with 15 to 20 year maturities. L plans to borrow the proceeds of Subordinated Bonds issued by the N to fund approxim ...

... rate to be established after receiving competitive bids from prospective purchasers. It is estimated that the Senior Bonds will provide interest rates between 5 percent and 6 percent with 15 to 20 year maturities. L plans to borrow the proceeds of Subordinated Bonds issued by the N to fund approxim ...

CVP Analysis

... 4. XYZ currently has an Equity Capital of Rs. 40 lacs consisting 40000 equity shares of Rs. 100 each. The management plans to raise another Rs. 30 lakhs to finance a major expansion through the following means: i) Entirely through Equity Shares ii) Rs. 15 lakhs in equity shares of Rs. 100 each & bal ...

... 4. XYZ currently has an Equity Capital of Rs. 40 lacs consisting 40000 equity shares of Rs. 100 each. The management plans to raise another Rs. 30 lakhs to finance a major expansion through the following means: i) Entirely through Equity Shares ii) Rs. 15 lakhs in equity shares of Rs. 100 each & bal ...

Pension Discount Rates: FASB ASC 715

... the liabilities of their pension plan for GAAP accounting purposes. As a result, the choice of discount rates will affect the balance sheet and credit rating. In addition, the disclosed discount rate will be used to determine FASB ASC 715 pension expense/income for the fiscal year as it affects serv ...

... the liabilities of their pension plan for GAAP accounting purposes. As a result, the choice of discount rates will affect the balance sheet and credit rating. In addition, the disclosed discount rate will be used to determine FASB ASC 715 pension expense/income for the fiscal year as it affects serv ...

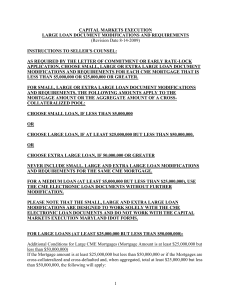

capital markets execution

... defined in the Repair Agreement), if any, as may be requested by the Lender or by the Rating Agencies or otherwise to effect the Secondary Market Transaction; provided, however, that the Borrower shall not be required to modify or amend any Loan Document if such modification or amendment would (i) c ...

... defined in the Repair Agreement), if any, as may be requested by the Lender or by the Rating Agencies or otherwise to effect the Secondary Market Transaction; provided, however, that the Borrower shall not be required to modify or amend any Loan Document if such modification or amendment would (i) c ...

Finance_Notes_2009 Size: 342.5kb Last modified

... Option Pricing (ROV): DCF applicable for traditional firms with cash cow characteristics (i.e. relatively predictable cash flows). Firms with high risk characteristics from either financial difficulty or growth firms have unpredictable cash flows that are difficult to evaluate using DCF methodology. ...

... Option Pricing (ROV): DCF applicable for traditional firms with cash cow characteristics (i.e. relatively predictable cash flows). Firms with high risk characteristics from either financial difficulty or growth firms have unpredictable cash flows that are difficult to evaluate using DCF methodology. ...

Risk and Return: Extensions

... CAPM/SML concepts are based on expectations, yet betas are calculated using historical data. A company’s historical data may not reflect investors’ expectations about future riskiness. Other models are being developed that will one day replace the CAPM, but it still provides a good framework for thi ...

... CAPM/SML concepts are based on expectations, yet betas are calculated using historical data. A company’s historical data may not reflect investors’ expectations about future riskiness. Other models are being developed that will one day replace the CAPM, but it still provides a good framework for thi ...

Why Do Interest Rates Change?

... The factors that influence the will to buy and hold asset or to buy one asset rather that another are: Wealth, the total resources owned by individual, including all assets Expected return, the return expected over the next period on one asset relative to alternative assets Risk, the degree of ...

... The factors that influence the will to buy and hold asset or to buy one asset rather that another are: Wealth, the total resources owned by individual, including all assets Expected return, the return expected over the next period on one asset relative to alternative assets Risk, the degree of ...