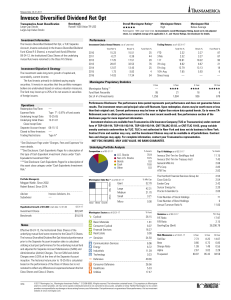

Invesco Diversified Dividend Ret Opt

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

BASIC CONCEPTS OF FINANCIAL ACCOUNTING

... • Even though over time an asset's value may increase above the historical cost, that cost is still kept on the books because the number is considered to be reliable. ...

... • Even though over time an asset's value may increase above the historical cost, that cost is still kept on the books because the number is considered to be reliable. ...

Owners` Equity - Southwest High School

... • Even though over time an asset's value may increase above the historical cost, that cost is still kept on the books because the number is considered to be reliable. ...

... • Even though over time an asset's value may increase above the historical cost, that cost is still kept on the books because the number is considered to be reliable. ...

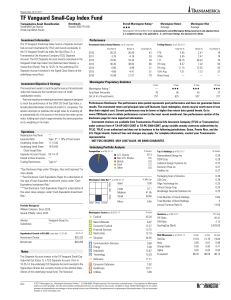

TF Vanguard Small-Cap Index Fund

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

STOCK Beta

... amplify the overall movements of the market. • Stocks with betas between 0 and 1.0 tend to move in the same direction as the market, but not as far. • Of course, the market is the portfolio of all stocks, so the “average” stock has a beta of ...

... amplify the overall movements of the market. • Stocks with betas between 0 and 1.0 tend to move in the same direction as the market, but not as far. • Of course, the market is the portfolio of all stocks, so the “average” stock has a beta of ...

Crowdfunding - North American Securities Administrators Association

... During the time until you can use the crowdfunding exemption, consider speaking with a licensed and experienced securities law attorney to help you in your offering. ...

... During the time until you can use the crowdfunding exemption, consider speaking with a licensed and experienced securities law attorney to help you in your offering. ...

El paso home loans email e-mail

... El Paso for regular servicing.. Email: Contact Us by E-mail (link sends e-mail). Hours of Operation:. El Paso Real Estate services include: El Paso Central appraisal, El Paso tx home appraisal, El Paso tx new homes and builders, El Paso Real Estate home . Lone Star Financing specializes in El Paso h ...

... El Paso for regular servicing.. Email: Contact Us by E-mail (link sends e-mail). Hours of Operation:. El Paso Real Estate services include: El Paso Central appraisal, El Paso tx home appraisal, El Paso tx new homes and builders, El Paso Real Estate home . Lone Star Financing specializes in El Paso h ...

In any secured financing, a borrower`s undertakings relating to

... deprive the third party of all benefit of the anti‐assignment terms; it provides, for example, that the secured party may not enforce its security interest in the rights that are otherwise subject to an enforceable anti‐assignment term. To further protect a borrower against breaching its ant ...

... deprive the third party of all benefit of the anti‐assignment terms; it provides, for example, that the secured party may not enforce its security interest in the rights that are otherwise subject to an enforceable anti‐assignment term. To further protect a borrower against breaching its ant ...

Corporation Tax treatment of interest-free loans and other

... lower amount (or no amount at all) for periods in which the arm’s length provision is required to be applied. Note that the accounting analysis under New UK GAAP may be different to the transfer pricing analysis. The accounting analysis does not take into account what amount the company could or wou ...

... lower amount (or no amount at all) for periods in which the arm’s length provision is required to be applied. Note that the accounting analysis under New UK GAAP may be different to the transfer pricing analysis. The accounting analysis does not take into account what amount the company could or wou ...

Margin-based Asset Pricing and Deviations from the Law of One Price

... of the securities (Brunnermeier and Pedersen 2009) and because of various institutional frictions. For instance, corporate bonds have low market liquidity in over-the-counter search markets (Duffie, Gârleanu, and Pedersen 2005, 2007; Vayanos and Weill 2008), and this makes them less attractive as c ...

... of the securities (Brunnermeier and Pedersen 2009) and because of various institutional frictions. For instance, corporate bonds have low market liquidity in over-the-counter search markets (Duffie, Gârleanu, and Pedersen 2005, 2007; Vayanos and Weill 2008), and this makes them less attractive as c ...

Determinants of non-performing loans in Central and Eastern

... Keaton and Morris (1987) introduced one of the earliest empirical studies on NPLs investigating the causes of loan loss diversity on a sample of 2,500 banks in the USA. Their study showed that a substantial part of the variation in loan losses was due to differences in local economic conditions and ...

... Keaton and Morris (1987) introduced one of the earliest empirical studies on NPLs investigating the causes of loan loss diversity on a sample of 2,500 banks in the USA. Their study showed that a substantial part of the variation in loan losses was due to differences in local economic conditions and ...

XPP-PDF Support Utility

... are exempt from registration under the Securities Act of 19333 and the Investment Company Act of 1940.4 To fall within applicable exemptions, as a general matter, such private investment funds permit only those investors who are ‘‘accredited investors’’ (as defined in the 1933 Act) and ‘‘qualified p ...

... are exempt from registration under the Securities Act of 19333 and the Investment Company Act of 1940.4 To fall within applicable exemptions, as a general matter, such private investment funds permit only those investors who are ‘‘accredited investors’’ (as defined in the 1933 Act) and ‘‘qualified p ...

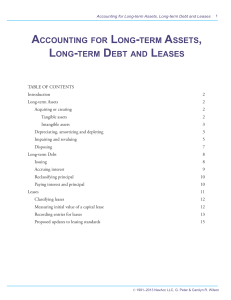

IFI_Ch14

... The Demand for Foreign Securities: The Role of International Portfolio Investors • The effect of market liquidity and segmentation – We will illustrate that the degree to which capital markets are illiquid or segmented will influence a firm’s MCC and thus change its weighted average cost of capital ...

... The Demand for Foreign Securities: The Role of International Portfolio Investors • The effect of market liquidity and segmentation – We will illustrate that the degree to which capital markets are illiquid or segmented will influence a firm’s MCC and thus change its weighted average cost of capital ...

II. How to Read a Mutual Fund Prospectus

... primarily in common stock for long-term capital gains. An aggressive growth fund may invest in the common stock of small companies, out-of-favor companies or companies in new industries. It, therefore, has a higher degree of risk than a basic growth fund. Income: An income fund invests in either cor ...

... primarily in common stock for long-term capital gains. An aggressive growth fund may invest in the common stock of small companies, out-of-favor companies or companies in new industries. It, therefore, has a higher degree of risk than a basic growth fund. Income: An income fund invests in either cor ...

FORM 10-Q - corporate

... guidance to provide a single, comprehensive revenue recognition model for all contracts with customers. Under the new guidance, an entity will recognize revenue to depict the transfer of promised goods or services to customers at an amount that the entity expects to be entitled to in exchange for th ...

... guidance to provide a single, comprehensive revenue recognition model for all contracts with customers. Under the new guidance, an entity will recognize revenue to depict the transfer of promised goods or services to customers at an amount that the entity expects to be entitled to in exchange for th ...

DOC - Europa EU

... is to ensure that all creditors are treated fairly. According to bankruptcy legislation, a transaction in which a creditor has been “favoured” shortly before the moment when the bankruptcy occurs is normally declared invalid by the liquidator (e.g. where an already existing loan has been secured wit ...

... is to ensure that all creditors are treated fairly. According to bankruptcy legislation, a transaction in which a creditor has been “favoured” shortly before the moment when the bankruptcy occurs is normally declared invalid by the liquidator (e.g. where an already existing loan has been secured wit ...

COMPUTER ASSOCIATES INTERNATIONAL INC

... plan. These historically higher second half revenues have resulted in significantly higher profit margins since total expenses have not increased in proportion to revenue. However, past financial performance may not be indicative of future performance, particularly in view of the uncertainties assoc ...

... plan. These historically higher second half revenues have resulted in significantly higher profit margins since total expenses have not increased in proportion to revenue. However, past financial performance may not be indicative of future performance, particularly in view of the uncertainties assoc ...