Year 11 Mathematics Standard Topic Guidance

... Background information The concept of charging interest has been attributed to ancient agricultural civilisations in which loans of grain could be repaid with ‘interest’ because the grain was self-reproducing. This concept was later applied to loans of commodities such as metals that could not ‘grow ...

... Background information The concept of charging interest has been attributed to ancient agricultural civilisations in which loans of grain could be repaid with ‘interest’ because the grain was self-reproducing. This concept was later applied to loans of commodities such as metals that could not ‘grow ...

March 2015 Financial Planning Bulletin

... bonds that Frontier purchases for clients are existing issues in the secondary market. Many of these bonds were issued at a point in time when coupon rates averaged 5 - 6%. Thus, we typically have to pay a premium (can be up to 10% range) to acquire such bonds. But doing so allows us to control dura ...

... bonds that Frontier purchases for clients are existing issues in the secondary market. Many of these bonds were issued at a point in time when coupon rates averaged 5 - 6%. Thus, we typically have to pay a premium (can be up to 10% range) to acquire such bonds. But doing so allows us to control dura ...

Lecture 27: CAPM and Risk Premium

... i. Where LV is the loan value, FP is the fixed payment and i is the interest rate. ii. Note the difference fixed payment loans make. With an interest rate of 7% and a LV of $100,000, the fixed payment over a 25 year period is $9,439.29 (or $235,982.25 total). The pendulum of compound interest rates ...

... i. Where LV is the loan value, FP is the fixed payment and i is the interest rate. ii. Note the difference fixed payment loans make. With an interest rate of 7% and a LV of $100,000, the fixed payment over a 25 year period is $9,439.29 (or $235,982.25 total). The pendulum of compound interest rates ...

STRATEGY

... mandate (full employment and 2% inflation, to sum up), and it has begun to raise rates. Here again, this is a mere normalisation and even the start of normalisation. The key rate is still very low, and the pace of tightening is extremely cautious and is being flagged as clearly as possible. We are l ...

... mandate (full employment and 2% inflation, to sum up), and it has begun to raise rates. Here again, this is a mere normalisation and even the start of normalisation. The key rate is still very low, and the pace of tightening is extremely cautious and is being flagged as clearly as possible. We are l ...

Global Economic Crisis What happened?

... If it sounds too good to be true, it probably is. Banks and investment houses invented complex ways to resell the mortgages as securities No government regulation Fin. Institutions did not maintain reserves in case mortgage-backed funds lost value ...

... If it sounds too good to be true, it probably is. Banks and investment houses invented complex ways to resell the mortgages as securities No government regulation Fin. Institutions did not maintain reserves in case mortgage-backed funds lost value ...

Looking Beyond the Fed for Clues on Interest Rates TH E

... sold easily and quickly—i.e., those classified as relatively liquid—more desirable than assets with little market flexibility. Greater liquidity tends to reduce risk and increase the supply of loanable funds, relaxing pressures on interest rates. Liquidity goes only one way over time— up. Financial ...

... sold easily and quickly—i.e., those classified as relatively liquid—more desirable than assets with little market flexibility. Greater liquidity tends to reduce risk and increase the supply of loanable funds, relaxing pressures on interest rates. Liquidity goes only one way over time— up. Financial ...

The Debt Ceiling and the Road Ahead

... Higher interest rates for Treasury bonds might also result in higher interest rates on other, nongovernmental loans such as mortgages and consumer credit. Since many interest rates are based on Treasury rates, rates generally would likely be affected. And since bond prices fall when rates rise, you ...

... Higher interest rates for Treasury bonds might also result in higher interest rates on other, nongovernmental loans such as mortgages and consumer credit. Since many interest rates are based on Treasury rates, rates generally would likely be affected. And since bond prices fall when rates rise, you ...

Alfred M. Pollard, General Counsel Attention: Comments/RIN 2590

... On behalf of __________(insert name of institution)________, we are contacting you to express our serious concerns that this proposed rule undermines a Federal Home Loan Bank system that supports housing finance and serves as a critical liquidity source for financial institutions. Community banks wo ...

... On behalf of __________(insert name of institution)________, we are contacting you to express our serious concerns that this proposed rule undermines a Federal Home Loan Bank system that supports housing finance and serves as a critical liquidity source for financial institutions. Community banks wo ...

November - Public Sector Consultants

... borrowed by the government to cover the federal debt. The federal government will continue to borrow regardless of the cost of credit and will pay whatever interest rate is required to attract the funds it needs. The remaining funds are available to the private sector. With consumers and businesses ...

... borrowed by the government to cover the federal debt. The federal government will continue to borrow regardless of the cost of credit and will pay whatever interest rate is required to attract the funds it needs. The remaining funds are available to the private sector. With consumers and businesses ...

Conflict of Interest

... (i) With regard to any non-publicly traded entity, a significant financial interest exists if the value of any remuneration received from the entity in the twelve months preceding the disclosure, when aggregated, exceeds $5,000, or when the Investigator (or the Investigator's spouse or dependent chi ...

... (i) With regard to any non-publicly traded entity, a significant financial interest exists if the value of any remuneration received from the entity in the twelve months preceding the disclosure, when aggregated, exceeds $5,000, or when the Investigator (or the Investigator's spouse or dependent chi ...

FNCE 3020 Spring 2004

... far, is a general representation of the “average” interest rate in the economy at a point in time. In addition to this general representation, we can extend the model to various segments of the bond market to account for relative changes in interest rates among a range of debt markets. ...

... far, is a general representation of the “average” interest rate in the economy at a point in time. In addition to this general representation, we can extend the model to various segments of the bond market to account for relative changes in interest rates among a range of debt markets. ...

Sample Exercises Chapter 11

... 1) Carter Co. is considering two alternatives to finance its construction of a new $2 million plant. Compare bond versus stock financing for: a) Issuance of 200,000 shares of common stock at the market price of $10 per share. b) Issuance of $2 million, 8% bonds at par ...

... 1) Carter Co. is considering two alternatives to finance its construction of a new $2 million plant. Compare bond versus stock financing for: a) Issuance of 200,000 shares of common stock at the market price of $10 per share. b) Issuance of $2 million, 8% bonds at par ...

Investing in the desert

... Act 2001) only. It may contain general advice without taking into account any particular persons objectives, financial situation or needs. Investors should, before acting on this information, consider the appropriateness of this information having regard to their own circumstances. Any opinions expr ...

... Act 2001) only. It may contain general advice without taking into account any particular persons objectives, financial situation or needs. Investors should, before acting on this information, consider the appropriateness of this information having regard to their own circumstances. Any opinions expr ...

Press Release on results of monetary policy management and

... Particularly, the average inter-bank VND/USD exchange rate adjusted by +3% and the band of exchange rate extended from +/- 1% to +/- 3% in order to promptly cope with negative impacts from the international financial market combining with appropriately adjusting VND interest rate in the interbank m ...

... Particularly, the average inter-bank VND/USD exchange rate adjusted by +3% and the band of exchange rate extended from +/- 1% to +/- 3% in order to promptly cope with negative impacts from the international financial market combining with appropriately adjusting VND interest rate in the interbank m ...

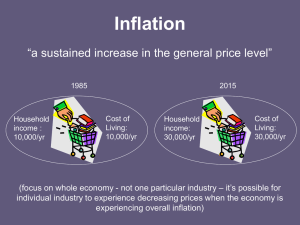

Inflation

... (focus on whole economy - not one particular industry – it’s possible for individual industry to experience decreasing prices when the economy is experiencing overall inflation) ...

... (focus on whole economy - not one particular industry – it’s possible for individual industry to experience decreasing prices when the economy is experiencing overall inflation) ...

Document

... • Too much of California’s growth was construction based and r.e. profit-based • Unemployment woes severe for some time • Port business could be a plus but California not in control • Budget woes not conducive to attracting new businesses • While not a leader, will make a great follower – human reso ...

... • Too much of California’s growth was construction based and r.e. profit-based • Unemployment woes severe for some time • Port business could be a plus but California not in control • Budget woes not conducive to attracting new businesses • While not a leader, will make a great follower – human reso ...

report - Blackpool Council

... borrowing of £10m was taken in April 2010 at a rate of 4.68% and will be repaid at maturity. A further £5m was borrowed in August 2010 over 7 years. This loan is scheduled to be repaid in equal instalments on the 30th September and 31st March each year. The 2010/2011 requirements for the remainder o ...

... borrowing of £10m was taken in April 2010 at a rate of 4.68% and will be repaid at maturity. A further £5m was borrowed in August 2010 over 7 years. This loan is scheduled to be repaid in equal instalments on the 30th September and 31st March each year. The 2010/2011 requirements for the remainder o ...

Why the Fed`s rate cuts won`t help you

... Just to top it all off, the Fed this week announced plans to allow the twin titans of government-supported mortgage finance, Fannie Mae (FNM, news, msgs) and Freddie Mac (FRE, news, msgs) -- which have proved themselves horrible at managing risk -- to make even bigger loans than they had previously. ...

... Just to top it all off, the Fed this week announced plans to allow the twin titans of government-supported mortgage finance, Fannie Mae (FNM, news, msgs) and Freddie Mac (FRE, news, msgs) -- which have proved themselves horrible at managing risk -- to make even bigger loans than they had previously. ...

Powerpoint Presentation

... capital by a bank to ensure it is solvent – an equity cushion. With mark to market accounting a bank can become insolvent on paper even though it is not illiquid – the bank can still meet its obligations as they become due. ...

... capital by a bank to ensure it is solvent – an equity cushion. With mark to market accounting a bank can become insolvent on paper even though it is not illiquid – the bank can still meet its obligations as they become due. ...

Robert T. Parry President and Chief Executive Officer

... tend toward the more cautious end of the spectrum—because a somewhat delayed action could be preferable to running the risk of tightening when it's not warranted. Therefore, since most forecasts of output and inflation have been off the mark for several years, it has made sense to place less weight ...

... tend toward the more cautious end of the spectrum—because a somewhat delayed action could be preferable to running the risk of tightening when it's not warranted. Therefore, since most forecasts of output and inflation have been off the mark for several years, it has made sense to place less weight ...

The Oak Financial Times - Oak Financial Group, Inc.

... you enter, you may not be able to get out. We have contended for quite some time now that the bond market and its proxies (such as REITS and Utilities) were stretched as the public piled into them for income, with little thought of losing principal. The sharp drop in the Utilities Index, which we ha ...

... you enter, you may not be able to get out. We have contended for quite some time now that the bond market and its proxies (such as REITS and Utilities) were stretched as the public piled into them for income, with little thought of losing principal. The sharp drop in the Utilities Index, which we ha ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.