REVIEW NOTES FOR THE SECOND BENCHMARK TEST

... The inverse or opposite operation for addition is subtraction, for subtraction it is addition. The inverse or opposite operation for multiplication is division, for division it is multiplication. Remember: when inequalities are multiplied or divided by negative numbers, the inequality symbol reverse ...

... The inverse or opposite operation for addition is subtraction, for subtraction it is addition. The inverse or opposite operation for multiplication is division, for division it is multiplication. Remember: when inequalities are multiplied or divided by negative numbers, the inequality symbol reverse ...

1 - City of Port Hueneme

... The mission of the Residential Rehabilitation Loan Program (“RRLP”) is to provide financial means to conserve the housing stock in the City’s mature neighborhoods, to eradicate substandard housing conditions, and to eliminate and prevent slums and blighting influences, principally for the benefit of ...

... The mission of the Residential Rehabilitation Loan Program (“RRLP”) is to provide financial means to conserve the housing stock in the City’s mature neighborhoods, to eradicate substandard housing conditions, and to eliminate and prevent slums and blighting influences, principally for the benefit of ...

chap6

... An ascending (upward sloping) yield curve indicates the market expectations of higher interest rates, higher periods of economic expansion and/or higher inflation levels. The yield curve starts sloping upwards at the beginning of the business cycle. Banks and financial institutions are expecte ...

... An ascending (upward sloping) yield curve indicates the market expectations of higher interest rates, higher periods of economic expansion and/or higher inflation levels. The yield curve starts sloping upwards at the beginning of the business cycle. Banks and financial institutions are expecte ...

BM 418 Personal Finance

... 13. Thai Steel in Thailand is currently trading at a PE of 15x earnings, at a price of 45 Baht (B), and is expected to pay a B1.5 dividend each year for the next 5 years. Assuming steel companies in Thailand are expected to trade at a PE of 10x five years from now, what is the intrinsic value of Tha ...

... 13. Thai Steel in Thailand is currently trading at a PE of 15x earnings, at a price of 45 Baht (B), and is expected to pay a B1.5 dividend each year for the next 5 years. Assuming steel companies in Thailand are expected to trade at a PE of 10x five years from now, what is the intrinsic value of Tha ...

Chapter 1: Introduction to Money and Banking

... the U.S. money supply, sets rules for currency flows and check clearing, and supervises the banking system. • The Fed also decides on the federal funds rate eight times per year, influencing interest rates on everything from Treasury bills to car loans. Copyright © Houghton Mifflin Company. All righ ...

... the U.S. money supply, sets rules for currency flows and check clearing, and supervises the banking system. • The Fed also decides on the federal funds rate eight times per year, influencing interest rates on everything from Treasury bills to car loans. Copyright © Houghton Mifflin Company. All righ ...

Chapter 11

... What will you use the money for? How much money do you need for your goals? How will you obtain the money? How long will it take you to obtain the money? How much risk are you willing to assume in an ...

... What will you use the money for? How much money do you need for your goals? How will you obtain the money? How long will it take you to obtain the money? How much risk are you willing to assume in an ...

general investment information

... ISSUER AGREES TO REPAY THE BONDHOLDER AT THE MATURITY DATE. (face value) THE COUPON RATE IS THE RATE OF INTEREST THAT THE ISSUER AGREES TO PAY EACH YEAR. (Example : a bond with an 8% coupon and a principal of $1000 will pay annual interest of $ 80 ) WHAT ARE ZERO-COUPON BONDS ? ...

... ISSUER AGREES TO REPAY THE BONDHOLDER AT THE MATURITY DATE. (face value) THE COUPON RATE IS THE RATE OF INTEREST THAT THE ISSUER AGREES TO PAY EACH YEAR. (Example : a bond with an 8% coupon and a principal of $1000 will pay annual interest of $ 80 ) WHAT ARE ZERO-COUPON BONDS ? ...

International Capital Flows and US Interest Rates

... International Monetary Fund 7th Jacques Polak Annual Research Conference November 9, 2006 ...

... International Monetary Fund 7th Jacques Polak Annual Research Conference November 9, 2006 ...

the money supply and the framework of monetary

... any housing market ‘crash’, which accounts for its caution. The Bank’s Quarterly Inflation Report (February 2005) concluded that ‘the overall risks to growth and inflation are finely balanced’, though added that if rates remained at 4.75%, stronger demand would push inflation above its 2% target by ...

... any housing market ‘crash’, which accounts for its caution. The Bank’s Quarterly Inflation Report (February 2005) concluded that ‘the overall risks to growth and inflation are finely balanced’, though added that if rates remained at 4.75%, stronger demand would push inflation above its 2% target by ...

What are assets?

... there is no credit check and assessment. • Cash flow is secured and not affected because borrower can access to line of credit to pay for emergency situations. • No restriction for the use of fund while many financing options have a narrow list of uses such as purchase of property. • It is flexible ...

... there is no credit check and assessment. • Cash flow is secured and not affected because borrower can access to line of credit to pay for emergency situations. • No restriction for the use of fund while many financing options have a narrow list of uses such as purchase of property. • It is flexible ...

Framework for Conducting Monetary Policy at Low Interest Rates

... In contrast to the more typical interest rate environment, there are clear benefits in a very low rate environment associated with conditional statements about the path of policy that are tied to the inflation outlook or other economic variables. In particular, statements that provide extraordinary ...

... In contrast to the more typical interest rate environment, there are clear benefits in a very low rate environment associated with conditional statements about the path of policy that are tied to the inflation outlook or other economic variables. In particular, statements that provide extraordinary ...

PROBLEM SET 2 Solutions 14.02 Principles of Macroeconomics February 23, 2005

... III. Long question (Policy Mix) Suppose the goods market is described as follows : c0 is the consumer con…dence. c1 is the marginal propensity to consume. Y is the output or income. I is the investment, which is equal to K0 when the interest rate i = 0 and output Y = 0. If i is positive, I decreases ...

... III. Long question (Policy Mix) Suppose the goods market is described as follows : c0 is the consumer con…dence. c1 is the marginal propensity to consume. Y is the output or income. I is the investment, which is equal to K0 when the interest rate i = 0 and output Y = 0. If i is positive, I decreases ...

Negative Interest Rates – A Panacea?

... time. Real estate developers can borrow more for a larger, new building investment; corporations can put more capital projects to work since the cost to finance them has dropped. The economy starts to perk up. Suppliers of funds (savers) have a different incentive. They want more interest and a high ...

... time. Real estate developers can borrow more for a larger, new building investment; corporations can put more capital projects to work since the cost to finance them has dropped. The economy starts to perk up. Suppliers of funds (savers) have a different incentive. They want more interest and a high ...

ALGEBRA 2

... The value of a car can be modeled by y a(0.75)t where y is the value of the car, a is the initial cost of the car and t is the time (in years) since the car was manufactured. The initial cost of the car was $25,000. _______________a. Does the model represent exponential growth or exponential decay ...

... The value of a car can be modeled by y a(0.75)t where y is the value of the car, a is the initial cost of the car and t is the time (in years) since the car was manufactured. The initial cost of the car was $25,000. _______________a. Does the model represent exponential growth or exponential decay ...

How Fed policy affects Treasury Inflation-Protected

... Past performance is no guarantee of future results. Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds issued by the U.S. government. They are fixed income securities whose principal value is periodically adjusted according to the rate of inflation, which will affect the int ...

... Past performance is no guarantee of future results. Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds issued by the U.S. government. They are fixed income securities whose principal value is periodically adjusted according to the rate of inflation, which will affect the int ...

Name Last 4 (PSU ID) ______ First 2 letters of

... support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at ...

... support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at ...

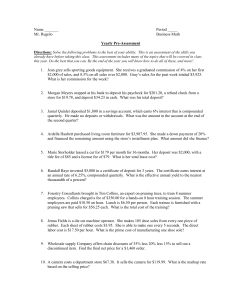

Business Math Yearly Pre

... this year. Do the best that you can. By the end of the year you will know how to do all of these, and more! ...

... this year. Do the best that you can. By the end of the year you will know how to do all of these, and more! ...

STEP TWO:

... DY% - This is the Dividend Yield i.e. the dividend per share (DPS) expressed as a percentage of the share price. ROE % - this is the Return on Equity, which is the headline profits attributable to ordinary shareholders divided by the weighted average ordinary shareholders' funds. Compare this return ...

... DY% - This is the Dividend Yield i.e. the dividend per share (DPS) expressed as a percentage of the share price. ROE % - this is the Return on Equity, which is the headline profits attributable to ordinary shareholders divided by the weighted average ordinary shareholders' funds. Compare this return ...

D.A.V. PUBLIC SCHOOL, NEW PANVEL

... One of the angles of the triangle is equal to the sum of the other two angles. If the ratio of other two angles is 4:5, find measures of all angles of the triangle Q.29.The diagonals of a rhombus are in the ratio 3:4 if its perimeter is 40cm, find the length of the diagonals of the rhombus. Q.30. Th ...

... One of the angles of the triangle is equal to the sum of the other two angles. If the ratio of other two angles is 4:5, find measures of all angles of the triangle Q.29.The diagonals of a rhombus are in the ratio 3:4 if its perimeter is 40cm, find the length of the diagonals of the rhombus. Q.30. Th ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.