Loanable funds vs. endogenous money: Krugman Egmont Kakarot-Handtke

... money at the end of an arbitrary number of periods is given by the absolute value either from (11) or (13): Mt ≡ ...

... money at the end of an arbitrary number of periods is given by the absolute value either from (11) or (13): Mt ≡ ...

Lesson - Federal Reserve Bank of St. Louis

... The central bank system of the United States. Monetary policy Central bank actions involving the use of interest rate or money supply tools to achieve such goals as maximum employment and stable prices. Open market operations The buying and selling of government securities through primary dealers by ...

... The central bank system of the United States. Monetary policy Central bank actions involving the use of interest rate or money supply tools to achieve such goals as maximum employment and stable prices. Open market operations The buying and selling of government securities through primary dealers by ...

1 SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... 1 PNC Bank, National Association, as Bank Constituent and Trust Agent (as defined in the Voting Trust Agreement (as defined below)), and PNC Bank Corp., as the parent of PNC Bank, National Association, also report their beneficial ownership as to 13,570,752 of the shares of Common Stock reported her ...

... 1 PNC Bank, National Association, as Bank Constituent and Trust Agent (as defined in the Voting Trust Agreement (as defined below)), and PNC Bank Corp., as the parent of PNC Bank, National Association, also report their beneficial ownership as to 13,570,752 of the shares of Common Stock reported her ...

Bulletin Contents Volume 76 No. 4, December 2013

... documents, read as a whole, make clear that there are ...

... documents, read as a whole, make clear that there are ...

Internet Banking in Europe: a comparative analysis

... ROAE is the ratio of gross or net income to average equity. Gross income is usually preferred to net income to avoid the differences in taxation among countries.5 ROAA is a good overall indicator for banking performance showing the ability of a bank to generate profits from the assets at its disposa ...

... ROAE is the ratio of gross or net income to average equity. Gross income is usually preferred to net income to avoid the differences in taxation among countries.5 ROAA is a good overall indicator for banking performance showing the ability of a bank to generate profits from the assets at its disposa ...

Endogenous state prices, liquidity, default, and the yield curve

... money stocks. Such a cash-in-advance model is widely considered to capture the effects of liquidity constraints in an analytically tractable way, and allows the quantity theory of money to hold. As a result, in such models, the value of trade is equal to overall supply of liquidity (i.e. money suppl ...

... money stocks. Such a cash-in-advance model is widely considered to capture the effects of liquidity constraints in an analytically tractable way, and allows the quantity theory of money to hold. As a result, in such models, the value of trade is equal to overall supply of liquidity (i.e. money suppl ...

monetary reform - a better monetary system for iceland

... Indeed, commercial banks expanded the money supply nineteen-‐fold in the fourteen year period that ended with the banking crisis of 2008. There is also indication that the fractional reserve system ...

... Indeed, commercial banks expanded the money supply nineteen-‐fold in the fourteen year period that ended with the banking crisis of 2008. There is also indication that the fractional reserve system ...

Balancing the Banks: Global Lessons from the Financial Crisis

... and then turn to the more complicated case of multi-institution hardship prompted by negative macroeconomic shocks. For a single institution, bad times are defined as times at which its capital falls below the regulatory solvency ratio, as defined by the Basel I and II international agreements. Such ...

... and then turn to the more complicated case of multi-institution hardship prompted by negative macroeconomic shocks. For a single institution, bad times are defined as times at which its capital falls below the regulatory solvency ratio, as defined by the Basel I and II international agreements. Such ...

Lecture Notes on Macroeconomic Principles

... Real and Nominal Interest Rates Since bank accounts, bonds, automobile loans, and mortgages all make or require dollar payments at different points in time, the interest rates on these investments or loans must also be corrected for the effects of inflation to gauge their true economic significan ...

... Real and Nominal Interest Rates Since bank accounts, bonds, automobile loans, and mortgages all make or require dollar payments at different points in time, the interest rates on these investments or loans must also be corrected for the effects of inflation to gauge their true economic significan ...

Money Supply Special Report

... find (the core PCE deflator), irrespective of its lack of relevance for consumers, in order to demonstrate how well consumer inflation has been contained by the Fed.1 The following money supply analysis explores the nature of monetary theory, and why -- with different degrees of success -- its key c ...

... find (the core PCE deflator), irrespective of its lack of relevance for consumers, in order to demonstrate how well consumer inflation has been contained by the Fed.1 The following money supply analysis explores the nature of monetary theory, and why -- with different degrees of success -- its key c ...

Transformation of Micro-finance Operations from NGO to Regulated

... liquidity. This was followed by the National Bank of Kenya experiencing a run on the bank, which almost caused its collapse. Because of these factors the Central Bank had other priorities and K-Rep’s application was put on hold. ...

... liquidity. This was followed by the National Bank of Kenya experiencing a run on the bank, which almost caused its collapse. Because of these factors the Central Bank had other priorities and K-Rep’s application was put on hold. ...

Chapter 20. Money Demand The Quantity Theory

... regular. This is important because it shows why Friedman’s modern quantity theory of money lost much of its explanatory power in the 1970s, leading to changes in central bank targeting and monetary theory. Figure 20.2, “The velocity of money in the United States, 1959–2008” suggests that velocity li ...

... regular. This is important because it shows why Friedman’s modern quantity theory of money lost much of its explanatory power in the 1970s, leading to changes in central bank targeting and monetary theory. Figure 20.2, “The velocity of money in the United States, 1959–2008” suggests that velocity li ...

DOC - World bank documents

... nominal interest rate had declined to 21 percent, and the real interest rate was 12 percent.10 Nominal interest rates for unsubsidized loans to SMEs were still as high as 35 percent. High taxes on financial intermediation increase spreads and lending rates. Furthermore, the current taxation system ...

... nominal interest rate had declined to 21 percent, and the real interest rate was 12 percent.10 Nominal interest rates for unsubsidized loans to SMEs were still as high as 35 percent. High taxes on financial intermediation increase spreads and lending rates. Furthermore, the current taxation system ...

handelsbankens småskriftserie_eng_29_jm_16.indd

... 1. Swedish housing has long been primarily financed through bonds issued by special mortgage institutions. The mortgage institutions gained special significance as a source of funding for the major housing construction projects in the 1960s and 1970s. Since then the system for funding housing has b ...

... 1. Swedish housing has long been primarily financed through bonds issued by special mortgage institutions. The mortgage institutions gained special significance as a source of funding for the major housing construction projects in the 1960s and 1970s. Since then the system for funding housing has b ...

The Second End of Laissez-Faire

... Milton Friedman would claim that these professional speculators who bear the risks of ordinary people have a stabilizing influence on the way markets function. “People who argue that speculation is generally destabilizing seldom realize that this is largely equivalent to saying that speculators lose ...

... Milton Friedman would claim that these professional speculators who bear the risks of ordinary people have a stabilizing influence on the way markets function. “People who argue that speculation is generally destabilizing seldom realize that this is largely equivalent to saying that speculators lose ...

Inflation and Other Risks of Unsound Money

... Money is different from all other economic goods in that it is not consumed. With other goods the process of exchange eventually reaches the individual who wishes to consume the good. As such, a claim on those goods will sooner or later be realised. The owner of such goods will not promise to delive ...

... Money is different from all other economic goods in that it is not consumed. With other goods the process of exchange eventually reaches the individual who wishes to consume the good. As such, a claim on those goods will sooner or later be realised. The owner of such goods will not promise to delive ...

Stand alone income statement

... Rubles in accordance with Russian accounting and banking legislation and related instructions (“RAL”). These stand alone financial statements are based on the Bank’s RAL books and records, as adjusted and reclassified in order to comply with IFRS. The reconciliation between RAL and IFRS is presented ...

... Rubles in accordance with Russian accounting and banking legislation and related instructions (“RAL”). These stand alone financial statements are based on the Bank’s RAL books and records, as adjusted and reclassified in order to comply with IFRS. The reconciliation between RAL and IFRS is presented ...

identifying balance-sheet channels with loan applications and

... applications with all the granted loans. We find that – conditioning on a firm’s need for funds – weak firms, and also average firms associated with banks with weaker capital or liquidity, have a higher probability of obtaining zero granted loans when economic and monetary conditions are tighter. He ...

... applications with all the granted loans. We find that – conditioning on a firm’s need for funds – weak firms, and also average firms associated with banks with weaker capital or liquidity, have a higher probability of obtaining zero granted loans when economic and monetary conditions are tighter. He ...

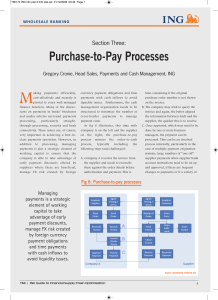

Purchase-to-Pay Processes

... unless using a multi-bank platform such as SWIFTNet, payments need to be transmitted through different electronic banking systems. Working with a single bank regionally enables companies to channel payments through to a single bank, even if payments are then made ...

... unless using a multi-bank platform such as SWIFTNet, payments need to be transmitted through different electronic banking systems. Working with a single bank regionally enables companies to channel payments through to a single bank, even if payments are then made ...

Occasional paper 47

... machinery. If you are able to trust the other party to the contract, you do not have to hedge against all possible outcomes. 11 The wheels of business turn faster and more smoothly. Although Kołakowski had been one of Marxism’s prominent post-war thinkers, by 1971 he had completely lost faith in the ...

... machinery. If you are able to trust the other party to the contract, you do not have to hedge against all possible outcomes. 11 The wheels of business turn faster and more smoothly. Although Kołakowski had been one of Marxism’s prominent post-war thinkers, by 1971 he had completely lost faith in the ...

The Federal Reserve`s Abandonment of its 1923

... banks, 2) the desire to meet the credit needs of business and 3) the preference of a focus on credit over a focus on monetary aggregates. I show that the first two principles remained important in FOMC deliberations until the mid-1960’s. After this, the FOMC also spent less time discussing the compo ...

... banks, 2) the desire to meet the credit needs of business and 3) the preference of a focus on credit over a focus on monetary aggregates. I show that the first two principles remained important in FOMC deliberations until the mid-1960’s. After this, the FOMC also spent less time discussing the compo ...

SHORT TERM FINANCIAL MANAGEMENT

... Many companies employ financial specialists called cash managers. One of their primary roles is to manage the cash low time line related to collection, concentration and disbursement of the company’s funds. Their job starts when a customer (payer) initiates payments to the company (the payee) in any ...

... Many companies employ financial specialists called cash managers. One of their primary roles is to manage the cash low time line related to collection, concentration and disbursement of the company’s funds. Their job starts when a customer (payer) initiates payments to the company (the payee) in any ...