New Investment Guidance from TPR means Responsible

... where they are financially significant. This represents an important step forward for responsible investment. The new guidance is clear: ‘trustees need to take environmental, social and governance factors into account if they believe they are financially significant’. The document also encourages sc ...

... where they are financially significant. This represents an important step forward for responsible investment. The new guidance is clear: ‘trustees need to take environmental, social and governance factors into account if they believe they are financially significant’. The document also encourages sc ...

How Sharpe is Your Fund?

... you know your investment objectives and risk appetite. If you are after high, longterm returns and willing to take a significant amount of risk on your money, then stock market investing is right for you. And since you know little about it, be wise and just hire fund managers to do the “dirty work” ...

... you know your investment objectives and risk appetite. If you are after high, longterm returns and willing to take a significant amount of risk on your money, then stock market investing is right for you. And since you know little about it, be wise and just hire fund managers to do the “dirty work” ...

Supplement to “Output contingent securities and

... technology, we propose to model perfect competition of the productive sector by considering the extreme case with a continuum K := [0, 1] of identical firms facing success-or-failure shocks that are perfectly correlated. This assumption is imposed to simplify the presentation.1 We pose a few remarks ...

... technology, we propose to model perfect competition of the productive sector by considering the extreme case with a continuum K := [0, 1] of identical firms facing success-or-failure shocks that are perfectly correlated. This assumption is imposed to simplify the presentation.1 We pose a few remarks ...

Probability of College Football Underdogs Winning Against the

... What we, as investors, can do is to rationally consider the expectations. “If You’re Gonna Play the Game Boy, You Gotta Learn to Play it Right” A strong case has been made by respected behavioral economist Richard Thaler that sports betting markets provide a better testing ground for market efficien ...

... What we, as investors, can do is to rationally consider the expectations. “If You’re Gonna Play the Game Boy, You Gotta Learn to Play it Right” A strong case has been made by respected behavioral economist Richard Thaler that sports betting markets provide a better testing ground for market efficien ...

Las Vegas Valley Water District Investment Policy

... organized and operating or licensed to operate in the United States under federal or state law or a securities dealer which is a registered broker/dealer, designated by the Federal Reserve Bank of New York as a primary dealer in United States government issued securities, and in full compliance with ...

... organized and operating or licensed to operate in the United States under federal or state law or a securities dealer which is a registered broker/dealer, designated by the Federal Reserve Bank of New York as a primary dealer in United States government issued securities, and in full compliance with ...

Individual Registration Officer Permanent | Full time Compliance and

... and fraudulent practices, and foster fair and efficient capital markets and confidence in capital markets. This mandate is performed through policy, operational, adjudication and enforcement work. The OSC also contributes to national and global securities regulation development. We offer a diverse, ...

... and fraudulent practices, and foster fair and efficient capital markets and confidence in capital markets. This mandate is performed through policy, operational, adjudication and enforcement work. The OSC also contributes to national and global securities regulation development. We offer a diverse, ...

The purpose of this presentation is trace some of the key

... in financial markets and banking have helped differentiate our era’s globalization from previous ones. Given the turmoil in capital markets, this lacuna in the literature is particularly odd. Insofar as the effect of the growth of multinational financial conglomerates on the financial system is disc ...

... in financial markets and banking have helped differentiate our era’s globalization from previous ones. Given the turmoil in capital markets, this lacuna in the literature is particularly odd. Insofar as the effect of the growth of multinational financial conglomerates on the financial system is disc ...

victory rs large cap alpha fund

... R-squared is a statistical measure that represents the percentage of a fund’s or security’s movements that can be explained by movements in a benchmark index. Turnover – Last 12 Months (LTM) is a measure of trading activity in a mutual fund portfolio of investments for the past year that indicates h ...

... R-squared is a statistical measure that represents the percentage of a fund’s or security’s movements that can be explained by movements in a benchmark index. Turnover – Last 12 Months (LTM) is a measure of trading activity in a mutual fund portfolio of investments for the past year that indicates h ...

Behavioral Finance

... with gains, investors often show risk seeking behavior when they face a loss ...

... with gains, investors often show risk seeking behavior when they face a loss ...

Y d iel Yield Series 1 can offer

... This document does not take into account your investment objectives, financial situation or particular needs. Accordingly, nothing in this document or the PDS is a recommendation by Instreet or their related entities or by any other person concerning investment in the Units and before acting on this ...

... This document does not take into account your investment objectives, financial situation or particular needs. Accordingly, nothing in this document or the PDS is a recommendation by Instreet or their related entities or by any other person concerning investment in the Units and before acting on this ...

Takeout financing

... •Projects sanctioned by IIFCL are spread over in 24 states of the country. • Of the 160 proposals sanctioned, 137 (88%) cases have achieved financial closure which indicates that participation of IIFCL has helped in speeding up financial closure. •Commercial Operation Date (CoD) has been achieved in ...

... •Projects sanctioned by IIFCL are spread over in 24 states of the country. • Of the 160 proposals sanctioned, 137 (88%) cases have achieved financial closure which indicates that participation of IIFCL has helped in speeding up financial closure. •Commercial Operation Date (CoD) has been achieved in ...

Chapter 13 Saving, Investment, and the Financial System

... Banks: A primary job of banks is to take in deposits from people who want to save and use these deposits to make loans to to people who want to borrow. • Besides being financial intermediaries, banks play a second important role in the economy: they facilitate purchases of goods and services by allo ...

... Banks: A primary job of banks is to take in deposits from people who want to save and use these deposits to make loans to to people who want to borrow. • Besides being financial intermediaries, banks play a second important role in the economy: they facilitate purchases of goods and services by allo ...

Focused on Delivering Superior Investment Advice

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to inve ...

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to inve ...

Investment Security Group May 2014 Volume V, Number V

... Replacing Perkins Mid Cap Value Fund Due to declining performance (relative to their peer group) and some “strategy drift” (frequent holdings outside of the intended mid-cap space), we have elected to sell longtime holding Perkins Mid Cap Value(JMCVX) in favor of Schwab U.S. Mid-Cap ETF(SCHM). Schwa ...

... Replacing Perkins Mid Cap Value Fund Due to declining performance (relative to their peer group) and some “strategy drift” (frequent holdings outside of the intended mid-cap space), we have elected to sell longtime holding Perkins Mid Cap Value(JMCVX) in favor of Schwab U.S. Mid-Cap ETF(SCHM). Schwa ...

simibtopic4 - Homework Market

... (cf. Lindblom, 1959; and Johnson, 1988). • Investment decisions and actual investment commitments are made incrementally as uncertainty is successively reduced. • The more the firm knows about a foreign market, the lower the perceived market risk will be and, consequently, the higher the actual inve ...

... (cf. Lindblom, 1959; and Johnson, 1988). • Investment decisions and actual investment commitments are made incrementally as uncertainty is successively reduced. • The more the firm knows about a foreign market, the lower the perceived market risk will be and, consequently, the higher the actual inve ...

Glossary - Investment 2020

... or to a loan. AER takes into account the timing of interest payments. For example, a quoted annual rate of 10% paid quarterly would have an AER of 10.38%. Also known as the Annual Effective Rate or Effective Annual Rate. ...

... or to a loan. AER takes into account the timing of interest payments. For example, a quoted annual rate of 10% paid quarterly would have an AER of 10.38%. Also known as the Annual Effective Rate or Effective Annual Rate. ...

Energy Access Ventures Fund launched: boost for access to energy

... The objective of the Energy Access ventures Fund is to combine economic investment, innovation, and skill development. The Fund will be backed by the experience acquired as the investment arm of the Schneider Electric Energy Access fund (SEEA), to help develop entrepreneurial initiatives to improve ...

... The objective of the Energy Access ventures Fund is to combine economic investment, innovation, and skill development. The Fund will be backed by the experience acquired as the investment arm of the Schneider Electric Energy Access fund (SEEA), to help develop entrepreneurial initiatives to improve ...

LionGlobal Asia Bond Fund

... insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the Fund is not guaranteed and the value of units in the Fund and the income accruing to the units, if any, may rise or fall. Past performance, ...

... insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the Fund is not guaranteed and the value of units in the Fund and the income accruing to the units, if any, may rise or fall. Past performance, ...

Wharton Finance - University of Pennsylvania

... for both FNCE 101 and ECON 102; ECON 102 does not count towards the FNCE 101 requirement. Students who have already taken ECON 102 must take a higher-level FNCE elective to count towards the FNCE 101 requirement. For students concentrating in FNCE, however, this higher level elective used for the FN ...

... for both FNCE 101 and ECON 102; ECON 102 does not count towards the FNCE 101 requirement. Students who have already taken ECON 102 must take a higher-level FNCE elective to count towards the FNCE 101 requirement. For students concentrating in FNCE, however, this higher level elective used for the FN ...

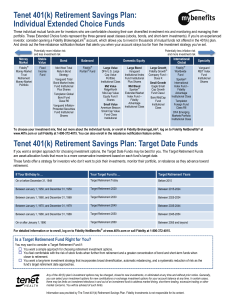

Tenet 401(k) Retirement Savings Plan: Individual Extended Choice

... These individual mutual funds are for investors who are comfortable choosing their own diversified investment mix and monitoring and managing their portfolio. These Extended Choice funds represent the three general asset classes (stocks, bonds, and short-term investments). If you’re an experienced ...

... These individual mutual funds are for investors who are comfortable choosing their own diversified investment mix and monitoring and managing their portfolio. These Extended Choice funds represent the three general asset classes (stocks, bonds, and short-term investments). If you’re an experienced ...

ministry of economy

... Following priority investments will benefit from terms and rates of the support measures of Region 5 even they are made in Regions 1, 2, 3, 4. ...

... Following priority investments will benefit from terms and rates of the support measures of Region 5 even they are made in Regions 1, 2, 3, 4. ...

Large Cap Growth Fund FAQ - Westfield Capital Management

... o Westfield believes its experience, extensive research, and first-hand knowledge of company operations derived through on-site visits and meetings with management provide a competitive edge. They utilize a team approach within a disciplined investment process that is designed to enable its team of ...

... o Westfield believes its experience, extensive research, and first-hand knowledge of company operations derived through on-site visits and meetings with management provide a competitive edge. They utilize a team approach within a disciplined investment process that is designed to enable its team of ...

Scientific knowledge as a public good

... estimated that a 1% increase in business R&D increases multifactor productivity by 0.13% and a 1% increase in public R&D increases multifactor productivity by 0.17%. However, more recent estimates from the UK (Haskel and Wallis, 2010) suggest that public R&D has its most potent impact when allocated ...

... estimated that a 1% increase in business R&D increases multifactor productivity by 0.13% and a 1% increase in public R&D increases multifactor productivity by 0.17%. However, more recent estimates from the UK (Haskel and Wallis, 2010) suggest that public R&D has its most potent impact when allocated ...

To view this press release as a Word document

... guidelines were issued, the goal of which was to increase the capital buffers and the group allowance for credit losses, in respect of the increased risk in the housing credit portfolio. In August 2013, limitations were placed on the variable interest rate share of a housing loan, and a prohibition ...

... guidelines were issued, the goal of which was to increase the capital buffers and the group allowance for credit losses, in respect of the increased risk in the housing credit portfolio. In August 2013, limitations were placed on the variable interest rate share of a housing loan, and a prohibition ...