“…but one of them would make war rather than let the nation survive

... mission model, while still others are best suited to some sort of mile for your clients because you practice life planning? mix. It is true that commissions take a bigger chunk out of the iniYour virtue, your essence, your strength are the services you tial investment than advisory fees, but a commi ...

... mission model, while still others are best suited to some sort of mile for your clients because you practice life planning? mix. It is true that commissions take a bigger chunk out of the iniYour virtue, your essence, your strength are the services you tial investment than advisory fees, but a commi ...

CAF DIRECT INVESTMENT SERVICE CAF MANAGED PORTFOLIO

... financial services that can help them build their resources and support their mission. Therefore CAF’s wholly owned subsidiary company, CAF Financial Solutions Limited (CFSL), has arranged access to an investment service for charities, trustees and other not-for-profit organisations. CFSL works with ...

... financial services that can help them build their resources and support their mission. Therefore CAF’s wholly owned subsidiary company, CAF Financial Solutions Limited (CFSL), has arranged access to an investment service for charities, trustees and other not-for-profit organisations. CFSL works with ...

Problem Set 6 – Some Answers FE312 Fall 2010 Rahman 1

... The decrease in national saving causes the (S – I) schedule to shift to the left, lowering the supply of dollars to be invested abroad. The lower supply of dollars causes the equilibrium real exchange rate to rise. As a result, domestic goods become more expensive relative to foreign goods, which ca ...

... The decrease in national saving causes the (S – I) schedule to shift to the left, lowering the supply of dollars to be invested abroad. The lower supply of dollars causes the equilibrium real exchange rate to rise. As a result, domestic goods become more expensive relative to foreign goods, which ca ...

Appendix F 151202-lgps-investment-pooling-next

... Draft regulation 8(2) describes the interventions the Secretary of State may make, including Requiring the development of a new investment strategy Directing the investment of the assets to adhere to the criteria and guidance Directing the implementation of the investment strategy to be undert ...

... Draft regulation 8(2) describes the interventions the Secretary of State may make, including Requiring the development of a new investment strategy Directing the investment of the assets to adhere to the criteria and guidance Directing the implementation of the investment strategy to be undert ...

Diapositiva 1

... or an enterprise that receives an investment, must file, along with the investment project to which the contract would be applied, a request before the appropriate Agency presenting the appropriate supporting arguments. When filing its request, the interested enterprise must also provide the followi ...

... or an enterprise that receives an investment, must file, along with the investment project to which the contract would be applied, a request before the appropriate Agency presenting the appropriate supporting arguments. When filing its request, the interested enterprise must also provide the followi ...

DE Seminar Invitation evite

... The guest speakers are neither employees nor affiliated with Morgan Stanley Wealth Management. Opinions expressed by the guest speakers are solely his/her own and do not necessarily reflect those of Morgan Stanley. Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanle ...

... The guest speakers are neither employees nor affiliated with Morgan Stanley Wealth Management. Opinions expressed by the guest speakers are solely his/her own and do not necessarily reflect those of Morgan Stanley. Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanle ...

Appendix A University of Virginia Investment Management Company

... a single manager. For long-term closed-end fund investments, including private equity and real estate funds, the 7.5% limitation applies to the net amount committed to active funds (calculated as the total cost basis of current investments plus total unfunded commitments, if any). For purposes of th ...

... a single manager. For long-term closed-end fund investments, including private equity and real estate funds, the 7.5% limitation applies to the net amount committed to active funds (calculated as the total cost basis of current investments plus total unfunded commitments, if any). For purposes of th ...

Is this a good time to invest in equity funds

... Equity markets for some time have been reeling under shaky macroeconomic fundamentals. While there are quite a few variables that are working against the business environment – some of the leading causes for the uncertainty include – Cash Management Bills (CMB), inflation and rupee-dollar exchange r ...

... Equity markets for some time have been reeling under shaky macroeconomic fundamentals. While there are quite a few variables that are working against the business environment – some of the leading causes for the uncertainty include – Cash Management Bills (CMB), inflation and rupee-dollar exchange r ...

SEBI (Venture Capital Funds) Regulations, 1996

... ARDC credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation (DEC) would be valued at over $355 million after the company's IPO in 1968 ARDC made an annualized return of 101% on the transaction ...

... ARDC credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation (DEC) would be valued at over $355 million after the company's IPO in 1968 ARDC made an annualized return of 101% on the transaction ...

PSSap Investment options and risk IBR

... shareholders in the form of dividends, and any capital gains or losses from share price fluctuations. Australian companies are exposed to both local and global market fluctuations and as the companies’ fortunes fluctuate, so will the value of any shares. Share prices are affected by market forces an ...

... shareholders in the form of dividends, and any capital gains or losses from share price fluctuations. Australian companies are exposed to both local and global market fluctuations and as the companies’ fortunes fluctuate, so will the value of any shares. Share prices are affected by market forces an ...

December 2011 - Capital Markets Board of Turkey

... covered ISE National-30 Index companies (excluding banks) has been enlarged to include other companies traded on the Istanbul Stock Exchange. However, companies trading on Watch List Market and Developing Companies Market are exempted from mandatory implementation of Corporate Governance Principles. ...

... covered ISE National-30 Index companies (excluding banks) has been enlarged to include other companies traded on the Istanbul Stock Exchange. However, companies trading on Watch List Market and Developing Companies Market are exempted from mandatory implementation of Corporate Governance Principles. ...

OTE (Hellenic Telecoms)

... provision of investment advice or as any solicitation whatsoever. The information contained herein has been obtained from sources believed to be reliable but it has not been verified by EUROBANK Equities Investment Firm S.A. The opinions expressed herein may not necessarily coincide with those of an ...

... provision of investment advice or as any solicitation whatsoever. The information contained herein has been obtained from sources believed to be reliable but it has not been verified by EUROBANK Equities Investment Firm S.A. The opinions expressed herein may not necessarily coincide with those of an ...

The Big Three: Not dead yet!

... However, it's worth noting that even though stocks were in the red Friday morning, they didn't plunge in the United States as sharply as they did in Japan and Europe. And when all was said and done, the Dow and S&P 500 each gained about 0.7% while the Nasdaq rose more than 2%. Phil Dow, director of ...

... However, it's worth noting that even though stocks were in the red Friday morning, they didn't plunge in the United States as sharply as they did in Japan and Europe. And when all was said and done, the Dow and S&P 500 each gained about 0.7% while the Nasdaq rose more than 2%. Phil Dow, director of ...

Of Banks and Mutual Funds: The Collective

... medium or small investor. The banks were forbidden to pool accounts other than those held for a "true fiduciary purpose" as trustee, guardian or administrator. Therefore, the bank-managed collective trusts were generally only available to widows, orphans and incompetents but not to ordinary investor ...

... medium or small investor. The banks were forbidden to pool accounts other than those held for a "true fiduciary purpose" as trustee, guardian or administrator. Therefore, the bank-managed collective trusts were generally only available to widows, orphans and incompetents but not to ordinary investor ...

Endowment Fund

... Matching funds Monies made available through programs established by provincial or federal governments, the University of Ottawa, donors or corporations. Matching funds leverage the donor’s endowed investments and its impact on programs or initiatives requested by the donor. Investment income earned ...

... Matching funds Monies made available through programs established by provincial or federal governments, the University of Ottawa, donors or corporations. Matching funds leverage the donor’s endowed investments and its impact on programs or initiatives requested by the donor. Investment income earned ...

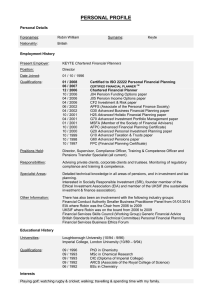

personal profile - Keyte Chartered Financial Planners

... Pensions Transfer Specialist (all current). ...

... Pensions Transfer Specialist (all current). ...

Minutes March 2016

... Jay Nogueira will move on to other opportunities within the firm. An added benefit of having two associate portfolios in different regions is the ability to gain region-specific information more efficiently. Mr. Berg noted that many investors are selling equities to “derisk”, essentially driven by i ...

... Jay Nogueira will move on to other opportunities within the firm. An added benefit of having two associate portfolios in different regions is the ability to gain region-specific information more efficiently. Mr. Berg noted that many investors are selling equities to “derisk”, essentially driven by i ...

Treasury International Capital System (“TIC”) Form S: Purchases

... and foreign clients that are placed through U.S. brokers, dealers, or underwriters if the U.S. investment manager does not disclose the identity of the foreign funds or clients to the U.S. broker, dealer, or underwriter.20 U.S. investment managers also have potential reporting obligations with respe ...

... and foreign clients that are placed through U.S. brokers, dealers, or underwriters if the U.S. investment manager does not disclose the identity of the foreign funds or clients to the U.S. broker, dealer, or underwriter.20 U.S. investment managers also have potential reporting obligations with respe ...

Text of Howard Davies lecture: Financial Reform in the Middle Kingdom

... 1. The Banking System The need for Banking System reform is well understood by the Chinese authorities and considerable steps have been taken already. Bad debts have been transferred to asset management companies, sizeable capital injections have been introduced into some of the banks, and there hav ...

... 1. The Banking System The need for Banking System reform is well understood by the Chinese authorities and considerable steps have been taken already. Bad debts have been transferred to asset management companies, sizeable capital injections have been introduced into some of the banks, and there hav ...

The Leverage effect of Structural Funds

... as your study clearly points out, the concept of leverage should be extended beyond this purely financial meaning, in order to grasp the importance of cohesion policy's value added. In this meaning we can say that European cohesion policy fosters multi-faceted partnership between different layers of ...

... as your study clearly points out, the concept of leverage should be extended beyond this purely financial meaning, in order to grasp the importance of cohesion policy's value added. In this meaning we can say that European cohesion policy fosters multi-faceted partnership between different layers of ...

Financial Results

... Investment) and it is not to be construed as an offer or solicitation for the purchase or sale of any financial instrument or the provision of an offer to provide investment services. Information, opinions and comments contained in this material are not under the scope of investment advisory service ...

... Investment) and it is not to be construed as an offer or solicitation for the purchase or sale of any financial instrument or the provision of an offer to provide investment services. Information, opinions and comments contained in this material are not under the scope of investment advisory service ...

There are six options for your investment in the CIF

... b. The credit union contacts Corporate One FCU at 800 366-2677. Corporate One will work with the credit union to find an investment that meets their asset liability strategy and fits their contribution goal set in Step a. Corporate One investment officers will work with the credit union to complete ...

... b. The credit union contacts Corporate One FCU at 800 366-2677. Corporate One will work with the credit union to find an investment that meets their asset liability strategy and fits their contribution goal set in Step a. Corporate One investment officers will work with the credit union to complete ...

incentives to investors in the industry

... potential is huge and growing, while investment hurdles are minimal and business risks not unconventional. The current growth momentum has been inspired by the Nigerian Communications Commission, and strong demand for communications services by the populace. Investors can shape the future of the nat ...

... potential is huge and growing, while investment hurdles are minimal and business risks not unconventional. The current growth momentum has been inspired by the Nigerian Communications Commission, and strong demand for communications services by the populace. Investors can shape the future of the nat ...

AIDA/ADC Investment

... Obligations issued, or fully insured or guaranteed as to the payment of principal and interest, by the United States of America, an agency thereof or a United States ...

... Obligations issued, or fully insured or guaranteed as to the payment of principal and interest, by the United States of America, an agency thereof or a United States ...