BangkokInvestments21.08.14

... easier for locals to buy residential assets and serves as a lucrative market for developers. Moreover, asset pricing will not come under pressure because banks have increased mortgage policies to accommodate the market consumption power. In an article on Property Report by Liam Bailey, Knight Fran ...

... easier for locals to buy residential assets and serves as a lucrative market for developers. Moreover, asset pricing will not come under pressure because banks have increased mortgage policies to accommodate the market consumption power. In an article on Property Report by Liam Bailey, Knight Fran ...

Sequential Investment, Hold-up, and Ownership Structure

... good producer may initiate the design and development, followed by the supplier’s effort in acquiring raw materials. We follow the framework of property rights theory from Grossman and Hart (1986) and Hart and Moore (1990) (hereinafter GHM). With incomplete contract, which arises due to causes such a ...

... good producer may initiate the design and development, followed by the supplier’s effort in acquiring raw materials. We follow the framework of property rights theory from Grossman and Hart (1986) and Hart and Moore (1990) (hereinafter GHM). With incomplete contract, which arises due to causes such a ...

Leadership and Governance

... Divestment is not ‘all or nothing’ Ask your fund manager how they are integrating environmental risks and opportunities ...

... Divestment is not ‘all or nothing’ Ask your fund manager how they are integrating environmental risks and opportunities ...

Investment in the OECD 19may2015

... bubble burst. Investment in the housing market fell rapidly as firms lost part of their former interest in this sector. In addition, assets prices fell leading to significant debt overhang. Firms saw their level of debt soar, although in various ways depending on the country, which in turn was partl ...

... bubble burst. Investment in the housing market fell rapidly as firms lost part of their former interest in this sector. In addition, assets prices fell leading to significant debt overhang. Firms saw their level of debt soar, although in various ways depending on the country, which in turn was partl ...

Merrill Lynch RPM Index

... informational purposes. It should not be redistributed to or relied on by others. This information was prepared by Sales and Trading personnel of BofAML. This information is not a publication of BofAML Research and it has not been reviewed or approved by any employee of BofAML Research. The informat ...

... informational purposes. It should not be redistributed to or relied on by others. This information was prepared by Sales and Trading personnel of BofAML. This information is not a publication of BofAML Research and it has not been reviewed or approved by any employee of BofAML Research. The informat ...

Presentation

... Revenue Management, & Good Governance Indicators of the Relation of the Oil Sector to the Economy, 2004 ...

... Revenue Management, & Good Governance Indicators of the Relation of the Oil Sector to the Economy, 2004 ...

portfolio commentary - Cary Street Partners

... The price of small company stocks are generally more volatile than large company stocks. Stocks may fluctuate in value and are subject to more risk than bonds or money market instruments. Shares, when redeemed, may be worth more or less than their original cost. Bonds, if held to maturity, provide a ...

... The price of small company stocks are generally more volatile than large company stocks. Stocks may fluctuate in value and are subject to more risk than bonds or money market instruments. Shares, when redeemed, may be worth more or less than their original cost. Bonds, if held to maturity, provide a ...

Retained Earnings of Mutual Funds

... investments are structured to produce a regular stream of income, through interest and/or dividends). The MF’s prospectus will indicate whether it can undertake any leveraging activity, and through which type of leveraging device (e.g., through straight borrowing, through repurchase agreements, or v ...

... investments are structured to produce a regular stream of income, through interest and/or dividends). The MF’s prospectus will indicate whether it can undertake any leveraging activity, and through which type of leveraging device (e.g., through straight borrowing, through repurchase agreements, or v ...

Why expenses matter - Charles Schwab Investment Management

... There is a $10 million minimum investment for Institutional Shares not purchased in an employer-sponsored plan. Operating Expense Ratios as reflected in each fund’s prospectus as of 3/1/17 and are subject to change. Investment returns will fluctuate and are subject to market volatility, so that an ...

... There is a $10 million minimum investment for Institutional Shares not purchased in an employer-sponsored plan. Operating Expense Ratios as reflected in each fund’s prospectus as of 3/1/17 and are subject to change. Investment returns will fluctuate and are subject to market volatility, so that an ...

NextGen College Investing Plan® Client Direct Series

... for purposes of FDIC insurance coverage only, considered to be held in the same ownership capacity as a Participant’s other single ownership accounts held at the Bank. However, Units of the NextGen Savings Portfolio are not insured or guaranteed by the FDIC or any other agency of state or federal go ...

... for purposes of FDIC insurance coverage only, considered to be held in the same ownership capacity as a Participant’s other single ownership accounts held at the Bank. However, Units of the NextGen Savings Portfolio are not insured or guaranteed by the FDIC or any other agency of state or federal go ...

ETFs: A Call for Greater Transparency and Consistent

... exposure is achieved by a swap, then to address systemic and investor concerns, the following features must be incorporated. First, any counterparty exposure must be wholly offset with high quality collateral. Second, the swap structure should follow best practices as outlined in the section below t ...

... exposure is achieved by a swap, then to address systemic and investor concerns, the following features must be incorporated. First, any counterparty exposure must be wholly offset with high quality collateral. Second, the swap structure should follow best practices as outlined in the section below t ...

Motives for FDI and inter-state investments in USA

... Indeed, quality of life is often higher ranked than incentives by investors • The country level evidence clearly shows that FDI performance is influenced by corporate tax – which is one key explanation why the FDI performance of the USA is weak; the US has the highest corporate tax in the developed ...

... Indeed, quality of life is often higher ranked than incentives by investors • The country level evidence clearly shows that FDI performance is influenced by corporate tax – which is one key explanation why the FDI performance of the USA is weak; the US has the highest corporate tax in the developed ...

Innovation: the transfer function of Science and Technology

... insight in the efficiency of the Innovation process? ...

... insight in the efficiency of the Innovation process? ...

Key Investor Information

... The risk category was calculated using historical performance data and may not be a reliable indicator of the fund's future risk profile. The fund's risk category is not guaranteed to remain fixed and may ...

... The risk category was calculated using historical performance data and may not be a reliable indicator of the fund's future risk profile. The fund's risk category is not guaranteed to remain fixed and may ...

Intertemporal capital budgeting

... to reduce the hurdle rate in the current period as the division manager accepts a grant when he predicts a low probability of investment. The cost of such an intertemporal capital allocation mechanism is that headquarters may deny funding to second-period projects that are value enhancing when judge ...

... to reduce the hurdle rate in the current period as the division manager accepts a grant when he predicts a low probability of investment. The cost of such an intertemporal capital allocation mechanism is that headquarters may deny funding to second-period projects that are value enhancing when judge ...

CF Heartwood Growth Multi Asset Fund

... The fund has the discretion to invest in the investments as described above with no need to adhere to a particular ...

... The fund has the discretion to invest in the investments as described above with no need to adhere to a particular ...

Effective Portfolio Management: Making Strategy a Reality

... realizing appropriate benefits. The outcome is that organizations receive a poor return from their investment by failing to unlock the full value of their capital investments. The following are the key elements for portfolio management to be effective through a combination of great strategy and powe ...

... realizing appropriate benefits. The outcome is that organizations receive a poor return from their investment by failing to unlock the full value of their capital investments. The following are the key elements for portfolio management to be effective through a combination of great strategy and powe ...

Regulation to amend Regulation 81

... investment risk level as determined by Items 1 and 2. However, a particular series or class of securities of a mutual fund may have a different investment risk level than the other series or classes of securities of the same mutual fund if that series or class of securities has an attribute that dif ...

... investment risk level as determined by Items 1 and 2. However, a particular series or class of securities of a mutual fund may have a different investment risk level than the other series or classes of securities of the same mutual fund if that series or class of securities has an attribute that dif ...

Document

... » Invest later stage – near-term revenue opportunities (within 12 months) » Opportunistic investment in technologies to address remaining gaps » Expand disease focus to include other emerging infectious disease ...

... » Invest later stage – near-term revenue opportunities (within 12 months) » Opportunistic investment in technologies to address remaining gaps » Expand disease focus to include other emerging infectious disease ...

Schroder Real Estate Investment Management Limited

... billion) under management as at 30 September 2015. Our clients are major financial institutions including pension funds, banks and insurance companies, local and public authorities, governments, charities, high net worth individuals and retail investors. With one of the largest networks of offices o ...

... billion) under management as at 30 September 2015. Our clients are major financial institutions including pension funds, banks and insurance companies, local and public authorities, governments, charities, high net worth individuals and retail investors. With one of the largest networks of offices o ...

OPTIMUM MARKET PORTFOLIOS With Experience

... large cap stocks, and the illiquidity of the small cap market may adversely affect the value of these investments so that when redeemed, shares may be worth more or less than their original cost. International and emerging market securities are also subject to additional risk such as currency fluctu ...

... large cap stocks, and the illiquidity of the small cap market may adversely affect the value of these investments so that when redeemed, shares may be worth more or less than their original cost. International and emerging market securities are also subject to additional risk such as currency fluctu ...

CIS Frequently Asked Questions

... When do managers have to start lodging material with the registrar and what are the submission periods? All advertising, marketing and information disclosure material will be lodged with the registrar as from 1st of March 2015. Generally any new material must be lodged with the registrar prior to it ...

... When do managers have to start lodging material with the registrar and what are the submission periods? All advertising, marketing and information disclosure material will be lodged with the registrar as from 1st of March 2015. Generally any new material must be lodged with the registrar prior to it ...

Focusing on Long-Term Return Objectives in a Low Return World

... assumptions used by many today. Investors in a situation like the one contemplated above have three options: ...

... assumptions used by many today. Investors in a situation like the one contemplated above have three options: ...

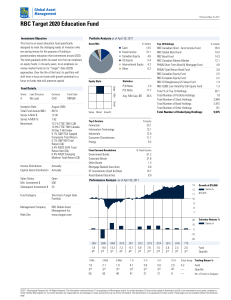

RBC Target 2020 Education Fund

... This fund is an asset allocation fund specifically designed to meet the changing needs of investors who are saving money for the purpose of funding a postsecondary education that commences around 2020. The fund gradually shifts its asset mix from an emphasis on equity funds, in its early years, to a ...

... This fund is an asset allocation fund specifically designed to meet the changing needs of investors who are saving money for the purpose of funding a postsecondary education that commences around 2020. The fund gradually shifts its asset mix from an emphasis on equity funds, in its early years, to a ...

Pillar 3 - Dimensional Fund Advisors

... The Firm offers a range of investments encompassing both equity and fixed interest strategies to clients primarily based in the UK, Europe, the Middle East, Latin America, Asia and Africa. Equity portfolios are highly diversified with, in some cases, many thousands of securities. Equity portfolios d ...

... The Firm offers a range of investments encompassing both equity and fixed interest strategies to clients primarily based in the UK, Europe, the Middle East, Latin America, Asia and Africa. Equity portfolios are highly diversified with, in some cases, many thousands of securities. Equity portfolios d ...