THEME: THE CHANGING ECONOMIC LANDSCAPE WITHIN EAC

... Some of them have grabbed attention making bad investments in several Wall Street financial firms such as Citigroup, Morgan Stanley, and Merrill Lynch. These firms needed a cash infusion due to losses resulting from mismanagement and the subprime mortgage crisis. SWFs invest in a variety of asset cl ...

... Some of them have grabbed attention making bad investments in several Wall Street financial firms such as Citigroup, Morgan Stanley, and Merrill Lynch. These firms needed a cash infusion due to losses resulting from mismanagement and the subprime mortgage crisis. SWFs invest in a variety of asset cl ...

Implications of Behavioural Economics for Mandatory

... in the United States, they showed that in schemes offering a majority of stock funds most contributions were invested in stocks, while in schemes offering a majority of fixed income funds most saving were invested in interest-bearing securities. Furthermore, they find a positive relationship at the ...

... in the United States, they showed that in schemes offering a majority of stock funds most contributions were invested in stocks, while in schemes offering a majority of fixed income funds most saving were invested in interest-bearing securities. Furthermore, they find a positive relationship at the ...

For general ART enquiries: Peter Allen Head of Alternative Risk

... for pricing and managing these have been developed by the banking and capital market industries. We have applied these techniques to model the loss experience of a syndicate writing a portfolio of credit enhancement business in order to investigate the resilience of the financial guarantee capitalis ...

... for pricing and managing these have been developed by the banking and capital market industries. We have applied these techniques to model the loss experience of a syndicate writing a portfolio of credit enhancement business in order to investigate the resilience of the financial guarantee capitalis ...

Saving

... • If a firm expects a rate of return of 7% on an investment of $10,000 or $700; it would not want to borrow money at any rate higher than 7% – For money borrowed at any rate above 7%, the firm would lose money – For money borrowed at any rate below 7%, the form would make money – This general rule a ...

... • If a firm expects a rate of return of 7% on an investment of $10,000 or $700; it would not want to borrow money at any rate higher than 7% – For money borrowed at any rate above 7%, the firm would lose money – For money borrowed at any rate below 7%, the form would make money – This general rule a ...

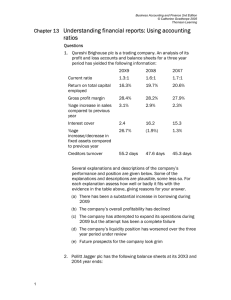

Chapter 13 Understanding financial reports: Using accounting ratios

... profits. The fact that the return on total capital employed has fallen may indicate a decline in operating profitability; however, it may be that capital employed has increased, but that the benefits of the increased investment have not yet emerged in the form of additional profits. (c) The company ...

... profits. The fact that the return on total capital employed has fallen may indicate a decline in operating profitability; however, it may be that capital employed has increased, but that the benefits of the increased investment have not yet emerged in the form of additional profits. (c) The company ...

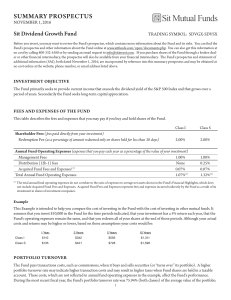

summary prospectus

... You could lose money by investing in the Fund. The principal risks of investing in the Fund are as follows: ›› Dividend Paying Company Risk: The Fund’s income objective may limit its ability to appreciate during a broad market advance because dividend paying stocks may not experience the same capita ...

... You could lose money by investing in the Fund. The principal risks of investing in the Fund are as follows: ›› Dividend Paying Company Risk: The Fund’s income objective may limit its ability to appreciate during a broad market advance because dividend paying stocks may not experience the same capita ...

`Parsing the Reality and Promise of Gulf

... entered into at least one power or desalination PPP in the region: Japan’s Marubeni Corporation is currently involved in six projects, third only to France’s GDF Suez and International Power by number of projects.4 While EPC and service contracts do not qualify as direct foreign investment in the GC ...

... entered into at least one power or desalination PPP in the region: Japan’s Marubeni Corporation is currently involved in six projects, third only to France’s GDF Suez and International Power by number of projects.4 While EPC and service contracts do not qualify as direct foreign investment in the GC ...

Chapter 28 Investment Policy and the Framework of the CFA Institute

... 13. An important benefit of Keogh plans is that A. they are not taxable until funds are withdrawn as benefits. B. they are protected against inflation. C. they are automatically insured by the Federal government. D. they are not taxable until funds are withdrawn as benefits and they are protected ag ...

... 13. An important benefit of Keogh plans is that A. they are not taxable until funds are withdrawn as benefits. B. they are protected against inflation. C. they are automatically insured by the Federal government. D. they are not taxable until funds are withdrawn as benefits and they are protected ag ...

Information regarding characteristics and risks associated with

... 2.5 Nominal price, splits and reverse splits A share’s nominal price represents its share of the company’s share capital. The sum of all of a company’s shares multiplied by the share’s nominal price is the company’s share capital. At times, the company may wish to alter the nominal price, for exampl ...

... 2.5 Nominal price, splits and reverse splits A share’s nominal price represents its share of the company’s share capital. The sum of all of a company’s shares multiplied by the share’s nominal price is the company’s share capital. At times, the company may wish to alter the nominal price, for exampl ...

Enrollment Form - Accurecord Direct

... If you have more than one primary beneficiary, your account balance will be divided as you specified. In the event a primary beneficiary does not survive you, your account balance will be divided among your contingent beneficiaries as specified. Your percent of assets must be in whole numbers and eq ...

... If you have more than one primary beneficiary, your account balance will be divided as you specified. In the event a primary beneficiary does not survive you, your account balance will be divided among your contingent beneficiaries as specified. Your percent of assets must be in whole numbers and eq ...

Capital Market: History Record

... • The return of large-company portfolio is essentially the return of S&P 500 index (proxy for market portfolio), so 8% − 3% = 5% market premium can be view as the reward to bear one unit systematic risk • If a stock has a beta of 2, how much risk premium should be awarded to investors who hold it? ...

... • The return of large-company portfolio is essentially the return of S&P 500 index (proxy for market portfolio), so 8% − 3% = 5% market premium can be view as the reward to bear one unit systematic risk • If a stock has a beta of 2, how much risk premium should be awarded to investors who hold it? ...

Chapter 12

... degree of influence are whether: Investor has representation on the investee's board of directors Investor participates in the investee's policy-making process Material transactions between the investor and the investee Common shares held by other shareholders are concentrated or dispersed ...

... degree of influence are whether: Investor has representation on the investee's board of directors Investor participates in the investee's policy-making process Material transactions between the investor and the investee Common shares held by other shareholders are concentrated or dispersed ...

lifeplan icfs financial advice satisfaction index

... and reliability, and technical abilities of an advisor. However, the period of taking advice did not impact the perceptions of performance. We do note that investors with longer than 10 years of taking financial advice did have a higher perception of performance which was statistically significant. ...

... and reliability, and technical abilities of an advisor. However, the period of taking advice did not impact the perceptions of performance. We do note that investors with longer than 10 years of taking financial advice did have a higher perception of performance which was statistically significant. ...

Stimulating Investment in Emerging-Market SMEs

... In developing countries, growth is far more constrained. Among low-income countries, SMEs contribute just 18 percent of employment and 16 percent of GDP. 3 If barriers to their growth were removed, SMEs would contribute more to economic development by providing jobs and income, expanding the middle ...

... In developing countries, growth is far more constrained. Among low-income countries, SMEs contribute just 18 percent of employment and 16 percent of GDP. 3 If barriers to their growth were removed, SMEs would contribute more to economic development by providing jobs and income, expanding the middle ...

FREE Sample Here

... Answer: In internal finance, both the household and the business firm use the current income and accumulated saving to acquire assets (self-financed). In external finance, the firm will issue the financial liabilities to raise additional funds to the household securities evidencing a loan of money. ...

... Answer: In internal finance, both the household and the business firm use the current income and accumulated saving to acquire assets (self-financed). In external finance, the firm will issue the financial liabilities to raise additional funds to the household securities evidencing a loan of money. ...

FREE Sample Here

... Answer: In internal finance, both the household and the business firm use the current income and accumulated saving to acquire assets (self-financed). In external finance, the firm will issue the financial liabilities to raise additional funds to the household securities evidencing a loan of money. ...

... Answer: In internal finance, both the household and the business firm use the current income and accumulated saving to acquire assets (self-financed). In external finance, the firm will issue the financial liabilities to raise additional funds to the household securities evidencing a loan of money. ...

Why do we invest ethically?

... segmentation, contrary to mainstream expectations at the time, did exist to the extent that individual preferences could hinder the free flow of capital and interfere with the establishment of coherent risk-return relationships among securities. They isolated five different investor groups with diff ...

... segmentation, contrary to mainstream expectations at the time, did exist to the extent that individual preferences could hinder the free flow of capital and interfere with the establishment of coherent risk-return relationships among securities. They isolated five different investor groups with diff ...

February 2017 - SIX Swiss Exchange

... including Switzerland’s most important blue-chip index SMI®. With the world’s most advanced trading technology Xstream INET it offers excellent trading conditions. www.six-swiss-exchange.com SIX Structured Products Exchange runs the structured products exchange in Switzerland and is a wholly owned s ...

... including Switzerland’s most important blue-chip index SMI®. With the world’s most advanced trading technology Xstream INET it offers excellent trading conditions. www.six-swiss-exchange.com SIX Structured Products Exchange runs the structured products exchange in Switzerland and is a wholly owned s ...

Applying Post-Modern Portfolio Theory to International Performance

... • Distributions do not have to be normal or symmetric ...

... • Distributions do not have to be normal or symmetric ...

Risk and Return: The Portfolio Theory The crux of portfolio theory

... broken down into two sources: - Firm specific risk (only faced by that firm), - Market wide risk (affects all investments). • Firm-specific risk can be reduced, if not eliminated, by increasing the number of investments in your portfolio (i.e. by being diversified). Market wide risk cannot. • On eco ...

... broken down into two sources: - Firm specific risk (only faced by that firm), - Market wide risk (affects all investments). • Firm-specific risk can be reduced, if not eliminated, by increasing the number of investments in your portfolio (i.e. by being diversified). Market wide risk cannot. • On eco ...

Risk Appetite: The Link Between Strategy and Capital

... The downturn (D) scenario suggests possible changes in risk appetite and the development of appropriate contingency plans to maintain ratios, sell assets and raise capital. ...

... The downturn (D) scenario suggests possible changes in risk appetite and the development of appropriate contingency plans to maintain ratios, sell assets and raise capital. ...

13.6 million uk adults without a pension

... skills, clients and business locations spanning world markets. Our investment competency encompasses developed and emerging market equity, fixed income and multi-asset portfolio management services offered to institutions, retail investors and private individuals. Worldwide clients include public an ...

... skills, clients and business locations spanning world markets. Our investment competency encompasses developed and emerging market equity, fixed income and multi-asset portfolio management services offered to institutions, retail investors and private individuals. Worldwide clients include public an ...

Risk and Return Analysis

... supposed to include all risky assets in their relative proportion, of which only a fraction are traded and quoted with up-to-date prices. Proxies may of course be used but it is not clear what the scope of the proxy should be, whether the portfolio can be taken as domestic-only for a US-based invest ...

... supposed to include all risky assets in their relative proportion, of which only a fraction are traded and quoted with up-to-date prices. Proxies may of course be used but it is not clear what the scope of the proxy should be, whether the portfolio can be taken as domestic-only for a US-based invest ...

The SEI Strategic Portfolios We have prepared the following

... institutional and boutique managers in addition to retail. This is then filtered down to a handful that meets all of their demanding criteria. SEI aims to have only the best managers in the portfolios at all times. 4. Portfolio Construction and Management SEI use a manager-of-managers approach to co ...

... institutional and boutique managers in addition to retail. This is then filtered down to a handful that meets all of their demanding criteria. SEI aims to have only the best managers in the portfolios at all times. 4. Portfolio Construction and Management SEI use a manager-of-managers approach to co ...