Foreign Debt and Foreign Investment

... borrow funds from overseas to finance investment (foreigners do not own domestic assets) – portfolio investment usually takes this form. – Equity investments are where foreigners invest in the ownership of domestic assets – direct investment usually takes this form. ...

... borrow funds from overseas to finance investment (foreigners do not own domestic assets) – portfolio investment usually takes this form. – Equity investments are where foreigners invest in the ownership of domestic assets – direct investment usually takes this form. ...

Appendix C

... The bank charges a yearly interest rate of 5% At the end of the year, how much will he have to pay back to the bank? Answer below In this case, the principal is the amount originally loaned out ($10,000) ...

... The bank charges a yearly interest rate of 5% At the end of the year, how much will he have to pay back to the bank? Answer below In this case, the principal is the amount originally loaned out ($10,000) ...

Limited Liability Partnership

... shares at a price of Rs.12 per share .The market value per share after this issue is expected to drop to Rs.17.33. Now if a shareholder has 100 shares, his financial situation with respect to Pradhan’s equity when he exercises the preemptive rights and when he does not exercise the preemptive rights ...

... shares at a price of Rs.12 per share .The market value per share after this issue is expected to drop to Rs.17.33. Now if a shareholder has 100 shares, his financial situation with respect to Pradhan’s equity when he exercises the preemptive rights and when he does not exercise the preemptive rights ...

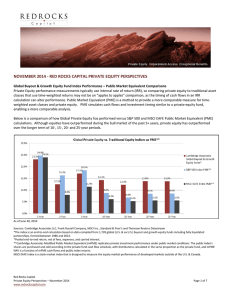

NOVEMBER 2014 - RED ROCKS CAPITAL PRIVATE EQUITY PERSPECTIVES

... trillion by 2020. The product will provide access to mix of private equity investments, such as partnerships, fund-of-funds and listed private equity, while providing daily liquidity for redemptions and rebalancing. http://blogs.wsj.com/privateequity/2014/10/24/partners-group-aims-to-bring-private-e ...

... trillion by 2020. The product will provide access to mix of private equity investments, such as partnerships, fund-of-funds and listed private equity, while providing daily liquidity for redemptions and rebalancing. http://blogs.wsj.com/privateequity/2014/10/24/partners-group-aims-to-bring-private-e ...

Boyang Sun

... Finance & Operations Intern (June 2015 – August 2015) Singapore Prepared financial reports, including annual budget, quarterly forecasts, and quarterly earnings release documents. Conducted presentation preparations pertaining to key business developments and operations, as well as other similar ...

... Finance & Operations Intern (June 2015 – August 2015) Singapore Prepared financial reports, including annual budget, quarterly forecasts, and quarterly earnings release documents. Conducted presentation preparations pertaining to key business developments and operations, as well as other similar ...

STRATEGIC INSIGHT WHISTLING PAST THE TOMBSTONES

... has been mostly borrowed by governments, making the debt to GDP ratios worse than they have ever been for these countries. To make matters worse, the dollar has since appreciated 20% against the global currency index, bringing the nominal sum of this incremental debt to over $64 trillion! At the top ...

... has been mostly borrowed by governments, making the debt to GDP ratios worse than they have ever been for these countries. To make matters worse, the dollar has since appreciated 20% against the global currency index, bringing the nominal sum of this incremental debt to over $64 trillion! At the top ...

Statement of Cash Flows

... assets $64,521,000 at December 31, 1994. Further, the Company has experienced significant cash flow difficulties and does not have sufficient cash resources and financing sources to meet its operating expenses and scheduled debt service obligations, and continue to fund its principal business activi ...

... assets $64,521,000 at December 31, 1994. Further, the Company has experienced significant cash flow difficulties and does not have sufficient cash resources and financing sources to meet its operating expenses and scheduled debt service obligations, and continue to fund its principal business activi ...

Equity Share Class Fact Sheet

... To achieve the stated objectives, the Investment Committee (IRC) may invest the Class in large-to-mid-capitalization common shares and equities with both low systematic risk and higher expected returns through capital appreciation, dividend income, or a combination of both. The IRC may also invest t ...

... To achieve the stated objectives, the Investment Committee (IRC) may invest the Class in large-to-mid-capitalization common shares and equities with both low systematic risk and higher expected returns through capital appreciation, dividend income, or a combination of both. The IRC may also invest t ...

Constructing the Appropriate Private Equity Investment

... Data is as of 6/30/2013. This analysis is an update to the original study completed by Adams Street Partners with data as of 6/30/2011. Study is available upon request. For private market investments, this exercise defines the final multiple of invested capital as the sum of cumulative investment di ...

... Data is as of 6/30/2013. This analysis is an update to the original study completed by Adams Street Partners with data as of 6/30/2011. Study is available upon request. For private market investments, this exercise defines the final multiple of invested capital as the sum of cumulative investment di ...

Slide 1 - Acionista.com.br

... Broad Diversification of Investor Base, notably Pension Funds, Parent Orgs., GPs, Family Offices, etc. Parent Organizations ...

... Broad Diversification of Investor Base, notably Pension Funds, Parent Orgs., GPs, Family Offices, etc. Parent Organizations ...

“Should U.S. Monetary Policy Have a Ternary Mandate?” • Alternative mechanism

... In their discussion of financial stability, participants generally did not see imbalances that posed significant near-term risks to the financial system and the broader economy, but they nevertheless reviewed some financial developments that pointed to potential future risks. A couple of participant ...

... In their discussion of financial stability, participants generally did not see imbalances that posed significant near-term risks to the financial system and the broader economy, but they nevertheless reviewed some financial developments that pointed to potential future risks. A couple of participant ...

Chapter 1 - Ning.com

... Some investors and investment companies focus on financing new small business ventures that have the potential earn a great deal of money Looking for high ROI – 6 times their investment in 5 years Venture Capitalists want equity Looking ...

... Some investors and investment companies focus on financing new small business ventures that have the potential earn a great deal of money Looking for high ROI – 6 times their investment in 5 years Venture Capitalists want equity Looking ...

l+m development and nelson management acquire 257

... strategically invest in the rehabilitation and preservation of thousands of affordable and middleincome units in the New York City area. We are pleased to collaborate with Nelson Management on this project, which will create reliable, sustainable homes and provide first-class property management to ...

... strategically invest in the rehabilitation and preservation of thousands of affordable and middleincome units in the New York City area. We are pleased to collaborate with Nelson Management on this project, which will create reliable, sustainable homes and provide first-class property management to ...

The future of corporate bond market liquidity

... The Volcker Rule is an important part of the Dodd-Frank legislation (Wall Street Reform and Consumer Protection Act), and it is intended to lower the risk of financial firms by limiting proprietary trading. Given the complexity of the topic, and difficulty in defining what is meant by “proprietary t ...

... The Volcker Rule is an important part of the Dodd-Frank legislation (Wall Street Reform and Consumer Protection Act), and it is intended to lower the risk of financial firms by limiting proprietary trading. Given the complexity of the topic, and difficulty in defining what is meant by “proprietary t ...

to - Fundsupermart.com

... These are all excellent moves in the right direction and help underpin a relief rally in share markets and other growth oriented assets as they help address the immediate concerns regarding Greece. However, its doubtful they will fundamentally solve the problem. First, the changes to the EFSF will h ...

... These are all excellent moves in the right direction and help underpin a relief rally in share markets and other growth oriented assets as they help address the immediate concerns regarding Greece. However, its doubtful they will fundamentally solve the problem. First, the changes to the EFSF will h ...

DebtRestructuringRequest

... will be able to agree upon an acceptable restructured debt repayment plan. I have taken a careful look at our financial situation. We have set up a realistic minimum budget for our living expenses and have developed a restructured debt repayment plan. I am hoping you will accept a reduced payment. A ...

... will be able to agree upon an acceptable restructured debt repayment plan. I have taken a careful look at our financial situation. We have set up a realistic minimum budget for our living expenses and have developed a restructured debt repayment plan. I am hoping you will accept a reduced payment. A ...

Personal Finance syllabus

... ownership, education, and retirement), budgeting and savings, personal income tax, investments (stocks, bonds, and mutual funds), insurance, retirement and estate planning. The effective management of credit is also covered. STUDENT LEARNING OUTCOMES: 1) Set financial goals and create a financial pl ...

... ownership, education, and retirement), budgeting and savings, personal income tax, investments (stocks, bonds, and mutual funds), insurance, retirement and estate planning. The effective management of credit is also covered. STUDENT LEARNING OUTCOMES: 1) Set financial goals and create a financial pl ...

View as DOCX (1) 139 KB

... Implications: This item has the following implications, as indicated: Risk management Private equity is illiquid and increasing the allocation from 5% of assets under management (AUM) to 7.5% reduces liquidity on these additional assets. This is compensated by the potential for superior returns (i.e ...

... Implications: This item has the following implications, as indicated: Risk management Private equity is illiquid and increasing the allocation from 5% of assets under management (AUM) to 7.5% reduces liquidity on these additional assets. This is compensated by the potential for superior returns (i.e ...

Chapter 11 Securities Markets

... Security Market Indexes are used to track overall market and sector performance for stocks, bonds, and other investments Well-known stock market indexes: – Dow Jones Industrial Average • Based on price – Standard & Poor’s (S&P) 500 • Based on market value ...

... Security Market Indexes are used to track overall market and sector performance for stocks, bonds, and other investments Well-known stock market indexes: – Dow Jones Industrial Average • Based on price – Standard & Poor’s (S&P) 500 • Based on market value ...

Chapter 13

... Equity finance versus debt finance The prices at which shares trade on stock exchange are determined by the supply and demand for the stock in the company Equity premium- bonus paid by the market to shareholders Stock index is the average of a group of stock prices ...

... Equity finance versus debt finance The prices at which shares trade on stock exchange are determined by the supply and demand for the stock in the company Equity premium- bonus paid by the market to shareholders Stock index is the average of a group of stock prices ...

Slides_

... The backbone of the current systemic configuration of the global economy is the US-Asia axis : China & Japan in different as well as in similar capacities ; less crucially Korea &Taiwan ; India in a particular position ...

... The backbone of the current systemic configuration of the global economy is the US-Asia axis : China & Japan in different as well as in similar capacities ; less crucially Korea &Taiwan ; India in a particular position ...

Your Oasis - Oasis Crescent

... payments. Working towards reducing your debt also means you will have more money at your disposal in the future. You can then invest a third of your money to help you save for your long-term goals. You could save it in a policy that will help provide for your retirement, your children’s education or ...

... payments. Working towards reducing your debt also means you will have more money at your disposal in the future. You can then invest a third of your money to help you save for your long-term goals. You could save it in a policy that will help provide for your retirement, your children’s education or ...

Turkish Capital Markets - Capital Markets Board of Turkey

... One of very few countries during the crisis, where there was ...

... One of very few countries during the crisis, where there was ...

BridgeValley Community and Technical College Financial Aid Office

... Your Free Application for Federal Student Aid (FAFSA) was received for the 2017-2018 academic year. In order to continue processing, verify yours and your parent’s (if you are a dependent student) asset information as of today by answering the following questions: 1. Balance of cash, savings, and ch ...

... Your Free Application for Federal Student Aid (FAFSA) was received for the 2017-2018 academic year. In order to continue processing, verify yours and your parent’s (if you are a dependent student) asset information as of today by answering the following questions: 1. Balance of cash, savings, and ch ...

Building Blocks of Personal Finance

... a. When developing a financial plan, a person must have long and short term goals, organized financial records, a spending plan, and an emergency savings fund. 4. Manage a. Solid financial management includes properly managing large expenses including housing, transportation, insurance, and income t ...

... a. When developing a financial plan, a person must have long and short term goals, organized financial records, a spending plan, and an emergency savings fund. 4. Manage a. Solid financial management includes properly managing large expenses including housing, transportation, insurance, and income t ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.