Blending - Switch to Green

... American Investment Facility (LAIF). • AFD, Inter-American Development Bank. ...

... American Investment Facility (LAIF). • AFD, Inter-American Development Bank. ...

Ebix Stands Out in the Insurance Software and Services Industry

... http://seekingalpha.com/article/270005-ebix-stands-out-in-the-insurance-s... ...

... http://seekingalpha.com/article/270005-ebix-stands-out-in-the-insurance-s... ...

CONSTRUCTION MANAGER

... (See petersonbc.com for much more information). The VP Asset Management position reports to the President and provides leadership, direction and strategic advice on asset management, property management, and leasing, to optimize cash flow, net income, and value of the real estate portfolio. It manag ...

... (See petersonbc.com for much more information). The VP Asset Management position reports to the President and provides leadership, direction and strategic advice on asset management, property management, and leasing, to optimize cash flow, net income, and value of the real estate portfolio. It manag ...

Quarter letter - OregonLive.com

... Based on all three factors -- reasonable valuations, healthy earnings growth and attractive dividends -we believe with careful stock selection investors can earn attractive returns during this extended period of slow economic growth. But we must stress one additional aspect of the New Normal that is ...

... Based on all three factors -- reasonable valuations, healthy earnings growth and attractive dividends -we believe with careful stock selection investors can earn attractive returns during this extended period of slow economic growth. But we must stress one additional aspect of the New Normal that is ...

Vincent Rague: Property Finance

... Sponsors other developer(s). IFC may take a stake in Devco It acts as developer of both commercial and residential properties Execution of development only, obtaining fees for development services rendered Property management fees are earned for management of completed properties, whether sold or he ...

... Sponsors other developer(s). IFC may take a stake in Devco It acts as developer of both commercial and residential properties Execution of development only, obtaining fees for development services rendered Property management fees are earned for management of completed properties, whether sold or he ...

The 8th Cumbre Financiera Mexicana April 9th, 2013

... vehicles, offer investors the opportunity to capitalize on Mexico’s strong macroeconomic environment, favorable demographics, attractive consumption trends, low formal retail and shopping center penetration, and increased competitiveness in the manufacturing sector. These vehicles have encouraged th ...

... vehicles, offer investors the opportunity to capitalize on Mexico’s strong macroeconomic environment, favorable demographics, attractive consumption trends, low formal retail and shopping center penetration, and increased competitiveness in the manufacturing sector. These vehicles have encouraged th ...

quarterly update - Strategic Asset Management Group

... There are plenty of challenges to our reflation point of view. The strength of the dollar is a problem for our multinationals and for the country’s balance of trade which could turn even more negative and impact GDP momentum. Additionally, personal consumption expenditures need to carry the country’ ...

... There are plenty of challenges to our reflation point of view. The strength of the dollar is a problem for our multinationals and for the country’s balance of trade which could turn even more negative and impact GDP momentum. Additionally, personal consumption expenditures need to carry the country’ ...

THe NK Approach to Exchange Rate Policy Analysis: Looking Forward

... The Transmission of International Shocks to Open Economies Reserve Bank of New Zealand, December 2010 ...

... The Transmission of International Shocks to Open Economies Reserve Bank of New Zealand, December 2010 ...

Investment returns - Rother District Council

... The Council has not entered into any new borrowing activity since becoming debt free in April 2002. ...

... The Council has not entered into any new borrowing activity since becoming debt free in April 2002. ...

Shipping Industry Profile and Competitive Landscape

... flows, liquid assets, and debt) when funding capital expenditures. They found that oil companies obtained more than half of their funding from internally generated cash flows. Myers and Majluf (1984) observed that managers know more about their firms than outside investors do. They are reluctant to ...

... flows, liquid assets, and debt) when funding capital expenditures. They found that oil companies obtained more than half of their funding from internally generated cash flows. Myers and Majluf (1984) observed that managers know more about their firms than outside investors do. They are reluctant to ...

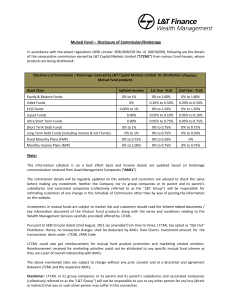

Mutual Fund – Disclosure of Commission/Brokerage Note:

... This information collation is on a best effort basis and Income details are updated based on brokerage communication received from Asset Management Companies (“AMCs”). The commission details will be regularly updated on this website and customers are advised to check the same before making any inves ...

... This information collation is on a best effort basis and Income details are updated based on brokerage communication received from Asset Management Companies (“AMCs”). The commission details will be regularly updated on this website and customers are advised to check the same before making any inves ...

Weekly Advisor Analysis 10-21-13 PAA

... within a country’s borders in a specific time period, through GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory. * The Standard & Poor's 500 (S&P 500) is an u ...

... within a country’s borders in a specific time period, through GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory. * The Standard & Poor's 500 (S&P 500) is an u ...

CHAPTER 17

... It is often used to measure managerial performance, even in not-for-profit businesses. Should not-for-profit managers be required to generate economic returns? ...

... It is often used to measure managerial performance, even in not-for-profit businesses. Should not-for-profit managers be required to generate economic returns? ...

A free market bailout alternative? Philipp Bagus, Juan Ramón Rallo

... in refinancing the short-term debts oblige mismatching institutions to liquidate longterm assets at prices that are inferior to those registered on the balance sheet.6 This deteriorates the capital of the company even more. At the same time the increase in default risk complicated the access to cred ...

... in refinancing the short-term debts oblige mismatching institutions to liquidate longterm assets at prices that are inferior to those registered on the balance sheet.6 This deteriorates the capital of the company even more. At the same time the increase in default risk complicated the access to cred ...

Current Acid-test Debt to Action Ratio Ratio Equity Ratio

... Identify and explain the deficiencies in the statement prepared by the company’s accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a note. ...

... Identify and explain the deficiencies in the statement prepared by the company’s accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a note. ...

Investment Companies Insights

... investment. The announcement by Witan Investment Trust on the reduction from five to three managers with a global remit is expected to see Witan’s combined active share rise from 70% to 74%. The changes at Alliance Trust to its new multi managers approach also places great emphasis on active manager ...

... investment. The announcement by Witan Investment Trust on the reduction from five to three managers with a global remit is expected to see Witan’s combined active share rise from 70% to 74%. The changes at Alliance Trust to its new multi managers approach also places great emphasis on active manager ...

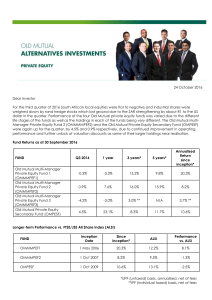

24 October 2016 Dear Investor For the third quarter of 2016 South

... OMMMPEF1 was down 0.3% for the quarter and 3.3% down over the last year. Despite the recent pullback, the fund is up 13.2% per year over the last three years and has been a superb creator of wealth for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has ...

... OMMMPEF1 was down 0.3% for the quarter and 3.3% down over the last year. Despite the recent pullback, the fund is up 13.2% per year over the last three years and has been a superb creator of wealth for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has ...

Australian Debt Sale Market Overview

... over the past 12 months. There is an indication that prices have started to soften in mature industries. Significant growth in volumes and record pricing is testing the depth of the market. ...

... over the past 12 months. There is an indication that prices have started to soften in mature industries. Significant growth in volumes and record pricing is testing the depth of the market. ...

2016 Capital Market Projections

... This chart articulates the asset mix and associated risk needed in order to achieve an expected 7.5% return at different points in history. ● Over time, achieving a 7.5% return has necessitated the assumption of three times the risk (standard deviation) ● Reality is that investors have had to make a ...

... This chart articulates the asset mix and associated risk needed in order to achieve an expected 7.5% return at different points in history. ● Over time, achieving a 7.5% return has necessitated the assumption of three times the risk (standard deviation) ● Reality is that investors have had to make a ...

careers

... How do I value stocks/bonds? Go to or Look at what? If T-bond rates go up – T-Bonds do what? And the US $? Points on a mortgage sound good. Really? Should I borrow to start my business? At what rate? ...

... How do I value stocks/bonds? Go to or Look at what? If T-bond rates go up – T-Bonds do what? And the US $? Points on a mortgage sound good. Really? Should I borrow to start my business? At what rate? ...

Application of the United Nations Model to payments received under

... LIBOR plus 1/2%, payable quarterly, for 10 years. It then enters into a 10year interest rate swap with its investment bank, pursuant to which it will make "periodic payments" of 6% quarterly with respect to a "notional principal amount" of $100 million to the investment bank, and the investment bank ...

... LIBOR plus 1/2%, payable quarterly, for 10 years. It then enters into a 10year interest rate swap with its investment bank, pursuant to which it will make "periodic payments" of 6% quarterly with respect to a "notional principal amount" of $100 million to the investment bank, and the investment bank ...

Assessment of the Non-Observed Economy in Albania

... lack of early stage segment skilled investors; – policy instruments should suit the market stage (kick-start, developing, re-vitalizing) ...

... lack of early stage segment skilled investors; – policy instruments should suit the market stage (kick-start, developing, re-vitalizing) ...

Chapter 5 The Time Value of Money

... For example, when being appraised, managers want to be judged relative to accounting numbers, such as profits and return on investment (ROI), because they can control these numbers to some extent. ...

... For example, when being appraised, managers want to be judged relative to accounting numbers, such as profits and return on investment (ROI), because they can control these numbers to some extent. ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.