Financial Assets - OpenTuition.com

... e.g. Redeemable preference shares . . to raise finance . . to finance projects . . Fixed dividend paid yearly . . initial loan repaid at agreed future date . . Show as loan Substance Over Form principle . . in substance this is a loan . . not equity (commercial substance of FI may differ from it’s s ...

... e.g. Redeemable preference shares . . to raise finance . . to finance projects . . Fixed dividend paid yearly . . initial loan repaid at agreed future date . . Show as loan Substance Over Form principle . . in substance this is a loan . . not equity (commercial substance of FI may differ from it’s s ...

Who is responsible for the financial crisis? by Brigitte Unger

... During the continuing boom the ‘Ponzi borrowers’ will start to dominate. They just speculate ...

... During the continuing boom the ‘Ponzi borrowers’ will start to dominate. They just speculate ...

Ethics of the Financial Professional

... 9.3.2. Dreier swindled $400 million from _________________________________________ by selling $700 million of _________________________________________________ . 9.3.3. Dreier’s story is told in the 2011 documentary, Unraveled. 10. Web Challenge #1: If financial professionals are compensated when th ...

... 9.3.2. Dreier swindled $400 million from _________________________________________ by selling $700 million of _________________________________________________ . 9.3.3. Dreier’s story is told in the 2011 documentary, Unraveled. 10. Web Challenge #1: If financial professionals are compensated when th ...

Key Features of the Deposit Protection Agency Act

... The blanket guarantee shall be gradually phased-out to limited coverage of 1 million Baht within 4 years as follows : 1st year : full amount of deposit (11 Aug 2008 – 10 Aug 2009) 2nd year : full amount of deposit (11 Aug 2009 – 10 Aug 2010) 3rd year : full amount of deposit (11 Aug 2010 – 10 Aug 20 ...

... The blanket guarantee shall be gradually phased-out to limited coverage of 1 million Baht within 4 years as follows : 1st year : full amount of deposit (11 Aug 2008 – 10 Aug 2009) 2nd year : full amount of deposit (11 Aug 2009 – 10 Aug 2010) 3rd year : full amount of deposit (11 Aug 2010 – 10 Aug 20 ...

Declan Costello (EC, DG ECFIN)

... studies "any early warnings or recommendations from the ESRB relevant to the Member States under review" into account • European Parliament has proposed additional ...

... studies "any early warnings or recommendations from the ESRB relevant to the Member States under review" into account • European Parliament has proposed additional ...

FRBSF E L

... equities exposes the investor to considerable risk. As a result these investments will have substantial risk premiums—that is, they will have to generate higher returns to account for the risk involved—which is consistent with the actual data. The risk premiums therefore reflect not only investors’ ...

... equities exposes the investor to considerable risk. As a result these investments will have substantial risk premiums—that is, they will have to generate higher returns to account for the risk involved—which is consistent with the actual data. The risk premiums therefore reflect not only investors’ ...

pdf - BNY Mellon Investment Management

... “Wide diversification is only required when investors do not understand what they are doing.”3 ...

... “Wide diversification is only required when investors do not understand what they are doing.”3 ...

Risk Profiling

... comparison, during the last 60 years, the Australian market has fallen by more than 50% in a twelve month period on just two occasions – in 1974 when it fell by 50.5% and during the global financial crisis when it fell by 55%. It has fallen by 38% or more on four occasions – in 1974, 1981/2, 1987 an ...

... comparison, during the last 60 years, the Australian market has fallen by more than 50% in a twelve month period on just two occasions – in 1974 when it fell by 50.5% and during the global financial crisis when it fell by 55%. It has fallen by 38% or more on four occasions – in 1974, 1981/2, 1987 an ...

Monthly Asset Allocation Private Banking Europe Investment

... product. Its content has been prepared by our staff and is based on sources of information we consider to be reliable. However, we cannot provide any confirmation or guarantee as to its being correct, complete and up to date. The circumstances and principles to which the information contained in thi ...

... product. Its content has been prepared by our staff and is based on sources of information we consider to be reliable. However, we cannot provide any confirmation or guarantee as to its being correct, complete and up to date. The circumstances and principles to which the information contained in thi ...

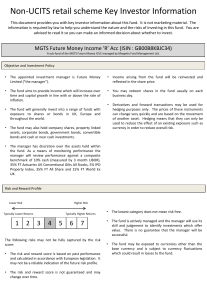

Small Cap Dividends: A Potential Path to

... Consumer Staples Sector Risk, Dividend-Paying Stock Risk, Energy Sector Risk, Financials Sector Risk, IndexRelated Risk, Management Risk, Market Risk, Risk of Secondary Listings, Secondary Market Trading Risk, MidCapitalization Companies Risk, Passive Investment Risk and Utilities Sector Risk. The a ...

... Consumer Staples Sector Risk, Dividend-Paying Stock Risk, Energy Sector Risk, Financials Sector Risk, IndexRelated Risk, Management Risk, Market Risk, Risk of Secondary Listings, Secondary Market Trading Risk, MidCapitalization Companies Risk, Passive Investment Risk and Utilities Sector Risk. The a ...

Comments on Faria & Mauro

... and focusing on barriers to entry – But just putting these in a regression (not instrumented) may not tell us very much • Likely correlated with broader institutions • Probably there is some form of “seesaw” effect: – If you push down on one end (lower some cost for new entrants to become large firm ...

... and focusing on barriers to entry – But just putting these in a regression (not instrumented) may not tell us very much • Likely correlated with broader institutions • Probably there is some form of “seesaw” effect: – If you push down on one end (lower some cost for new entrants to become large firm ...