Chapter 1: Introduction

... Economics Principles Arbitrage: A market situation whereby an investor can make a profit with: no equity and no risk. Efficiency: A market is said to be efficient if prices are such that there exist no arbitrage opportunities. Alternatively, a market is said to be inefficient if prices present arbit ...

... Economics Principles Arbitrage: A market situation whereby an investor can make a profit with: no equity and no risk. Efficiency: A market is said to be efficient if prices are such that there exist no arbitrage opportunities. Alternatively, a market is said to be inefficient if prices present arbit ...

Solutions to Chapter 9

... for the TSX than for the Long Bond portfolio. This is what we find: the TSX risk premium has a 14.2% standard deviation and the Long Bond risk premium has a 3.33% standard deviation. There is a lot more variation in the TSX risk premium because there is a lot more variation in the TSX return than fo ...

... for the TSX than for the Long Bond portfolio. This is what we find: the TSX risk premium has a 14.2% standard deviation and the Long Bond risk premium has a 3.33% standard deviation. There is a lot more variation in the TSX risk premium because there is a lot more variation in the TSX return than fo ...

Crisis Alpha and Risk in Alternative Investment

... siren call of Alternative Investments. Their seductive return properties and the mystique surrounding how they make money has tantalized investors resulting in exponential growth of assets under management. The key issue remains that dynamic strategies in Alternative Investments perform differently ...

... siren call of Alternative Investments. Their seductive return properties and the mystique surrounding how they make money has tantalized investors resulting in exponential growth of assets under management. The key issue remains that dynamic strategies in Alternative Investments perform differently ...

The course presents an introduction to financial intermediation and

... trading and aims at investigating the following aspects: 1) what are banks and what do they do? 2) what are the motives for trading and how is the trading process organized? 3) how do traders (and protocols) affect market quality? The analysis of these ...

... trading and aims at investigating the following aspects: 1) what are banks and what do they do? 2) what are the motives for trading and how is the trading process organized? 3) how do traders (and protocols) affect market quality? The analysis of these ...

investment diversification

... interest paid on that account will change relative to other accounts. This could mean that the interest you receive is no longer as good as when you originally invested. It is important to remember that all investments have a degree of risk. Even choosing not to invest is risky. The key is to get th ...

... interest paid on that account will change relative to other accounts. This could mean that the interest you receive is no longer as good as when you originally invested. It is important to remember that all investments have a degree of risk. Even choosing not to invest is risky. The key is to get th ...

Monetary Policy and Financial Stability Turalay Kenç Deputy Governor

... *Average of EM countries: Brazil, Chile, Czech Rep. Hungary, Mexico, Poland, S.Africa, Indonesia, South Korea and Colombia. Source: CBRT and Bloomberg ...

... *Average of EM countries: Brazil, Chile, Czech Rep. Hungary, Mexico, Poland, S.Africa, Indonesia, South Korea and Colombia. Source: CBRT and Bloomberg ...

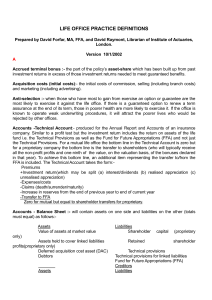

LIFE OFFICE PRACTICE DEFINITIONS

... guarantees and options) and furthermore allowing for the market risk (the risk of a sudden change in financial conditions), credit risk and persistency risk. The market risk, credit risk and persistency risk stress tests are specified by the FSA. Nonetheless a given stress test may proportionally ef ...

... guarantees and options) and furthermore allowing for the market risk (the risk of a sudden change in financial conditions), credit risk and persistency risk. The market risk, credit risk and persistency risk stress tests are specified by the FSA. Nonetheless a given stress test may proportionally ef ...

CORPORATE FINANCE

... Interstate Transport has a target capital structure of 50 percent debt and 50 percent common equity. The firm is considering a new independent project which has an IRR of 13 percent and which is not related to transportation. However, a pure play proxy firm has been identified that is exclusively en ...

... Interstate Transport has a target capital structure of 50 percent debt and 50 percent common equity. The firm is considering a new independent project which has an IRR of 13 percent and which is not related to transportation. However, a pure play proxy firm has been identified that is exclusively en ...

2-4 Financial Analysis-

... • Market Value Measures: ratios utilizing market prices. Price per share – Price Earnings (PE) Ratio Earnings per share ...

... • Market Value Measures: ratios utilizing market prices. Price per share – Price Earnings (PE) Ratio Earnings per share ...

How to Characterise Financial Systems

... The lender has information about the borrower which is not available publicly. This gives the lender direct influence on the borrower and monopolistic power in the market. ...

... The lender has information about the borrower which is not available publicly. This gives the lender direct influence on the borrower and monopolistic power in the market. ...

Using the CAPM

... β will measure the percentage effect in the dependent variable that is caused by a 1 percent change in the independent variable (the slope of the regression line). And α will be the excess return on the security when the market’s excess return is zero (the Y intercept) Ri – Rf = α + β (Rm – Rf) + e ...

... β will measure the percentage effect in the dependent variable that is caused by a 1 percent change in the independent variable (the slope of the regression line). And α will be the excess return on the security when the market’s excess return is zero (the Y intercept) Ri – Rf = α + β (Rm – Rf) + e ...

Market Pricing of Economic Risks and Stock Returns

... Economic fundamentals do matter for stock pricing. Different companies show different exposures to inflation and real output growth risks. Cross-sectional variations are much larger than time-series variations. Regressing market portfolio returns on the economic indicators are likely to generate ins ...

... Economic fundamentals do matter for stock pricing. Different companies show different exposures to inflation and real output growth risks. Cross-sectional variations are much larger than time-series variations. Regressing market portfolio returns on the economic indicators are likely to generate ins ...

Some Lessons from Capital Market History

... • We can examine returns in the financial markets to help us determine the appropriate returns on non-financial assets • Lessons from capital market history – There is a reward for bearing risk – The greater the potential reward, the greater the risk – This is called the risk-return trade-off ...

... • We can examine returns in the financial markets to help us determine the appropriate returns on non-financial assets • Lessons from capital market history – There is a reward for bearing risk – The greater the potential reward, the greater the risk – This is called the risk-return trade-off ...

Operating Speed

... killed an impact from a vehicle travelling at 80km/h and above. In essence, the safety of a road cannot be understood without knowledge of traffic speeds, and as such, speed is a critical part of the iRAP methodology. This topic is discussed further in Vehicle Speeds and the iRAP Protocols, availabl ...

... killed an impact from a vehicle travelling at 80km/h and above. In essence, the safety of a road cannot be understood without knowledge of traffic speeds, and as such, speed is a critical part of the iRAP methodology. This topic is discussed further in Vehicle Speeds and the iRAP Protocols, availabl ...

JPM US Value X (acc)

... may be held liable solely on the basis of any statement contained in this document that is misleading, inaccurate or inconsistent with the relevant parts of the Prospectus. JPMorgan Funds consists of separate Sub-Funds, each of which issues one or more Share Classes. This document is prepared for a ...

... may be held liable solely on the basis of any statement contained in this document that is misleading, inaccurate or inconsistent with the relevant parts of the Prospectus. JPMorgan Funds consists of separate Sub-Funds, each of which issues one or more Share Classes. This document is prepared for a ...

Ultra-low or negative interest rates

... banks. Negative nominal deposit rates are presented as a tax imposed by the central bank on commercial banks to encourage them to expand lending, and not as a tax on the savers. But there are two possibilities here: either the banks pass on the tax to their customers, so that negative rates are char ...

... banks. Negative nominal deposit rates are presented as a tax imposed by the central bank on commercial banks to encourage them to expand lending, and not as a tax on the savers. But there are two possibilities here: either the banks pass on the tax to their customers, so that negative rates are char ...

Hubert Cottogni_3rd Danube Financing Dialogue

... largely owned by Eurozone banks, the financial crisis has had severe knock-on effects. Greek banks in particular continue to own a significant share in economies in the Danube Region. ...

... largely owned by Eurozone banks, the financial crisis has had severe knock-on effects. Greek banks in particular continue to own a significant share in economies in the Danube Region. ...