BEA Union Investment Series Product Key Facts

... Even if the Sub-Fund aims to pay realisation proceeds and/or dividends to investors of the RMB class of units in RMB, investors may not receive RMB upon realisation of their investments or receive dividend payments in RMB under extreme market conditions when there is not sufficient RMB for currency ...

... Even if the Sub-Fund aims to pay realisation proceeds and/or dividends to investors of the RMB class of units in RMB, investors may not receive RMB upon realisation of their investments or receive dividend payments in RMB under extreme market conditions when there is not sufficient RMB for currency ...

Unlocking SME finance through market-based debt

... funding for SMEs, while providing banks with capital relief that allows for the unlocking of resources and further on-lending to the real economy. Securitisation can act as a credit risk transfer mechanism potentially resulting in a deeper and sounder financial system. While regulatory reforms are r ...

... funding for SMEs, while providing banks with capital relief that allows for the unlocking of resources and further on-lending to the real economy. Securitisation can act as a credit risk transfer mechanism potentially resulting in a deeper and sounder financial system. While regulatory reforms are r ...

increasing the sustain ability of european pension systems

... The current crisis is also one of the factors putting increasing pressure on the sustainability of pension systems. The European Commission therefore proposes new regulation for pension systems. Jurre de Haan and Wilfried Mulder of APG explain some highly topical developments in European pension pol ...

... The current crisis is also one of the factors putting increasing pressure on the sustainability of pension systems. The European Commission therefore proposes new regulation for pension systems. Jurre de Haan and Wilfried Mulder of APG explain some highly topical developments in European pension pol ...

The Industry Life Cycle and Acquisitions and Investment: Does Firm

... - where the value of financial resources is likely to be the highest. There are several key differences between our approach and the existing literature on investment and internal capital markets. First, we relate the firm’s investment and financing needs to long-run changes in industry conditions. ...

... - where the value of financial resources is likely to be the highest. There are several key differences between our approach and the existing literature on investment and internal capital markets. First, we relate the firm’s investment and financing needs to long-run changes in industry conditions. ...

- UConn School of Business

... cash-preserving incentive. This is especially true given that most managers are entitled to an actuarial lump-sum pension value on reaching retirement age, thus leaving concerns related only to losing their pension in the years leading up to their retirement.1 Our third hypothesis is therefore: ...

... cash-preserving incentive. This is especially true given that most managers are entitled to an actuarial lump-sum pension value on reaching retirement age, thus leaving concerns related only to losing their pension in the years leading up to their retirement.1 Our third hypothesis is therefore: ...

Voluntary Sovereign Debt Exchanges

... It should be noted that creditors face difficulties when trying to confiscate assets of a defaulting country (see, for instance, Panizza et al., 2009 and Hatchondo and Martinez, 2011). In many countries (including the U.S.), there are legal procedures that creditors may follow once individuals or co ...

... It should be noted that creditors face difficulties when trying to confiscate assets of a defaulting country (see, for instance, Panizza et al., 2009 and Hatchondo and Martinez, 2011). In many countries (including the U.S.), there are legal procedures that creditors may follow once individuals or co ...

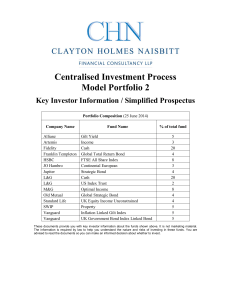

Key Investor Information - Clayton Holmes Naisbitt

... For more information, please consult the Prospectus and latest Reports and Accounts which can be obtained free of charge in English and other main languages from the Fund Manager, the distributors or online at any time. The Net Asset Values per unit are available at the registered office of the Fund ...

... For more information, please consult the Prospectus and latest Reports and Accounts which can be obtained free of charge in English and other main languages from the Fund Manager, the distributors or online at any time. The Net Asset Values per unit are available at the registered office of the Fund ...

Not Just One Man - Barings I. How Leeson Broke Barings II. Lessons

... the same strikes and maturities. Leeson earned premium income from selling well over 37,000 straddles over a fourteen month period. Such trades are very profitable provided the Nikkei 225 is trading at the options' strike on expiry date since both the puts and calls would expire worthless. The selle ...

... the same strikes and maturities. Leeson earned premium income from selling well over 37,000 straddles over a fourteen month period. Such trades are very profitable provided the Nikkei 225 is trading at the options' strike on expiry date since both the puts and calls would expire worthless. The selle ...

161128 APS 210 FINAL clean

... Board and senior management responsibilities ............................................... 4 Liquidity risk management framework .............................................................. 6 Management of liquidity risk ........................................................................... ...

... Board and senior management responsibilities ............................................... 4 Liquidity risk management framework .............................................................. 6 Management of liquidity risk ........................................................................... ...

esa_tdp_priips_eapb_replyform - ESMA

... here, which simplifies the evaluation of price change risk for the retail investor. This means that the risk which results from the liquidity profile of the financial instrument is described. However, it would be inexact or even misleading to entitle this as "liquidity risk", to say the least.

... here, which simplifies the evaluation of price change risk for the retail investor. This means that the risk which results from the liquidity profile of the financial instrument is described. However, it would be inexact or even misleading to entitle this as "liquidity risk", to say the least.

IFRS 17 Insurance Contracts

... IFRS 17 requires a company to reflect, in the measurement of all insurance contracts, an explicit risk adjustment and to disclose how the company determined this amount. IFRS 17 defines the risk adjustment for non-financial risk as the compensation a company requires for bearing the uncertainty abou ...

... IFRS 17 requires a company to reflect, in the measurement of all insurance contracts, an explicit risk adjustment and to disclose how the company determined this amount. IFRS 17 defines the risk adjustment for non-financial risk as the compensation a company requires for bearing the uncertainty abou ...

Did the recent financial crisis affect credibility of credit rating agencies?

... directly received a NRSRO status in 1975. Major investment banks and security firms were, since that decision, permitted to use credit ratings for certain regulatory purposes (like for instance determination of capital requirements). The new regulatory rules of the SEC made credit ratings of central ...

... directly received a NRSRO status in 1975. Major investment banks and security firms were, since that decision, permitted to use credit ratings for certain regulatory purposes (like for instance determination of capital requirements). The new regulatory rules of the SEC made credit ratings of central ...

Word - corporate

... statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could” or “may,” or by variations of such words or by similar e ...

... statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could” or “may,” or by variations of such words or by similar e ...

between insurance companies Different forms of cooperation and

... application of competition rules to two categories of agreements in the insurance sector: information- and risk-sharing agreements. The latter category encompasses the common coverage of risks by co-insurance and co-reinsurance pools. Such cooperative structures are exempted subject to certain condi ...

... application of competition rules to two categories of agreements in the insurance sector: information- and risk-sharing agreements. The latter category encompasses the common coverage of risks by co-insurance and co-reinsurance pools. Such cooperative structures are exempted subject to certain condi ...