Money - University of Wyoming

... The Federal Reserve is the bank’s bank, regulating the financial system, controlling the money supply and making loans to private banks. Money supply is controlled by open market operations, regulating the reserves private banks must hold, and by setting the discount rate. The money multiplier descr ...

... The Federal Reserve is the bank’s bank, regulating the financial system, controlling the money supply and making loans to private banks. Money supply is controlled by open market operations, regulating the reserves private banks must hold, and by setting the discount rate. The money multiplier descr ...

Chapter 11 - Patrick M. Crowley

... • The number of banks has declined dramatically over the last 30 years. – Bank failures and consolidation – Deregulation: Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 – Economies of scale and scope from information technology ...

... • The number of banks has declined dramatically over the last 30 years. – Bank failures and consolidation – Deregulation: Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 – Economies of scale and scope from information technology ...

ICS BANKS Trade Finance Brochure

... with customers during the business process and ensure customer acquisition, satisfaction & retention. This includes mail, fax, e-mail, internet, mobile, or any other delivery channels devices. Users of ICS BANKS® Trade Finance gain a reputable, best-in-class customer support and service ...

... with customers during the business process and ensure customer acquisition, satisfaction & retention. This includes mail, fax, e-mail, internet, mobile, or any other delivery channels devices. Users of ICS BANKS® Trade Finance gain a reputable, best-in-class customer support and service ...

The Liberal Financial Order in Crisis: Analysis of International System

... to be the subprime mortgage market; a market whose borrowers could only pay back their ...

... to be the subprime mortgage market; a market whose borrowers could only pay back their ...

The determinants of banks` profits in Greece during the

... divided by customers plus short-term funding (LODEP) is used as a measure of liquidity. Higher figures denote lower liquidity. Without the required liquidity and funding to meet obligations, a bank may fail. Thus, in order to avoid insolvency problems, bank often hold liquid assets, which can be eas ...

... divided by customers plus short-term funding (LODEP) is used as a measure of liquidity. Higher figures denote lower liquidity. Without the required liquidity and funding to meet obligations, a bank may fail. Thus, in order to avoid insolvency problems, bank often hold liquid assets, which can be eas ...

Document

... with banks || OD = other deposits held with the Reserve Bank of India which include demand deposits of quasi government institution, foreign central banks, government (central and state) the International Monetary Fund, the World Bank etc. The usefulness of this measure of money supply lies in the f ...

... with banks || OD = other deposits held with the Reserve Bank of India which include demand deposits of quasi government institution, foreign central banks, government (central and state) the International Monetary Fund, the World Bank etc. The usefulness of this measure of money supply lies in the f ...

effects of the 2008 crisis on the volatility of returns on bank stocks in

... of the time was based substantially on deposits and loans. According Savoia (2004), the Brazilian banking system remained without much change until the mid-twentieth century, as the economy revolved around the primary and export sectors. During that time there has been efforts to tailor it to the ne ...

... of the time was based substantially on deposits and loans. According Savoia (2004), the Brazilian banking system remained without much change until the mid-twentieth century, as the economy revolved around the primary and export sectors. During that time there has been efforts to tailor it to the ne ...

Chapter 15: Financial Markets and Expectations

... shoulder a risk you don’t want to take. Both parties to the transaction benefit: ...

... shoulder a risk you don’t want to take. Both parties to the transaction benefit: ...

Analyzing the Creditworthiness of Islamic Financial Institutions

... On one side, it is often the case that Islamic banks have a lower cost of funds than ribā-based banks because many of their deposits are qard-hassan and so free to the bank. This often translates into higher profitability—and strong profitability is an important element in being creditworthy. IFIs c ...

... On one side, it is often the case that Islamic banks have a lower cost of funds than ribā-based banks because many of their deposits are qard-hassan and so free to the bank. This often translates into higher profitability—and strong profitability is an important element in being creditworthy. IFIs c ...

`Tis Only My Opinion

... The FDIC as of the beginning of 2008 had reserves of approximately $55 billion dollars to cover the losses which depositors might suffer if banks failed. As the credit crisis at banks escalated in 2008, the FDIC requested Congress to authorize on September 30, 2008 a temporary increase in its insure ...

... The FDIC as of the beginning of 2008 had reserves of approximately $55 billion dollars to cover the losses which depositors might suffer if banks failed. As the credit crisis at banks escalated in 2008, the FDIC requested Congress to authorize on September 30, 2008 a temporary increase in its insure ...

The neglected side of banking union: reshaping Europe`s financial

... mergers taking place predominantly between institutions in the same country. Europe is heavily dependent on bank credit, much in contrast to the US, whether other forms of financial intermediation play a more important role. 2 At the same time, EU corporate bond markets and equity markets remain fra ...

... mergers taking place predominantly between institutions in the same country. Europe is heavily dependent on bank credit, much in contrast to the US, whether other forms of financial intermediation play a more important role. 2 At the same time, EU corporate bond markets and equity markets remain fra ...

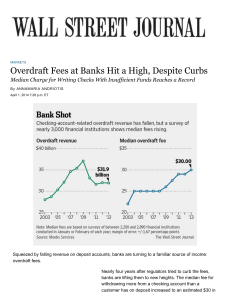

Overdraft fees at banks make a comeback, hitting a record.

... allowed overdrafts even if consumers didn't ask for the service—and that many banks processed debitcard and other transactions in a particular order to maximize the number of overdraft fees consumers would incur. The 2010 Fed regulation required customers to give banks permission to allow overdrafts ...

... allowed overdrafts even if consumers didn't ask for the service—and that many banks processed debitcard and other transactions in a particular order to maximize the number of overdraft fees consumers would incur. The 2010 Fed regulation required customers to give banks permission to allow overdrafts ...

Increased Capital and Financial Stability

... Bank capital mismeasurement: Regulatory capital measures may be awed, and may have become even more awed over ...

... Bank capital mismeasurement: Regulatory capital measures may be awed, and may have become even more awed over ...

Securitisation in Ireland

... Securitisation activity accelerated despite freezing of market post-crisis “Internal securitisations” used to create eligible assets for refinancing operations ...

... Securitisation activity accelerated despite freezing of market post-crisis “Internal securitisations” used to create eligible assets for refinancing operations ...

Pre-tax result turned positive in Q4

... Owing mainly to lower integration expenses and realised synergies, operating expenses fell 14% to 455m. The synergies announced at the acquisition in 2007 have now been fully realised. Retail lending remained at the same level as in 2008, while corporate lending declined 18% because of lower financ ...

... Owing mainly to lower integration expenses and realised synergies, operating expenses fell 14% to 455m. The synergies announced at the acquisition in 2007 have now been fully realised. Retail lending remained at the same level as in 2008, while corporate lending declined 18% because of lower financ ...

Document

... Since the mid-1980s, securitization has spread from the mortgage market to other markets including credit card balances, automobile and truck loans and leases, accounts receivable, computer leases, home equity loans, student loans, railroad car leases, small business loans, and boat loans. Banks, fi ...

... Since the mid-1980s, securitization has spread from the mortgage market to other markets including credit card balances, automobile and truck loans and leases, accounts receivable, computer leases, home equity loans, student loans, railroad car leases, small business loans, and boat loans. Banks, fi ...

Indonesian Banking Survey 32% 2014

... More intense competition for funds, customers and talent Having gone through 2013, Indonesian banks are facing an even more challenging environment in 2014 given the tight economic conditions. Bankers surveyed said that the top three challenges for the year are margin pressure, tougher competition a ...

... More intense competition for funds, customers and talent Having gone through 2013, Indonesian banks are facing an even more challenging environment in 2014 given the tight economic conditions. Bankers surveyed said that the top three challenges for the year are margin pressure, tougher competition a ...

PR-Tinkoff-Bank-Mortgage-18-May-2015-ENG

... branchless platform, the Group has also developed a "smart courier" network covering almost 600 cities and towns in Russia which allows next day delivery to many customers. Since its launch in 2007 by Mr Oleg Tinkov, a renowned Russian entrepreneur with a long track record of creating successful bus ...

... branchless platform, the Group has also developed a "smart courier" network covering almost 600 cities and towns in Russia which allows next day delivery to many customers. Since its launch in 2007 by Mr Oleg Tinkov, a renowned Russian entrepreneur with a long track record of creating successful bus ...

Yannis Stournaras: Entrepreneurship, NPL resolution policies and

... But prospects for entrepreneurs are also closely related to the paths taken by the various programme reviews. After the successful completion of the first review, a positive momentum developed which affected confidence and liquidity. A number of key indicators of economic activity, such as industria ...

... But prospects for entrepreneurs are also closely related to the paths taken by the various programme reviews. After the successful completion of the first review, a positive momentum developed which affected confidence and liquidity. A number of key indicators of economic activity, such as industria ...

Political economy of debt

... Financial innovations, not by chance discovery, but systematically pursued monetary innovations (consumer credit, mortgage finance) financial asset innovations – turning every debt into a tradable commodity credit innovations (borrowing against long term financial assets, using every asset as a base ...

... Financial innovations, not by chance discovery, but systematically pursued monetary innovations (consumer credit, mortgage finance) financial asset innovations – turning every debt into a tradable commodity credit innovations (borrowing against long term financial assets, using every asset as a base ...

Development Banks and Mozambique

... 2. If the development bank offers below-market interest rates and credit to sectors that are not getting much credit now through market channels, then someone in the bank will be making an administrative decision to allocate a scarce and valuable financial resource to someone else. This almost alway ...

... 2. If the development bank offers below-market interest rates and credit to sectors that are not getting much credit now through market channels, then someone in the bank will be making an administrative decision to allocate a scarce and valuable financial resource to someone else. This almost alway ...

Specialist finance providers and other sources

... or the purchase of intangible assets, such as patents and trademarks). Repayment of bank loans is generally done in installments following a determined timeline (that is, the debt schedule). Unlike with typical bonds, the payments cover both the interest rates and a share of the principal, even if t ...

... or the purchase of intangible assets, such as patents and trademarks). Repayment of bank loans is generally done in installments following a determined timeline (that is, the debt schedule). Unlike with typical bonds, the payments cover both the interest rates and a share of the principal, even if t ...

REDEFINING THE ROLE OF CENTRAL BANKS IN A WORLD …

... exchange rate. The depreciation from 3.8 to 4.3 RON/EUR has taken some pressure off the real economy. However, further depreciation should be avoided A dramatic relaxation of the policy interest rate (by 2-3 pps) would do more harm (inflation) than good (GDP growth). The result could be stagflatio ...

... exchange rate. The depreciation from 3.8 to 4.3 RON/EUR has taken some pressure off the real economy. However, further depreciation should be avoided A dramatic relaxation of the policy interest rate (by 2-3 pps) would do more harm (inflation) than good (GDP growth). The result could be stagflatio ...

State-owned banks - Study of Financial System Guarantees

... over 700 to just under 200. Most of that decline is the result of voluntary mergers between credit unions. Some, however, involved transfers of business required by State regulators in cases where credit unions were in breach of legislative requirements or, in a small number of cases (primarily in t ...

... over 700 to just under 200. Most of that decline is the result of voluntary mergers between credit unions. Some, however, involved transfers of business required by State regulators in cases where credit unions were in breach of legislative requirements or, in a small number of cases (primarily in t ...

Bank

A bank is a financial intermediary that creates credit by lending money to a borrower, thereby creating a corresponding deposit on the bank's balance sheet. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial system and influence on national economies, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords.Banking in its modern sense evolved in the 14th century in the rich cities of Renaissance Italy but in many ways was a continuation of ideas and concepts of credit and lending that had their roots in the ancient world. In the history of banking, a number of banking dynasties — notably, the Medicis, the Fuggers, the Welsers, the Berenbergs and the Rothschilds — have played a central role over many centuries. The oldest existing retail bank is Monte dei Paschi di Siena, while the oldest existing merchant bank is Berenberg Bank.