Corporate Finance What - Hong Kong Securities and Investment

... – Many of those entering investment banking are young and highly ambitious; they have a work hard, play hard attitude. – Graduates looking to go into corporate finance, debt capital, or equity capital will need to be high academic achievers, capable of processing large amounts of information in a sh ...

... – Many of those entering investment banking are young and highly ambitious; they have a work hard, play hard attitude. – Graduates looking to go into corporate finance, debt capital, or equity capital will need to be high academic achievers, capable of processing large amounts of information in a sh ...

State-owned banks - Study of Financial System Guarantees

... Occidental Life was a medium-sized life insurance company which specialised in term and disability insurance and investment products, both capital guaranteed and investment linked. Investment business was predominantly superannuation for individuals and small schemes. The company had experienced str ...

... Occidental Life was a medium-sized life insurance company which specialised in term and disability insurance and investment products, both capital guaranteed and investment linked. Investment business was predominantly superannuation for individuals and small schemes. The company had experienced str ...

Diapositiva 1

... II. Exposures of financial corporations Subsidiaries and Parent Banks •Financial regulation limits the exposure that domestic banks may have to related counterparties (i.e. individuals, firms and any financial entity owned by the same shareholders). •For domestic banks, which are subsidiaries of fo ...

... II. Exposures of financial corporations Subsidiaries and Parent Banks •Financial regulation limits the exposure that domestic banks may have to related counterparties (i.e. individuals, firms and any financial entity owned by the same shareholders). •For domestic banks, which are subsidiaries of fo ...

The Fed`s 405% problem

... early phases of the European debt crisis. To us, the debate whether the tapering U-turn is a policy mistake or not misses a more important question, namely why the US economy once again has failed to perform in line with the bullish expectations of analysts and the Fed. The weakness that prompted th ...

... early phases of the European debt crisis. To us, the debate whether the tapering U-turn is a policy mistake or not misses a more important question, namely why the US economy once again has failed to perform in line with the bullish expectations of analysts and the Fed. The weakness that prompted th ...

Competition Policy in Banking and Financial Services

... How have attitudes to bank competition policy changed over time For much of the twentieth century, many nations adopted a fairly common approach to banking sector competition policy. Entry into banking was relatively difficult, and in the case of foreign banks often impossible. There was substantial ...

... How have attitudes to bank competition policy changed over time For much of the twentieth century, many nations adopted a fairly common approach to banking sector competition policy. Entry into banking was relatively difficult, and in the case of foreign banks often impossible. There was substantial ...

「M2+債券型基金」統計數之編製說明

... The newly-modified table will therefore replace the existing table currently known as the Consolidated Assets and Liabilities of Major Financial Institutions. (5) This modification applies to all relevant data for the Financial Statistics Monthly collected since January 1997. ...

... The newly-modified table will therefore replace the existing table currently known as the Consolidated Assets and Liabilities of Major Financial Institutions. (5) This modification applies to all relevant data for the Financial Statistics Monthly collected since January 1997. ...

Market discipline, disclosure and moral hazard in banking

... In recent years considerable attention has been paid to the topic of market discipline in banking. Market discipline refers to a market-based incentive scheme in which investors in bank liabilities, such as subordinated debt or uninsured deposits, “punish” banks for greater risk-taking by demanding ...

... In recent years considerable attention has been paid to the topic of market discipline in banking. Market discipline refers to a market-based incentive scheme in which investors in bank liabilities, such as subordinated debt or uninsured deposits, “punish” banks for greater risk-taking by demanding ...

Chapter 15

... or sell U.S. Treasury bills in the open market Buying securities increases money in supply and ...

... or sell U.S. Treasury bills in the open market Buying securities increases money in supply and ...

english,

... banking mortgages to investment entities called special purpose vehicles (SPV). Hence, SPVs took over a series of activities with high risk and low liquidity (derivatives that had mortgages underlying assets) and placed them in the financial market. This technique of selling loans to investors has t ...

... banking mortgages to investment entities called special purpose vehicles (SPV). Hence, SPVs took over a series of activities with high risk and low liquidity (derivatives that had mortgages underlying assets) and placed them in the financial market. This technique of selling loans to investors has t ...

Burton and Lambra: Chapter One

... The study of how the financial system coordinates and channels the flow of funds from lenders to borrowers - and vice versa - and how new funds are created by financial intermediaries in the borrowing ...

... The study of how the financial system coordinates and channels the flow of funds from lenders to borrowers - and vice versa - and how new funds are created by financial intermediaries in the borrowing ...

Chapter 1 An Introduction to Money and the Financial System

... Today we have mutual funds and other stocks available through banks or online. Putting together a portfolio is open to everyone. ...

... Today we have mutual funds and other stocks available through banks or online. Putting together a portfolio is open to everyone. ...

the determinants of banking system vulnerability

... Whether diversification in banking activities leads to financial stability or increase the vulnerability is a question addressed in many research studies (Stiroh, 2006, Baele, De Jonghe and Vander Vennet, 2007, Laeven and Levine, 2007, Schmid and Walter, 2009). Various financial innovations were con ...

... Whether diversification in banking activities leads to financial stability or increase the vulnerability is a question addressed in many research studies (Stiroh, 2006, Baele, De Jonghe and Vander Vennet, 2007, Laeven and Levine, 2007, Schmid and Walter, 2009). Various financial innovations were con ...

International Regulatory Standards: Vital for Economic Growth

... entry and creating positive downstream incentives to finance the real economy. Banks do not function solely within national boundaries, and indeed some of the most important growth opportunities for financial institutions rest in their ability to serve clients abroad as well as at home. It is signif ...

... entry and creating positive downstream incentives to finance the real economy. Banks do not function solely within national boundaries, and indeed some of the most important growth opportunities for financial institutions rest in their ability to serve clients abroad as well as at home. It is signif ...

Multiple Choice Tutorial Chapter 33 International Trade

... 9. Prior to 1992, the government required Fannie Mae and Freddie Mac to buy only prime mortgages. After 1992, Congress required Fan and Fred to purchase subprime loans as well. True Congress was eager to make almost everyone in American a home owner. Thus they pressured Fan and Fred to make more su ...

... 9. Prior to 1992, the government required Fannie Mae and Freddie Mac to buy only prime mortgages. After 1992, Congress required Fan and Fred to purchase subprime loans as well. True Congress was eager to make almost everyone in American a home owner. Thus they pressured Fan and Fred to make more su ...

Monetary policy of India

... liquid assets with themselves at any point of time of their total time and demand liabilities. These assets have to be kept in non cash form such as G-secs precious metals, approved securities like bonds etc. The ratio of the liquid assets to time and demand assets is termed as the statutory liquidi ...

... liquid assets with themselves at any point of time of their total time and demand liabilities. These assets have to be kept in non cash form such as G-secs precious metals, approved securities like bonds etc. The ratio of the liquid assets to time and demand assets is termed as the statutory liquidi ...

Patterns in international banking: Key take

... Sum of all cross-border claims and locally extended claims in foreign currency. 2 Intraregional share is the sum of international claims on the emerging Asia-Pacific region of banks headquartered in Chinese Taipei, Hong Kong SAR, India, Singapore and the offices of banks located in the region that h ...

... Sum of all cross-border claims and locally extended claims in foreign currency. 2 Intraregional share is the sum of international claims on the emerging Asia-Pacific region of banks headquartered in Chinese Taipei, Hong Kong SAR, India, Singapore and the offices of banks located in the region that h ...

ECON 104---Financial Crisis What is the nature of the current crisis

... 1. What is the nature of the current crisis? There are 3 big proximate causes: a bunch of new and unregulated assets emerged, and people traded them without knowing their value; there was a bubble in asset prices, but now it is popping---asset prices (such as house prices) have fallen, so that peopl ...

... 1. What is the nature of the current crisis? There are 3 big proximate causes: a bunch of new and unregulated assets emerged, and people traded them without knowing their value; there was a bubble in asset prices, but now it is popping---asset prices (such as house prices) have fallen, so that peopl ...

Risk transfer mechanisms

... – Capital optimisation: Increased focus on capital charges as an integral part of credit lending. ...

... – Capital optimisation: Increased focus on capital charges as an integral part of credit lending. ...

FINANCIAL KEYNESIANISM AND MARKET INSTABILITY

... Hence, the problem is the rise of what Minsky called money manager capitalism—the modern form of the previous stage of finance capitalism that self-destructed in the Great Depression of the 1930s. He characterized money manger capitalism as one dominated by highly leveraged funds seeking maximum re ...

... Hence, the problem is the rise of what Minsky called money manager capitalism—the modern form of the previous stage of finance capitalism that self-destructed in the Great Depression of the 1930s. He characterized money manger capitalism as one dominated by highly leveraged funds seeking maximum re ...

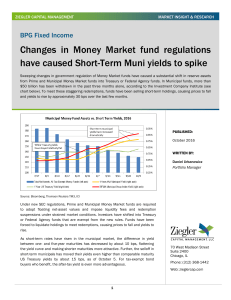

Changes In Money Market Fund Regulations

... US Treasury yields by about 15 bps, as of October 5. For tax-exempt bond buyers who benefit, the after-tax yield is even more advantageous. ...

... US Treasury yields by about 15 bps, as of October 5. For tax-exempt bond buyers who benefit, the after-tax yield is even more advantageous. ...