marvin c - WORKPHIL.COM

... Processes the settlements and documentation of Philippine stock and bond trades for foreign clients, held by HSBC as custodian. Prepares daily and weekly repatriation reports to the Bangko Sentral ng Pilipinas. ...

... Processes the settlements and documentation of Philippine stock and bond trades for foreign clients, held by HSBC as custodian. Prepares daily and weekly repatriation reports to the Bangko Sentral ng Pilipinas. ...

Big Freeze part 1: How it began - Departamento de Economia PUC

... widespread adherence to three big assumptions – or articles of faith – that have steathily underpinned 21st century finance in recent years. The first of these was a belief that modern capital markets had become so much more advanced than their predecessors that banks would always be able to trade d ...

... widespread adherence to three big assumptions – or articles of faith – that have steathily underpinned 21st century finance in recent years. The first of these was a belief that modern capital markets had become so much more advanced than their predecessors that banks would always be able to trade d ...

Slides - AWSCPA Houston

... presentation standards since the issuance of FASB Statement No. 117, Financial Statements for Not-for-Profit Organizations, in 1993. • This new standard is part of the FASB’s ongoing review of Generally Accepted Accounting Principles (GAAP) to ensure that they continue to meet the evolving needs of ...

... presentation standards since the issuance of FASB Statement No. 117, Financial Statements for Not-for-Profit Organizations, in 1993. • This new standard is part of the FASB’s ongoing review of Generally Accepted Accounting Principles (GAAP) to ensure that they continue to meet the evolving needs of ...

“Bailouts and Financial Fragility” by Todd Keister

... The paper is primarily a theoretical exercise In general, the relationship between government’s bailout policies and financial fragility is very complex The approach is based on this one assumption that the distortions created by the bailout policy cause intermediaries to become too illiquid - The p ...

... The paper is primarily a theoretical exercise In general, the relationship between government’s bailout policies and financial fragility is very complex The approach is based on this one assumption that the distortions created by the bailout policy cause intermediaries to become too illiquid - The p ...

Higher Capital Ratios

... Regulatory and Monetary Policy Act cumulatively to lower (P/B) (RoE) Monetary Policy levers higher Regulatory capital buffers into greater incentives to increase returns on equity ...

... Regulatory and Monetary Policy Act cumulatively to lower (P/B) (RoE) Monetary Policy levers higher Regulatory capital buffers into greater incentives to increase returns on equity ...

Subject: Economics with Financial Literacy

... credit score-and provide them to lenders. An applicant’s credit score can also be used by prospective employers, landlords, insurance companies, ...

... credit score-and provide them to lenders. An applicant’s credit score can also be used by prospective employers, landlords, insurance companies, ...

money notes

... Mortgage loans: The term of a mortgage typically ranges from 15 to 30 years principal: the amount of money borrowed, or the amount of money still owed on a loan, apart from the interest *A house purchased for $220,000 30-year mortgage fixed interest rate 5 percent per year, monthly installments, co ...

... Mortgage loans: The term of a mortgage typically ranges from 15 to 30 years principal: the amount of money borrowed, or the amount of money still owed on a loan, apart from the interest *A house purchased for $220,000 30-year mortgage fixed interest rate 5 percent per year, monthly installments, co ...

ICAI J.B. Nagar Study Circle By CA Huzeifa I. Unwala,

... ensuring that the individual banks initiate corrective action much before the problems could undermine their safety and soundness. Under a compliance based approach, supervisory activities focus on the financial position of the supervised entities at a given point in time (stock). Risk-Based Supervi ...

... ensuring that the individual banks initiate corrective action much before the problems could undermine their safety and soundness. Under a compliance based approach, supervisory activities focus on the financial position of the supervised entities at a given point in time (stock). Risk-Based Supervi ...

Luc Laeven

... “securitized banking banking” (illiquid loans become tradable) tradable), scalable trading activities, wholesale funding – Increased systemic y risk? Securitization reduces bankspecific risk but increases interconnectedness ...

... “securitized banking banking” (illiquid loans become tradable) tradable), scalable trading activities, wholesale funding – Increased systemic y risk? Securitization reduces bankspecific risk but increases interconnectedness ...

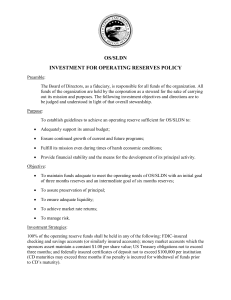

Investment Policy - OutServe-SLDN

... Investment Strategies: 100% of the operating reserve funds shall be held in any of the following: FDIC-insured checking and savings accounts (or similarly insured accounts); money market accounts which the sponsors assert maintain a constant $1.00 per share value; US Treasury obligations not to exce ...

... Investment Strategies: 100% of the operating reserve funds shall be held in any of the following: FDIC-insured checking and savings accounts (or similarly insured accounts); money market accounts which the sponsors assert maintain a constant $1.00 per share value; US Treasury obligations not to exce ...

Lessons We Should Have Learned from the Global Financial Crisis

... worth a dollar), causing a run. Similarly, shadow banks that relied on “rolling-over” very shortterm liabilities (including commercial paper) found rising “hair cuts” (the discount applied to their collateral) so that they could not refinance positions in assets. That led to “fire sales” of assets, ...

... worth a dollar), causing a run. Similarly, shadow banks that relied on “rolling-over” very shortterm liabilities (including commercial paper) found rising “hair cuts” (the discount applied to their collateral) so that they could not refinance positions in assets. That led to “fire sales” of assets, ...

The eurozone banking system: a sector undergoing

... while ensuring equal treatment between entities. Yet, it is also a source of asymmetries that may end up generating conflicts. The mismatch between the geographical area in which the entities operate and the action of the SSM may also give rise to problems (see, for example, Hüttl and Schoenmaker, 2 ...

... while ensuring equal treatment between entities. Yet, it is also a source of asymmetries that may end up generating conflicts. The mismatch between the geographical area in which the entities operate and the action of the SSM may also give rise to problems (see, for example, Hüttl and Schoenmaker, 2 ...

Global insurance regulation and systemic risk

... – Concept of contagion implies that failure of any financial institution (banks, broker dealers, ...

... – Concept of contagion implies that failure of any financial institution (banks, broker dealers, ...

Government of Pakistan

... help of commercial banks. The scope of the Scheme which was limited to production loans for inputs has been broadened to the whole value chain of agriculture sector. The broadening of the scope as well the removal of other restrictions e.g forcing the banks to lend at subsidized rate and then share ...

... help of commercial banks. The scope of the Scheme which was limited to production loans for inputs has been broadened to the whole value chain of agriculture sector. The broadening of the scope as well the removal of other restrictions e.g forcing the banks to lend at subsidized rate and then share ...

Driving for Top-Tier Performance

... The presentation, including related questions and answers, contain forwardlooking statements about issues like anticipated first quarter and full-year 2004 earnings, anticipated level of net loan charge-offs and nonperforming assets and anticipated improvement in profitability and competitiveness. F ...

... The presentation, including related questions and answers, contain forwardlooking statements about issues like anticipated first quarter and full-year 2004 earnings, anticipated level of net loan charge-offs and nonperforming assets and anticipated improvement in profitability and competitiveness. F ...

Bank Management of Assets and Liabilities

... A life insurance companies can predict quite accurately the dollar claims that it will pay each year. Thus these liabilities have a cash flow resembling long-term debt. To avoid risk, the life insurance company matches its assets to these liabilities, by buying long-term bonds and mortgage loans. ...

... A life insurance companies can predict quite accurately the dollar claims that it will pay each year. Thus these liabilities have a cash flow resembling long-term debt. To avoid risk, the life insurance company matches its assets to these liabilities, by buying long-term bonds and mortgage loans. ...

A Study on Indian Money Market, Capital Market and Banking

... which banks provide funds for working capital required by commerce, trade and industry. The financial instrument trading in the bills market is the bill of exchange. It is a written instrument containing unconditional order signed by the maker, directing to pay a certain amount of money to a particu ...

... which banks provide funds for working capital required by commerce, trade and industry. The financial instrument trading in the bills market is the bill of exchange. It is a written instrument containing unconditional order signed by the maker, directing to pay a certain amount of money to a particu ...

Report overview [pdf]

... Why are financial markets so inefficient and exploitative – and a suggested remedy - Paul Woolley The chapter offers a new understanding of how financial markets work. The key departure from conventional theory is to recognise that investors do not invest directly in securities but through agents su ...

... Why are financial markets so inefficient and exploitative – and a suggested remedy - Paul Woolley The chapter offers a new understanding of how financial markets work. The key departure from conventional theory is to recognise that investors do not invest directly in securities but through agents su ...

![Report overview [pdf]](http://s1.studyres.com/store/data/008781664_1-1830d3eb500407c73b24e758e32efc88-300x300.png)