* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Financial planning

Survey

Document related concepts

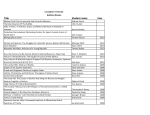

Transcript

Business Plan The Techniques • Our Case : The Red Line Saigon Hotel • Mission and Vision • SWOT Analysis • The Financial Plan Step by Step Initial Balance Sheet Year 1 • • • • Profit and Loss Balance Sheet Calculation of financial debt and interest Cash Flow Statement Year 2 Etc. Vietnam Master in Management – HCMC dec 2003 BP Techniques Hanoi Hotel : Mission and Vision • What we are A medium size high level hotel in the centre of HCMC • 130 rooms • Average income per night/room in 2003 : 80 US$ • Mission We want to deliver excellent service to our business (40%) and leisure (60%) customers and want them to come back • What we want to become Possibility to add 60 additional rooms • Vision We want to become immediately after the Rex the reference hotel for people who want a unique experience and not the standard (high level) service provided by international chains Vietnam Master in Management – HCMC dec 2003 BP Techniques SWOT Analysis STRENGTHS Good image Excellent location (centre) Experienced management and personnel WEAKNESSES Not a member of an international chain Quite old building (we should renovate all rooms for a total capex of 3Mio US$) OPPORTUNITIES New building with 60 rooms (total capex of 4Mio US$) Become member of international network (license of 1 MioUS$) THREATS A lot of new hotels are coming on the market Competition try to hire our personnel Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 1 : Initial Balance Sheet • last available figures for existing company • opening Balance Sheet for new venture Liabilities = only equity Assets = only cash BPcons.xls - STEP1!A1 Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 1bis : Simplified Balance Sheet • Calculation of Working Capital R + S - DSTop • Calculation of Capital Employed FIX + WC + CASH BPcons.xls - STEP1bis!B1 Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 2 : Profit & Loss Year 1 based on • P&L of last year • Operational assumptions for year 1 Turnover Margins (Cost of sales) Costs of goods and services Salaries and productivity of labor • Fixed assets table depreciation • Balance Sheet of last year calculation of interests on debt BPcons.xls - STEP2!A48 Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 2bis : Fixed assets & depreciation based on • Fixed assets at the end of last year • Depreciation rules • Capex of the year Tangible Intangible BPcons.xls - STEP2bis!A111 Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 3 : Balance Sheet Year 1 based on • Balance Sheet of Year 0 • P&L of Year 1 EAT & DIV for EQ Depreciation for FIX • Operational assumptions Change in Working Capital • Duration of inventories • Duration of collection • Etc. • Capex for FIX Financial assumptions New LT debt Capital increase for EQ Reimbursed LT debt • Short term fin debt to balance BPcons.xls - STEP3!A1 Vietnam Master in Management – HCMC dec 2003 BP Techniques How to do to finance the company ? • Cash Flow from financing activities • First : use the existing cash or credit lines • Second : seek additional debt provided by banks Duration should depend on needs but … • Always seek long term to reduce the risks Limits for the bankers • Future Cash flows • Cover of interest ratio must be respected • Cover of debt must be respected • Finally : seek new capital provided by shareholders Is it an interesting investment for them ? Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 4 : Cash flow statement Year 1 based on • Cash Flow from operations P&L of the year Operational assumptions • EAT • Depreciation • Changes in components of WC • CF from investing activities Fixed assets assumptions • Capital expenditures • Assets sales • CF from financing activities Financial assumptions • New and reimbursment LT • Calculation short term debt • Sanity check : the cash BPcons.xls - STEP4!A173 Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 5 : Profit & Loss Year 2 based on • P&L of Year 1 • Operational assumptions for Year 2 Turnover Margins (Cost of sales) Costs of goods and services Salaries and productivity of labor • Fixed assets table depreciation • Balance Sheet of Year 1 & 2 calculation of interests on debt BPcons.xls - STEP5!A48 Vietnam Master in Management – HCMC dec 2003 BP Techniques Iterative Process • Step 5 : • Step 6 : • P&L for year 3 Steps 9 • • Cash flow statement for year 2 Step 8 • Balance Sheet for year 2 Step 7 : • P&L for year 2 Balance Sheet for year 3 Step 10 …… Vietnam Master in Management – HCMC dec 2003 BP Techniques How to build the Financial Plan Balance Sheet t BPcons.xls - STEPfoll!A48 BPcons.xls - STEPfoll!A1 Profit & Loss t+1 Balance Sheet t+1 Cash Flow Statement t+1 BPcons.xls - STEPfoll!A160 Vietnam Master in Management – HCMC dec 2003 BP Techniques Sensibility studies • We can see immediately all the consequences of changing one assumption occupancy rate or load factor unit price additional capital expenditures • more rooms, more planes, more shops • fixed and variable costs interest rate exchange rate etc. BPcons.xls - SENSIB!A1 Vietnam Master in Management – HCMC dec 2003 BP Techniques