The corporate finance implications of rapidly rising interest rates.

... Unparalleled global central bank intervention: Perhaps the most significant factor making the current low-rate environment different from past environments, and a driver of the negative real rates, is the unprecedented intervention of not only the U.S. Federal Reserve (Fed), but also the European Ce ...

... Unparalleled global central bank intervention: Perhaps the most significant factor making the current low-rate environment different from past environments, and a driver of the negative real rates, is the unprecedented intervention of not only the U.S. Federal Reserve (Fed), but also the European Ce ...

Chapter 6

... Explains Fact 2 that yield curves tend to have steep slope when short rates are low and downward slope when short rates are high 1. When short rates are low, they are expected to rise to normal level, and long rate = average of future short rates will be well above today’s short rate: yield curve w ...

... Explains Fact 2 that yield curves tend to have steep slope when short rates are low and downward slope when short rates are high 1. When short rates are low, they are expected to rise to normal level, and long rate = average of future short rates will be well above today’s short rate: yield curve w ...

(Attachment: 3)PI 2005 - Council

... The general policy objective contained in the guidance is that local authorities should invest prudently the short-term cash surpluses held on behalf of their communities. The guidance emphasises that priority should be given to security and liquidity rather than yield. Within that framework the aut ...

... The general policy objective contained in the guidance is that local authorities should invest prudently the short-term cash surpluses held on behalf of their communities. The guidance emphasises that priority should be given to security and liquidity rather than yield. Within that framework the aut ...

does the budget deficit crowd-out private credit from the banking

... The relationship between budget deficits and macroeconomic variables such as growth, interest rates, and private investment, among others, represents one of the most widely debated topics among economists and policymakers. Theoretical and empirical literature are not conclusive about the nature of s ...

... The relationship between budget deficits and macroeconomic variables such as growth, interest rates, and private investment, among others, represents one of the most widely debated topics among economists and policymakers. Theoretical and empirical literature are not conclusive about the nature of s ...

Assessing the risk-return trade-off in loans

... rates and probabilities of default. In the case of the variances, (15) is the sum of two components. The first one is proportional to the reciprocal of (17), which can be interpreted as a granularity parameter. For any finite number of loans, (17) will always be finite. However, if I let Nk grow to infi ...

... rates and probabilities of default. In the case of the variances, (15) is the sum of two components. The first one is proportional to the reciprocal of (17), which can be interpreted as a granularity parameter. For any finite number of loans, (17) will always be finite. However, if I let Nk grow to infi ...

The household balance sheet and the macroeconomic assessment

... outstanding value between two quarters, adjusted for the transactions that have taken place during the quarter. Sources: Affärsvärlden, Statistics Sweden and the Riksbank ...

... outstanding value between two quarters, adjusted for the transactions that have taken place during the quarter. Sources: Affärsvärlden, Statistics Sweden and the Riksbank ...

Impairment Measurement of the impairment loss: Debt

... The accounting requirements applicable to small and medium-sized entities (SMEs) are set out in the International Financial Reporting Standard (IFRS) for SMEs, which was issued by the IASB in July 2009. The IFRS Foundation, the authors, the presenters and the publishers do not accept responsibility ...

... The accounting requirements applicable to small and medium-sized entities (SMEs) are set out in the International Financial Reporting Standard (IFRS) for SMEs, which was issued by the IASB in July 2009. The IFRS Foundation, the authors, the presenters and the publishers do not accept responsibility ...

ABS 415 Help Education Expert/abs415helpdotcom

... coupon. Bond B sells at par. Assuming interest rates remain constant for the next 10 years, which of the following statements is CORRECT? • a. Bond A’s current yield will increase each year. • b. Since the bonds have the same YTM, they should all have the same price, and since interest rates are not ...

... coupon. Bond B sells at par. Assuming interest rates remain constant for the next 10 years, which of the following statements is CORRECT? • a. Bond A’s current yield will increase each year. • b. Since the bonds have the same YTM, they should all have the same price, and since interest rates are not ...

Managing global finance as a system

... So what are the implications of this increase in global financial integration? There have been large numbers of studies exploring the growth and welfare implications of these trends, using cross-country and time-series evidence (Rey (2013)). This evidence paints, at best, a mixed picture. While capi ...

... So what are the implications of this increase in global financial integration? There have been large numbers of studies exploring the growth and welfare implications of these trends, using cross-country and time-series evidence (Rey (2013)). This evidence paints, at best, a mixed picture. While capi ...

Chapter 11 PPP

... Reinvestment effect: as coupon payments are received, they are reinvested at higher or lower rates than original coupon rate Bond immunization occurs when the average duration of the ...

... Reinvestment effect: as coupon payments are received, they are reinvested at higher or lower rates than original coupon rate Bond immunization occurs when the average duration of the ...

- TestbankU

... level (debt-to-asset ratio total liabilities/total assets), and your savings rate (savings rate savings during the period/disposable income during the period). 20. The liquidity ratio measures your liquid assets against your current liabilities. It is an indication of the sufficiency of your fun ...

... level (debt-to-asset ratio total liabilities/total assets), and your savings rate (savings rate savings during the period/disposable income during the period). 20. The liquidity ratio measures your liquid assets against your current liabilities. It is an indication of the sufficiency of your fun ...

Fundamentals of Bond - RBC Wealth Management

... completeness. This information is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is furnished on the basis and understanding that neither the Member Companies nor its employees, agents, or information supp ...

... completeness. This information is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is furnished on the basis and understanding that neither the Member Companies nor its employees, agents, or information supp ...

The Euro`s Three Crises

... the liquidity crunch, and Gorton (2008) for a description of how bank and nonbank funding problems led to a bank run–like crunch in liquidity. Housing bubbles also emerged in a number of EU countries, leaving some euro-area banks exposed to their own real estate markets as well. 6. The EONIA swap i ...

... the liquidity crunch, and Gorton (2008) for a description of how bank and nonbank funding problems led to a bank run–like crunch in liquidity. Housing bubbles also emerged in a number of EU countries, leaving some euro-area banks exposed to their own real estate markets as well. 6. The EONIA swap i ...

Working Paper 17-6: Does Greece Need More Official Debt Relief? If

... Since mid-2015, the International Monetary Fund (IMF), EU institutions, and European creditor countries have been arguing whether Greece requires additional official debt relief—and if so, how much.1 One-and-a-half years later, their positions seem as far apart as ever. In a report released on Febru ...

... Since mid-2015, the International Monetary Fund (IMF), EU institutions, and European creditor countries have been arguing whether Greece requires additional official debt relief—and if so, how much.1 One-and-a-half years later, their positions seem as far apart as ever. In a report released on Febru ...

Term Sheet Indian Railway Finance Corporation Limited 8.23

... under the provisions of the I-Tax Act, as applicable, from the date of realisation* of the cheque(s) Amounts liable to be /demand draft(s)/any other mode or three days from the date of receipt of the Application (being the date Refunded of presentation of each Application as acknowledged by the Bank ...

... under the provisions of the I-Tax Act, as applicable, from the date of realisation* of the cheque(s) Amounts liable to be /demand draft(s)/any other mode or three days from the date of receipt of the Application (being the date Refunded of presentation of each Application as acknowledged by the Bank ...

Chapter 11

... It has often been said that if the company can't earn a rate of return greater than the cost of capital it should not make investments. Explain. If the firm cannot earn the overall cost of financing on a given project, the investment will have a negative impact on the firm's operations and will lowe ...

... It has often been said that if the company can't earn a rate of return greater than the cost of capital it should not make investments. Explain. If the firm cannot earn the overall cost of financing on a given project, the investment will have a negative impact on the firm's operations and will lowe ...

Chapter 5: Credit Management

... Pricing Motive All reasons are related to market imperfections ...

... Pricing Motive All reasons are related to market imperfections ...

Financial Intermediation Services Indirectly Measured (FISIM)

... The regulation specifies that the calculation of the external reference rate should follow a similar approach using interest flows and comparable stocks for business with non-resident banks. However, using this approach in the UK raises several concerns. The biggest of which is the effect that large ...

... The regulation specifies that the calculation of the external reference rate should follow a similar approach using interest flows and comparable stocks for business with non-resident banks. However, using this approach in the UK raises several concerns. The biggest of which is the effect that large ...

Reducing the Lower Bound on Market Interest Rates

... zero, conventional monetary policy had run out of options concerning the reduction of market interest rates. Thus a growing credit spread in combination with the zero floor to nominal interest rates caused real interest rates for the private sector to rise in the midst of recession. Given the potent ...

... zero, conventional monetary policy had run out of options concerning the reduction of market interest rates. Thus a growing credit spread in combination with the zero floor to nominal interest rates caused real interest rates for the private sector to rise in the midst of recession. Given the potent ...

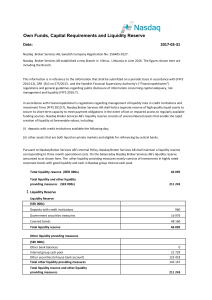

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

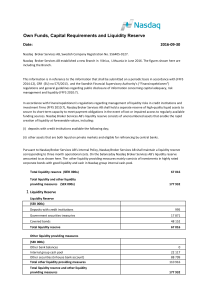

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

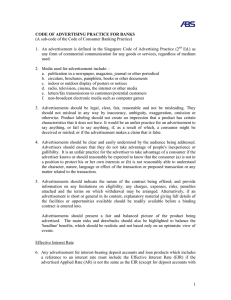

Code of Advertising Practice for Banks_June2010

... (iv) The calculation of the EIR should be consistent and comparable across products. To achieve this, the upfront fees and charges must be included in the loan amount for calculating the EIR, where the loan amount is indicated by PV in the EIR formula : PV = PMT (PVIFA k/m, m*n). The fees and charge ...

... (iv) The calculation of the EIR should be consistent and comparable across products. To achieve this, the upfront fees and charges must be included in the loan amount for calculating the EIR, where the loan amount is indicated by PV in the EIR formula : PV = PMT (PVIFA k/m, m*n). The fees and charge ...

The arbitrage-free valuation and hedging of demand deposits and

... swap, where the principal depends on the past history of market rates. This interest rate swap analogy provides the necessary insights to both price and hedge these ®nancial instruments. Solutions are obtained which are independent of any particular model for the evolution of the term structure of i ...

... swap, where the principal depends on the past history of market rates. This interest rate swap analogy provides the necessary insights to both price and hedge these ®nancial instruments. Solutions are obtained which are independent of any particular model for the evolution of the term structure of i ...

New Submission Email - Central Bank of Ireland

... Type of Securities: [Debt/Fund/Equity] Document to be used for: Public Offer [Yes/No] Admission to trading on a regulated market [Yes/No] If Yes to admission to trading on a regulated market, name of regulated market: [Name of regulated market] Is this document related to a programme: [Yes/No] If Ye ...

... Type of Securities: [Debt/Fund/Equity] Document to be used for: Public Offer [Yes/No] Admission to trading on a regulated market [Yes/No] If Yes to admission to trading on a regulated market, name of regulated market: [Name of regulated market] Is this document related to a programme: [Yes/No] If Ye ...