EUROPEAN COMMISSION Brussels, 26.2.2015 SWD(2015) 46 final

... The Russian-Ukrainian crisis had so far limited direct impact on Swedish trade and growth as the direct trade exposure towards these countries is small. Russia constitutes less than 1.5% of Sweden’s goods exports (most importantly automobiles, telecommunications equipment and chemicals) and approxim ...

... The Russian-Ukrainian crisis had so far limited direct impact on Swedish trade and growth as the direct trade exposure towards these countries is small. Russia constitutes less than 1.5% of Sweden’s goods exports (most importantly automobiles, telecommunications equipment and chemicals) and approxim ...

catalytic first-loss capital - Global Impact Investing Network

... guarantees spurring business growth. There are many examples. In the US, the Small Business Administration (SBA) runs a program that guarantees up to 85% of commercial loans made to small businesses.2 Elsewhere, government sponsored enterprises, such as Fannie Mae and Freddie Mac aim to enhance the ...

... guarantees spurring business growth. There are many examples. In the US, the Small Business Administration (SBA) runs a program that guarantees up to 85% of commercial loans made to small businesses.2 Elsewhere, government sponsored enterprises, such as Fannie Mae and Freddie Mac aim to enhance the ...

Download Syllabus

... minimum capital requirements vs. internal measures of EC. Evolution of Basel rules from Basel I through Basel III. The Fundamental Review of the Trading Book. Regulatory stress tests of financial institutions. The integration of risk measurement with strategic planning. Economic capital, regulatory ...

... minimum capital requirements vs. internal measures of EC. Evolution of Basel rules from Basel I through Basel III. The Fundamental Review of the Trading Book. Regulatory stress tests of financial institutions. The integration of risk measurement with strategic planning. Economic capital, regulatory ...

111 KB - Budget.gov.au

... There is a decline in 2000-01 primarily because the funding for initiatives associated with the Managed Investments Bill ceases at the end of 1999-2000. This is subject to a Parliamentary review in 2000-01. Secondary reasons include savings in salaries and package costs associated with voluntary red ...

... There is a decline in 2000-01 primarily because the funding for initiatives associated with the Managed Investments Bill ceases at the end of 1999-2000. This is subject to a Parliamentary review in 2000-01. Secondary reasons include savings in salaries and package costs associated with voluntary red ...

How to Estimate the Effect of a Stock Repurchase on Share Price

... risk from heavier debt would outweigh the additional earnings per share gained from the reduction in shares outstanding- causing the stock price to drop. Can this situation be prevented? Yes, if financial decision makers know the smallest percentage of outstanding stock that must be repurchased for ...

... risk from heavier debt would outweigh the additional earnings per share gained from the reduction in shares outstanding- causing the stock price to drop. Can this situation be prevented? Yes, if financial decision makers know the smallest percentage of outstanding stock that must be repurchased for ...

Estimating the intensity of price and non

... their antitrust and merger policies. In addition to long-standing efforts to divine existing and possible future price competition from measures of deposit or loan market structure, direct measures – such as the Panzar and Rosse (1987) H-statistic, loan or deposit interest margins, and Lerner indice ...

... their antitrust and merger policies. In addition to long-standing efforts to divine existing and possible future price competition from measures of deposit or loan market structure, direct measures – such as the Panzar and Rosse (1987) H-statistic, loan or deposit interest margins, and Lerner indice ...

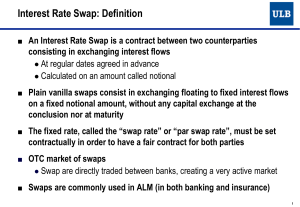

Interest Rate Swap

... the swap, but pays a floating rate in the swap, and has to put aside (in the mathematical reserves) the guaranteed rate of 4.75% of the insurance contracts Some interest rate risk is still present, linked to the potential spread existing ...

... the swap, but pays a floating rate in the swap, and has to put aside (in the mathematical reserves) the guaranteed rate of 4.75% of the insurance contracts Some interest rate risk is still present, linked to the potential spread existing ...

Bond Markets in Serbia: Regulatory Challenges for an Efficient Market

... four bond series accounted for 37.2% of the total debt, which meant that the government relied on acquiring bonds before they reach maturity through the process of privatization, or by allowing the possibility of purchasing government property with 'frozen savings' bonds. ...

... four bond series accounted for 37.2% of the total debt, which meant that the government relied on acquiring bonds before they reach maturity through the process of privatization, or by allowing the possibility of purchasing government property with 'frozen savings' bonds. ...

DOCUMENTOS DE TRABAJO Serie Economía CAPITAL CONTROLS AND THE COST OF DEBT

... We construct our data set for capital account restrictions by using the methodology introduced by Schindler (2009), which is based on information provided in the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER). To reduce the potential for errors in the coding of the ...

... We construct our data set for capital account restrictions by using the methodology introduced by Schindler (2009), which is based on information provided in the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER). To reduce the potential for errors in the coding of the ...

Chapter 5

... and demand for, riskless securities in an economy with zero inflation. The real riskfree rate could also be called the pure rate of interest since it is the rate of interest that would exist on very short-term, default-free U.S. Treasury securities if the expected rate of inflation were zero. It has ...

... and demand for, riskless securities in an economy with zero inflation. The real riskfree rate could also be called the pure rate of interest since it is the rate of interest that would exist on very short-term, default-free U.S. Treasury securities if the expected rate of inflation were zero. It has ...

NBER WORKING PAPER SERIES OVERBORROWING, FINANCIAL CRISES AND 'MACRO-PRUDENTIAL' TAXES Javier Bianchi

... We study overborrowing and financial crises in an equilibrium model of business cycles and asset prices with collateral constraints. Private agents in a decentralized competitive equilibrium do not internalize the effects of their individual borrowing plans on the market price of assets at which col ...

... We study overborrowing and financial crises in an equilibrium model of business cycles and asset prices with collateral constraints. Private agents in a decentralized competitive equilibrium do not internalize the effects of their individual borrowing plans on the market price of assets at which col ...

Irwin/McGraw-Hill

... (NP&E) over the period?” 1. Based on the 1998 and 1999 B/S, NP&E rose from $985 to $1100, so NP&E rose by $115 (a use of cash). 2. If we standardized the 1999 numbers by dividing each by the 1998 number, we get a common base year statement. In this case, $1100/$985 = 1.117, so NP&E rose by 11.7% ove ...

... (NP&E) over the period?” 1. Based on the 1998 and 1999 B/S, NP&E rose from $985 to $1100, so NP&E rose by $115 (a use of cash). 2. If we standardized the 1999 numbers by dividing each by the 1998 number, we get a common base year statement. In this case, $1100/$985 = 1.117, so NP&E rose by 11.7% ove ...

EUROPEAN COMMISSION Brussels, 26.2.2015 SWD(2015) 30 final

... a greater extent than peer economies in the region, the sizeable FDI inflows largely bypassed the tradable sector. The investment-led internal demand contributed to rapid import penetration. Though price and wages dynamics were contained in relative terms, subdued productivity dynamics resulted in i ...

... a greater extent than peer economies in the region, the sizeable FDI inflows largely bypassed the tradable sector. The investment-led internal demand contributed to rapid import penetration. Though price and wages dynamics were contained in relative terms, subdued productivity dynamics resulted in i ...

Concepts of Equity Method

... Excess of Cost Over BV Acquired The amortization of the difference associated with the undervalued assets is recorded as a reduction of both the Investment account and the Equity in Investee Income account. ...

... Excess of Cost Over BV Acquired The amortization of the difference associated with the undervalued assets is recorded as a reduction of both the Investment account and the Equity in Investee Income account. ...

Financing Local Infrastructure – Linking Local

... the demands of local governments. Financial markets might not see local governments as potential clients whereas banks and other financial intermediaries, where they exist, might not be familiar with local government needs and requirements. Respective capacities and information are needed to reduce ...

... the demands of local governments. Financial markets might not see local governments as potential clients whereas banks and other financial intermediaries, where they exist, might not be familiar with local government needs and requirements. Respective capacities and information are needed to reduce ...

The future of the euro

... Markets created the illusion of permanently easy access to funds. Before the sovereign debt crisis became critical, sovereign bond yields declined and risk premiums of individual EMU members fell virtually to zero. Access to funds was apparently unlimited and inexpensive, creating the illusion of ch ...

... Markets created the illusion of permanently easy access to funds. Before the sovereign debt crisis became critical, sovereign bond yields declined and risk premiums of individual EMU members fell virtually to zero. Access to funds was apparently unlimited and inexpensive, creating the illusion of ch ...

DOC - Europa.eu

... Yes. The delegated act takes into account the centralised management of liquidity in networks of cooperative banks or banks participating in an institutional protection scheme. Here a central institution or body often plays a key role in providing liquidity to the members of the network. Therefore, ...

... Yes. The delegated act takes into account the centralised management of liquidity in networks of cooperative banks or banks participating in an institutional protection scheme. Here a central institution or body often plays a key role in providing liquidity to the members of the network. Therefore, ...