1 Estate Planning Issues With Intra-Family Loans and Notes Steve R

... in which the entire transaction was disallowed. The partnership was determined to be a sham, with no substantial economic effect, and the note attributable to the sale was reclassified as equity and not debt. The result was a determination that a gift had been made of the entire undiscounted amount ...

... in which the entire transaction was disallowed. The partnership was determined to be a sham, with no substantial economic effect, and the note attributable to the sale was reclassified as equity and not debt. The result was a determination that a gift had been made of the entire undiscounted amount ...

2013 Low-Income Countries Global Risks and Vulnerabilities

... Possible capital flow reversals in LICs due a faster-than-expected rise in US interest rates could have negative repercussions on several LICs that have close links to global financial markets. The paper examines the impact of capital flow reversals and the ensuing impact on the funding costs and bu ...

... Possible capital flow reversals in LICs due a faster-than-expected rise in US interest rates could have negative repercussions on several LICs that have close links to global financial markets. The paper examines the impact of capital flow reversals and the ensuing impact on the funding costs and bu ...

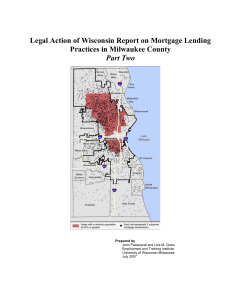

Legal Action of Wisconsin Report on Mortgage Lending

... More than 30 subprime lenders have stopped operations or been sold because of increasing delinquencies from subprime loans (Boston Globe, April 20, 2007). In January 2006 Ameriquest Mortgage Company agreed to pay a $325 million settlement to 49 states and to reform its lending practices. (Wis. Depar ...

... More than 30 subprime lenders have stopped operations or been sold because of increasing delinquencies from subprime loans (Boston Globe, April 20, 2007). In January 2006 Ameriquest Mortgage Company agreed to pay a $325 million settlement to 49 states and to reform its lending practices. (Wis. Depar ...

Cheap Credit, Collateral and the Boom-Bust Cycle

... During the period of 2000 to 2006, there was a decline in real interest rates followed by a rise of securitization and an easing of collateral requirements (Figure 1a). The US flow of funds during this period shows that in just seven years the stock of household mortgage liabilities more than double ...

... During the period of 2000 to 2006, there was a decline in real interest rates followed by a rise of securitization and an easing of collateral requirements (Figure 1a). The US flow of funds during this period shows that in just seven years the stock of household mortgage liabilities more than double ...

2.2.1 What

... In some economies there is high inflation and therefore the investor is taking a tremendous risk because the inflation will just eat their investment up. An investment with risk of 6.5% inflation and interest rate of their investment only being 5% will not be attractive since their investment is neg ...

... In some economies there is high inflation and therefore the investor is taking a tremendous risk because the inflation will just eat their investment up. An investment with risk of 6.5% inflation and interest rate of their investment only being 5% will not be attractive since their investment is neg ...

Russian BCS Holding International Ltd. Assigned

... conservative trading strategy, focusing on fairly liquid bonds rated 'B-' or above. Long equity positions accounted for 21% of the total portfolio at mid-year 2012. Single-name issuer concentrations are high, reflecting the limited number of available investments on the market, which in our view may ...

... conservative trading strategy, focusing on fairly liquid bonds rated 'B-' or above. Long equity positions accounted for 21% of the total portfolio at mid-year 2012. Single-name issuer concentrations are high, reflecting the limited number of available investments on the market, which in our view may ...

Shifts from Deposits into Currency

... funds to make loans to borrower-spenders. For example, a bank might acquire funds by issuing a liability to the public (an asset for the public) in the form of saving deposits. It might then use the funds to acquire an asset by making a loan to a corporation or by buying a Treasury bond in the finan ...

... funds to make loans to borrower-spenders. For example, a bank might acquire funds by issuing a liability to the public (an asset for the public) in the form of saving deposits. It might then use the funds to acquire an asset by making a loan to a corporation or by buying a Treasury bond in the finan ...

Risk Factors A number of risk factors affect Prudential`s operating

... crediting rates. Declines in spread from these products or other spread businesses that Jackson conducts, and increases in surrenders levels arising from interest rate rises, could have a material impact on its businesses or results of operations. Jackson also writes a significant amount of variable ...

... crediting rates. Declines in spread from these products or other spread businesses that Jackson conducts, and increases in surrenders levels arising from interest rate rises, could have a material impact on its businesses or results of operations. Jackson also writes a significant amount of variable ...

High-Level Results

... 6b. How do you plan to change each of the following components as a proportion of total compensation - Other specified ...

... 6b. How do you plan to change each of the following components as a proportion of total compensation - Other specified ...

Central Bank of the Republic of China (Taiwan)

... of 2014 and the NPL coverage ratio reached 502.87%, reflecting sound asset quality and abundant loan loss provisions. The average capital adequacy ratio of domestic banks stood at 12.34%, which was well above the statutory minimum requirement of 8%, and there was abundant liquidity in the financial ...

... of 2014 and the NPL coverage ratio reached 502.87%, reflecting sound asset quality and abundant loan loss provisions. The average capital adequacy ratio of domestic banks stood at 12.34%, which was well above the statutory minimum requirement of 8%, and there was abundant liquidity in the financial ...

download

... BE16-2: Yuen Corp. has outstanding 1,000, $1,000 bonds, each convertible into 50 shares of $10 par value common stock. The bonds are converted on December 31, 2008, when the unamortized discount is $30,000 and the market price of the stock is $21 per share. Journal entry at conversion: Bonds payable ...

... BE16-2: Yuen Corp. has outstanding 1,000, $1,000 bonds, each convertible into 50 shares of $10 par value common stock. The bonds are converted on December 31, 2008, when the unamortized discount is $30,000 and the market price of the stock is $21 per share. Journal entry at conversion: Bonds payable ...

reorganizing with Value but Without Profit (or Equity)

... Priority Rule does not, by its terms, prohibit a debtor entity from retaining its own assets, and cannot, by its terms, apply to a situation such as this where the debtor has no equity security holders.”21 Indeed, even where the members of a nonprofit do obtain some personal economic benefit from th ...

... Priority Rule does not, by its terms, prohibit a debtor entity from retaining its own assets, and cannot, by its terms, apply to a situation such as this where the debtor has no equity security holders.”21 Indeed, even where the members of a nonprofit do obtain some personal economic benefit from th ...

Bank Capital Methodology And Assumptions - A

... Unexpected losses that we define as losses incurred beyond normalized losses in a given stress scenario ...

... Unexpected losses that we define as losses incurred beyond normalized losses in a given stress scenario ...

macquarie infrastructure company llc

... scalability, such that relatively small amounts of growth can generate significant increases in earnings before interest, taxes, depreciation and amortization, or EBITDA; and ...

... scalability, such that relatively small amounts of growth can generate significant increases in earnings before interest, taxes, depreciation and amortization, or EBITDA; and ...

Table A1: Resolution of Finance Distress, Sample

... accounting and economic variables at the time of default which are expected to influence these outcomes. Estimation results reveal the OLR specification to achieve best balance between in-sample fit, consistency with financial theory and out-of-sample classification accuracy. In predicting liquidati ...

... accounting and economic variables at the time of default which are expected to influence these outcomes. Estimation results reveal the OLR specification to achieve best balance between in-sample fit, consistency with financial theory and out-of-sample classification accuracy. In predicting liquidati ...

Soft Landings (February 2000), with Martin Schneider

... a bailout always occurs in case of default, why should lenders care whether borrowers can commit to repay ? This argument overlooks the fact that bailout guarantees typically insure lenders only against systemic risk. A bailout will not occur if just an isolated firm defaults, especially not a small ...

... a bailout always occurs in case of default, why should lenders care whether borrowers can commit to repay ? This argument overlooks the fact that bailout guarantees typically insure lenders only against systemic risk. A bailout will not occur if just an isolated firm defaults, especially not a small ...

USING THE BALANCE SHEET APPROACH IN FINANCIAL

... The Balance Sheet Approach to analyzing financial stability is a sectoral approach to analyzing the financial risks of the economy as a whole, based on the assets and liabilities of each sector in the economy (national balance sheet accounts). The novelty of this approach is that it does not focus s ...

... The Balance Sheet Approach to analyzing financial stability is a sectoral approach to analyzing the financial risks of the economy as a whole, based on the assets and liabilities of each sector in the economy (national balance sheet accounts). The novelty of this approach is that it does not focus s ...

Differential Access to Capital from Financial Institutions by Minority

... Hispanic-owned and White-owned firms. Lumping Hispanic-owned with African-American owned firms as minority-owned firms is therefore not optimal. Fifth, our results are robust to three different causal inference methods, namely, propensity score matching, inverse probability weighting matching, and n ...

... Hispanic-owned and White-owned firms. Lumping Hispanic-owned with African-American owned firms as minority-owned firms is therefore not optimal. Fifth, our results are robust to three different causal inference methods, namely, propensity score matching, inverse probability weighting matching, and n ...

SAI - Cortina Asset Management

... price may be volatile. Therefore, the price of a convertible security may reflect variations in the price of the underlying common stock in a way that nonconvertible debt does not. The extent to which such risk is reduced, however, depends in large measure upon the degree to which the convertible se ...

... price may be volatile. Therefore, the price of a convertible security may reflect variations in the price of the underlying common stock in a way that nonconvertible debt does not. The extent to which such risk is reduced, however, depends in large measure upon the degree to which the convertible se ...

OTC Derivatives Presentation

... • Buyer makes periodic payments (typically monthly or quarterly) to the Seller which terminate upon Credit Event • Upon the occurrence of a “Credit Event”, Seller pays Buyer’s loss resulting from Credit Event – Settled by physical delivery of a Deliverable Obligation or cash settled by difference be ...

... • Buyer makes periodic payments (typically monthly or quarterly) to the Seller which terminate upon Credit Event • Upon the occurrence of a “Credit Event”, Seller pays Buyer’s loss resulting from Credit Event – Settled by physical delivery of a Deliverable Obligation or cash settled by difference be ...

Discounting Pension Liabilities: Funding versus Value

... the market value of the liabilities. Measuring underfunding and placing a market value on liabilities are clearly two distinct concepts, and both are useful for answering different questions. For example, the use of a default-free discount rate is informative to participants who want to know how muc ...

... the market value of the liabilities. Measuring underfunding and placing a market value on liabilities are clearly two distinct concepts, and both are useful for answering different questions. For example, the use of a default-free discount rate is informative to participants who want to know how muc ...

Investors Bancorp Inc

... Many of the counties we serve are projected to experience strong to moderate population and household income growth through 2016. Though slower population growth is projected for some of the counties we serve, it is important to note that these counties represent some of the most densely populated c ...

... Many of the counties we serve are projected to experience strong to moderate population and household income growth through 2016. Though slower population growth is projected for some of the counties we serve, it is important to note that these counties represent some of the most densely populated c ...