financial ratios management tool - VISION 2020 e

... organization. This is the starting point for making future plans for expansion and development. The use of Ratios are required from various users. The owners, creditors, Investors, lenders, Unions etc. Trade creditors The material suppliers may decide on their credit terms and also on the price base ...

... organization. This is the starting point for making future plans for expansion and development. The use of Ratios are required from various users. The owners, creditors, Investors, lenders, Unions etc. Trade creditors The material suppliers may decide on their credit terms and also on the price base ...

Job Description

... Implement and align credit policies and procedures for Malaysia in consultation with Regional Credit Control Manager and GM. Liaise with Sales Managers on credit control/customer issues; as well as with Customer Services, Sales Operation and Accounts receivables. ...

... Implement and align credit policies and procedures for Malaysia in consultation with Regional Credit Control Manager and GM. Liaise with Sales Managers on credit control/customer issues; as well as with Customer Services, Sales Operation and Accounts receivables. ...

Growth in a Time of Debt

... tighten by reducing spending, which can also be contractionary. As for inflation, an obvious connection stems from the fact that unanticipated high inflation can reduce the real cost of servicing the debt. Of course, the efficacy of the inflation channel is quite sensitive to the maturity structure ...

... tighten by reducing spending, which can also be contractionary. As for inflation, an obvious connection stems from the fact that unanticipated high inflation can reduce the real cost of servicing the debt. Of course, the efficacy of the inflation channel is quite sensitive to the maturity structure ...

commercial analytical services

... Prior to the recession and recovery, now in its fourth year, small business lending, which includes credit cards, lines of credit, term loans and trade credit, was more abundant. In addition to business-specific financing, small business owners could access personal capital or wealth with rising hom ...

... Prior to the recession and recovery, now in its fourth year, small business lending, which includes credit cards, lines of credit, term loans and trade credit, was more abundant. In addition to business-specific financing, small business owners could access personal capital or wealth with rising hom ...

statement on subprime mortgage lending

... should refer to the 2006 NTM Guidance, which details similar criteria for qualifying borrowers for products that may result in payment shock. Prudent qualifying standards recognize the potential effect of payment shock in evaluating a borrower’s ability to service debt. A provider’s analysis of a b ...

... should refer to the 2006 NTM Guidance, which details similar criteria for qualifying borrowers for products that may result in payment shock. Prudent qualifying standards recognize the potential effect of payment shock in evaluating a borrower’s ability to service debt. A provider’s analysis of a b ...

Interest rates on mortgages 2. Fixed Rate Mortgage

... Types of mortgages Offset Mortgages Example: You have a mortgage of a £100,000 and have a savings account with £8,000 and £2,000 in a current account. For the purpose of calculating interest, the £100,000 is offset by the £10,000 worth of savings, so in effect you only pay interest on £90,000 of yo ...

... Types of mortgages Offset Mortgages Example: You have a mortgage of a £100,000 and have a savings account with £8,000 and £2,000 in a current account. For the purpose of calculating interest, the £100,000 is offset by the £10,000 worth of savings, so in effect you only pay interest on £90,000 of yo ...

Capital Budgeting for Small Businesses

... issue of only $1 million. Because of these costs, small businesses with smaller capital requirements typically rely upon owners' equity and com mercial banks as their main sources of capital instead of primary capital markets. The loans are generally short-term, seldom exceeding the life of the pro ...

... issue of only $1 million. Because of these costs, small businesses with smaller capital requirements typically rely upon owners' equity and com mercial banks as their main sources of capital instead of primary capital markets. The loans are generally short-term, seldom exceeding the life of the pro ...

Powerpoint - Blakeley LLP

... Sherman Act does not prohibit an SP for the purpose of collecting a delinquent account An SP cannot have its members agree to refuse credit requested by the customer, even where the customer is delinquent and may be liquidating its assets The decision to extend credit is with each SP member, and the ...

... Sherman Act does not prohibit an SP for the purpose of collecting a delinquent account An SP cannot have its members agree to refuse credit requested by the customer, even where the customer is delinquent and may be liquidating its assets The decision to extend credit is with each SP member, and the ...

The New Monetary Framework

... making to voters. So the country’s national currency was devalued in the early 1970s and depreciated continuously for a couple more decades until the drachma was replaced by the euro. Once Greek politicians realized they could sell euro-denominated bonds to foreign investors in order to fund the pro ...

... making to voters. So the country’s national currency was devalued in the early 1970s and depreciated continuously for a couple more decades until the drachma was replaced by the euro. Once Greek politicians realized they could sell euro-denominated bonds to foreign investors in order to fund the pro ...

Chapter 5 The Time Value of Money

... The cash budget is the basic tool for forecasting the cash inflows and outflows through a company. Although it helps financial managers identify key items, unfortunately, it does not explain the cause of the problem. Instead, we can look at the drivers of cash flow. These drivers include the company ...

... The cash budget is the basic tool for forecasting the cash inflows and outflows through a company. Although it helps financial managers identify key items, unfortunately, it does not explain the cause of the problem. Instead, we can look at the drivers of cash flow. These drivers include the company ...

Mnyl - Funds-apr 2010

... Focus on safety with investments in AAA rated debt instruments Capital preservation is the key driving parameter rather than returns Money also invested in liquid funds in the varying interest scenario ...

... Focus on safety with investments in AAA rated debt instruments Capital preservation is the key driving parameter rather than returns Money also invested in liquid funds in the varying interest scenario ...

Asian Bonds Still Sitting Pretty - March 2013

... other person without prior consent. This information is not an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not lawful or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such an ...

... other person without prior consent. This information is not an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not lawful or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such an ...

The Minsky Paradox and the Structural Contradiction of Big

... But what is unsustainable cannot be sustained. As the housing bubble developed, both the internal and external imbalances of the US economy continued to widen. The imbalances could not keep expanding forever and had to be corrected at certain point. The bubble eventually collapsed more or less unde ...

... But what is unsustainable cannot be sustained. As the housing bubble developed, both the internal and external imbalances of the US economy continued to widen. The imbalances could not keep expanding forever and had to be corrected at certain point. The bubble eventually collapsed more or less unde ...

Document

... • Non-systemic events—such as for example, people being persuaded by the failure of the system that the system must be changed – There is a limit to modelling—institutions and evolution and human agency must also be understood… – But we do at least get a better handle on the system by knowing its ch ...

... • Non-systemic events—such as for example, people being persuaded by the failure of the system that the system must be changed – There is a limit to modelling—institutions and evolution and human agency must also be understood… – But we do at least get a better handle on the system by knowing its ch ...

NN IP overweights Russia`s corporate bonds despite its damaged

... The major metal & mining companies expect demand for flat and long steel products to contract by 510% but the negative impact on these corporations is partially offset by their ability to redirect steel and ferrous products to export markets. They also benefit from cost leadership and strong balance ...

... The major metal & mining companies expect demand for flat and long steel products to contract by 510% but the negative impact on these corporations is partially offset by their ability to redirect steel and ferrous products to export markets. They also benefit from cost leadership and strong balance ...

Buying and Selling Bonds

... Bondholders can sell their bond before maturity at a price higher than they paid for it as bonds often appreciate in value ...

... Bondholders can sell their bond before maturity at a price higher than they paid for it as bonds often appreciate in value ...

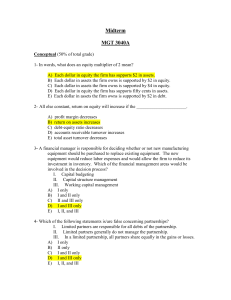

Answers to Midterm 3040A

... D) Net new bonds are sold and outstanding common stock is repurchased. E) Net new bonds are sold and short-term notes payable are paid off. ...

... D) Net new bonds are sold and outstanding common stock is repurchased. E) Net new bonds are sold and short-term notes payable are paid off. ...

Market Comment - Emerging Market Corporate Bonds

... not be a part of the benchmark because it’s a small issue. Bigger investment houses are less willing to use research resources on smaller, non-benchmark companies or smaller issues. But what’s important to us in the Value Bonds team is the company behind the issue. If the fundamentals are strong and ...

... not be a part of the benchmark because it’s a small issue. Bigger investment houses are less willing to use research resources on smaller, non-benchmark companies or smaller issues. But what’s important to us in the Value Bonds team is the company behind the issue. If the fundamentals are strong and ...