Is It Too Late to Bail Out the Troubled Countries in the Eurozone?

... for the bonds: they know that the government will repay for sure if the country recovers, which occurs with probability p , and it will also repay even if the country is still in a recession, which occurs with probability 1 p , as long as there is no crisis, which occurs with probability 1 . T ...

... for the bonds: they know that the government will repay for sure if the country recovers, which occurs with probability p , and it will also repay even if the country is still in a recession, which occurs with probability 1 p , as long as there is no crisis, which occurs with probability 1 . T ...

The Debt Crisis Ahead: Late 2010 – Late 2012

... l Businesses sell less, so they borrow less, employ fewer people and pay less in wages. l Falling spending, falling wages, rising unemployment and declining debt levels lead to deflation in prices and reinforce the lower spending cycle. This cycle cannot be fully broken by stimulus spending as Japan ...

... l Businesses sell less, so they borrow less, employ fewer people and pay less in wages. l Falling spending, falling wages, rising unemployment and declining debt levels lead to deflation in prices and reinforce the lower spending cycle. This cycle cannot be fully broken by stimulus spending as Japan ...

The National Debt Tops $19 Trillion - 106% Of GDP

... the largest expansion of debt in history. Even though the deficits have come down significantly in recent years – $483 billion in FY2014 and $439 billion in FY2015 – the CBO projects that the annual deficit for FY2016 will rise to $544 billion. The CBO projects the deficit to rise every year going f ...

... the largest expansion of debt in history. Even though the deficits have come down significantly in recent years – $483 billion in FY2014 and $439 billion in FY2015 – the CBO projects that the annual deficit for FY2016 will rise to $544 billion. The CBO projects the deficit to rise every year going f ...

Modelling the Monetary Circuit

... crises and depressions. – This instability, in my view, is due to characteristics the financial system must possess if it is to be consistent with full-blown capitalism. – Such a financial system will be capable of both generating signals that induce an accelerating desire to invest and of financing ...

... crises and depressions. – This instability, in my view, is due to characteristics the financial system must possess if it is to be consistent with full-blown capitalism. – Such a financial system will be capable of both generating signals that induce an accelerating desire to invest and of financing ...

CHAP15

... A high govt debt may be an incentive for policymakers to create inflation (to reduce real value of debt at expense of bond holders) Fortunately: little evidence that the link between fiscal and monetary policy is important most governments know the folly of creating inflation most central ba ...

... A high govt debt may be an incentive for policymakers to create inflation (to reduce real value of debt at expense of bond holders) Fortunately: little evidence that the link between fiscal and monetary policy is important most governments know the folly of creating inflation most central ba ...

General government deficit and debt 2016

... Central government's EDP debt differs as a concept from the central government debt published by the State Treasury. Central government's EDP debt includes loans granted to beneficiary counties by the European Financial Stability Facility EFSF, received cash collateral related to derivative contract ...

... Central government's EDP debt differs as a concept from the central government debt published by the State Treasury. Central government's EDP debt includes loans granted to beneficiary counties by the European Financial Stability Facility EFSF, received cash collateral related to derivative contract ...

Debt, inequality and economic stability Steve Keen www.debtdeflation.com/blogs www.debunkingeconomics.com

... • Now, I’m all for including the banking sector in stories where it’s relevant; – but why is it so crucial to a story about debt and leverage?...” • (Krugman 2012) • Ignorance of finance sector due to false model of money & lending – “If I decide to cut back on my spending – and stash the funds in a ...

... • Now, I’m all for including the banking sector in stories where it’s relevant; – but why is it so crucial to a story about debt and leverage?...” • (Krugman 2012) • Ignorance of finance sector due to false model of money & lending – “If I decide to cut back on my spending – and stash the funds in a ...

Misunderstanding the Great Depression, making the next one worse

... • Markets must “take a hit” from fall in turnover • Similar but smaller effect even if debt grows 10% – No growth in nominal demand—rise in unemployment ...

... • Markets must “take a hit” from fall in turnover • Similar but smaller effect even if debt grows 10% – No growth in nominal demand—rise in unemployment ...

ECON366 - KONSTANTINOS KANELLOPOULOS

... convert its balance sheet figures to a market value basis. KJM Corporation's balance sheet as of January 1, 2001, is as follows: Long-term debt (bonds, at par) ...

... convert its balance sheet figures to a market value basis. KJM Corporation's balance sheet as of January 1, 2001, is as follows: Long-term debt (bonds, at par) ...

Long Term Debt - McFarland UCC

... UCC about the existence of unpaid debt dating back almost 30 years. The funds, secured with the assistance of the Conference, enabled MUCC to purchase land and build our church in McFarland. Two loans exist: One for $51,495 (owed to the Wisconsin Conference), and another for $19,503 (owed to the nat ...

... UCC about the existence of unpaid debt dating back almost 30 years. The funds, secured with the assistance of the Conference, enabled MUCC to purchase land and build our church in McFarland. Two loans exist: One for $51,495 (owed to the Wisconsin Conference), and another for $19,503 (owed to the nat ...

7-0 - McGraw-Hill Education Canada

... • Bonds of similar risk (and maturity) will be priced to yield about the same return, regardless of the coupon rate • If you know the price of one bond, you can estimate its YTM and use that to find the price of the second bond • This is a useful concept that can be transferred to valuing assets oth ...

... • Bonds of similar risk (and maturity) will be priced to yield about the same return, regardless of the coupon rate • If you know the price of one bond, you can estimate its YTM and use that to find the price of the second bond • This is a useful concept that can be transferred to valuing assets oth ...

Economics for Today 2nd edition Irvin B. Tucker

... effect of deficit government spending. d. It affects interest rates and, in turn, consumption and investment spending. D. The crowding-out effect is a reduction in private spending caused by federal deficits financed by U.S. Treasury borrowing. ...

... effect of deficit government spending. d. It affects interest rates and, in turn, consumption and investment spending. D. The crowding-out effect is a reduction in private spending caused by federal deficits financed by U.S. Treasury borrowing. ...

Government units` financial situation cautiously positive

... Government units' financial situation cautiously positive For the first time in two years, the government units ended 2015 in positive territory again. The good result was driven primarily by the high surpluses of the Confederation and the social security funds. A surplus can probably be expected in ...

... Government units' financial situation cautiously positive For the first time in two years, the government units ended 2015 in positive territory again. The good result was driven primarily by the high surpluses of the Confederation and the social security funds. A surplus can probably be expected in ...

Experience of the Accounts Chamber of the Russian Federation in

... Relation of annual costs of public debt redemption and service to federal fiscal revenue Relation of public debt of the Russian Federation to federal fiscal revenue Relation of external debt of the Russian Federation to annual export of goods and services Relation of annual costs of external debt re ...

... Relation of annual costs of public debt redemption and service to federal fiscal revenue Relation of public debt of the Russian Federation to federal fiscal revenue Relation of external debt of the Russian Federation to annual export of goods and services Relation of annual costs of external debt re ...

ECONOMIES IN CRISIS

... move from stability to crisis thanks largely to speculative borrowing in good times. • Steve Keen uses the “Financial Instability Hypothesis” to analyse Australian and US levels of debt. For his PhD, he built a mathematical model of Minsky’s hypothesis. ...

... move from stability to crisis thanks largely to speculative borrowing in good times. • Steve Keen uses the “Financial Instability Hypothesis” to analyse Australian and US levels of debt. For his PhD, he built a mathematical model of Minsky’s hypothesis. ...

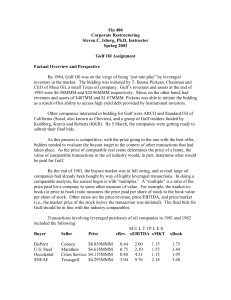

Factual Overview and Perspective

... Conoco and Marathon were in part purchased for their rich oil reserves. In both cases, there were oil and non-oil companies involved in the bidding. The other two transactions involved the purchase of one oil company by another. As of the end of 1983, Gulf had 165.3 million shares outstanding. The ...

... Conoco and Marathon were in part purchased for their rich oil reserves. In both cases, there were oil and non-oil companies involved in the bidding. The other two transactions involved the purchase of one oil company by another. As of the end of 1983, Gulf had 165.3 million shares outstanding. The ...

Country Risk by Marijke Zewuster

... 1. The European debt crisis, a brief update 2. Sovereign defaults it happened before 3. Country risk analysis at ABN AMRO 4. The Greece case ...

... 1. The European debt crisis, a brief update 2. Sovereign defaults it happened before 3. Country risk analysis at ABN AMRO 4. The Greece case ...

Public Debt Monitor, 2017-1

... The debt-to-GDP ratio for the General Government sector dropped four tenths of a percentage point in 2016 up to the target of 99.4%. However, in nominal terms public indebtedness has reached a new historic annual peak. Moreover, the legal requirement for a yearly reduction of at least 2% of GDP has ...

... The debt-to-GDP ratio for the General Government sector dropped four tenths of a percentage point in 2016 up to the target of 99.4%. However, in nominal terms public indebtedness has reached a new historic annual peak. Moreover, the legal requirement for a yearly reduction of at least 2% of GDP has ...

the Powerpoint file

... • Minsky: growing aggregate private debt source of economic growth – “If income is to grow, the financial markets must generate an aggregate demand that is ever rising. – For real aggregate demand to be increasing, it is necessary that current spending plans be greater than current received income a ...

... • Minsky: growing aggregate private debt source of economic growth – “If income is to grow, the financial markets must generate an aggregate demand that is ever rising. – For real aggregate demand to be increasing, it is necessary that current spending plans be greater than current received income a ...

15.3 Federal Deficits and Federal Debt

... Economic Impact of the Debt Debt and interest rates Who bears the burden of the debt? We owe it to ourselves Foreign ownership of debt ...

... Economic Impact of the Debt Debt and interest rates Who bears the burden of the debt? We owe it to ourselves Foreign ownership of debt ...

Martin Feldstein Professor of Economics , Harvard University

... witnessed many countries in recent years where a weak banking system lead to a financial crisis which then turned into a general economic crisis. In my judgement, this will not happen in China. As you know, the major banks here are not private commercial banks in the same way that they are in the Un ...

... witnessed many countries in recent years where a weak banking system lead to a financial crisis which then turned into a general economic crisis. In my judgement, this will not happen in China. As you know, the major banks here are not private commercial banks in the same way that they are in the Un ...

HBW with speaker notes - North Carolina Cooperative Extension

... • Investment of mortgage dollars • Interest is tax deductible • Home can increase in value Disadvantage to Buy • Commitment of time, etc. • Ties up money • Maintenance ...

... • Investment of mortgage dollars • Interest is tax deductible • Home can increase in value Disadvantage to Buy • Commitment of time, etc. • Ties up money • Maintenance ...

Quarterly Review and Outlook, First Quarter 2016

... actions - quantitative easing, negative or near zero overnight rates, forward guidance and other untested techniques. In 2015 the aggregate nominal GDP growth rose by 3.6%, sharply lower than the 5.8% growth in 2010 (Chart 6). The only year in which nominal GDP was materially worse than 2015 was the ...

... actions - quantitative easing, negative or near zero overnight rates, forward guidance and other untested techniques. In 2015 the aggregate nominal GDP growth rose by 3.6%, sharply lower than the 5.8% growth in 2010 (Chart 6). The only year in which nominal GDP was materially worse than 2015 was the ...

Government debt

Government debt (also known as public debt, national debt and sovereign debt) is the debt owed by a central government. (In federal states, ""government debt"" may also refer to the debt of a state or provincial, municipal or local government.) By contrast, the annual ""government deficit"" refers to the difference between government receipts and spending in a single year, that is, the increase of debt over a particular year.Government debt is one method of financing government operations, but it is not the only method. Governments can also create money to monetize their debts, thereby removing the need to pay interest. But this practice simply reduces government interest costs rather than truly canceling government debt, and can result in hyperinflation if used unsparingly.Governments usually borrow by issuing securities, government bonds and bills. Less creditworthy countries sometimes borrow directly from a supranational organization (e.g. the World Bank) or international financial institutions.As the government draws its income from much of the population, government debt is an indirect debt of the taxpayers. Government debt can be categorized as internal debt (owed to lenders within the country) and external debt (owed to foreign lenders). Another common division of government debt is by duration until repayment is due. Short term debt is generally considered to be for one year or less, long term is for more than ten years. Medium term debt falls between these two boundaries. A broader definition of government debt may consider all government liabilities, including future pension payments and payments for goods and services the government has contracted but not yet paid.