Stop Kicking the Can Down the Road

... The U.S. is in the middle of a balance sheet recession that shows alarming similarities to Japan’s situation in the 1990s.4 Both recessions were the result of the bursting of debt-financed asset-price bubbles, resulting in massive private-sector deleveraging. Asset prices in the U.S. follow exactly ...

... The U.S. is in the middle of a balance sheet recession that shows alarming similarities to Japan’s situation in the 1990s.4 Both recessions were the result of the bursting of debt-financed asset-price bubbles, resulting in massive private-sector deleveraging. Asset prices in the U.S. follow exactly ...

Effects of Government Debt on Macroeconomic Activity (The Case of

... of the implemented fiscal policy largely determine the short-term results, which considerably limit the macroeconomic effects of the expansionary fiscal policy and can neutralize them. This neutrality is best exemplified by the so called Ricardian Equivalence which states that deficit financing of b ...

... of the implemented fiscal policy largely determine the short-term results, which considerably limit the macroeconomic effects of the expansionary fiscal policy and can neutralize them. This neutrality is best exemplified by the so called Ricardian Equivalence which states that deficit financing of b ...

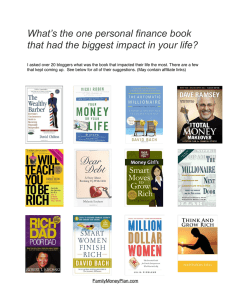

What`s the one personal finance book that had the biggest impact in

... concepts I didn’t understand and would ordinarily have never really thought about - retirement savings and what my 401k was, the latte factor and how saving small over time could actually be a big deal. It was an amazing book for young Bola. -Clever Girl Finance Dave Ramsey's The Total Money Makeove ...

... concepts I didn’t understand and would ordinarily have never really thought about - retirement savings and what my 401k was, the latte factor and how saving small over time could actually be a big deal. It was an amazing book for young Bola. -Clever Girl Finance Dave Ramsey's The Total Money Makeove ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... out by debt servicing, thereby adversely affecting productivity growth. This argument is supported by Fosu (2010) who contends that constraining debt servicing would shift public expenditure away from important social services such as health and education. The government would be forced to increase ...

... out by debt servicing, thereby adversely affecting productivity growth. This argument is supported by Fosu (2010) who contends that constraining debt servicing would shift public expenditure away from important social services such as health and education. The government would be forced to increase ...

Carmen M. Reinhart Kenneth Rogoff 11 August 2010, VOX.EU

... post World War II period.5 The median public debt/GDP ratio is 0.36; about 92% of the observations fall below the 90% threshold. In effect, about 76% of the observations were below the 60% Maastricht criteria. Put differently, our “high vulnerability” region for lower growth (the area under the curv ...

... post World War II period.5 The median public debt/GDP ratio is 0.36; about 92% of the observations fall below the 90% threshold. In effect, about 76% of the observations were below the 60% Maastricht criteria. Put differently, our “high vulnerability” region for lower growth (the area under the curv ...

debt and macroeconomic stability

... during a downturn helps cushion the effects of large, adverse shocks. Ultimately, as seen in the recent crisis, governments can be forced to rescue the financial and parts of the non-financial corporate sector. More indirectly, but usually quantitatively more important, government budgets are affect ...

... during a downturn helps cushion the effects of large, adverse shocks. Ultimately, as seen in the recent crisis, governments can be forced to rescue the financial and parts of the non-financial corporate sector. More indirectly, but usually quantitatively more important, government budgets are affect ...

Chapter 7: Government, corporate, and household balance sheets

... by 32.5% of GDP in 2009 and deteriorated further, bottoming out at -47.6% of GDP in 2012. Since then the position has been improving, and in 2015 net financial assets stood at -41.5% of GDP. After the financial crisis, currency and deposits emerged as the central government’s largest asset group, as ...

... by 32.5% of GDP in 2009 and deteriorated further, bottoming out at -47.6% of GDP in 2012. Since then the position has been improving, and in 2015 net financial assets stood at -41.5% of GDP. After the financial crisis, currency and deposits emerged as the central government’s largest asset group, as ...

The Role of Debt and Equity Financing over the Business Cycle

... (reduction in default probability and the value of this transfer is smaller during a boom) • Covas and Denhaan (pro-cylical) • Standard debt contract with default Desire to expand leads to tightening of bank break-even condition pro-cyclical equity issuance • Counter-cyclical risk premium and eq ...

... (reduction in default probability and the value of this transfer is smaller during a boom) • Covas and Denhaan (pro-cylical) • Standard debt contract with default Desire to expand leads to tightening of bank break-even condition pro-cyclical equity issuance • Counter-cyclical risk premium and eq ...

Simplify to Innovate

... thinking clean to make it simple. But it’s worth it in the end because once you get there, you can move mountains.” In the United States, generally accepted accounting principles, commonly referred to as GAAP, have become incredibly complex over the last few decades. The Financial Accounting Standar ...

... thinking clean to make it simple. But it’s worth it in the end because once you get there, you can move mountains.” In the United States, generally accepted accounting principles, commonly referred to as GAAP, have become incredibly complex over the last few decades. The Financial Accounting Standar ...

Bank Runs, Deposit Insurance, and Liquidity Diamond and

... The return of financial repression? To deal with the current debt overhang, similar policies to those documented here may re-emerge in the guise of prudential regulation rather than under the politically incorrect label of financial repression. Moreover, the process where debts are being “placed” a ...

... The return of financial repression? To deal with the current debt overhang, similar policies to those documented here may re-emerge in the guise of prudential regulation rather than under the politically incorrect label of financial repression. Moreover, the process where debts are being “placed” a ...

Instability in the US:

... financial system, the massive confidence shock and a fall of GDP growth on a scale not seen in the post-war decades. Curiously, in an earlier statement the same rating agency made a more informed assessment when it citied as a most important destabilising factor the risk of a recession combined with ...

... financial system, the massive confidence shock and a fall of GDP growth on a scale not seen in the post-war decades. Curiously, in an earlier statement the same rating agency made a more informed assessment when it citied as a most important destabilising factor the risk of a recession combined with ...

Quiz 3

... dividends on preferred stock _____ treated as an expense of the firm for tax purposes. a. b. c. d. e. ...

... dividends on preferred stock _____ treated as an expense of the firm for tax purposes. a. b. c. d. e. ...

An enhanced methodology of compiling financial

... FISIM should be compiled on the basis of the difference between market interest rates on loans and deposits and a reference rate as a rate between bank interest rates on deposits and loans. ...

... FISIM should be compiled on the basis of the difference between market interest rates on loans and deposits and a reference rate as a rate between bank interest rates on deposits and loans. ...

AIF_Sponsor Based Leveraged Acquisition June 2010

... This information has been prepared solely for informational purposes and is not intended to provide or should not be relied upon for accounting, legal, tax, or investment advice. The factual statements herein have been taken from sources believed to be reliable, but such statements are made without ...

... This information has been prepared solely for informational purposes and is not intended to provide or should not be relied upon for accounting, legal, tax, or investment advice. The factual statements herein have been taken from sources believed to be reliable, but such statements are made without ...

what is happening to pakistan`s external sector

... growing trade deficit faced by Pakistan in the current fiscal year, as well as, about the rise in the absolute level of External Debt. In raising these issues a serious concern has been expressed about Pakistan’s ability to pay its external obligations and the impact on foreign reserves in the futur ...

... growing trade deficit faced by Pakistan in the current fiscal year, as well as, about the rise in the absolute level of External Debt. In raising these issues a serious concern has been expressed about Pakistan’s ability to pay its external obligations and the impact on foreign reserves in the futur ...

Bureau Of Consumer Financial Protection

... Participants” docket that are being sent in by Americans for Financial Reform, the National Consumer Law Center, the Consumer Federation of America, U.S. PIRG and other AFR members. The rule is critical in determining which “non-banks” -- in addition to the statutory authority already granted over r ...

... Participants” docket that are being sent in by Americans for Financial Reform, the National Consumer Law Center, the Consumer Federation of America, U.S. PIRG and other AFR members. The rule is critical in determining which “non-banks” -- in addition to the statutory authority already granted over r ...

History of National Debt

... This would reduce the amount of bonds in private portfolios, but it would give the ex-bondholders an equivalent amount of cash to spend on something else. The cash comes from a budget surplus, which means that taxpayers have paid in extra. Those who don’t own bonds are now net payers to those who do ...

... This would reduce the amount of bonds in private portfolios, but it would give the ex-bondholders an equivalent amount of cash to spend on something else. The cash comes from a budget surplus, which means that taxpayers have paid in extra. Those who don’t own bonds are now net payers to those who do ...

Introduction - Brookings Institution

... more easily. Indeed, by early 2005, the spread on interest rates on emergingmarket bonds relative to those on U.S. treasury bonds stood at an eight-year low. The lower spread, coupled with the lower level of U.S. rates, has eased the debt service of all emerging-market borrowers. It remains to be se ...

... more easily. Indeed, by early 2005, the spread on interest rates on emergingmarket bonds relative to those on U.S. treasury bonds stood at an eight-year low. The lower spread, coupled with the lower level of U.S. rates, has eased the debt service of all emerging-market borrowers. It remains to be se ...

botswana country debt profile

... This is commendable and in line with the AFRODAD Borrowing Charter recommendation on the need and importance of countries to have debt ceilings. However, there are some concerns that these fiscal targets are fixed and not updated in relation to changing macroeconomic ...

... This is commendable and in line with the AFRODAD Borrowing Charter recommendation on the need and importance of countries to have debt ceilings. However, there are some concerns that these fiscal targets are fixed and not updated in relation to changing macroeconomic ...

Week 1 Discussion Assignment Problem Sets

... Complete practice problem 4.6 (Du Pont Analysis) on page 147 of your course textbook. Donaldson & Son has an ROA of 10%, a 2% profit margin, and a return on equity equal to 15%. What is the company’s total assets turnover? What is the firm’s equity multiplier? Complete practice problems 4-10 (Times- ...

... Complete practice problem 4.6 (Du Pont Analysis) on page 147 of your course textbook. Donaldson & Son has an ROA of 10%, a 2% profit margin, and a return on equity equal to 15%. What is the company’s total assets turnover? What is the firm’s equity multiplier? Complete practice problems 4-10 (Times- ...

High earners can still struggle

... accumulating insurmountable debt. Many of those in this income bracket believe they should be able to handle their finances and fear the disapproval of others who may view them as reckless spenders, say credit advisers such as Gail Cunningham, vice president of business relations at Consumer Credit ...

... accumulating insurmountable debt. Many of those in this income bracket believe they should be able to handle their finances and fear the disapproval of others who may view them as reckless spenders, say credit advisers such as Gail Cunningham, vice president of business relations at Consumer Credit ...

THE RISING PUBLIC DOMESTIC DEBT – SHOULD WE WORRY?

... Implications for policy • There is need for a domestic debt policy – The shift in the composition of overall public debt with increasing domestic debt brings to the fore the need for Government to formulate and implement prudent domestic debt management strategies by improving oversight procedures ...

... Implications for policy • There is need for a domestic debt policy – The shift in the composition of overall public debt with increasing domestic debt brings to the fore the need for Government to formulate and implement prudent domestic debt management strategies by improving oversight procedures ...

“save social security” bonds

... Department of Economics, Colby College The major long-term macroeconomic problem facing the United States is the eventual inability to finance social security benefits for the boomer generation without either cutting benefits or raising payroll taxes. Much else about the general macroeconomy is outs ...

... Department of Economics, Colby College The major long-term macroeconomic problem facing the United States is the eventual inability to finance social security benefits for the boomer generation without either cutting benefits or raising payroll taxes. Much else about the general macroeconomy is outs ...

Impact of External Debt Financing on Economic Development in

... External debt burden in Nigeria can be traced to so many factors in the past which caused the growth of the economy to decline alongside its development. Between the period of 1950 – 1960, Nigeria had a magnificent growth in its economy due to her huge investment in agriculture which was a major sou ...

... External debt burden in Nigeria can be traced to so many factors in the past which caused the growth of the economy to decline alongside its development. Between the period of 1950 – 1960, Nigeria had a magnificent growth in its economy due to her huge investment in agriculture which was a major sou ...

Government debt

Government debt (also known as public debt, national debt and sovereign debt) is the debt owed by a central government. (In federal states, ""government debt"" may also refer to the debt of a state or provincial, municipal or local government.) By contrast, the annual ""government deficit"" refers to the difference between government receipts and spending in a single year, that is, the increase of debt over a particular year.Government debt is one method of financing government operations, but it is not the only method. Governments can also create money to monetize their debts, thereby removing the need to pay interest. But this practice simply reduces government interest costs rather than truly canceling government debt, and can result in hyperinflation if used unsparingly.Governments usually borrow by issuing securities, government bonds and bills. Less creditworthy countries sometimes borrow directly from a supranational organization (e.g. the World Bank) or international financial institutions.As the government draws its income from much of the population, government debt is an indirect debt of the taxpayers. Government debt can be categorized as internal debt (owed to lenders within the country) and external debt (owed to foreign lenders). Another common division of government debt is by duration until repayment is due. Short term debt is generally considered to be for one year or less, long term is for more than ten years. Medium term debt falls between these two boundaries. A broader definition of government debt may consider all government liabilities, including future pension payments and payments for goods and services the government has contracted but not yet paid.