Components of Economic Analysis

... There really is a limit to how much debt leverage an economy can handle before it becomes dangerously unstable. And, we now know that aggressive use of debt leverage fuels asset bubbles and can for a very long time sustain a seemingly benign environment. But there is also a simple truism. People, bu ...

... There really is a limit to how much debt leverage an economy can handle before it becomes dangerously unstable. And, we now know that aggressive use of debt leverage fuels asset bubbles and can for a very long time sustain a seemingly benign environment. But there is also a simple truism. People, bu ...

The Radical Implications of Stable, Quiet Inflation

... → QE (twist), forward guidance, and i policy are the same thing. ...

... → QE (twist), forward guidance, and i policy are the same thing. ...

Downlaod File

... FINA 3311: Financial Management Principles Instructor: Rashida Sharmin Section (201) Project: Case Study By: Shouq Al-Hamoudi 200900213 Rasha Bubahait 200901816 Fadheelah Al-Soqair 200900765 ...

... FINA 3311: Financial Management Principles Instructor: Rashida Sharmin Section (201) Project: Case Study By: Shouq Al-Hamoudi 200900213 Rasha Bubahait 200901816 Fadheelah Al-Soqair 200900765 ...

Introduction - Brookings Institution

... its crisis, in part because of the political turmoil surrounding the end of the Suharto regime and realignment of the political economy as the country developed a democratic government. The Latin American countries that suffered crises in the 1990s recovered quickly. Nonetheless, despite their upswi ...

... its crisis, in part because of the political turmoil surrounding the end of the Suharto regime and realignment of the political economy as the country developed a democratic government. The Latin American countries that suffered crises in the 1990s recovered quickly. Nonetheless, despite their upswi ...

Research Statement

... future periods. High domestic exposure to such costs enables the government to borrow more ex ante. Furthermore, the government may manipulate the level of domestic economic activity so as to affect the willingness of domestic banks to hold its debt. I evaluate different policies by international fi ...

... future periods. High domestic exposure to such costs enables the government to borrow more ex ante. Furthermore, the government may manipulate the level of domestic economic activity so as to affect the willingness of domestic banks to hold its debt. I evaluate different policies by international fi ...

full version ( ppt ) - Institute for Fiscal Studies

... • Darling’s temporary operating rule: “…improve the cyclically-adjusted current budget each year, once the economy emerges from the downturn so it reaches balance and debt is falling as a proportion of GDP once the global shocks have worked their way through the economy in full”. • Tory proposal, Se ...

... • Darling’s temporary operating rule: “…improve the cyclically-adjusted current budget each year, once the economy emerges from the downturn so it reaches balance and debt is falling as a proportion of GDP once the global shocks have worked their way through the economy in full”. • Tory proposal, Se ...

PowerPoint-Präsentation

... The global financial crisis and the European sovereign debt crisis originated in the United States US housing finance system is at the core of the crisis - Low-interest rate policy of the US Federal Reserve caused real interest rates to be negative - US Mortgage loans became more affordable - Demand ...

... The global financial crisis and the European sovereign debt crisis originated in the United States US housing finance system is at the core of the crisis - Low-interest rate policy of the US Federal Reserve caused real interest rates to be negative - US Mortgage loans became more affordable - Demand ...

Zero is the Cardinal Number of the Empty Set It`s the most effective

... It’s the number of things you have when you don’t have anything ...

... It’s the number of things you have when you don’t have anything ...

Chapter 29

... pay for future bills can be predicted by how you paid for past bills 2. Capacity--refers to the ability to pay a debt when it is due; size of income and current debt will be scrutinized 3. Capital--value of borrower’s possessions; includes money and property ...

... pay for future bills can be predicted by how you paid for past bills 2. Capacity--refers to the ability to pay a debt when it is due; size of income and current debt will be scrutinized 3. Capital--value of borrower’s possessions; includes money and property ...

... of debts. Government debt, catagorized as internal (domestic debt in home currency) and external debt ( debt issued in foreign currency),can sometimes prove to be highly unsafe especially in case of developing nations. Inability of any government to repay its debt can lead to a sovereign debt defaul ...

Crushing national debts, economic revolutions, and extraordinary

... writers such as Dickens, who complained of the widespread piracy of their works. The British, who had peacefully freed their slaves in the 1830s, felt that slavery in the United States was another indication of the moral inferiority of Americans. But, just as Americans who complain about exploited C ...

... writers such as Dickens, who complained of the widespread piracy of their works. The British, who had peacefully freed their slaves in the 1830s, felt that slavery in the United States was another indication of the moral inferiority of Americans. But, just as Americans who complain about exploited C ...

1st Half 2016 Newsletter - Harpswell Capital Advisors

... This commentary is prepared by Harpswell Capital Advisors for informational purposes only and is not intended as an offer of solicitation for the purchase or sale of any security. The information contained herein is neither investment advice nor a legal option. The views expressed are those of Harps ...

... This commentary is prepared by Harpswell Capital Advisors for informational purposes only and is not intended as an offer of solicitation for the purchase or sale of any security. The information contained herein is neither investment advice nor a legal option. The views expressed are those of Harps ...

FRBSF E L CONOMIC ETTER

... few decades, the volatility of the financial structure of firms has increased.To explain this observation, they construct an economic model where business cycle fluctuations are driven by asset price shocks. Because of financial frictions, increases in asset prices affect firms’ ability to produce, ...

... few decades, the volatility of the financial structure of firms has increased.To explain this observation, they construct an economic model where business cycle fluctuations are driven by asset price shocks. Because of financial frictions, increases in asset prices affect firms’ ability to produce, ...

Alan Bollard: Investing in a low inflation world (Central Bank Articles

... or industrial property. Investors need to be mindful that the laws of gravity apply not only to Newton's apple - they also apply to asset prices, including house prices. In real estate, the "laws of gravity" relate to things like population, income, household formation and the earning potential of t ...

... or industrial property. Investors need to be mindful that the laws of gravity apply not only to Newton's apple - they also apply to asset prices, including house prices. In real estate, the "laws of gravity" relate to things like population, income, household formation and the earning potential of t ...

Household debt: statistics and impact on economy

... back on their spending. Other factors such as rising debt repayments due to higher interest rates may also lead to reductions in spending. Magnified to the whole economy, an economic downturn or recession can cause many individuals to face this problem and lead to reductions in consumer spending. In ...

... back on their spending. Other factors such as rising debt repayments due to higher interest rates may also lead to reductions in spending. Magnified to the whole economy, an economic downturn or recession can cause many individuals to face this problem and lead to reductions in consumer spending. In ...

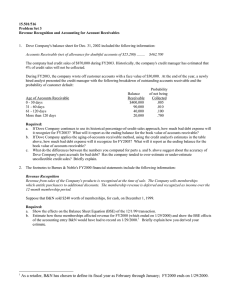

15.501/516 Problem Set 3 Revenue Recognition and Accounting for Account Receivables

... The company had credit sales of $870,000 during FY2003. Historically, the company's credit manager has estimated that 4% of credit sales will not be collected. During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented ...

... The company had credit sales of $870,000 during FY2003. Historically, the company's credit manager has estimated that 4% of credit sales will not be collected. During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented ...

Standards and Analysis: Part II - National Farm Viability Conference

... Depreciation: annual “non-cash” cost of wear and tear on assets Opportunity Cost of Owners: $40,000 + ...

... Depreciation: annual “non-cash” cost of wear and tear on assets Opportunity Cost of Owners: $40,000 + ...

Better incentives to service debt

... Offshore borrowing. But • NBFCs have declined since 1997 crisis • New inflows and demand for offshore funds drying up. • India’s capital market is one of largest but it is down India is still bank dominated: Banks assets more than double market capitalization. Banks are critical ...

... Offshore borrowing. But • NBFCs have declined since 1997 crisis • New inflows and demand for offshore funds drying up. • India’s capital market is one of largest but it is down India is still bank dominated: Banks assets more than double market capitalization. Banks are critical ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.