Questions Chapter 17 1) Which of the following statements are true

... [B] If the firm dramatically increases its depreciation expense it may have more of a need for an interest tax shield. [C] The present value of the interest tax shield is the amount of debt multiplied by the corporate tax rate. [D] The interest tax shield increases as a firm reduces its level of de ...

... [B] If the firm dramatically increases its depreciation expense it may have more of a need for an interest tax shield. [C] The present value of the interest tax shield is the amount of debt multiplied by the corporate tax rate. [D] The interest tax shield increases as a firm reduces its level of de ...

ACCA F9 Workbook Questions 1

... B. By providing insurance on transactions for buyers and sellers. C. By providing finance to enable transactions to take place. D. By selling foreign currency on the currencies exchange. Short Form Questions 1. What are the 4 targets of economic policy? 2. Name 2 examples of cost-push inflation. 3. ...

... B. By providing insurance on transactions for buyers and sellers. C. By providing finance to enable transactions to take place. D. By selling foreign currency on the currencies exchange. Short Form Questions 1. What are the 4 targets of economic policy? 2. Name 2 examples of cost-push inflation. 3. ...

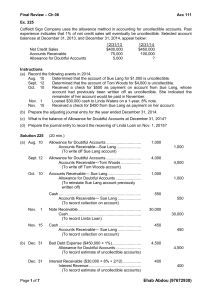

Final Review – Ch 08 Acc 111 Ex. 225 Coffeldt Sign Company uses

... Instructions (a) Prepare the adjusting entry on December 31, 2014, to recognize bad debts expense. (b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $500 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting ...

... Instructions (a) Prepare the adjusting entry on December 31, 2014, to recognize bad debts expense. (b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $500 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting ...

Bank exposures and sovereign stress transmission

... The euro-area sovereign debt crisis dramatically spotlighted the nexus between governments and banks and its powerful effects on lending and economic activity. The sovereign debt repricing in Ireland, Italy, Portugal and Spain after the Greek default in 2010 induced a repricing of bank risk in these ...

... The euro-area sovereign debt crisis dramatically spotlighted the nexus between governments and banks and its powerful effects on lending and economic activity. The sovereign debt repricing in Ireland, Italy, Portugal and Spain after the Greek default in 2010 induced a repricing of bank risk in these ...

STEP - Merrill Lynch

... The STEP Income Securities ® Linked to the Common Stock of Delta Air Lines, Inc., due May , 2017 (the “notes”) are our senior unsecured debt securities. The notes are not guaranteed or insured by the Canada Deposit Insurance Corporation or the FDIC, and are not, either directly or indirectly, an obl ...

... The STEP Income Securities ® Linked to the Common Stock of Delta Air Lines, Inc., due May , 2017 (the “notes”) are our senior unsecured debt securities. The notes are not guaranteed or insured by the Canada Deposit Insurance Corporation or the FDIC, and are not, either directly or indirectly, an obl ...

Form 10-K - Kimco Investor Relations

... affect actual results, performances or achievements. Factors which may cause actual results to differ materially from current expectations include, but are not limited to (i) general adverse economic and local real estate conditions, (ii) the inability of major tenants to continue paying their rent ...

... affect actual results, performances or achievements. Factors which may cause actual results to differ materially from current expectations include, but are not limited to (i) general adverse economic and local real estate conditions, (ii) the inability of major tenants to continue paying their rent ...

Saving in New Zealand - Issues and Options

... stronger and more balanced economy, there are many other – potentially more significant – factors that should also be considered. For example, the quality of New Zealand’s capital stock, the efficiency of the overall tax system, and the quality of government spending and regulations all have signifi ...

... stronger and more balanced economy, there are many other – potentially more significant – factors that should also be considered. For example, the quality of New Zealand’s capital stock, the efficiency of the overall tax system, and the quality of government spending and regulations all have signifi ...

550.448 Financial Engineering and Structured Products

... The rate is referred to as the interest on the mortgage. Rates are quoted annually, but paid in installments determined in the contract (frequency), usually monthly. Rates can be fixed for the life of the loan, they can float based on an index and a spread, or they can be fixed for a set period ...

... The rate is referred to as the interest on the mortgage. Rates are quoted annually, but paid in installments determined in the contract (frequency), usually monthly. Rates can be fixed for the life of the loan, they can float based on an index and a spread, or they can be fixed for a set period ...

Rede ning Financial Constraints: a Text-Based

... We find that firms that are marginally constrained in the equity and debt markets are highly distinct. Constrained firms focusing on equity are from industries with high Tobin’s Q, low dividends, high cash holdings, low leverage and lower operating income to sales. Relative to their industry peers, ...

... We find that firms that are marginally constrained in the equity and debt markets are highly distinct. Constrained firms focusing on equity are from industries with high Tobin’s Q, low dividends, high cash holdings, low leverage and lower operating income to sales. Relative to their industry peers, ...

understanding mortgage market behavior: creating good mortgage

... This study was funded by a Ford Foundation grant to the Joint Center for Housing Studies of Harvard University. Nicolas P. Retsinas, the Joint Center Director and Blue Ribbon Committee Chair, gratefully acknowledges the guidance and support of Brandee McHale and George McCarthy of the Ford Foundatio ...

... This study was funded by a Ford Foundation grant to the Joint Center for Housing Studies of Harvard University. Nicolas P. Retsinas, the Joint Center Director and Blue Ribbon Committee Chair, gratefully acknowledges the guidance and support of Brandee McHale and George McCarthy of the Ford Foundatio ...

Does the Purpose of a Loan Matter?

... Both theoretical and empirical research suggests that debt covenants have an inverse relationship with spread yield.14 Accordingly, we observe that while a reduction in the loan spread is similar for both restructure and operations purpose loans in the case of security requirement and dividend issua ...

... Both theoretical and empirical research suggests that debt covenants have an inverse relationship with spread yield.14 Accordingly, we observe that while a reduction in the loan spread is similar for both restructure and operations purpose loans in the case of security requirement and dividend issua ...

Determinants of Capital Structure: Evidence from a Major

... In addition to statistical significance, we analyze the economic significance of leverage determinants, a first in the capital structure literature on developing economies. Our findings indicate that each of the four broad types of leverage determinants does indeed play an economically important ro ...

... In addition to statistical significance, we analyze the economic significance of leverage determinants, a first in the capital structure literature on developing economies. Our findings indicate that each of the four broad types of leverage determinants does indeed play an economically important ro ...

A Review of Policy Options for Monitoring Household Saving

... macroeconomic policies aiming at a balanced economic recovery in the EU-15. The process of monitoring household saving is twofold: on the one hand, it concerns the liquidity level of the household savings portfolio (liquidity approach); and on the other hand, it places emphasis on the saving rates o ...

... macroeconomic policies aiming at a balanced economic recovery in the EU-15. The process of monitoring household saving is twofold: on the one hand, it concerns the liquidity level of the household savings portfolio (liquidity approach); and on the other hand, it places emphasis on the saving rates o ...

Key Credit Factors For The Regulated Utilities

... contained and symmetrical. The tariff set includes mechanisms allowing for a tariff adjustment for the timely recovery of volatile or unexpected operating and capital costs. There is a track record of earning a stable, compensatory rate of return in cash through various economic and political cycles ...

... contained and symmetrical. The tariff set includes mechanisms allowing for a tariff adjustment for the timely recovery of volatile or unexpected operating and capital costs. There is a track record of earning a stable, compensatory rate of return in cash through various economic and political cycles ...

Building Sub-national Debt Markets

... a result, private lending to local governments has virtually disappeared, and Treasury lending to local governments has increased rapidly. The pricing of Treasury credit to local governments does not take into account any credit risk and does not involve a credit risk appraisal, as the Treasury reli ...

... a result, private lending to local governments has virtually disappeared, and Treasury lending to local governments has increased rapidly. The pricing of Treasury credit to local governments does not take into account any credit risk and does not involve a credit risk appraisal, as the Treasury reli ...

Measuring National Well-being: Life in the UK, 2012

... Two years ago, the ONS launched the Measuring National Well-being (MNW) programme. The aim is to ‘develop and publish an accepted and trusted set of National Statistics which help people understand and monitor well-being’. Traditional measures of progress such as Gross Domestic Product (GDP) have lo ...

... Two years ago, the ONS launched the Measuring National Well-being (MNW) programme. The aim is to ‘develop and publish an accepted and trusted set of National Statistics which help people understand and monitor well-being’. Traditional measures of progress such as Gross Domestic Product (GDP) have lo ...

Management`s Discussion and Analysis

... assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Refer to section 11.1 in this MD&A for further informati ...

... assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Refer to section 11.1 in this MD&A for further informati ...

download

... managers and directors from scrutiny. Claessens et al. (2000b) argue that preferential deals could ruin natural market competition, hence inducing disproportionate risk and lower incentives for banks to monitor. If debt financing fails as a governance tool, firm performance will suffer. ...

... managers and directors from scrutiny. Claessens et al. (2000b) argue that preferential deals could ruin natural market competition, hence inducing disproportionate risk and lower incentives for banks to monitor. If debt financing fails as a governance tool, firm performance will suffer. ...

Building Sub-national Debt Markets in Developing and

... lending to local governments has virtually disappeared, and Treasury lending to local governments, mostly short-term, has increased rapidly. 13. There are several commonly acknowledged costs of this system. Foremost among them is the local governments’ loss of autonomy and control over their investm ...

... lending to local governments has virtually disappeared, and Treasury lending to local governments, mostly short-term, has increased rapidly. 13. There are several commonly acknowledged costs of this system. Foremost among them is the local governments’ loss of autonomy and control over their investm ...

Chapter 1 - Florida International University

... standard of living in your later years. Instead of spending the money now, you defer actual spending until the future when you retire. Thirty-four percent of Americans say retirement planning is their most pressing financial concern. Other examples of deferred spending include saving for a child’s e ...

... standard of living in your later years. Instead of spending the money now, you defer actual spending until the future when you retire. Thirty-four percent of Americans say retirement planning is their most pressing financial concern. Other examples of deferred spending include saving for a child’s e ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.