MAGI-Based Income Methodologies

... increases or decreases in household income. Determining Household Income The following two statements are displayed. These are statements of federal policy which apply under the regulations to all states, so no response from the state is required. “Except as provided at 42 CFR 435.603(d)(2) through ...

... increases or decreases in household income. Determining Household Income The following two statements are displayed. These are statements of federal policy which apply under the regulations to all states, so no response from the state is required. “Except as provided at 42 CFR 435.603(d)(2) through ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... financial position, results of operations and cash flows for those periods indicated, and contain adequate disclosure to make the information presented not misleading. Such adjustments are of a normal, recurring nature unless otherwise disclosed in the notes to consolidated financial statements. How ...

... financial position, results of operations and cash flows for those periods indicated, and contain adequate disclosure to make the information presented not misleading. Such adjustments are of a normal, recurring nature unless otherwise disclosed in the notes to consolidated financial statements. How ...

Dutch economy in calmer waters - Sociaal

... In the Netherlands, spatial planning imposes significant restrictions on new building. The disadvantage of this is that building production often lags behind demand and that houses are built in locations that people do not really prefer. In recent years, however, this has had the benefit of ensuring ...

... In the Netherlands, spatial planning imposes significant restrictions on new building. The disadvantage of this is that building production often lags behind demand and that houses are built in locations that people do not really prefer. In recent years, however, this has had the benefit of ensuring ...

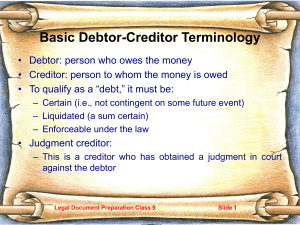

Slides in Microsoft PowerPoint Format

... – This is where the debtor gives up all of his assets (except exempt assets) – If it’s a business, it gives up all its assets and inventory and ceases to operate unless a creditor takes it over ...

... – This is where the debtor gives up all of his assets (except exempt assets) – If it’s a business, it gives up all its assets and inventory and ceases to operate unless a creditor takes it over ...

Scenarios on the sovereign debt crisis

... states have been driven up by higher default risk and in some cases liquidity squeezes have also taken place in the banking sectors of weaker states as foreign funds have fled. These developments have driven up borrowing costs and limited the availability of credit to the wider economy. ■ Wealth eff ...

... states have been driven up by higher default risk and in some cases liquidity squeezes have also taken place in the banking sectors of weaker states as foreign funds have fled. These developments have driven up borrowing costs and limited the availability of credit to the wider economy. ■ Wealth eff ...

Some international trends in the regulation of mortgage markets

... provide a background of legal certainty that results in significant advantages compared to the use of other types of funding. Issuers of covered bonds obtain a resilient funding source, whereas investors are protected by the double guarantee inherent in covered bonds, and benefit at the same time fr ...

... provide a background of legal certainty that results in significant advantages compared to the use of other types of funding. Issuers of covered bonds obtain a resilient funding source, whereas investors are protected by the double guarantee inherent in covered bonds, and benefit at the same time fr ...

The fiscal space in emerging market economies

... limit is not defined, which means that the paths of the debt ratio are explosive. Other authors such as Zandi et al (2011), Fournier and Fall (2015) and Pommier (2015) have used this methodology to estimate the debt limit for other samples of advanced economies. In the second approach, a threshold o ...

... limit is not defined, which means that the paths of the debt ratio are explosive. Other authors such as Zandi et al (2011), Fournier and Fall (2015) and Pommier (2015) have used this methodology to estimate the debt limit for other samples of advanced economies. In the second approach, a threshold o ...

Interpreting Farm Financial Ratios

... Working capital is simply a way to see how much of the current assets would be left over if all of them were sold and used to pay off all current liabilities. This is like the current ratio in that the farmer wants a positive number, but not too high a number as this indicates the assets not being u ...

... Working capital is simply a way to see how much of the current assets would be left over if all of them were sold and used to pay off all current liabilities. This is like the current ratio in that the farmer wants a positive number, but not too high a number as this indicates the assets not being u ...

TITLE SLIDE IS IN SENTENCE CASE. GREEN BACKGROUND

... As a percentage of risk-weighted assets; fully loaded CET1 ratios on a pro forma basis; Total Capital includes grandfathered capital securities. Excluding insurance dividend, CET1 reported ratios are 12.8% and 13.6% as at December 2015 and December 2016 respectively. (2) Excluding £0.5bn insurance d ...

... As a percentage of risk-weighted assets; fully loaded CET1 ratios on a pro forma basis; Total Capital includes grandfathered capital securities. Excluding insurance dividend, CET1 reported ratios are 12.8% and 13.6% as at December 2015 and December 2016 respectively. (2) Excluding £0.5bn insurance d ...

Review PowerPoint

... Bad purchases may cause loss of income and property Credit does not give you more money – still have to pay later May have trouble paying bills ...

... Bad purchases may cause loss of income and property Credit does not give you more money – still have to pay later May have trouble paying bills ...

economic crisis and higher education

... securities that Fannie and Freddie insure. They will soon be buying long-term Treasury bonds. I'm fairly confident that they'll be buying private label residential mortgage securities, commercial mortgage securities. They would be buying muni bonds, but they can't by law. If the muni market does sta ...

... securities that Fannie and Freddie insure. They will soon be buying long-term Treasury bonds. I'm fairly confident that they'll be buying private label residential mortgage securities, commercial mortgage securities. They would be buying muni bonds, but they can't by law. If the muni market does sta ...

Budgeting

... towards an emergency fund that they can use when they need it. Jimmy’s top tip is to be realistic when working out a budget. At the start, Jimmy and Aroha just wanted to pay off their debts and they didn’t leave enough money for their weekly expenses. So they changed their budget to have a bit more ...

... towards an emergency fund that they can use when they need it. Jimmy’s top tip is to be realistic when working out a budget. At the start, Jimmy and Aroha just wanted to pay off their debts and they didn’t leave enough money for their weekly expenses. So they changed their budget to have a bit more ...

McDonald`s

... 2012, which results in the increase in average days’ inventory on hand. The increasing of days on hand is not big and it is reasonable for the small difference between years. This means in 2012, McDonald maintains its good ability to sell inventories. The operating cycle decreases a little in 2012, ...

... 2012, which results in the increase in average days’ inventory on hand. The increasing of days on hand is not big and it is reasonable for the small difference between years. This means in 2012, McDonald maintains its good ability to sell inventories. The operating cycle decreases a little in 2012, ...

Financial Globalization

... Type IV crises – containment issues Contract-abiding containment proves insufficient Defenses of currency (int’l reserves, interest rate hikes) and of banks (LOLR)—inconsistent and break down Full deposit guarantee (to retain depositors at home while facilitating bank closures) lacks credibility ...

... Type IV crises – containment issues Contract-abiding containment proves insufficient Defenses of currency (int’l reserves, interest rate hikes) and of banks (LOLR)—inconsistent and break down Full deposit guarantee (to retain depositors at home while facilitating bank closures) lacks credibility ...

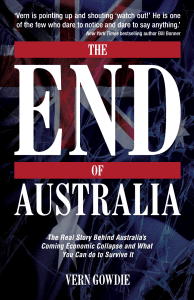

foreword - Port Phillip Publishing

... But just because you have to wait a long time for big events to occur doesn’t mean that they won’t occur. That which has to happen sooner or later will happen sometime. And the longer you wait for it, usually, the more important the event finally is. In this book, my friend and colleague, Vern Gowdi ...

... But just because you have to wait a long time for big events to occur doesn’t mean that they won’t occur. That which has to happen sooner or later will happen sometime. And the longer you wait for it, usually, the more important the event finally is. In this book, my friend and colleague, Vern Gowdi ...

Document

... After studying this chapter, you should be able to: 1. Identify the basic requirements for an accounting ...

... After studying this chapter, you should be able to: 1. Identify the basic requirements for an accounting ...

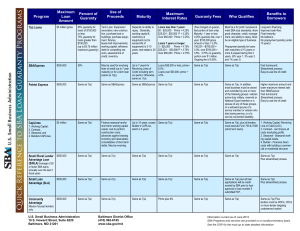

Program Maximum Loan Amount Percent of Guaranty Use of

... (FY 2012) is 0.9375% of principal outstanding. Ongoing fee % does not change during term. ...

... (FY 2012) is 0.9375% of principal outstanding. Ongoing fee % does not change during term. ...

Collateralized Mortgage Obligations

... Companion bonds are a special class of CMO bond that is paid off first when the underlying mortgages in a CMO pool are prepaid. Prepayments tend to occur when interest rates fall, so the payment rate on the companion bonds vary with interest rates. As a result, companion bonds absorb much of the pre ...

... Companion bonds are a special class of CMO bond that is paid off first when the underlying mortgages in a CMO pool are prepaid. Prepayments tend to occur when interest rates fall, so the payment rate on the companion bonds vary with interest rates. As a result, companion bonds absorb much of the pre ...

first name

... General Motors Corporation. Please fill out the table below using the financial statements provided. Please note that you can detach (“rip out”) Appendix 1 for easier analysis. a) (24 marks) Calculate the following ratios for 2007: ...

... General Motors Corporation. Please fill out the table below using the financial statements provided. Please note that you can detach (“rip out”) Appendix 1 for easier analysis. a) (24 marks) Calculate the following ratios for 2007: ...

Discussion on “Monetary Policy “Contagion” in the Pacific: A Historical Inquiry

... and lower sovereign bond yields in the EMEs; and U.S. credit expansions also stimulate the offshore bond issuance after 2010 • Choi et al. (2015): Quantify the effect of U.S. policy tightening, in comparison with EMEs’ own policy tightening, on their macro-fundamentals and capital flows – Explore ho ...

... and lower sovereign bond yields in the EMEs; and U.S. credit expansions also stimulate the offshore bond issuance after 2010 • Choi et al. (2015): Quantify the effect of U.S. policy tightening, in comparison with EMEs’ own policy tightening, on their macro-fundamentals and capital flows – Explore ho ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.