De Nederlandsche Bank Monetary and Economic Policy

... 3.1 The capital structure measure We take firm-level data (1993-2001) from Bureau van Dijk’s AMADEUS ‘top 200.000’ database. Annual balance sheet data and profit and loss account details are included for firms that have either more than 100 employees, more than €10 million operating revenue, or more ...

... 3.1 The capital structure measure We take firm-level data (1993-2001) from Bureau van Dijk’s AMADEUS ‘top 200.000’ database. Annual balance sheet data and profit and loss account details are included for firms that have either more than 100 employees, more than €10 million operating revenue, or more ...

Default Risk, the Real Exchange Rate and Income

... business cycles. Neumeyer and Perri (2001) model the effect that exogenous interest rate fluctuations have on business cycles and find that interest rate shocks can account for 50% of the volatility of output. Uribe and Yue (2003) construct an empirical VAR to uncover the relationship between countr ...

... business cycles. Neumeyer and Perri (2001) model the effect that exogenous interest rate fluctuations have on business cycles and find that interest rate shocks can account for 50% of the volatility of output. Uribe and Yue (2003) construct an empirical VAR to uncover the relationship between countr ...

0001193125-14-167598 - Town Sports International Holdings, Inc.

... Association, as syndication agent. The 2013 Senior Credit Facility consists of a $325,000 term loan facility maturing on November 15, 2020 (“2013 Term Loan Facility”) and a $45,000 revolving loan facility maturing on November 15, 2018 (“2013 Revolving Loan Facility”). Proceeds from the 2013 Term Loa ...

... Association, as syndication agent. The 2013 Senior Credit Facility consists of a $325,000 term loan facility maturing on November 15, 2020 (“2013 Term Loan Facility”) and a $45,000 revolving loan facility maturing on November 15, 2018 (“2013 Revolving Loan Facility”). Proceeds from the 2013 Term Loa ...

Credit spreads - Bank of England

... mechanisms outlined in the economic literature through which credit conditions may affect demand and potential output.(2) But there is no clear consensus about how best to capture credit conditions in the models used by central banks and other macroeconomic forecasters. When credit spreads are low a ...

... mechanisms outlined in the economic literature through which credit conditions may affect demand and potential output.(2) But there is no clear consensus about how best to capture credit conditions in the models used by central banks and other macroeconomic forecasters. When credit spreads are low a ...

Evaluation of Firm Performance

... performance It is important to keep in mind that it is not necessary to use all of these ratios in performing a ratio analysis. Selection of the ratios to be examined will depend on the particular individual’s perspective and objectives. For example, suppliers and short-term creditors are likely to ...

... performance It is important to keep in mind that it is not necessary to use all of these ratios in performing a ratio analysis. Selection of the ratios to be examined will depend on the particular individual’s perspective and objectives. For example, suppliers and short-term creditors are likely to ...

Ground rents: an opportunity for institutional investors to

... therefore, is normally paid relatively easily. In addition, the leaseholder of the property is incentivized to make ground rent payments to avoid forfeiting significant value if the freeholder repossessed the property in the event of default. Thus, ground rent cash flows are both wellsecured and sta ...

... therefore, is normally paid relatively easily. In addition, the leaseholder of the property is incentivized to make ground rent payments to avoid forfeiting significant value if the freeholder repossessed the property in the event of default. Thus, ground rent cash flows are both wellsecured and sta ...

Partisan Discrimination in Credit Ratings in Developed Economies

... downgrades since 2008. While emerging market economies are more likely to encounter debt crises and defaults due to their underdeveloped financial markets (Reinhart and Rogoff, 2008), recent events suggest that sovereigns with fully developed financial markets are not as immune to sovereign risk as ...

... downgrades since 2008. While emerging market economies are more likely to encounter debt crises and defaults due to their underdeveloped financial markets (Reinhart and Rogoff, 2008), recent events suggest that sovereigns with fully developed financial markets are not as immune to sovereign risk as ...

The business finance guide

... Growing a business from the first seed of an idea is not a smooth linear journey and it’s not as simple as a journey from A to B. The destination is seldom decided as the business idea takes form, becomes a reality and then grows into a successful enterprise. The finance journey is continuous; there ...

... Growing a business from the first seed of an idea is not a smooth linear journey and it’s not as simple as a journey from A to B. The destination is seldom decided as the business idea takes form, becomes a reality and then grows into a successful enterprise. The finance journey is continuous; there ...

Small Firm Use of Debt: An Examination of the Smallest Small Firms

... address a broad range of needs: to cover start-up costs, to provide working capital, to secure facilities or equipment, and to hire employees. Most small firms are at a relative disadvantage, because they are too small to access the public debt and equity markets. Similarly, they are typically too s ...

... address a broad range of needs: to cover start-up costs, to provide working capital, to secure facilities or equipment, and to hire employees. Most small firms are at a relative disadvantage, because they are too small to access the public debt and equity markets. Similarly, they are typically too s ...

Determination of Optimal Foreign Exchange Reserves in Nigeria

... million and 1.54 per cent, per quarter. The increase in FPI despite the lower spread could be explained by the significant decline in the ratio of short-term debt to reserves during the period. Furthermore, it coincided with a period when the economy exited the Paris and London club debt obligations ...

... million and 1.54 per cent, per quarter. The increase in FPI despite the lower spread could be explained by the significant decline in the ratio of short-term debt to reserves during the period. Furthermore, it coincided with a period when the economy exited the Paris and London club debt obligations ...

1 VALUING PRIVATE FIRMS So far in this book, we

... may have to be changed given the special circumstances surrounding private firms. Cost of Equity In assessing the cost of equity for publicly traded firms, we looked at the risk of investments through the eyes of the marginal investors in these firms. With the added assumption that these investors w ...

... may have to be changed given the special circumstances surrounding private firms. Cost of Equity In assessing the cost of equity for publicly traded firms, we looked at the risk of investments through the eyes of the marginal investors in these firms. With the added assumption that these investors w ...

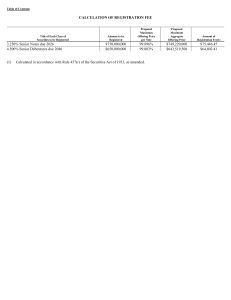

KELLOGG CO (Form: 424B5, Received: 02/26/2016 17:06:57)

... Tender Offer for 7.45% debentures due 2031 On February 25, 2016, we commenced an offer to purchase for cash (the “tender offer”) up to $440 million aggregate principal amount (the “Maximum Tender Amount”) of our 7.45% debentures due 2031 (the “2031 Debentures”). As of such date, $1,100,000,000 aggre ...

... Tender Offer for 7.45% debentures due 2031 On February 25, 2016, we commenced an offer to purchase for cash (the “tender offer”) up to $440 million aggregate principal amount (the “Maximum Tender Amount”) of our 7.45% debentures due 2031 (the “2031 Debentures”). As of such date, $1,100,000,000 aggre ...

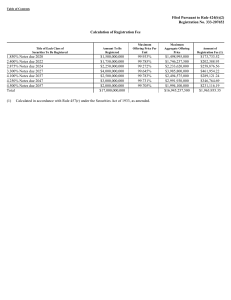

SPIRE INC (Form: 424B2, Received: 02/23/2017 15:27:05)

... Gas Utilities in 2017 reflects the continued ramp-up of infrastructure upgrades across both Missouri and Alabama, and the addition of capital expenditures to support EnergySouth. Acquiring and Integrating Gas Utilities We utilize a well-defined, disciplined process based on appropriate returns on in ...

... Gas Utilities in 2017 reflects the continued ramp-up of infrastructure upgrades across both Missouri and Alabama, and the addition of capital expenditures to support EnergySouth. Acquiring and Integrating Gas Utilities We utilize a well-defined, disciplined process based on appropriate returns on in ...

Chapter 2: A Further Look at Financial Statements

... providing them with a higher return on their investment. This will cause the company’s shares to become more attractive and hopefully increase in price. An increase in the current ratio usually signals good news because the company improved its ability to meet maturing short-term obligations. It can ...

... providing them with a higher return on their investment. This will cause the company’s shares to become more attractive and hopefully increase in price. An increase in the current ratio usually signals good news because the company improved its ability to meet maturing short-term obligations. It can ...

Montenegro Pre-accession Economic Programme 2011

... space for increase of budgetary revenues. The continuation of structural reforms and improvement of business environment and administration efficiency create the base for more dynamic growth. Basic features of individual chapters Chapter 2 – “Economic framework”; The recovery of economic activity in ...

... space for increase of budgetary revenues. The continuation of structural reforms and improvement of business environment and administration efficiency create the base for more dynamic growth. Basic features of individual chapters Chapter 2 – “Economic framework”; The recovery of economic activity in ...

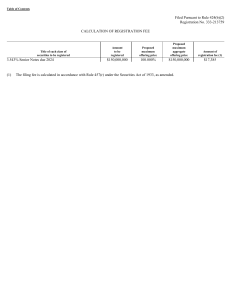

MICROSOFT CORP (Form: 424B2, Received: 01/31/2017 16:20:44)

... In deploying technology that advances business strategy, enterprises decide what solutions will make employees more productive, collaborative, and satisfied, and connect with customers in new and compelling ways . They work to unlock business insights from a world of data . To achieve these objectiv ...

... In deploying technology that advances business strategy, enterprises decide what solutions will make employees more productive, collaborative, and satisfied, and connect with customers in new and compelling ways . They work to unlock business insights from a world of data . To achieve these objectiv ...

Inflation and the Housing Market

... residence (totally exempt if reinvested in another residence and taxed at the capital gain rate otherwise), inflation should actually lower the real cost of home ownership. The Level of Inflation and the Ability of Households to Purchase Housing. Even though inflation does not increase the sum of di ...

... residence (totally exempt if reinvested in another residence and taxed at the capital gain rate otherwise), inflation should actually lower the real cost of home ownership. The Level of Inflation and the Ability of Households to Purchase Housing. Even though inflation does not increase the sum of di ...

Mortgage Choices and Housing Speculation

... If credit markets play a role in allowing for speculative bubbles, then credit market data may be relevant for predicting the occurrence of such episodes. For example, if borrowers bid up house prices above their underlying value because they can default if prices collapse, boom-bust cycles might be ...

... If credit markets play a role in allowing for speculative bubbles, then credit market data may be relevant for predicting the occurrence of such episodes. For example, if borrowers bid up house prices above their underlying value because they can default if prices collapse, boom-bust cycles might be ...

Forced Savings in the Soviet Republics: Re

... result of shortages in the Soviet Union only by referring to these gaps between two economic systems although the hyperinflation after the transition reform indirectly suggests the existence of unsatisfied and unrealized consumer effective demand. The reason is that neither voluntary nor involuntar ...

... result of shortages in the Soviet Union only by referring to these gaps between two economic systems although the hyperinflation after the transition reform indirectly suggests the existence of unsatisfied and unrealized consumer effective demand. The reason is that neither voluntary nor involuntar ...

The Role of Interest Rate Swaps in Corporate

... market are yet to be fully understood, financial economists have proposed a number of different hypotheses to explain how and why firms use interest rate swaps. The early explanation, popular among market participants, was that interest rate swaps lowered financing costs by making it possible for fi ...

... market are yet to be fully understood, financial economists have proposed a number of different hypotheses to explain how and why firms use interest rate swaps. The early explanation, popular among market participants, was that interest rate swaps lowered financing costs by making it possible for fi ...

discount rates

... the United States was 2.27%, a historic low. Assume that you were valuing a company in US dollars then, but were wary about the risk free rate being too low. Which of the following should you do? a. ...

... the United States was 2.27%, a historic low. Assume that you were valuing a company in US dollars then, but were wary about the risk free rate being too low. Which of the following should you do? a. ...

Margin Credit and Stock Return Predictability

... debt capacity margin credit (details in Section 2). Over our sample period of 31 years from 1984 to 2014, we find that a higher margin credit predicts lower future market returns. We compare margin credit with other popular predictors and find that margin credit is the strongest predictor to date of ...

... debt capacity margin credit (details in Section 2). Over our sample period of 31 years from 1984 to 2014, we find that a higher margin credit predicts lower future market returns. We compare margin credit with other popular predictors and find that margin credit is the strongest predictor to date of ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.