Governor. Universidad de Granada (341 KB )

... I should first like to highlight the crucial importance of banks in resource allocation and their role of intermediation between those supplying and demanding financing. Mass access to owner-occupied housing would be almost inconceivable without their intermediation. Mortgage lending is a very impor ...

... I should first like to highlight the crucial importance of banks in resource allocation and their role of intermediation between those supplying and demanding financing. Mass access to owner-occupied housing would be almost inconceivable without their intermediation. Mortgage lending is a very impor ...

Comments on Lifecycle Impacts of the Financial and Economic

... Comments on Lifecycle Impacts of the Financial and Economic Crisis on Household Optimal Consumption, Portfolio Choice and Labor Supply by Chai, Maurer, Mitchell, Rogalia ...

... Comments on Lifecycle Impacts of the Financial and Economic Crisis on Household Optimal Consumption, Portfolio Choice and Labor Supply by Chai, Maurer, Mitchell, Rogalia ...

Systemic indicators

... Real economy: GDP, government fiscal position, inflation Corporate sector: debt to equity, earnings (to interest and ...

... Real economy: GDP, government fiscal position, inflation Corporate sector: debt to equity, earnings (to interest and ...

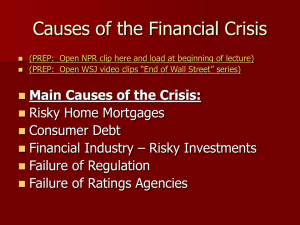

Understanding the Financial Crisis: Origin and Impact

... The credit crisis is a direct outgrowth of the fall in housing prices that began in 2006. While many channels exist by which the housing prices enter the financial sector, the core connection is straightforward. Every bank or other financial entity in the United States is required to have capital as ...

... The credit crisis is a direct outgrowth of the fall in housing prices that began in 2006. While many channels exist by which the housing prices enter the financial sector, the core connection is straightforward. Every bank or other financial entity in the United States is required to have capital as ...

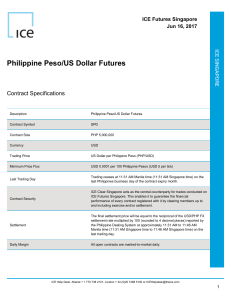

Philippine Peso/US Dollar Futures

... last Philippines business day of the contract expiry month. ...

... last Philippines business day of the contract expiry month. ...

BANK OF ISRAEL Office of the Spokesperson and Economic

... particularly with respect to investments abroad which have grown from 8% to 19% of their assets between 2005 and 2015. However, they have so far not taken much part in the retail credit market, either in mortgages or in consumer credit. The truth is that it is not typical for large asset managers in ...

... particularly with respect to investments abroad which have grown from 8% to 19% of their assets between 2005 and 2015. However, they have so far not taken much part in the retail credit market, either in mortgages or in consumer credit. The truth is that it is not typical for large asset managers in ...

LESSONS FROM THE HOUSING CRISIS BOG_Karakitsos

... • Issuance of US Treasuries: $2.5 trillion in 2009 • Rising long term interest rates • Printing of money: Inflation when economy recovers. Dollar depreciation. ...

... • Issuance of US Treasuries: $2.5 trillion in 2009 • Rising long term interest rates • Printing of money: Inflation when economy recovers. Dollar depreciation. ...

Data and a lack thereof

... Reserve Bank fit in and why focus on Credit data Esti van Wyk de Vries SAFARI into the Credit Industry 16 February 2017 ...

... Reserve Bank fit in and why focus on Credit data Esti van Wyk de Vries SAFARI into the Credit Industry 16 February 2017 ...

National Finances and MNCs

... Made up of foreign direct investment: ownership of tangible property, such as real estate, corporations or manufacturing facilities, and indirect portfolio investment: holding of stocks, bonds or the making of loans. Thus, net capital flows can be made up in various ways, depending on the balance of ...

... Made up of foreign direct investment: ownership of tangible property, such as real estate, corporations or manufacturing facilities, and indirect portfolio investment: holding of stocks, bonds or the making of loans. Thus, net capital flows can be made up in various ways, depending on the balance of ...

Notice to shareholders of Mr Price Group Limited Shareholders are

... Notice to shareholders of Mr Price Group Limited Shareholders are hereby given notice, in terms of section 45(5) of the Companies Act, Act No 71 of 2008 (“the Act”), that the Board has approved appropriate financial assistance levels to wholly owned local and international subsidiaries, in the ordin ...

... Notice to shareholders of Mr Price Group Limited Shareholders are hereby given notice, in terms of section 45(5) of the Companies Act, Act No 71 of 2008 (“the Act”), that the Board has approved appropriate financial assistance levels to wholly owned local and international subsidiaries, in the ordin ...

M&B-Ch.1

... Everything else constant, a stronger dinar will mean that vacationing in England becomes less expensive. And the country’s goods exported abroad will cost more in foreign countries, and so foreigners will buy fewer of them. Everything else held constant, a stronger dollar benefits the country’s con ...

... Everything else constant, a stronger dinar will mean that vacationing in England becomes less expensive. And the country’s goods exported abroad will cost more in foreign countries, and so foreigners will buy fewer of them. Everything else held constant, a stronger dollar benefits the country’s con ...

Quarterly Annual Investor Review Superannuation 30 June 2012

... economic issues will keep being put off and central bankers will keep taking extraordinary measures to keep up the appearance of economic and financial health. However, the risk of another sharp downturn in global activity and more instability is higher than usual. The potential concerns aren’t just ...

... economic issues will keep being put off and central bankers will keep taking extraordinary measures to keep up the appearance of economic and financial health. However, the risk of another sharp downturn in global activity and more instability is higher than usual. The potential concerns aren’t just ...

New Financial Intermediaries: Private Equity and the Corporation

... Assets as collateral High free cash flow to repay debt Debt disciplines managers; requires shareholder focus LBO movement ended in scandal, replaced in 1990s by PE ...

... Assets as collateral High free cash flow to repay debt Debt disciplines managers; requires shareholder focus LBO movement ended in scandal, replaced in 1990s by PE ...

Paulson`s plan was not a true solution to the crisis

... Given the recent explosion in leverage, the challenge is unlikely to be one of mispricing of the toxic mortgage-backed securities alone. Many people and institutions made leveraged bets that have since gone sour. Their debt cannot be repaid. Creditors are responding accordingly. Now turn to the cri ...

... Given the recent explosion in leverage, the challenge is unlikely to be one of mispricing of the toxic mortgage-backed securities alone. Many people and institutions made leveraged bets that have since gone sour. Their debt cannot be repaid. Creditors are responding accordingly. Now turn to the cri ...

march market commentary

... economies. Moderating growth in the developing world means current inflationary pressures should abate. Central banks are primed to make further substantial reductions in interest rates if needed and this will help banks and consumers. Housing will continue to be a drag on activity overall but the e ...

... economies. Moderating growth in the developing world means current inflationary pressures should abate. Central banks are primed to make further substantial reductions in interest rates if needed and this will help banks and consumers. Housing will continue to be a drag on activity overall but the e ...

Regulation of credit and maximum rates: an analysis of their effects

... Since the promulgation of Financial System Law No. 393, the social function was introduced into the activity of Bolivian financial intermediation. In this direction, the regulation established maximum limits for the active interest rates and minimum levels of portfolio destined to sectors considered ...

... Since the promulgation of Financial System Law No. 393, the social function was introduced into the activity of Bolivian financial intermediation. In this direction, the regulation established maximum limits for the active interest rates and minimum levels of portfolio destined to sectors considered ...

Working America, Financial Markets and the power of

... • Riskier investments must offer a higher expected return in order to attract capital. • You are rewarded financially for investing your money in more risky propositions -- on average… • It’s the “on average” part that is the complicating factor. Bad things can happen financially, in addition to all ...

... • Riskier investments must offer a higher expected return in order to attract capital. • You are rewarded financially for investing your money in more risky propositions -- on average… • It’s the “on average” part that is the complicating factor. Bad things can happen financially, in addition to all ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.