Answer Key - Department Of Economics

... a. relative to prices wages are higher and employment rise. b. relative to prices wages are higher and employment falls. c. relative to prices wages are lower and employment rises. d. relative to prices wages are lower and employment falls. ANSWER: ...

... a. relative to prices wages are higher and employment rise. b. relative to prices wages are higher and employment falls. c. relative to prices wages are lower and employment rises. d. relative to prices wages are lower and employment falls. ANSWER: ...

Solutions to Assignment 2

... and, therefore, income by ∆G. This increase in income causes consumption to rise by MPC × ∆G, where MPC is the marginal propensity to consume. This increase in consumption raises expenditure and income even further. This feedback from consumption to income continues indefinitely. Therefore, in the K ...

... and, therefore, income by ∆G. This increase in income causes consumption to rise by MPC × ∆G, where MPC is the marginal propensity to consume. This increase in consumption raises expenditure and income even further. This feedback from consumption to income continues indefinitely. Therefore, in the K ...

105-notes inflation-stagflation-phillipscurve

... events because they are based on expected economic conditions and government policy, not past inflation rates. A strong version of forward-looking expectation is called ...

... events because they are based on expected economic conditions and government policy, not past inflation rates. A strong version of forward-looking expectation is called ...

QUIZ 2: Macro – Winter 2002 - The University of Chicago Booth

... developed in class to answer the questions (like we did in the middle of class last week). Focus your analysis on the short run (such that nominal wages are fixed and the labor market is allowed to be in disequilibrium). Again, assume prices are fixed (and all other quiz assumptions hold). All answe ...

... developed in class to answer the questions (like we did in the middle of class last week). Focus your analysis on the short run (such that nominal wages are fixed and the labor market is allowed to be in disequilibrium). Again, assume prices are fixed (and all other quiz assumptions hold). All answe ...

Money and Inflation in Colonial Massachusetts

... with a problem of long-term inflation and currency depreciation. The methods used to attack these problems were also used, with some variation, in other countries and time periods to successfully end extremely severe inflationary episodes. This alone would render the monetary system of colonial Mass ...

... with a problem of long-term inflation and currency depreciation. The methods used to attack these problems were also used, with some variation, in other countries and time periods to successfully end extremely severe inflationary episodes. This alone would render the monetary system of colonial Mass ...

The Theory of Relative-Price Changes, Money, and Demand Factors

... pure deflation was the norm after 1999 until late 2007, except for a few hikes above zero. Although the rate then became positive through 2008, more recently it has again turned negative. Such a long period of disinflation/deflation, lasting almost 20 years, is a rarity in history.1 It is no surpris ...

... pure deflation was the norm after 1999 until late 2007, except for a few hikes above zero. Although the rate then became positive through 2008, more recently it has again turned negative. Such a long period of disinflation/deflation, lasting almost 20 years, is a rarity in history.1 It is no surpris ...

Textbooks and Pure Fiscal Policy: The Neglect of Monetary Basics

... reallocation of resources from the production of goods and services for the private sector—especially investment—to production for the government. The reduction of private investment is achieved… by a rise in the interest rate as the increased government borrowing drives down the price of bonds… The ...

... reallocation of resources from the production of goods and services for the private sector—especially investment—to production for the government. The reduction of private investment is achieved… by a rise in the interest rate as the increased government borrowing drives down the price of bonds… The ...

Chapter 16 Money in macroeconomics

... through the gold standard. And under the Bretton-Woods agreement, 194771, the currencies of the developed Western countries outside the United States were convertible into US dollars at a fixed exchange rate (or rather an exchange rate which is adjustable only under specific circumstances); and US d ...

... through the gold standard. And under the Bretton-Woods agreement, 194771, the currencies of the developed Western countries outside the United States were convertible into US dollars at a fixed exchange rate (or rather an exchange rate which is adjustable only under specific circumstances); and US d ...

Wicksell after Woodford

... and contract nominal aggregate demand without limits (Wicksell 1898 [1936: 62-69], 1915 [1935: 79-87]). In the other version, the fictitious centralization of credit helped to simplify the analysis of monetary policy and cumulative price changes. Wicksell’s (1898 [1936]) originally presented his pur ...

... and contract nominal aggregate demand without limits (Wicksell 1898 [1936: 62-69], 1915 [1935: 79-87]). In the other version, the fictitious centralization of credit helped to simplify the analysis of monetary policy and cumulative price changes. Wicksell’s (1898 [1936]) originally presented his pur ...

AP Macro Economics 2005 Section I MACROECONOMICS Section I

... D. high levels of unemployment use up tax collections E. interest payments on the national debt increase from one year to the next 6 Under which of the fo11owing conditions would consumer spending most likely increase? A. Consumers have large unpaid balances on their credit cards. B. Consumers’ weal ...

... D. high levels of unemployment use up tax collections E. interest payments on the national debt increase from one year to the next 6 Under which of the fo11owing conditions would consumer spending most likely increase? A. Consumers have large unpaid balances on their credit cards. B. Consumers’ weal ...

Mankiw SM Chap10 correct size:chap10.qxd.qxd

... 100. This is what we expect to find, because the formula for the government-purchases multiplier is 1/(1 – MPC), the MPC is 0.75, and the government-purchases multiplier therefore has a numerical value of 4. An income level of 1,600 represents an increase of 300 over the original level of income. Th ...

... 100. This is what we expect to find, because the formula for the government-purchases multiplier is 1/(1 – MPC), the MPC is 0.75, and the government-purchases multiplier therefore has a numerical value of 4. An income level of 1,600 represents an increase of 300 over the original level of income. Th ...

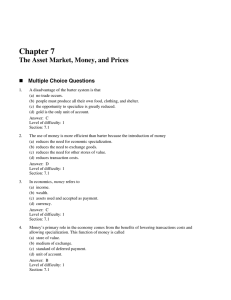

Chapter 7 The Asset Market, Money, and Prices

... Answer: Currency demand is large mostly because foreigners hold many dollars. They do so because of inflation or political instability in their countries. Policymakers shouldn’t be very concerned, since foreigners’ dollar holdings represent an interest-free loan to the United States. However, a caus ...

... Answer: Currency demand is large mostly because foreigners hold many dollars. They do so because of inflation or political instability in their countries. Policymakers shouldn’t be very concerned, since foreigners’ dollar holdings represent an interest-free loan to the United States. However, a caus ...

Money and the Payments System

... • Electronic funds transfer systems have greatly improved the efficiency in settling and clearing transactions. Here is how: • Cash registers are linked to bank computers, so when a customer uses a debit card, his bank instantly credits the store’s account. In this way, debit cards eliminate the pro ...

... • Electronic funds transfer systems have greatly improved the efficiency in settling and clearing transactions. Here is how: • Cash registers are linked to bank computers, so when a customer uses a debit card, his bank instantly credits the store’s account. In this way, debit cards eliminate the pro ...

Aggregate Demand/Aggregate Supply

... model and activist policy prescriptions...and use of demand management tools during the post-WWII “Golden Age.” Alternative schools of thought use models that differ significantly from the standard aggregate demand and aggregate supply model. We can briefly consider each of three major alternative m ...

... model and activist policy prescriptions...and use of demand management tools during the post-WWII “Golden Age.” Alternative schools of thought use models that differ significantly from the standard aggregate demand and aggregate supply model. We can briefly consider each of three major alternative m ...

Document

... • According to Keynes, what will a shift in aggregate demand do? • What is the Classical view of the aggregate supply curve? • According to the Classical economists, where does the economy normally operate? • What factors can cause a shift in the aggregate supply curve? • What are the two types of i ...

... • According to Keynes, what will a shift in aggregate demand do? • What is the Classical view of the aggregate supply curve? • According to the Classical economists, where does the economy normally operate? • What factors can cause a shift in the aggregate supply curve? • What are the two types of i ...

MONEY MARKET EQUILIBRIUM IN THE CZECH REPUBLIC

... market in the Czech Republic (CR), which is determined, on the one hand, by the money supply and, on the other hand, by the money demand. In terms of further development of the CR and its sustainable economic growth the examination of the balance in the domestic money market is relevant particularly ...

... market in the Czech Republic (CR), which is determined, on the one hand, by the money supply and, on the other hand, by the money demand. In terms of further development of the CR and its sustainable economic growth the examination of the balance in the domestic money market is relevant particularly ...

Document

... So money demand doesn't vary much, no matter how well or poorly an economy is doing, but nominal money supply growth differs across countries by hundreds of percentage points, so large inflation differences must be due to money supply, not money demand Copyright © 2005 Pearson Addison-Wesley. All ...

... So money demand doesn't vary much, no matter how well or poorly an economy is doing, but nominal money supply growth differs across countries by hundreds of percentage points, so large inflation differences must be due to money supply, not money demand Copyright © 2005 Pearson Addison-Wesley. All ...

MACROECONOMICS Section I

... (B) Consumers' wealth is increased by changes in the stock market. (e) The government encourages consumers to increase their savings. (D) Social security taxes are increased. (E) Consumers believe they will not receive pay increases next year. 7. Crowding out is best described as which of the follow ...

... (B) Consumers' wealth is increased by changes in the stock market. (e) The government encourages consumers to increase their savings. (D) Social security taxes are increased. (E) Consumers believe they will not receive pay increases next year. 7. Crowding out is best described as which of the follow ...

Liquidity Traps and the Stability of Money Demand: Is Japan Really

... output or prices with near zero nominal interest rates. This broad definition seems to fit Japan well. In fact, the call rate, a primary indicator of monetary policy in Japan, was lowered to 1 basis point (0.01 percent) in 1999 by the zero interest rate policy and further down to 0.1 basis point by ...

... output or prices with near zero nominal interest rates. This broad definition seems to fit Japan well. In fact, the call rate, a primary indicator of monetary policy in Japan, was lowered to 1 basis point (0.01 percent) in 1999 by the zero interest rate policy and further down to 0.1 basis point by ...