1. The World of Business:

... • Address four basic economic questions: – Which & how many goods & services will be produced? – How will they be produced? – For whom will they be produced? – Who owns & controls the factors of production? ...

... • Address four basic economic questions: – Which & how many goods & services will be produced? – How will they be produced? – For whom will they be produced? – Who owns & controls the factors of production? ...

Free Enterprise System

... Substitutes are goods that are related in such a way that in increase in the price of one good leads to an increase in demand for the other good Complements are goods that are related in such a way that an increase in the price of one leads to a decrease in the demand for the other ...

... Substitutes are goods that are related in such a way that in increase in the price of one good leads to an increase in demand for the other good Complements are goods that are related in such a way that an increase in the price of one leads to a decrease in the demand for the other ...

Real GDP and price indexes Practice problems Problem: Suppose

... production was 8 units at a price of $10 each. The next year, production increased to 9 units and the price of the good increased to $12. a. b. c. ...

... production was 8 units at a price of $10 each. The next year, production increased to 9 units and the price of the good increased to $12. a. b. c. ...

Market Commentary December 2014

... China’s slowdown is more worrisome, as they have provided an important ...

... China’s slowdown is more worrisome, as they have provided an important ...

Aggregate Supply

... b. Production Capacity: The max value of goods an economy is capable of producing given the available resources c. Full Capacity: Max value of Real GDP representing the most production possible in the economy. i. Max level of Real GDP is max level of production; ii. Because AS is measured as a level ...

... b. Production Capacity: The max value of goods an economy is capable of producing given the available resources c. Full Capacity: Max value of Real GDP representing the most production possible in the economy. i. Max level of Real GDP is max level of production; ii. Because AS is measured as a level ...

Chapter 10

... • Changes in demand for goods and services (C, I, G) only affect prices (r), not output. • Assumes complete flexibility of overall price level (P). • Applies to the long run. ...

... • Changes in demand for goods and services (C, I, G) only affect prices (r), not output. • Assumes complete flexibility of overall price level (P). • Applies to the long run. ...

OCM 2012 Spring Folio - Q4 Wealth Management

... Unlike the stagflation years of the late 1970s, today we have an underutilized work force (unemployment in Eurozone at 10.2%, the US at 8.3%, and 7.5% in Canada), no real cost controls (artificially keeping prices low and demand high) and an economy still in the early stages of recovery. While oil p ...

... Unlike the stagflation years of the late 1970s, today we have an underutilized work force (unemployment in Eurozone at 10.2%, the US at 8.3%, and 7.5% in Canada), no real cost controls (artificially keeping prices low and demand high) and an economy still in the early stages of recovery. While oil p ...

COMMENT ON CHAPTER 6 (USE TABLE)

... the inputs and outputs, provides the most reliable possible estimate of GDP at current or constant prices and recommends that statisticians use them in estimating GDP ...

... the inputs and outputs, provides the most reliable possible estimate of GDP at current or constant prices and recommends that statisticians use them in estimating GDP ...

Textbook Chapter 4 (pages 43-53)

... Gross Domestic Product – the total dollar VALUE of all G&S PRODUCED (may be sitting in a warehouse) by a country in one year. It does not accurately measure the welfare or well-being of a population. REAL GDP – GDP adjusted for INFLATION What is INFLATION? – Occurs when people are spending money & a ...

... Gross Domestic Product – the total dollar VALUE of all G&S PRODUCED (may be sitting in a warehouse) by a country in one year. It does not accurately measure the welfare or well-being of a population. REAL GDP – GDP adjusted for INFLATION What is INFLATION? – Occurs when people are spending money & a ...

price decrease letter

... decline. Propylene has dropped, which is the driver on the DINP alcohol and similarly ethylene has dropped, which is the major component driving 2-EH the DOP alcohol. Oil is also driving the current price decrease along with a slow economy. The EU economy is extremely slow and therefore affecting gl ...

... decline. Propylene has dropped, which is the driver on the DINP alcohol and similarly ethylene has dropped, which is the major component driving 2-EH the DOP alcohol. Oil is also driving the current price decrease along with a slow economy. The EU economy is extremely slow and therefore affecting gl ...

Short-run Causes: Demand-pull and Cost-push

... agreements, such as Social Security payments and cost-of-living adjustments, automatically increase wages. Also, in an inflationary economy, people tend to spend today, and this spending also perpetuates demand-pull. ...

... agreements, such as Social Security payments and cost-of-living adjustments, automatically increase wages. Also, in an inflationary economy, people tend to spend today, and this spending also perpetuates demand-pull. ...

deflating price series in regression models

... Inherent in the nature of the scientific method is that today 's sophisticated and obscure technology becomes commonplace tomorrow. This maxim also holds true in the agricultural economics literature. Sophisticated techniques are developed and experimented with by econometricians. There is then, how ...

... Inherent in the nature of the scientific method is that today 's sophisticated and obscure technology becomes commonplace tomorrow. This maxim also holds true in the agricultural economics literature. Sophisticated techniques are developed and experimented with by econometricians. There is then, how ...

Commodity price increases: causes, effects and policy responses

... • Oil price near record levels in nominal and real terms, in dollar terms and in other currencies. • Some fall back in oil prices recently, but above historical average past 30 years. • Current levels are consistent with a longer term trend observed since the start of the decade. • Prices for other ...

... • Oil price near record levels in nominal and real terms, in dollar terms and in other currencies. • Some fall back in oil prices recently, but above historical average past 30 years. • Current levels are consistent with a longer term trend observed since the start of the decade. • Prices for other ...

market signals

... Pricing: Oil vs. Natural Gas •A barrel of oil usually sells at about 8 times an mcf of natural gas. That ratio is now 20 times. Either oil prices are too high or natural gas prices are too low. •The past weakness in energy prices is causing a big decrease in drilling plans and lays the groundwork f ...

... Pricing: Oil vs. Natural Gas •A barrel of oil usually sells at about 8 times an mcf of natural gas. That ratio is now 20 times. Either oil prices are too high or natural gas prices are too low. •The past weakness in energy prices is causing a big decrease in drilling plans and lays the groundwork f ...

Chapter25

... a) Beginning in a long-run equilibrium with Y=Y*, suppose there is an increase in households’ desired saving (which is equivalent to a decrease in desired consumption). The AD curve shifts to the left, reducing both real GDP and the price level. The short-run effect of the increase in desired saving ...

... a) Beginning in a long-run equilibrium with Y=Y*, suppose there is an increase in households’ desired saving (which is equivalent to a decrease in desired consumption). The AD curve shifts to the left, reducing both real GDP and the price level. The short-run effect of the increase in desired saving ...

Intro to Economics

... prices increase do to increase in input costs (i.e. oil prices rise) Real inflation – occurs when the government or banks issue more money. ...

... prices increase do to increase in input costs (i.e. oil prices rise) Real inflation – occurs when the government or banks issue more money. ...

Table 1 Timeline of major economic events - PRICES

... Export price for wool falls by 30%; contraction phase/recession ...

... Export price for wool falls by 30%; contraction phase/recession ...

Mankiw 5/e Chapter 5: The Open Economy

... A price reduction by one firm causes the overall price level to fall (albeit slightly). This raises real money balances and increases aggregate demand, which benefits other firms. ...

... A price reduction by one firm causes the overall price level to fall (albeit slightly). This raises real money balances and increases aggregate demand, which benefits other firms. ...

CGEP_The impact of lower oil prices on the Mexican economy

... For 2015 the government has partially hedged its oil revenues. The hedging program, possibly the largest in the world, has two components: 1) a combination of Maya and Brent put options at an average strike price of $76.40 per barrel for the Mexican export mix, with a cost of $773 million; and 2) an ...

... For 2015 the government has partially hedged its oil revenues. The hedging program, possibly the largest in the world, has two components: 1) a combination of Maya and Brent put options at an average strike price of $76.40 per barrel for the Mexican export mix, with a cost of $773 million; and 2) an ...

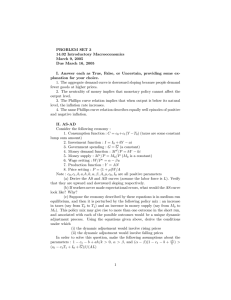

PROBLEM SET 3 14.02 Introductory Macroeconomics March 9, 2005 Due March 16, 2005

... PROBLEM SET 3 14.02 Introductory Macroeconomics March 9, 2005 Due March 16, 2005 I. Answer each as True, False, or Uncertain, providing some explanation for your choice. 1. The aggregate demand curve is downward sloping because people demand fewer goods at higher prices. 2. The neutrality of money i ...

... PROBLEM SET 3 14.02 Introductory Macroeconomics March 9, 2005 Due March 16, 2005 I. Answer each as True, False, or Uncertain, providing some explanation for your choice. 1. The aggregate demand curve is downward sloping because people demand fewer goods at higher prices. 2. The neutrality of money i ...

Homework 4

... Using aggregate demand, short-run aggregate supply and long-run aggregate supply curves, explain the process by which each of the following economic events will move the economy from one long-run macroeconomic equilibrium to another. Illustrate with diagrams. In each case, what are the short-run and ...

... Using aggregate demand, short-run aggregate supply and long-run aggregate supply curves, explain the process by which each of the following economic events will move the economy from one long-run macroeconomic equilibrium to another. Illustrate with diagrams. In each case, what are the short-run and ...

Title (Ask Karin for agenda)

... because of increased vehicle miles traveled, especially in the 2020-2030 period. • Tax credits are a very expensive option costing the government between $22-$37 billion per year. • Even with the high priced scenario plus the gasoline tax, losses in GDP relative to the reference case are less than 1 ...

... because of increased vehicle miles traveled, especially in the 2020-2030 period. • Tax credits are a very expensive option costing the government between $22-$37 billion per year. • Even with the high priced scenario plus the gasoline tax, losses in GDP relative to the reference case are less than 1 ...

Macro Final Topic Review

... Revenue Tariff - designed to raise revenue Protective Tariff – designed to protect domestic market Quotas- limit # of goods imported ...

... Revenue Tariff - designed to raise revenue Protective Tariff – designed to protect domestic market Quotas- limit # of goods imported ...

2000s commodities boom

The 2000s commodities boom or the commodities super cycle was the rise in many physical commodity prices (such as those of food stuffs, oil, metals, chemicals, fuels and the like) which occurred during the decade of the 2000s (2000–2009), following the Great Commodities Depression of the 1980s and 1990s. The boom was largely due to the rising demand from emerging markets such as the BRIC countries, as well as the result of concerns over long-term supply availability. There was a sharp down-turn in prices during 2008 and early 2009 as a result of the credit crunch and sovereign debt crisis, but prices began to rise as demand recovered from late 2009 to mid-2010. Oil began to slip downwards after mid-2010, but peaked at $101.80 on 30 and 31 January 2011, as then Egyptian political crisis and rioting broke out, leading to concerns over both the safe use of the Suez Canal and over all security in Arabia itself. On 3 March, Libya's National Oil Corp said that output had halved due to the departure of foreign workers. As this happened, Brent Crude surged to a new high of above $116.00 a barrel as supply disruptions and potential for more unrest in the Middle East and North Africa continued to worry investors. Thus the price of oil kept rising into the 2010s. The commodities super-cycle peaked in 2011, ""driven by a combination of strong demand from emerging nations and low supply growth."" Prior to 2002, only 5 to 10 per cent of trading in the commodities market was attributable to investors. Since 2002 ""30 per cent of trading is attributable to investors in the commodities market"" which ""has caused higher price volatility.""