THE IMPACT OF OIL PRICE ON BANK PROFITABILITY IN CANADA

... There are many previous studies examined how the oil price movement affect the economic activities. Yoshizaki & Hamori (2013) extend Kilian’s (2009) method, which studies the effect of oil price shocks on the GDP and CPI of the United States, to investigates the effect of oil price shocks on the exc ...

... There are many previous studies examined how the oil price movement affect the economic activities. Yoshizaki & Hamori (2013) extend Kilian’s (2009) method, which studies the effect of oil price shocks on the GDP and CPI of the United States, to investigates the effect of oil price shocks on the exc ...

Why are Central Banks Delegated Macroprudential Responsibilities?

... Next to addressing adverse political economy problems and the opportunities for corruption that bedevil MPR policy, the complexity of macroprudential policy is a further reason that justifies its delegation to an ‘expert’ central banks. A systemic approach to financial stability entails understandin ...

... Next to addressing adverse political economy problems and the opportunities for corruption that bedevil MPR policy, the complexity of macroprudential policy is a further reason that justifies its delegation to an ‘expert’ central banks. A systemic approach to financial stability entails understandin ...

The role of the central bank balance sheet in monetary policy

... the last few years, albeit at different speeds, as economic conditions necessitated increasingly tight control over the balance sheet in order to effectively steer the monetary policy stance. 2.3 From passive to active central bank balance sheet policies: credit easing In certain cases, providing li ...

... the last few years, albeit at different speeds, as economic conditions necessitated increasingly tight control over the balance sheet in order to effectively steer the monetary policy stance. 2.3 From passive to active central bank balance sheet policies: credit easing In certain cases, providing li ...

The role of the Riksbank in Swedish society (Central Bank Articles

... In my speech today I would like to concentrate on the role of the Riksbank in Swedish society. I am going to begin by trying to clarify the sometimes exaggerated idea about the meaning of the Riksbank having an independent position in relation to our democratically elected representatives. Later in ...

... In my speech today I would like to concentrate on the role of the Riksbank in Swedish society. I am going to begin by trying to clarify the sometimes exaggerated idea about the meaning of the Riksbank having an independent position in relation to our democratically elected representatives. Later in ...

Resolving Large Financial Intermediaries: Banks Versus

... implied guarantee in the sense that they are perceived to be “too-big-to-fail”. As a result, it is logical to consider how best to deal with a potential failure of either Fannie Mae or Freddie Mac by comparing the structure Congress established to deal with the insolvency of commercial banks, especi ...

... implied guarantee in the sense that they are perceived to be “too-big-to-fail”. As a result, it is logical to consider how best to deal with a potential failure of either Fannie Mae or Freddie Mac by comparing the structure Congress established to deal with the insolvency of commercial banks, especi ...

ANALYSIS OF FINANCIAL HEALTH OF BANKING INDUSTRY

... India. (Joint Stock Bank: A company that issues stock and requires shareholders to be held liable for the company's debt) It was not the first though. That honor belongs to the Bank of Upper India, which was established in 1863, and which survived until 1913, when it failed, with some of its assets ...

... India. (Joint Stock Bank: A company that issues stock and requires shareholders to be held liable for the company's debt) It was not the first though. That honor belongs to the Bank of Upper India, which was established in 1863, and which survived until 1913, when it failed, with some of its assets ...

The Agencies and `One Bank`

... intelligence. Agents undertake some 5,500 company visits a year across a range of sectors, broadly in line with those sectors’ contributions to UK economic output (Chart 1). These visits are supplemented by panel discussions with some 3,500 businesses. The Agents’ meetings take place across all regi ...

... intelligence. Agents undertake some 5,500 company visits a year across a range of sectors, broadly in line with those sectors’ contributions to UK economic output (Chart 1). These visits are supplemented by panel discussions with some 3,500 businesses. The Agents’ meetings take place across all regi ...

Bank bias in Europe - European Central Bank

... therefore become strongly bank-based – far more so than in other advanced economies. Being highly leveraged, banks respond disproportionately to changes in collateral values: balance sheets expand when asset prices rise, and contract when prices drop. This amplification mechanism underpins two predi ...

... therefore become strongly bank-based – far more so than in other advanced economies. Being highly leveraged, banks respond disproportionately to changes in collateral values: balance sheets expand when asset prices rise, and contract when prices drop. This amplification mechanism underpins two predi ...

Too Big To Fail Or To Save? Evidence from the

... analyze how the importance changed over the financial crisis. For that purpose, we divide our sample into three sub-periods. The first period starts in 2005 and ends in July 2007, just before the beginning of the financial crisis. The second period comprises the first crisis phase until August 2008. ...

... analyze how the importance changed over the financial crisis. For that purpose, we divide our sample into three sub-periods. The first period starts in 2005 and ends in July 2007, just before the beginning of the financial crisis. The second period comprises the first crisis phase until August 2008. ...

27 | Money and Banking

... use. You must go to the bank or ATM machine and withdraw that cash to buy your lunch. Thus, $10 in your savings account is less liquid. The Federal Reserve Bank, which is the central bank of the United States, is a bank regulator and is responsible for monetary policy and defines money according to ...

... use. You must go to the bank or ATM machine and withdraw that cash to buy your lunch. Thus, $10 in your savings account is less liquid. The Federal Reserve Bank, which is the central bank of the United States, is a bank regulator and is responsible for monetary policy and defines money according to ...

Relationship and Transaction Lending in a Crisis

... modi…cation of the Bolton and Freixas (2006) model is to introduce aggregate business-cycle risk, to allow …rms to di¤er in their exposure to this risk, and to consider how the response of R banks to a crisis di¤ers from that of T banks. The main predictions emerging from the theoretical analysis a ...

... modi…cation of the Bolton and Freixas (2006) model is to introduce aggregate business-cycle risk, to allow …rms to di¤er in their exposure to this risk, and to consider how the response of R banks to a crisis di¤ers from that of T banks. The main predictions emerging from the theoretical analysis a ...

financialIntermediation_KiyotakiPaper

... In this paper we develop a macroeconomic model with an intermediation sector that allow banks to issue outside equity as well as short term debt. This makes bank risk exposure an endogenous choice. Here the goal is to have a model that can not only capture a crisis when …nancial institutions are hig ...

... In this paper we develop a macroeconomic model with an intermediation sector that allow banks to issue outside equity as well as short term debt. This makes bank risk exposure an endogenous choice. Here the goal is to have a model that can not only capture a crisis when …nancial institutions are hig ...

p75AssExam results - Association of Corporate Treasurers

... Results were comparable to previous diets, although Treasury Management was particularly good. Students found VlllB more difficult than VlllA. They had difficulty in valuing debt, and in other questions, offering advice to the founders of an internet start-up and the financing plan for an acquisitio ...

... Results were comparable to previous diets, although Treasury Management was particularly good. Students found VlllB more difficult than VlllA. They had difficulty in valuing debt, and in other questions, offering advice to the founders of an internet start-up and the financing plan for an acquisitio ...

Limited Commitment and Central Bank Lending

... safety net supporting the stability of the banking system and financial markets. An independent central bank can provide liquidity to financial institutions on very short notice.1 Indeed, central bank lending has been a prominent part of regulatory assistance to troubled financial institutions in re ...

... safety net supporting the stability of the banking system and financial markets. An independent central bank can provide liquidity to financial institutions on very short notice.1 Indeed, central bank lending has been a prominent part of regulatory assistance to troubled financial institutions in re ...

The Framework for the Bank of England`s Operations in the Sterling

... maintenance period, a bank can vary its reserves holdings from day to day. Those holdings are remunerated at Bank Rate so long as they are, on average over the maintenance period, within a small range around the target. 16 Average reserves outside the target range attract a charge. But a bank can av ...

... maintenance period, a bank can vary its reserves holdings from day to day. Those holdings are remunerated at Bank Rate so long as they are, on average over the maintenance period, within a small range around the target. 16 Average reserves outside the target range attract a charge. But a bank can av ...

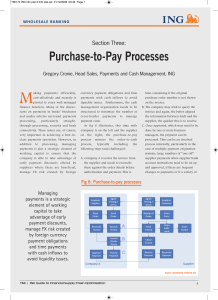

Purchase-to-Pay Processes

... at one of Europe’s largest pension schemes The company had been maintaining a large number of interfaces between proprietary systems at a cost of €30-€40,000 per year. As well as the issue of cost, the firm wanted to achieve greater bank independence, allowing them to decide on our banking relations ...

... at one of Europe’s largest pension schemes The company had been maintaining a large number of interfaces between proprietary systems at a cost of €30-€40,000 per year. As well as the issue of cost, the firm wanted to achieve greater bank independence, allowing them to decide on our banking relations ...

ICAS 2015 Template

... Bank-specific or bank-characteristics data are collected from BankScope database. The sample dataset consists of 19 commercial banks in Malaysia over the period 2002-20111. The dataset compromises over 190 bank-year observations for each variable. We choose the year of 2002 as a beginning of the tim ...

... Bank-specific or bank-characteristics data are collected from BankScope database. The sample dataset consists of 19 commercial banks in Malaysia over the period 2002-20111. The dataset compromises over 190 bank-year observations for each variable. We choose the year of 2002 as a beginning of the tim ...

Banking, Liquidity and Bank Runs in an Infinite Horizon Economy

... interaction between banking distress and the real economy. The first, summarized recently in Gertler and Kiyotaki (2011), emphasizes how the depletion of bank capital in an economic downturn hinders banks ability to intermediate funds. Due to agency problems (and possibly also regulatory constraints ...

... interaction between banking distress and the real economy. The first, summarized recently in Gertler and Kiyotaki (2011), emphasizes how the depletion of bank capital in an economic downturn hinders banks ability to intermediate funds. Due to agency problems (and possibly also regulatory constraints ...

Bank Asia Annual Report 2015

... Dhaka in 1986 and then moved to Hong Kong in 1988 to take up a position in international trade finance with the Bank of Credit and Commerce HK Limited. After 5 years he returned to Banque Indosuez to join their trade finance team in Dhaka. He left international banking to start his own textile tradi ...

... Dhaka in 1986 and then moved to Hong Kong in 1988 to take up a position in international trade finance with the Bank of Credit and Commerce HK Limited. After 5 years he returned to Banque Indosuez to join their trade finance team in Dhaka. He left international banking to start his own textile tradi ...

Modelling in Corporate Finance

... Observations of the potential explanatory variable k for bank i and period t Random error term with distribution N(0,), Variance-covariance matrix of it error terms Number of banks in sample Years in observation period Number of explanatory variables Maximum lag of the explanatory variable k of th ...

... Observations of the potential explanatory variable k for bank i and period t Random error term with distribution N(0,), Variance-covariance matrix of it error terms Number of banks in sample Years in observation period Number of explanatory variables Maximum lag of the explanatory variable k of th ...

Legal Origin, Creditors` Rights and Bank Lending

... and money market funding are able to make more loans as compared to their smaller competitors. • In addition, large banks are likely to be more diversified than small banks. • For both reasons, we expect bank risk to increase with bank size so that the loan-to-asset ratio will be positively related ...

... and money market funding are able to make more loans as compared to their smaller competitors. • In addition, large banks are likely to be more diversified than small banks. • For both reasons, we expect bank risk to increase with bank size so that the loan-to-asset ratio will be positively related ...

Bank of Baroda: Performance Analysis: Q2 & H1, 2015 16 (FY16)

... This presentation has been prepared by Bank of Baroda (the “Bank”) solely for information purposes, without regard to any specific objectives, financial situations or informational needs of any particular person. Except for the historical information contained herein, statements in this release whic ...

... This presentation has been prepared by Bank of Baroda (the “Bank”) solely for information purposes, without regard to any specific objectives, financial situations or informational needs of any particular person. Except for the historical information contained herein, statements in this release whic ...

3.1 Profile of Dashen Bank SC - Ethiopian Economic Association

... custody of money, which it plays out on a customer order”. This however is not satisfactory definition as it ignores the most important function of a bank that is creating money or creating credit. As many reliable sources indicate, the history of banking begins with the first prototype banks of mer ...

... custody of money, which it plays out on a customer order”. This however is not satisfactory definition as it ignores the most important function of a bank that is creating money or creating credit. As many reliable sources indicate, the history of banking begins with the first prototype banks of mer ...

Banks` loan rejection rates and thecreditworthiness of the banks

... the loan application. As shown, the median of the solvency ratio in 2008 was significantly lower in the groups of firms, which got their application for bank loans in 20092010 totally or partly rejected, than in the group of companies which got their application for bank loans fully accepted. It was ...

... the loan application. As shown, the median of the solvency ratio in 2008 was significantly lower in the groups of firms, which got their application for bank loans in 20092010 totally or partly rejected, than in the group of companies which got their application for bank loans fully accepted. It was ...

Are Bank Holding Companies a Source of Strength to

... Bank of New York (e-mail: adam.ashcraft@ny.frb.org). The views expressed in the paper are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. ...

... Bank of New York (e-mail: adam.ashcraft@ny.frb.org). The views expressed in the paper are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. ...