part i: introduction and measurement

... working overseas, whereas gross domestic product does not include these earnings. Gross domestic product includes earnings from current production in the United States that accrue to foreign residents or foreign-owned firms, while gross national product excludes these items. GDP has become more attr ...

... working overseas, whereas gross domestic product does not include these earnings. Gross domestic product includes earnings from current production in the United States that accrue to foreign residents or foreign-owned firms, while gross national product excludes these items. GDP has become more attr ...

UK BUSINESS CONFIDENCE MONITOR Q1 2009 East Midlands Summary Report

... end of 2009. The latest UK Business Confidence Monitor data corroborates this, with firms reporting that they expect to cut their workforce over the coming year. As we predicted, inflation is disappearing as fast as it arrived. Commodity prices have fallen significantly and domestic demand is contra ...

... end of 2009. The latest UK Business Confidence Monitor data corroborates this, with firms reporting that they expect to cut their workforce over the coming year. As we predicted, inflation is disappearing as fast as it arrived. Commodity prices have fallen significantly and domestic demand is contra ...

Chapter 8

... ___ ___ 1. You buy a purple “Tinky Winky”, [produced in TX] from Wal-Mart. ___ ___ 2. You and your family paint your house. [labor involved] ___ ___ 3. You marry your housemaid. [“working-for-love”] [her services] ___ ___ 4. You buy 100 shares of Microsoft Corporation. ___ ___ 5. You volunteer to ba ...

... ___ ___ 1. You buy a purple “Tinky Winky”, [produced in TX] from Wal-Mart. ___ ___ 2. You and your family paint your house. [labor involved] ___ ___ 3. You marry your housemaid. [“working-for-love”] [her services] ___ ___ 4. You buy 100 shares of Microsoft Corporation. ___ ___ 5. You volunteer to ba ...

Is Currency Depreciation Expansionary? The Case of South Korea

... The real exchange rate is calculated as the nominal exchange rate times the relative consumer price indexes in the U.S. and South Korea, respectively. Government debt is measured as a percent of GDP. The real interest rate is equal to the corporate bond yield minus the expected inflation rate. Produ ...

... The real exchange rate is calculated as the nominal exchange rate times the relative consumer price indexes in the U.S. and South Korea, respectively. Government debt is measured as a percent of GDP. The real interest rate is equal to the corporate bond yield minus the expected inflation rate. Produ ...

Monetary Policy Statement June 2011 Contents

... Reconstruction in Canterbury is projected to add about 2 percentage points to GDP growth over 2012, and boost the level of activity for several years thereafter. Despite the strong outlook for export earnings, household expenditure is expected to grow only modestly. Household debt remains very high ...

... Reconstruction in Canterbury is projected to add about 2 percentage points to GDP growth over 2012, and boost the level of activity for several years thereafter. Despite the strong outlook for export earnings, household expenditure is expected to grow only modestly. Household debt remains very high ...

Ch 7 aggregate supply and aggregate demand* I. Aggregate Supply

... b) Intertemporal substitution effect: A rise in the price level, other things remaining the same, decreases the real value of money and raises the interest rate. Faced with a higher interest rate, people borrow less and spend less so the quantity of real GDP demanded decreases. Similarly, a fall in ...

... b) Intertemporal substitution effect: A rise in the price level, other things remaining the same, decreases the real value of money and raises the interest rate. Faced with a higher interest rate, people borrow less and spend less so the quantity of real GDP demanded decreases. Similarly, a fall in ...

NBER WORKING PAPER SERIES ON THE BENEFITS OF DOLLARIZATION WHEN

... guidelines for lenders in terms of ratios of debt payments to income (net and gross of mortgage loans) of prospective borrowers which vary with interest rates and downpayments. ...

... guidelines for lenders in terms of ratios of debt payments to income (net and gross of mortgage loans) of prospective borrowers which vary with interest rates and downpayments. ...

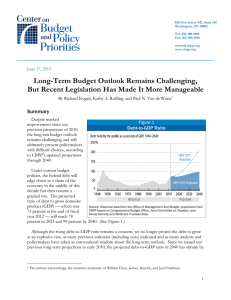

Long-Term Budget Outlook Remains Challenging, But Recent

... the long term. We have long maintained that stabilizing the debt-to-GDP ratio over the coming decade (with deficit reduction measures phased in after the economy has recovered more fully) is a minimum appropriate budget course.7 Deficits are not a problem when the economy is operating well below its ...

... the long term. We have long maintained that stabilizing the debt-to-GDP ratio over the coming decade (with deficit reduction measures phased in after the economy has recovered more fully) is a minimum appropriate budget course.7 Deficits are not a problem when the economy is operating well below its ...

Chapter 12 - Production, Income, and Employment

... • Only goods produced during that period are counted • GDP is actually measured for each quarter, and then reported as an annual rate for the quarter • Once fourth quarter figures are in, government also reports official GDP figure for entire year ...

... • Only goods produced during that period are counted • GDP is actually measured for each quarter, and then reported as an annual rate for the quarter • Once fourth quarter figures are in, government also reports official GDP figure for entire year ...

Document

... 17. By increasing the growth rate of the money supply, the Federal Reserve can decrease the inflation rate. ANSWER: F 18. Most economists think that labor unions in the United States have contributed significantly to inflation. ANSWER: F 19. Fiscal policy cannot deal with inflation on a long-term ba ...

... 17. By increasing the growth rate of the money supply, the Federal Reserve can decrease the inflation rate. ANSWER: F 18. Most economists think that labor unions in the United States have contributed significantly to inflation. ANSWER: F 19. Fiscal policy cannot deal with inflation on a long-term ba ...

The Production Possibilities Frontier

... If the economy is pushed beyond the PPF, its unemployment rate being driven below the 5-6 percent band, we say the economy is “overheated.” Points very far beyond the PPF are simply out of reach (in real terms). Strong market forces pushing in this direction will impinge on prices rather than on qua ...

... If the economy is pushed beyond the PPF, its unemployment rate being driven below the 5-6 percent band, we say the economy is “overheated.” Points very far beyond the PPF are simply out of reach (in real terms). Strong market forces pushing in this direction will impinge on prices rather than on qua ...

US: thinking about the next US recession - 1

... recessions of 1949, 1969-1970, and 1990-1991. In fact, monetary policy has by far been the most important cause of US recessions since 1945. And this was under normal circumstances, without nearzero policy rates and an excessive central balance sheet. In the current circumstances monetary policy mis ...

... recessions of 1949, 1969-1970, and 1990-1991. In fact, monetary policy has by far been the most important cause of US recessions since 1945. And this was under normal circumstances, without nearzero policy rates and an excessive central balance sheet. In the current circumstances monetary policy mis ...

AP Macro Unit 2 Review Powerpoint

... money Examples: • It takes $2 to buy what $1 bought in 1982 • It takes $6 to buy what $1 bought in 1961 ...

... money Examples: • It takes $2 to buy what $1 bought in 1982 • It takes $6 to buy what $1 bought in 1961 ...

... We forecast stable GDP growth over the forecast, averaging 2.4 per cent a year and dipping only slightly in 2016 when the pace of fiscal tightening is greatest. That reflects above-trend growth in the early years of the forecast, as the small negative output gap closes, then on-trend growth thereaft ...

Abenomics

.jpg?width=300)

Abenomics (アベノミクス, Abenomikusu) refers to the economic policies advocated by Shinzō Abe since the December 2012 general election, which elected Abe to his second term as prime minister of Japan. Abenomics is based upon ""three arrows"" of fiscal stimulus, monetary easing and structural reforms. The Economist characterized the program as a ""mix of reflation, government spending and a growth strategy designed to jolt the economy out of suspended animation that has gripped it for more than two decades.""The term ""Abenomics"" is a portmanteau of Abe and economics, and follows previous political neologisms for economic policies linked to specific leaders, such as Reaganomics, Clintonomics and Rogernomics.