One of the biggest strategic questions facing any

... One of the biggest strategic questions facing any endowed foundation is whether or not to limit grantmaking so that investments can provide philanthropic funding in perpetuity. A contrasting approach, often referred to as “sunset,” involves making grants at a faster rate than the investment portfoli ...

... One of the biggest strategic questions facing any endowed foundation is whether or not to limit grantmaking so that investments can provide philanthropic funding in perpetuity. A contrasting approach, often referred to as “sunset,” involves making grants at a faster rate than the investment portfoli ...

Eurizon EasyFund Azioni Strategia Flessibile R

... Exposure to stocks denominated in currencies other than the euro was consistently hedged against exchange rate fluctuations, in respect of the sub-fund’s management policy, which is aimed at preventing exposure to this source of risk. The product’s investment philosophy awards a preference to Europe ...

... Exposure to stocks denominated in currencies other than the euro was consistently hedged against exchange rate fluctuations, in respect of the sub-fund’s management policy, which is aimed at preventing exposure to this source of risk. The product’s investment philosophy awards a preference to Europe ...

Europe ex UK Smaller Companies Fund

... The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited (“FTSE”), by the London Stock Exchange Plc (the “Exchange”), Euronext N.V. (“Euronext”), The Financial Times Limited (“FT”), European Public Real Estate Association (“EPRA”) or the National Association of ...

... The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited (“FTSE”), by the London Stock Exchange Plc (the “Exchange”), Euronext N.V. (“Euronext”), The Financial Times Limited (“FT”), European Public Real Estate Association (“EPRA”) or the National Association of ...

investment policy - University of Arkansas at Pine Bluff

... The primary objective of our cash management system is to provide for day-to-day funding needs (liquidity) so that current transactional requirements and obligations can be met. To accomplish this objective, cash is maintained in interest bearing checking accounts and excess cash is reduced and made ...

... The primary objective of our cash management system is to provide for day-to-day funding needs (liquidity) so that current transactional requirements and obligations can be met. To accomplish this objective, cash is maintained in interest bearing checking accounts and excess cash is reduced and made ...

Mutual Funds Sharekhan`s Top Equity Fund Picks

... Past performance of any scheme of the Mutual fund do not indicate the future performance of the Schemes of the Mutual Fund. Sharekhan shall not responsible or liable for any loss or shortfall incurred by the investors. ...

... Past performance of any scheme of the Mutual fund do not indicate the future performance of the Schemes of the Mutual Fund. Sharekhan shall not responsible or liable for any loss or shortfall incurred by the investors. ...

Mutual Fund

... Principal Global Opportunities Fund It is an open-ended growth fund. The fund is suitable for investors who would like to diversify investments into other markets / securities by taking advantage of the potential growth in the global markets and thereby reduce the risk of having a portfolio predomin ...

... Principal Global Opportunities Fund It is an open-ended growth fund. The fund is suitable for investors who would like to diversify investments into other markets / securities by taking advantage of the potential growth in the global markets and thereby reduce the risk of having a portfolio predomin ...

T. Rowe Price Large Cap Growth Portfolio

... investment portfolios offered thereunder, are available from your financial professional. The contract prospectus contains information about the contract¶s features, risks, charges and expenses. Investors should consider the investment objectives, risks, charges and expenses of the investment compan ...

... investment portfolios offered thereunder, are available from your financial professional. The contract prospectus contains information about the contract¶s features, risks, charges and expenses. Investors should consider the investment objectives, risks, charges and expenses of the investment compan ...

MFS MERIDIAN ® FUNDS ― EMERGING MARKETS DEBT LOCAL

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

View Document

... Born from a legacy of making a difference, TIAA Investments is a global asset manager dedicated to helping investors pursue important life goals. We offer a diversified roster of index, quantitative and actively managed funds across five share classes so you can select the funds that fit best. Exper ...

... Born from a legacy of making a difference, TIAA Investments is a global asset manager dedicated to helping investors pursue important life goals. We offer a diversified roster of index, quantitative and actively managed funds across five share classes so you can select the funds that fit best. Exper ...

Pioneer Funds – US Dollar Short-Term I USD

... The Sub-Fund may not be registered for sale with the relevant authorities in your jurisdiction. Where unregistered, the Sub-Fund may not be sold or offered except in the circumstances permitted by law. The Fund may not be regulated or supervised by any governmental or similar authority in your juris ...

... The Sub-Fund may not be registered for sale with the relevant authorities in your jurisdiction. Where unregistered, the Sub-Fund may not be sold or offered except in the circumstances permitted by law. The Fund may not be regulated or supervised by any governmental or similar authority in your juris ...

Click to download IMVA Opportunity November 2014

... (e) Source: eVestment Analytics – All numbers are presented gross of fees and expenses. (f) Share Class A is tax transparent in Germany and has been granted Reporting Status by HMRC as of 31 January 2014. This document is for information purposes and internal use only. It is neither an advice nor a ...

... (e) Source: eVestment Analytics – All numbers are presented gross of fees and expenses. (f) Share Class A is tax transparent in Germany and has been granted Reporting Status by HMRC as of 31 January 2014. This document is for information purposes and internal use only. It is neither an advice nor a ...

Fixed maturity, attractive dividends: ESPA

... ESPA CORPORATE PLUS BASKET 2017 II invests in a balanced, international mix of bonds from various sectors. The fund is suitable for clients who are looking for an investment in corporate bonds with an attractive yield, a medium-term maturity, and an ongoing dividend. The default risk is broadly dive ...

... ESPA CORPORATE PLUS BASKET 2017 II invests in a balanced, international mix of bonds from various sectors. The fund is suitable for clients who are looking for an investment in corporate bonds with an attractive yield, a medium-term maturity, and an ongoing dividend. The default risk is broadly dive ...

register your private contractual investment fund in armenia

... REGISTER YOUR PRIVATE CONTRACTUAL INVESTMENT FUND IN ARMENIA In order to develop private market for investment funds, the Regulator adopted a regulation which enables fast registration process for private contractual investment funds (PCF). Now you can register your PCF in Armenia by uploading the n ...

... REGISTER YOUR PRIVATE CONTRACTUAL INVESTMENT FUND IN ARMENIA In order to develop private market for investment funds, the Regulator adopted a regulation which enables fast registration process for private contractual investment funds (PCF). Now you can register your PCF in Armenia by uploading the n ...

the presentation

... managed by Andrew Weiss (collectively, the “Funds”). Solicitations to invest in the Funds are made only by means of a confidential offering memorandum and in accordance with applicable securities laws. This presentation has been prepared from original sources and data and information contained in th ...

... managed by Andrew Weiss (collectively, the “Funds”). Solicitations to invest in the Funds are made only by means of a confidential offering memorandum and in accordance with applicable securities laws. This presentation has been prepared from original sources and data and information contained in th ...

Addendum - Canara Robeco

... units of the various Schemes of the Fund of the value of Rs. 100000 or more have to obtain a UIN before 31.03.2005. c) Foreign Institutional Investors, sub accounts and foreign venture capital investors who buy, sell or deal or subscribe to units of the various Schemes of the Fund, have to obtain a ...

... units of the various Schemes of the Fund of the value of Rs. 100000 or more have to obtain a UIN before 31.03.2005. c) Foreign Institutional Investors, sub accounts and foreign venture capital investors who buy, sell or deal or subscribe to units of the various Schemes of the Fund, have to obtain a ...

(acc) USD - Fund Fact Sheet - Franklin Templeton Investments

... Asset allocation figures shown reflect certain derivatives held in the portfolio (or their underlying reference assets) and may not total 100% or may be negative due to rounding, use of derivatives, unsettled trades or other factors. Fund Measures figures shown for Average Duration, Average Weighted ...

... Asset allocation figures shown reflect certain derivatives held in the portfolio (or their underlying reference assets) and may not total 100% or may be negative due to rounding, use of derivatives, unsettled trades or other factors. Fund Measures figures shown for Average Duration, Average Weighted ...

Franklin Quotential Growth Portfolio Series A

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

Mercer Low Volatility Equity Fund M3 GBP

... The investment objective of the Fund is to seek long-term growth of capital and income. The Fund will primarily invest in a diversified range of global shares and equity interests, either directly, or it can invest up to 100% of its assets in other funds ('Underlying Funds') which are consistent wit ...

... The investment objective of the Fund is to seek long-term growth of capital and income. The Fund will primarily invest in a diversified range of global shares and equity interests, either directly, or it can invest up to 100% of its assets in other funds ('Underlying Funds') which are consistent wit ...

Stock Market directions

... o What does the company produce? Describe the market environment of the business? o P/E Ratio, Dividend yield o Identify the owners/board of directors (Top 2) o Identify recent company news. What is the outlook for the company for the next few months? o Explain what your reasons or justifications ar ...

... o What does the company produce? Describe the market environment of the business? o P/E Ratio, Dividend yield o Identify the owners/board of directors (Top 2) o Identify recent company news. What is the outlook for the company for the next few months? o Explain what your reasons or justifications ar ...

As filed with the Securities and Exchange Commission

... closed-end registered investment company with shares listed on the New York Stock Exchange (the “Fund”), announced today that the Board of Directors of the Fund approved a proposed acquisition of its assets, and the assumption of its liabilities, by AB Income Fund (“Income Fund”), a newly-formed ser ...

... closed-end registered investment company with shares listed on the New York Stock Exchange (the “Fund”), announced today that the Board of Directors of the Fund approved a proposed acquisition of its assets, and the assumption of its liabilities, by AB Income Fund (“Income Fund”), a newly-formed ser ...

Finance Glossary of Terms

... True Endowment – An endowment fund, the principal of which is designated by its donor to be held in perpetuity or permanently, and the income/payout from which is used to support the specified purpose of the endowment. Founders Fund – The remaining balance of the funds given to the UC Santa Cruz Fo ...

... True Endowment – An endowment fund, the principal of which is designated by its donor to be held in perpetuity or permanently, and the income/payout from which is used to support the specified purpose of the endowment. Founders Fund – The remaining balance of the funds given to the UC Santa Cruz Fo ...

MS Word - Securities Commission Malaysia

... Where the investment strategy includes investments in foreign securities / derivatives / instruments, this fact and the proposed foreign exposure should be clearly highlighted. 10. For item (3) of Section C, please state clearly and concisely the product differentiation / distinction between the pro ...

... Where the investment strategy includes investments in foreign securities / derivatives / instruments, this fact and the proposed foreign exposure should be clearly highlighted. 10. For item (3) of Section C, please state clearly and concisely the product differentiation / distinction between the pro ...

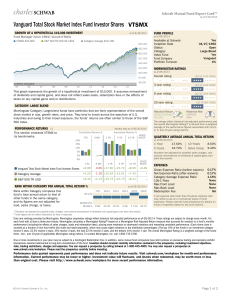

Vanguard Total Stock Market Index Fund Investor Shares

... This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that inve ...

... This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that inve ...

Inflection Performance: January 2017

... has a global mandate and focuses primarily on the Americas, Europe and Asia, providing access to the expertise of hedge fund managers in identifying what we believe are exceptional investment opportunities throughout the world. Some taxable investors may find that the Fund’s option structure has sig ...

... has a global mandate and focuses primarily on the Americas, Europe and Asia, providing access to the expertise of hedge fund managers in identifying what we believe are exceptional investment opportunities throughout the world. Some taxable investors may find that the Fund’s option structure has sig ...