Exchange-Traded Funds (ETF)

... or an investment fund that tracks an underlying index and trades as a single equity. • Created around every conceivable types of index… – Market Indices (S&P 500, NASDAQ 100, etc.) – Market Sectors (Health Care, Oil & Gas, etc.) – Stock types (value, growth, etc.) – Specialty, International, Real Es ...

... or an investment fund that tracks an underlying index and trades as a single equity. • Created around every conceivable types of index… – Market Indices (S&P 500, NASDAQ 100, etc.) – Market Sectors (Health Care, Oil & Gas, etc.) – Stock types (value, growth, etc.) – Specialty, International, Real Es ...

Investment Policy Statement Employees

... investments will be made to take advantage of long term developments of the market. Hence, EPF should not be unduly affected or become vulnerable for short term volatilities in the market. However, in view of avoiding or minimizing the losses, the IC may also consider selling some securities at a lo ...

... investments will be made to take advantage of long term developments of the market. Hence, EPF should not be unduly affected or become vulnerable for short term volatilities in the market. However, in view of avoiding or minimizing the losses, the IC may also consider selling some securities at a lo ...

May 2016 Factsheet Monthly

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

Suitability report

... registered elsewhere in the UK. It means that the SLP itself can own assets, enter into contracts, sue or be sued, own property, borrow money and grant certain types of security. Tax transparency: this means that the SLP is taxed as though it did not have a separate legal personality. No tax is paya ...

... registered elsewhere in the UK. It means that the SLP itself can own assets, enter into contracts, sue or be sued, own property, borrow money and grant certain types of security. Tax transparency: this means that the SLP is taxed as though it did not have a separate legal personality. No tax is paya ...

MS-Word, RTF - Maine Legislature

... repurchase agreements that mature within the succeeding 12 months that are secured by obligations of the United States and its agencies and instrumentalities, prime commercial paper, tax-exempt obligations and corporate bonds rated "AAA" that mature not more than 3624 months from the date of investm ...

... repurchase agreements that mature within the succeeding 12 months that are secured by obligations of the United States and its agencies and instrumentalities, prime commercial paper, tax-exempt obligations and corporate bonds rated "AAA" that mature not more than 3624 months from the date of investm ...

CIMB-Principal ASEAN Total Return Fund

... the Fund Prospectus, subject to the terms and conditions therein. Investments in the Fund are exposed to country risk, credit (default) and counterparty risk, currency risk, Equity specific risk, interest rate risk, liquidity risk, risk associated with temporary defensive positions and risk of inves ...

... the Fund Prospectus, subject to the terms and conditions therein. Investments in the Fund are exposed to country risk, credit (default) and counterparty risk, currency risk, Equity specific risk, interest rate risk, liquidity risk, risk associated with temporary defensive positions and risk of inves ...

Time to Take Stock Brochure - Franklin Templeton Investments

... and CDs offer a fixed rate of return. Treasuries, if held to maturity, offer a fixed rate of return and fixed principal value; their interest payments and principal are guaranteed. Fund investment returns and share prices will fluctuate with market conditions, and investors may have a gain or a loss ...

... and CDs offer a fixed rate of return. Treasuries, if held to maturity, offer a fixed rate of return and fixed principal value; their interest payments and principal are guaranteed. Fund investment returns and share prices will fluctuate with market conditions, and investors may have a gain or a loss ...

PDF - 50 South Capital

... The information contained herein is for informational and educational purposes only. It is neither an offer to sell, nor a solicitation of an offer to buy an interest in any investment fund managed by 50 South Capital Advisors, LLC. The information is obtained from sources believed to be reliable, a ...

... The information contained herein is for informational and educational purposes only. It is neither an offer to sell, nor a solicitation of an offer to buy an interest in any investment fund managed by 50 South Capital Advisors, LLC. The information is obtained from sources believed to be reliable, a ...

Goldman Sachs India Equity Portfolio

... time period. The number of funds in a Morningstar sector varies over time as new funds are launched and funds close. Source: Morningstar ©2017 Morningstar, Inc. All Rights Reserved. (2) The ongoing charges figure is based on expenses during the previous year. See details in the Key Investor Informat ...

... time period. The number of funds in a Morningstar sector varies over time as new funds are launched and funds close. Source: Morningstar ©2017 Morningstar, Inc. All Rights Reserved. (2) The ongoing charges figure is based on expenses during the previous year. See details in the Key Investor Informat ...

tax loss selling strategies for closed-end fund investors

... value (NAV) of a fund’s shares will fluctuate with market conditions. Closed-end funds may trade at a premium to NAV but often trade at a discount. All return data assumes reinvestment of all distributions. Current performance may be lower or higher than the performance data quoted. In evaluating to ...

... value (NAV) of a fund’s shares will fluctuate with market conditions. Closed-end funds may trade at a premium to NAV but often trade at a discount. All return data assumes reinvestment of all distributions. Current performance may be lower or higher than the performance data quoted. In evaluating to ...

The hidden risks of going passive

... investment strategy. There can be no such thing as a passive asset allocation policy, yet the asset allocation adopted can make a crucial difference to returns. Once that decision has been made, there may be reasons for adopting passive investment approaches, but investors should realise that they m ...

... investment strategy. There can be no such thing as a passive asset allocation policy, yet the asset allocation adopted can make a crucial difference to returns. Once that decision has been made, there may be reasons for adopting passive investment approaches, but investors should realise that they m ...

Franklin Double Tax-Free Income Fund Fact Sheet

... Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. Performance: The fund offers other shar ...

... Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. Performance: The fund offers other shar ...

Dear Direxion Shareholder: We will soon be making changes to our

... all purchases at the close of business on Monday August 4, 2014, and will be liquidated on or about August 22, 2014. During the intervening period, shareholders may redeem or exchange from that fund to other Direxion Funds during times when the New York Stock Exchange is open for business, but they ...

... all purchases at the close of business on Monday August 4, 2014, and will be liquidated on or about August 22, 2014. During the intervening period, shareholders may redeem or exchange from that fund to other Direxion Funds during times when the New York Stock Exchange is open for business, but they ...

Franklin Growth Fund Fact Sheet - Franklin Templeton Investments

... Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. To obtain a summary prospectus and/or prospectus, which contains this and other information, talk to your financial advisor, call us at (800) DIAL BEN/342-5236 or visit franklintempleton.com. ...

... Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. To obtain a summary prospectus and/or prospectus, which contains this and other information, talk to your financial advisor, call us at (800) DIAL BEN/342-5236 or visit franklintempleton.com. ...

Key Investor Information AMUNDI ETF MSCI EUROPE MATERIALS

... The latest prospectus and most recent periodic disclosure documents, and all other useful information, are available free of charge from the Management Company. The updated details of the management company’s remuneration policy are available on its website or free of charge upon written request to ...

... The latest prospectus and most recent periodic disclosure documents, and all other useful information, are available free of charge from the Management Company. The updated details of the management company’s remuneration policy are available on its website or free of charge upon written request to ...

Field of Interest Fund Agreement

... WCF’s Board of Directors that the original purpose no longer best serves the interests of the community or of WCF. In such case, the WCF Board of Directors may apply the Fund to such other purposes as will, in the Board’s opinion, most nearly accomplish the donors’ underlying intentions, wishes and ...

... WCF’s Board of Directors that the original purpose no longer best serves the interests of the community or of WCF. In such case, the WCF Board of Directors may apply the Fund to such other purposes as will, in the Board’s opinion, most nearly accomplish the donors’ underlying intentions, wishes and ...

PDF article file - Krungsri Asset Management

... Investors should carefully study fund features, performance, and risk before making an investment decision. Past performance is not a guarantee of future results. For KF-HUSINDX and KF-HJPINDX 1. KF-HUSINDX allocates at least 80% of NAV in each accounting year in a foreign fund titled iShares Cor ...

... Investors should carefully study fund features, performance, and risk before making an investment decision. Past performance is not a guarantee of future results. For KF-HUSINDX and KF-HJPINDX 1. KF-HUSINDX allocates at least 80% of NAV in each accounting year in a foreign fund titled iShares Cor ...

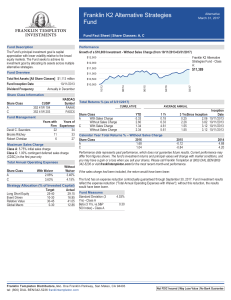

Franklin K2 Alternative Strategies Fund Fact Sheet

... involve greater credit risk, including the possibility of default or bankruptcy. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or sub-advisor expects. The Fund may make short sales of securities, which involves the risk that ...

... involve greater credit risk, including the possibility of default or bankruptcy. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or sub-advisor expects. The Fund may make short sales of securities, which involves the risk that ...

Important information on Fidelity Advisor Stable Value Portfolio

... The fund seeks to preserve your principal investment while earning a level of interest income that is consistent with principal preservation. The fund seeks to maintain a stable net asset value (NAV) of $1 per share, but it cannot guarantee that it will be able to do so. The yield of the fund will f ...

... The fund seeks to preserve your principal investment while earning a level of interest income that is consistent with principal preservation. The fund seeks to maintain a stable net asset value (NAV) of $1 per share, but it cannot guarantee that it will be able to do so. The yield of the fund will f ...

Invesco Core Plus Bond Fund investment philosophy and process

... issuer’s credit rating. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic ...

... issuer’s credit rating. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic ...

Creating a Financial Plan

... with the provincial securities commissions and as such our Advisors are entitled to sell mutual funds, stocks, bonds and other securities as permitted under our registration. They may also be able to provide other services or products to you through their own business. As a member of the Investment ...

... with the provincial securities commissions and as such our Advisors are entitled to sell mutual funds, stocks, bonds and other securities as permitted under our registration. They may also be able to provide other services or products to you through their own business. As a member of the Investment ...

Coronation Granite Fixed Income Fund Fact Sheet

... European data have been resillient. Eurozone domestic demand remains solid, supported by easy monetary policy, relatively low oil prices, some strength in labour markets and an increase in fiscal outlays. GDP data published for the first quarter of 2016 surprised to the upside, and the region is exp ...

... European data have been resillient. Eurozone domestic demand remains solid, supported by easy monetary policy, relatively low oil prices, some strength in labour markets and an increase in fiscal outlays. GDP data published for the first quarter of 2016 surprised to the upside, and the region is exp ...

2050 Retirement Strategy Fund

... those in your employer-sponsored retirement plan). You should view the Retirement Strategy Funds as one part of your entire plan for retirement income. The Retirement Strategy Funds’ underlying investments include international companies, which involve such risks as currency fluctuations, economic i ...

... those in your employer-sponsored retirement plan). You should view the Retirement Strategy Funds as one part of your entire plan for retirement income. The Retirement Strategy Funds’ underlying investments include international companies, which involve such risks as currency fluctuations, economic i ...