Asset Price Bubble in Japan in the 1980s: Lessons for Financial and

... The bursting of the asset price bubble not only triggered the materialization of adverse effects but also amplified them as time passed, thereby making such structural adjustment more difficult. This incomplete economic adjustment to major changes in a relative price system resulted in the downward ...

... The bursting of the asset price bubble not only triggered the materialization of adverse effects but also amplified them as time passed, thereby making such structural adjustment more difficult. This incomplete economic adjustment to major changes in a relative price system resulted in the downward ...

Prosperity for Latin America by the Direct Route

... property, going concerns, trademarks, and electromagnetic spectrum are priced lower than their productive capacity would justify. Those same assets, if they were in Europe or the U.S., would be worth more, and in some cases as much as ten times more. This point may seem of little importance because ...

... property, going concerns, trademarks, and electromagnetic spectrum are priced lower than their productive capacity would justify. Those same assets, if they were in Europe or the U.S., would be worth more, and in some cases as much as ten times more. This point may seem of little importance because ...

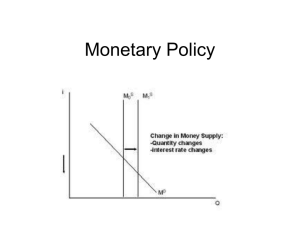

Monetary Policy

... • Decreases AD (investment and consumption) • Higher interest rates lead to capital inflow, so dollar appreciates, and exports decrease (lower AD) • Asset prices decrease ...

... • Decreases AD (investment and consumption) • Higher interest rates lead to capital inflow, so dollar appreciates, and exports decrease (lower AD) • Asset prices decrease ...

Financial bubbles and economic crises

... Installation ends in a ‘Frenzy’ phase. In the previous surge – for the age of mass production – this was the ‘Roaring Twenties’. In the current one it was the ‘frantic nineties’. A casino economy takes shape, ramping up speculation and financial bubbles, and creating a super-rich elite. Individualis ...

... Installation ends in a ‘Frenzy’ phase. In the previous surge – for the age of mass production – this was the ‘Roaring Twenties’. In the current one it was the ‘frantic nineties’. A casino economy takes shape, ramping up speculation and financial bubbles, and creating a super-rich elite. Individualis ...

The Global Economic Crisis in the Perspective of

... Loose regulation of US financial sector and the uncontrolled development of sub-prime mortgage and other financial derivatives with high risks are the superficial origination of the crisis. When the bubble in US real estate market bursts, systematic risks in the financial sector emerge. However, the ...

... Loose regulation of US financial sector and the uncontrolled development of sub-prime mortgage and other financial derivatives with high risks are the superficial origination of the crisis. When the bubble in US real estate market bursts, systematic risks in the financial sector emerge. However, the ...

Contents of the course - Solvay Brussels School of

... Monetary approach Overshooting model - Hypotheses Money is neutral in the long-run : changes in the supply of money have no long-run effect on the real economy : an % increase (decrease) in money supply will lead to the same % increase (decrease) in p and s. Short-run adjustments : m supply decr ...

... Monetary approach Overshooting model - Hypotheses Money is neutral in the long-run : changes in the supply of money have no long-run effect on the real economy : an % increase (decrease) in money supply will lead to the same % increase (decrease) in p and s. Short-run adjustments : m supply decr ...

“A Just Society: Honoring Joseph Stiglitz” Comments prepared for the conference

... its intellectual roots in this research. As events unfolded, I was struck by the immediate translation of abstract theoretical models to the real world. Despite the fact that the trend in macro for decades was to abstract from these issues. Despite the fact that many of the early problems were in ca ...

... its intellectual roots in this research. As events unfolded, I was struck by the immediate translation of abstract theoretical models to the real world. Despite the fact that the trend in macro for decades was to abstract from these issues. Despite the fact that many of the early problems were in ca ...

Asset Bubbles, Inflation, and Agricultural Land Values

... values are changing rapidly, accessing the most current data is crucial. We examined farm land sales data from the state of Kansas to look at price levels from the last few years. The data were obtained from the Kansas Society of Farm Managers and Rural Appraisers which maintains a land sales databa ...

... values are changing rapidly, accessing the most current data is crucial. We examined farm land sales data from the state of Kansas to look at price levels from the last few years. The data were obtained from the Kansas Society of Farm Managers and Rural Appraisers which maintains a land sales databa ...

excess demand for tradables

... You cannot be a borrower for ever, but you can be a creditor as long as you wish to be. The creditors may change their minds given that risk exposure is rising and the return to their investments is very low. In China, reserves make up half of GDP. ...

... You cannot be a borrower for ever, but you can be a creditor as long as you wish to be. The creditors may change their minds given that risk exposure is rising and the return to their investments is very low. In China, reserves make up half of GDP. ...

Presentation to Lambda Alpha International and Arizona Bankers Association Phoenix, Arizona

... “on the other hand,” the recovery in the housing sector comes with concerns that prices might be rising too rapidly. I don’t think this should set off alarm bells, at least yet. First, there are important differences between circumstances now and what we saw leading into the crisis. Lending standard ...

... “on the other hand,” the recovery in the housing sector comes with concerns that prices might be rising too rapidly. I don’t think this should set off alarm bells, at least yet. First, there are important differences between circumstances now and what we saw leading into the crisis. Lending standard ...

Homework 4 - I can be contacted at

... Match the correct definition to the word or phrase below 1. The speed with which an asset can be converted to currency 2. Currency held at a financial institutions in order to manage the demand for cash flows 3. The percentage of bank deposits a bank must keep on hand as required by the Federal Rese ...

... Match the correct definition to the word or phrase below 1. The speed with which an asset can be converted to currency 2. Currency held at a financial institutions in order to manage the demand for cash flows 3. The percentage of bank deposits a bank must keep on hand as required by the Federal Rese ...

Financial Mathematics and Applied Probability Seminars 2003-2004

... reshuffling the disturbances. This approach is totally non parametric when constant volatility is assumed, or semi-parametric in presence of GARCH (1,1) volatility and is shown without a loss in accuracy to be much more powerful in terms of computer efficiency than the Monte Carlo approach. This app ...

... reshuffling the disturbances. This approach is totally non parametric when constant volatility is assumed, or semi-parametric in presence of GARCH (1,1) volatility and is shown without a loss in accuracy to be much more powerful in terms of computer efficiency than the Monte Carlo approach. This app ...

Global Asset Allocation Views - JP Morgan Asset Management

... Investing in foreign countries involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies in foreign countries can raise or lower returns. Also, some markets may not be as politically and economically stable. The ...

... Investing in foreign countries involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies in foreign countries can raise or lower returns. Also, some markets may not be as politically and economically stable. The ...

References - Lorenzo Bini Smaghi

... may impair the effectiveness of monetary policy. This means not only that monetary policy might become less effective in achieving price stability, but also that it could have perverse effects on financial stability itself. I will consider two cases. The first case occurs when the market turmoil has ...

... may impair the effectiveness of monetary policy. This means not only that monetary policy might become less effective in achieving price stability, but also that it could have perverse effects on financial stability itself. I will consider two cases. The first case occurs when the market turmoil has ...

Looking into the crystal ball: A forecast

... controls implemented in the Russia Federation that have created a shortage of logs for Chinese markets, increasing the price of New Zealand logs. ...

... controls implemented in the Russia Federation that have created a shortage of logs for Chinese markets, increasing the price of New Zealand logs. ...

No Slide Title

... Markets, has been obtained from sources which we believe to be reliable and accurate. This material is not to be considered an offer or solicitation regarding the sale of any security. Discussions of past performance do not imply a guarantee of future results. ...

... Markets, has been obtained from sources which we believe to be reliable and accurate. This material is not to be considered an offer or solicitation regarding the sale of any security. Discussions of past performance do not imply a guarantee of future results. ...

Asset Policy - Dove House School Academy

... (b) are expected to be used during more than one financial year. This policy will outline the procedures for the recognition and recording of fixed assets including purchasing, disposals, depreciation and impairment. All fixed assets above £5,000 in value are recorded in the Asset Register along wit ...

... (b) are expected to be used during more than one financial year. This policy will outline the procedures for the recognition and recording of fixed assets including purchasing, disposals, depreciation and impairment. All fixed assets above £5,000 in value are recorded in the Asset Register along wit ...

The US and UK resembled Japan during its lost decade. Real estate

... directly to the interbank market, eliminating rollover risk. And non-bank financial institutions like Yamaichi Securities received emergency loans. In an attempt to prompt credit growth interest rates were cut to zero and the monetary base increased 110% (Table 1).4 The central bank’s unprecedented ...

... directly to the interbank market, eliminating rollover risk. And non-bank financial institutions like Yamaichi Securities received emergency loans. In an attempt to prompt credit growth interest rates were cut to zero and the monetary base increased 110% (Table 1).4 The central bank’s unprecedented ...

The US and UK resembled Japan during its lost

... directly to the interbank market, eliminating rollover risk. And non-bank financial institutions like Yamaichi Securities received emergency loans. In an attempt to prompt credit growth interest rates were cut to zero and the monetary base increased 110% (Table 1).4 The central bank’s unprecedented ...

... directly to the interbank market, eliminating rollover risk. And non-bank financial institutions like Yamaichi Securities received emergency loans. In an attempt to prompt credit growth interest rates were cut to zero and the monetary base increased 110% (Table 1).4 The central bank’s unprecedented ...

20140416 20090104 Singapore Current Economic Situation Talk

... High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people”… – Solution? Wait it out; the capital stock of the global economy has to fall, and anything that ...

... High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people”… – Solution? Wait it out; the capital stock of the global economy has to fall, and anything that ...

No Slide Title

... • The folks who react rationally to the new circumstances are already the winners. ...

... • The folks who react rationally to the new circumstances are already the winners. ...

Lessons of the Great Depression

... been caused by Fed and ECB policy errors, which allowed nominal GDP to fall at the sharpest rate since 1938, especially during a time when banks were already stressed by the subprime fiasco, and when the resources for repaying nominal debts come from nominal income? ...

... been caused by Fed and ECB policy errors, which allowed nominal GDP to fall at the sharpest rate since 1938, especially during a time when banks were already stressed by the subprime fiasco, and when the resources for repaying nominal debts come from nominal income? ...

Macro Brew “Top-heavy was the ship as a dinnerless student with all

... crude oil to Asian cars and toys to Russian-made armaments. So what does it mean for the global economy when the Fed tapers QE and threatens to reduce the size of its balance sheet? Well, it would mean a dearth of US dollars relative to other currencies, which would naturally strengthen its exchange ...

... crude oil to Asian cars and toys to Russian-made armaments. So what does it mean for the global economy when the Fed tapers QE and threatens to reduce the size of its balance sheet? Well, it would mean a dearth of US dollars relative to other currencies, which would naturally strengthen its exchange ...

Economic bubble

An economic bubble (sometimes referred to as a speculative bubble, a market bubble, a price bubble, a financial bubble, a speculative mania or a balloon) is trade in an asset at a price or price range that strongly deviates from the corresponding asset's intrinsic value. It could also be described as a situation in which asset prices appear to be based on implausible or inconsistent views about the future.Because it is often difficult to observe intrinsic values in real-life markets, bubbles are often conclusively identified only in retrospect, when a sudden drop in prices appears. Such a drop is known as a crash or a bubble burst. Both the boom and the burst phases of the bubble are examples of a positive feedback mechanism, in contrast to the negative feedback mechanism that determines the equilibrium price under normal market circumstances. Prices in an economic bubble can fluctuate erratically, and become impossible to predict from supply and demand alone.While some economists deny that bubbles occur, the cause of bubbles remains disputed by those who are convinced that asset prices often deviate strongly from intrinsic values. Many explanations have been suggested, and research has recently shown that bubbles may appear even without uncertainty, speculation, or bounded rationality. In such cases, the bubbles may be argued to be rational, where investors at every point fully compensated for the possibility that the bubble might collapse by higher returns. These approaches require that the timing of the bubble collapse can only be forecast probabilistically and the bubble process is often modelled using a Markov switching model. It has also been suggested that bubbles might ultimately be caused by processes of price coordination or emerging social norms.