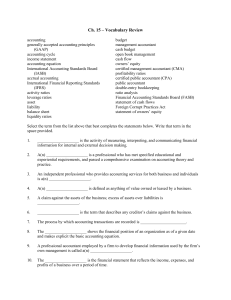

Ch. 15 – Vocabulary Review accounting generally accepted

... operating expenses, cash receipts, and outlays for a future time period. ...

... operating expenses, cash receipts, and outlays for a future time period. ...

LESSON ONE

... expected to be discharged in the normal course of the entity’s operating cycle: or ...

... expected to be discharged in the normal course of the entity’s operating cycle: or ...

Model og layout of project accounting (text)

... connection with the administration of grant funds from mini programmes within the agreement with DPOD. Those standards and guidelines require that we plan and perform the audit to obtain reasonable assurance that the project accounts are free of material misstatement. An audit includes examining, on ...

... connection with the administration of grant funds from mini programmes within the agreement with DPOD. Those standards and guidelines require that we plan and perform the audit to obtain reasonable assurance that the project accounts are free of material misstatement. An audit includes examining, on ...

BERRIEN COUNTY BUILDING AUTHORITY

... America and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of ma ...

... America and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of ma ...

QuickBooks Lesson 4

... You will use the Journal in QuickBooks to record the adjustments. The process will be exactly like that used in a manual system. You will determine the amount of the adjustment then select the accounts to debit and credit, entering the appropriate amount in the QuickBooks journal. Complete the Adjus ...

... You will use the Journal in QuickBooks to record the adjustments. The process will be exactly like that used in a manual system. You will determine the amount of the adjustment then select the accounts to debit and credit, entering the appropriate amount in the QuickBooks journal. Complete the Adjus ...

Lecture 1: A model for Processing Accounting Information

... Lenders – banks and suppliers need financial information to safeguard loans the have made or intend to make. ...

... Lenders – banks and suppliers need financial information to safeguard loans the have made or intend to make. ...

KENTEX PETROLEUM INC

... 3. Based on my knowledge, the financial statements, and other financial information included in this Quarterly Report, fairly present in all material respects the financial condition, results of operations and cash flows of the Registrant as of, and for, the periods presented in this Quarterly Repor ...

... 3. Based on my knowledge, the financial statements, and other financial information included in this Quarterly Report, fairly present in all material respects the financial condition, results of operations and cash flows of the Registrant as of, and for, the periods presented in this Quarterly Repor ...

ISA 520 Analytical procedures

... analytical procedures in response to assessed risks. When such controls are effective, the auditor generally has greater confidence in the reliability of the information and, therefore, in the results of analytical procedures. The operating effectiveness of controls over non-financial information ma ...

... analytical procedures in response to assessed risks. When such controls are effective, the auditor generally has greater confidence in the reliability of the information and, therefore, in the results of analytical procedures. The operating effectiveness of controls over non-financial information ma ...

Managing Financial Aspects of a Business

... Going Concern – The financial statements are normally prepared on the assumption that an enterprise is a going concern and will continue in operation for the foreseeable future. Hence it is assumed that the entity has neither the intention nor the need to liquidate or curtail materially the scale of ...

... Going Concern – The financial statements are normally prepared on the assumption that an enterprise is a going concern and will continue in operation for the foreseeable future. Hence it is assumed that the entity has neither the intention nor the need to liquidate or curtail materially the scale of ...

LO 5 - Test Banks Shop

... Enron: an economic entity decision as to whether various entities, under the control of Enron, be included in the company’s financial statements WorldCom: the decision as to whether certain costs should have been treated as expenses rather than assets Accounting firms’ independence is question ...

... Enron: an economic entity decision as to whether various entities, under the control of Enron, be included in the company’s financial statements WorldCom: the decision as to whether certain costs should have been treated as expenses rather than assets Accounting firms’ independence is question ...

Companies Act 2014 - Audit reports

... financial statements give a true and fair view solely on the basis that the financial statements were prepared in accordance with accounting standards and any other applicable legal requirements.’ - paragraph 18, ISA 700 (UK and Ireland) ‘The independent auditor’s report on financial statements’ ISA ...

... financial statements give a true and fair view solely on the basis that the financial statements were prepared in accordance with accounting standards and any other applicable legal requirements.’ - paragraph 18, ISA 700 (UK and Ireland) ‘The independent auditor’s report on financial statements’ ISA ...

Audited Financial Statements

... States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to expres ...

... States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to expres ...

Amendments to Prospective Financial Statements

... Zealand Additional Disclosures (paragraphs 11.1 and 11.2) are relevant. This Standard requires that an entity present a complete set of prospective financial statements for the usual annual reporting period of the entity. This requirement assists entities to meet the requirements of other standards ...

... Zealand Additional Disclosures (paragraphs 11.1 and 11.2) are relevant. This Standard requires that an entity present a complete set of prospective financial statements for the usual annual reporting period of the entity. This requirement assists entities to meet the requirements of other standards ...

NHC Financial Statements

... with accounting principles generally accepted in the United States of America. This includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or err ...

... with accounting principles generally accepted in the United States of America. This includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or err ...

Role of a Board Member in Financial Oversight

... – Are we overly dependent on a single funding source? – Is revenue increasing at least as fast as expenses? – Did our bottom line meet expectations? ...

... – Are we overly dependent on a single funding source? – Is revenue increasing at least as fast as expenses? – Did our bottom line meet expectations? ...

Module 5 – Understanding the Basic Elements of School Board

... To recommend, to the Board of Trustees, the approval of the annual audited financial statements ...

... To recommend, to the Board of Trustees, the approval of the annual audited financial statements ...

Financial Accounting and Accounting Standards

... satisfactory income? 3. Which product line is most profitable? 4. Is cash sufficient to pay dividends to the stockholders? 5. What price for our product will maximize net income? 6. Will the company be able to pay its short-term debts? Chapter ...

... satisfactory income? 3. Which product line is most profitable? 4. Is cash sufficient to pay dividends to the stockholders? 5. What price for our product will maximize net income? 6. Will the company be able to pay its short-term debts? Chapter ...

Chapter 5

... • Full disclosure (transparency) – Financial statements must present all information relevant to users’ understanding of the statements – Explanatory notes disclosing changes in account procedures, or significant events occurring after balance sheet dates ...

... • Full disclosure (transparency) – Financial statements must present all information relevant to users’ understanding of the statements – Explanatory notes disclosing changes in account procedures, or significant events occurring after balance sheet dates ...

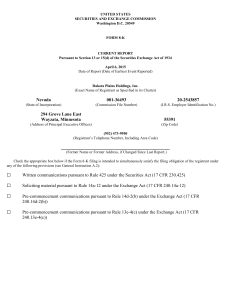

DAKOTA PLAINS HOLDINGS, INC. (Form: 8

... BDO’s reports on the Company’s consolidated financial statements for the fiscal years ended December 31, 2014 and 2013 do not contain an adverse opinion or a disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope, or accounting principles. During the Compan ...

... BDO’s reports on the Company’s consolidated financial statements for the fiscal years ended December 31, 2014 and 2013 do not contain an adverse opinion or a disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope, or accounting principles. During the Compan ...

Contrapartida

... detectar el fraude. Según señala el párrafo 3 de la Norma Internacional de Auditoría 240 - The auditor’s responsibilities relating to fraud in an audit of financial statements- “(…) Two types of intentional misstatements are relevant to the auditor – misstatements resulting from fraudulent financial ...

... detectar el fraude. Según señala el párrafo 3 de la Norma Internacional de Auditoría 240 - The auditor’s responsibilities relating to fraud in an audit of financial statements- “(…) Two types of intentional misstatements are relevant to the auditor – misstatements resulting from fraudulent financial ...

balance sheet or statement of financial position

... presented "except for" items which the auditor discloses; an adverse opinion is issued when the financial statements have departures from GAAP so numerous that the statements are not presented fairly. A disclaimer of opinion is caused by a 2|Page ...

... presented "except for" items which the auditor discloses; an adverse opinion is issued when the financial statements have departures from GAAP so numerous that the statements are not presented fairly. A disclaimer of opinion is caused by a 2|Page ...

FY 2004-2005 - FSM National Public Auditor

... As part of obtaining reasonable assurance about whether the Corporation’s financial statements are free of material misstatement, I performed tests of its compliance with certain provisions of laws, regulations, contracts and grants, noncompliance with which could have a direct and material effect o ...

... As part of obtaining reasonable assurance about whether the Corporation’s financial statements are free of material misstatement, I performed tests of its compliance with certain provisions of laws, regulations, contracts and grants, noncompliance with which could have a direct and material effect o ...

Financial Accounting and Accounting Standards

... United States regulators and lawmakers were very concerned that the economy would suffer if investors lost confidence in corporate accounting because of unethical financial reporting. ...

... United States regulators and lawmakers were very concerned that the economy would suffer if investors lost confidence in corporate accounting because of unethical financial reporting. ...