FY2011 Compilation Report from the accountants

... Our responsibility is to conduct the compilation in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants. The objective of a compilation is to assist management in presenting financial information in the form of f ...

... Our responsibility is to conduct the compilation in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants. The objective of a compilation is to assist management in presenting financial information in the form of f ...

MANDATORY EMPHASIS PARAGRAPHS, CLARIFYING

... condition, the audit report did not include a critical audit matter paragraph. Given that any modifications to the audit report are useful only when they provide new information that is not available in the financial statements (Mock et al. 2013), we examine whether the disclosure of a ...

... condition, the audit report did not include a critical audit matter paragraph. Given that any modifications to the audit report are useful only when they provide new information that is not available in the financial statements (Mock et al. 2013), we examine whether the disclosure of a ...

NewsRelease - Lydall Inc.

... of 1995. Any statements contained in this press release that are not statements of historical fact, including statements related to the expected timetable for integrating the acquisition, expected benefits of the acquisition, estimated annual cost savings, expectations of the acquisition’s impact on ...

... of 1995. Any statements contained in this press release that are not statements of historical fact, including statements related to the expected timetable for integrating the acquisition, expected benefits of the acquisition, estimated annual cost savings, expectations of the acquisition’s impact on ...

DOC

... U.S. generally accepted accounting principles; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. Auditor's Responsibility Our re ...

... U.S. generally accepted accounting principles; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. Auditor's Responsibility Our re ...

Century Park Pictures Corporation

... The Company follows the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America and has adopted a year-end of September 30. The preparation of financial statements in conformity with accounting principles generally accepted in the Unite ...

... The Company follows the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America and has adopted a year-end of September 30. The preparation of financial statements in conformity with accounting principles generally accepted in the Unite ...

ARATANA THERAPEUTICS, INC. AUDIT COMMITTEE CHARTER

... Notwithstanding the foregoing, the Committee’s responsibilities are limited to oversight. Management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements as well as the Company’s financial reporting process, accounting policies, internal ...

... Notwithstanding the foregoing, the Committee’s responsibilities are limited to oversight. Management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements as well as the Company’s financial reporting process, accounting policies, internal ...

Developing a Cost Accounting System for First Government Contract

... ledger. The company’s accounting system was rejected by DCAA during an audit, and the foreign entity requested our services to remedy audit findings and assist in developing new or amending existing cost accounting capabilities. The client was under pressure to have in place an acceptable accounting ...

... ledger. The company’s accounting system was rejected by DCAA during an audit, and the foreign entity requested our services to remedy audit findings and assist in developing new or amending existing cost accounting capabilities. The client was under pressure to have in place an acceptable accounting ...

Auditor Liability and Professional Skepticism: A Look at Lehman

... prepared by company management, followed by the expression of opinions as to whether those financial statements have been fairly presented in accordance with a stated basis of accounting, such as U.S. GAAP or IFRS.1 ...

... prepared by company management, followed by the expression of opinions as to whether those financial statements have been fairly presented in accordance with a stated basis of accounting, such as U.S. GAAP or IFRS.1 ...

2012 News - GoldQuest Corporation

... exploration success, continued availability of capital and financing and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the for ...

... exploration success, continued availability of capital and financing and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the for ...

Chapter 1 - Class notes file from textbook

... How does “interperiod equity” relate to accountability? Interperiod equity is a government’s obligation to disclose whether current-year revenues were sufficient to pay for current-year benefits—or did current citizens defer payments to future taxpayers? It is important to understand this concept of ...

... How does “interperiod equity” relate to accountability? Interperiod equity is a government’s obligation to disclose whether current-year revenues were sufficient to pay for current-year benefits—or did current citizens defer payments to future taxpayers? It is important to understand this concept of ...

internal-auditing-instructional-material

... Work is to be adequately planned Assistants are to be properly supervised A review is to be made of compliance with applicable laws & regulation During the audit, a study and evaluation shall be made of internal control systemadmin control ) applicable to the organization program, activity, or funct ...

... Work is to be adequately planned Assistants are to be properly supervised A review is to be made of compliance with applicable laws & regulation During the audit, a study and evaluation shall be made of internal control systemadmin control ) applicable to the organization program, activity, or funct ...

Syllabus - Institute of Credit Management

... The T account format and ‘balancing’ accounts should not be taught. Ledger accounts should be explained and presented instead using the continuous running account balance format. As computerised accounts are produced in this way CICM learners are already likely to have some experience of the continu ...

... The T account format and ‘balancing’ accounts should not be taught. Ledger accounts should be explained and presented instead using the continuous running account balance format. As computerised accounts are produced in this way CICM learners are already likely to have some experience of the continu ...

Approved form - Australian Prudential Regulation Authority

... period .../.../... to .../.../...] (*) (only to the extent that they reflect the information required by paragraph 66 of Australian Accounting Standard AAS 25 Financial Reporting by Superannuation Plans) [delete as necessary]. My auditor’s report on the financial statements was signed on ……/……/……[in ...

... period .../.../... to .../.../...] (*) (only to the extent that they reflect the information required by paragraph 66 of Australian Accounting Standard AAS 25 Financial Reporting by Superannuation Plans) [delete as necessary]. My auditor’s report on the financial statements was signed on ……/……/……[in ...

AASB 2005-10 Amendments to Australian Accounting Standards

... Under this Standard the disclosure requirements in AASB 132 are deleted. AASB 132 continues to contain the requirements for the presentation of financial instruments. Further, the issuance of AASB 7 and the amendments to AASB 132, outlined above, necessitate additional consequential amendments to AA ...

... Under this Standard the disclosure requirements in AASB 132 are deleted. AASB 132 continues to contain the requirements for the presentation of financial instruments. Further, the issuance of AASB 7 and the amendments to AASB 132, outlined above, necessitate additional consequential amendments to AA ...

Lesson 1 PowerPoint

... Fair Value – measurement is based on the price that would be received to sell assets or transfer liabilities in an orderly market transaction ...

... Fair Value – measurement is based on the price that would be received to sell assets or transfer liabilities in an orderly market transaction ...

APES 205 Conformity with Accounting Standards

... (whether as standards or as guidance) by the AUASB, to the extent that they are not inconsistent with the AUASB standards. Australian Accounting Standards means the Accounting Standards (including Australian Accounting Interpretations) promulgated by the AASB. Australian Financial Reporting Framewor ...

... (whether as standards or as guidance) by the AUASB, to the extent that they are not inconsistent with the AUASB standards. Australian Accounting Standards means the Accounting Standards (including Australian Accounting Interpretations) promulgated by the AASB. Australian Financial Reporting Framewor ...

the accounting process

... Accounting Process • Simplifies the accounting process by automating data entry and calculations. • Software available to handle accounting information for international businesses. ...

... Accounting Process • Simplifies the accounting process by automating data entry and calculations. • Software available to handle accounting information for international businesses. ...

FINANCIAL STATEMENTS DECEMBER 31, 2015 toge

... accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to f ...

... accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to f ...

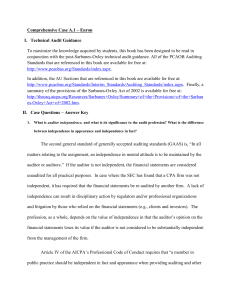

Comprehensive Case A.1 – Enron

... actually relates to the financial statement assertion being tested. That is, will the evidence allow the auditor to reach conclusions related to that financial statement assertion? The reliability of the evidence specifically relates to whether the evidence gathered can truly be relied upon as provi ...

... actually relates to the financial statement assertion being tested. That is, will the evidence allow the auditor to reach conclusions related to that financial statement assertion? The reliability of the evidence specifically relates to whether the evidence gathered can truly be relied upon as provi ...

Document

... Low transaction costs – The price paid to buy/sell the good requires few operational resources to complete the transaction. Organized and regulated – The market in which the good is traded has standard definitions for making transactions and is open to new, ...

... Low transaction costs – The price paid to buy/sell the good requires few operational resources to complete the transaction. Organized and regulated – The market in which the good is traded has standard definitions for making transactions and is open to new, ...

Chapter 2

... • The guidelines used to prepare and maintain financial records and reports are known as generally accepted accounting principles (GAAP). • GAAP is authorized by the Financial Accounting Standards Board (FASB). • The Sarbanes-Oxley Act of 2002, passed to eliminate the many disclosure and conflict of ...

... • The guidelines used to prepare and maintain financial records and reports are known as generally accepted accounting principles (GAAP). • GAAP is authorized by the Financial Accounting Standards Board (FASB). • The Sarbanes-Oxley Act of 2002, passed to eliminate the many disclosure and conflict of ...

Financial Accounting..

... SYLLABUS FINANCIAL ACCOUNTING 3, ZIMBABWE In Financial Accounting 2, students are required to show familiarity with and competence in certain topics, mostly related to company accounts. With the admission of the Istitute into the Zimbabwe public Accountants and Auditors Board, IAC graduates in Accou ...

... SYLLABUS FINANCIAL ACCOUNTING 3, ZIMBABWE In Financial Accounting 2, students are required to show familiarity with and competence in certain topics, mostly related to company accounts. With the admission of the Istitute into the Zimbabwe public Accountants and Auditors Board, IAC graduates in Accou ...

1. Accountants refer to an economic event as a a. purchase. b. sale

... A post-closing trial balance will show a. only permanent account balances. b. only temporary account balances. c. zero balances for all accounts. d. the amount of net income (or loss) for the period. ...

... A post-closing trial balance will show a. only permanent account balances. b. only temporary account balances. c. zero balances for all accounts. d. the amount of net income (or loss) for the period. ...

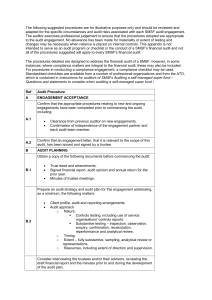

Illustrative financial audit procedures for a self

... instances, where compliance matters are integral to the financial audit, these may also be included. For procedures in conducting a compliance engagement, a compliance checklist may be used. Standardised checklists are available from a number of professional organisations and from the ATO, which is ...

... instances, where compliance matters are integral to the financial audit, these may also be included. For procedures in conducting a compliance engagement, a compliance checklist may be used. Standardised checklists are available from a number of professional organisations and from the ATO, which is ...

Audit change data shows differences at Big 4 firms

... while three others have seen net losses numbering in the 20s. Data assembled by Audit Analytics based on public company disclosures of audit firm changes shows Deloitte has held relatively steady for the past few years. The firm has lost no more clients than it has picked up, to end both years with ...

... while three others have seen net losses numbering in the 20s. Data assembled by Audit Analytics based on public company disclosures of audit firm changes shows Deloitte has held relatively steady for the past few years. The firm has lost no more clients than it has picked up, to end both years with ...