Submission - Review of the managed investments act 1998

... three or more individuals, a majority of whom are independent of the fund manager, the governance agency would owe its allegiance to investors and would be responsible for ensuring that the fund manager acts in the best interests of investors. “Most Canadian mutual fund investors currently have neit ...

... three or more individuals, a majority of whom are independent of the fund manager, the governance agency would owe its allegiance to investors and would be responsible for ensuring that the fund manager acts in the best interests of investors. “Most Canadian mutual fund investors currently have neit ...

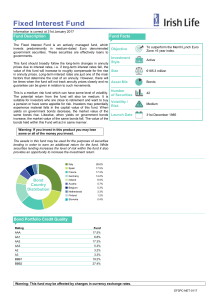

Fixed Interest Fund - Irish Life Corporate Business

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

MANULIFE HIGH YIELD BOND FUND

... value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be ...

... value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be ...

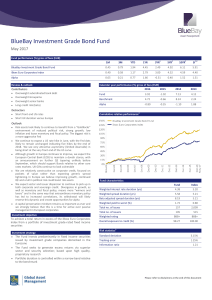

BlueBay Investment Grade Bond Fund

... 3. Risk statistics are annualized and calculated using weekly data points since inception. Risk statistics will be produced once there are 3 complete months of data available; for meaningful results a minimum sample of 36 data points is recommended and where history is less than 3 years caution shou ...

... 3. Risk statistics are annualized and calculated using weekly data points since inception. Risk statistics will be produced once there are 3 complete months of data available; for meaningful results a minimum sample of 36 data points is recommended and where history is less than 3 years caution shou ...

global health investment fund

... leading cause of death from a single infectious agent, after the human immunodeficiency virus (HIV). The TB bacteria usually attack the lungs, but can attack any part of the body such as the kidney, spine, and brain ...

... leading cause of death from a single infectious agent, after the human immunodeficiency virus (HIV). The TB bacteria usually attack the lungs, but can attack any part of the body such as the kidney, spine, and brain ...

Summary of Investments

... with the access and passwords to the account, we are no longer authorized access to these balances. The NCMF Board recently voted to make distributions from the fund based on 3% of the running 3-year average of the year-end fund balance. These distributions are made quarterly. The Dale Fund was esta ...

... with the access and passwords to the account, we are no longer authorized access to these balances. The NCMF Board recently voted to make distributions from the fund based on 3% of the running 3-year average of the year-end fund balance. These distributions are made quarterly. The Dale Fund was esta ...

Epoch Global Equity Shareholder Yield Fund Institutional Class

... Gross Expense and Net Expense Ratios are taken from the most recent prospectus. Actual Expense Ratio is historical and annualized based on the six-month period ending 01/31/2017 as calculated in the most recent annual report. The Net Expense Ratio represents the amount that will be paid by the inves ...

... Gross Expense and Net Expense Ratios are taken from the most recent prospectus. Actual Expense Ratio is historical and annualized based on the six-month period ending 01/31/2017 as calculated in the most recent annual report. The Net Expense Ratio represents the amount that will be paid by the inves ...

Field of Interest Fund Agreement

... The initial contribution to the Foundation for the Fund will not be less than $25,000, in cash or in property acceptable to the Foundation. Subsequent contributions made to the Fund by Donor(s) or others, and designated for the Fund without further restriction, shall be administered in accordance wi ...

... The initial contribution to the Foundation for the Fund will not be less than $25,000, in cash or in property acceptable to the Foundation. Subsequent contributions made to the Fund by Donor(s) or others, and designated for the Fund without further restriction, shall be administered in accordance wi ...

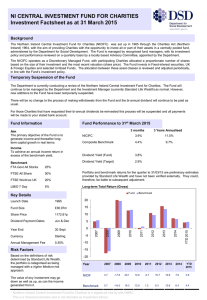

NORTHERN IRELAND CENTRAL INVESTMENT FUND FOR CHARITIES

... Ireland) 1964, with the aim of providing Charities with the opportunity to invest all or part of their assets in a centrally pooled fund, administered by the Department for Social Development. The Fund is managed by recognised fund managers, with its investment policy and performance reviewed on a q ...

... Ireland) 1964, with the aim of providing Charities with the opportunity to invest all or part of their assets in a centrally pooled fund, administered by the Department for Social Development. The Fund is managed by recognised fund managers, with its investment policy and performance reviewed on a q ...

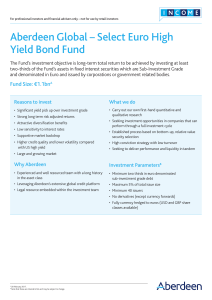

Aberdeen Global – Select Euro High Yield Bond Fund

... It does not include any initial charges or the cost of buying and selling stocks for the Funds. The Ongoing Charges figure can help you compare the annual operating expenses of different Funds. ...

... It does not include any initial charges or the cost of buying and selling stocks for the Funds. The Ongoing Charges figure can help you compare the annual operating expenses of different Funds. ...

Call: June 19, 2015 AFFIDAVIT SAMPLE Contact Person

... of [...........................................], with VAT number [...........................................], supported by the submitted documentation and in accordance with the requirements indicated on the Basis for the selection of up to two (2) growth capital management companies or self-mana ...

... of [...........................................], with VAT number [...........................................], supported by the submitted documentation and in accordance with the requirements indicated on the Basis for the selection of up to two (2) growth capital management companies or self-mana ...

global equity fund

... account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Returns for time periods of more than one year are historical annual compounded total returns while returns for time periods of one year or less are cumulative f ...

... account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Returns for time periods of more than one year are historical annual compounded total returns while returns for time periods of one year or less are cumulative f ...

View as DOCX (1) 139 KB

... This strategy has been developed in consultation between officers and the Fund's Independent Advisers. Implications: This item has the following implications, as indicated: Risk management Private equity is illiquid and increasing the allocation from 5% of assets under management (AUM) to 7.5% reduc ...

... This strategy has been developed in consultation between officers and the Fund's Independent Advisers. Implications: This item has the following implications, as indicated: Risk management Private equity is illiquid and increasing the allocation from 5% of assets under management (AUM) to 7.5% reduc ...

Investment Policy - OutServe-SLDN

... three months; and federally insured certificates of deposit not to exceed $100,000 per institution (CD maturities may exceed three months if no penalty is incurred for withdrawal of funds prior to CD’s maturity). ...

... three months; and federally insured certificates of deposit not to exceed $100,000 per institution (CD maturities may exceed three months if no penalty is incurred for withdrawal of funds prior to CD’s maturity). ...

and what can you invest in?

... • This is NOT a finance course. – This is a Management course (MANGT 566) ...

... • This is NOT a finance course. – This is a Management course (MANGT 566) ...

TEMPLETON GLOBAL SMALLER COMPANIES FUND

... base currency, include reinvested dividends and are net of management fees. Sales charges and other commissions, taxes and other relevant costs to be paid by an investor are not included in the calculations. Past performance is no guarantee of future performance. When investing in a fund denominated ...

... base currency, include reinvested dividends and are net of management fees. Sales charges and other commissions, taxes and other relevant costs to be paid by an investor are not included in the calculations. Past performance is no guarantee of future performance. When investing in a fund denominated ...

Premier Multi-Asset Distribution Fund

... Tritax Big Box REIT a UK Real Estate Investment Trust, is a London Stock Exchange (Specialist Fund Market) and Channel Islands Stock Exchange (CISX) listing. The Investment policy is to acquire and manage a high quality portfolio of Big Box logistics assets (modern distribution units typically >500, ...

... Tritax Big Box REIT a UK Real Estate Investment Trust, is a London Stock Exchange (Specialist Fund Market) and Channel Islands Stock Exchange (CISX) listing. The Investment policy is to acquire and manage a high quality portfolio of Big Box logistics assets (modern distribution units typically >500, ...

RISK FACTORS As is the case with any type of investment, hedge

... expected to develop. In addition, illiquidity of a hedge fund’s investments, held directly or indirectly, in the case of a fund of hedge funds, may prevent a fund’s management company from satisfying investor demand for redemptions. Use of leverage and other speculative investment practices Hedge fu ...

... expected to develop. In addition, illiquidity of a hedge fund’s investments, held directly or indirectly, in the case of a fund of hedge funds, may prevent a fund’s management company from satisfying investor demand for redemptions. Use of leverage and other speculative investment practices Hedge fu ...

Refinancing of 700 million euros for ARC Fund

... extends to nearly 10 years and the loan has a flexible structure, with part of the portfolio being used as security for the banks. This new facility allows Amvest, with its new investors, to safeguard the financing requirements and growth of the Amvest Residential Core fund over the next few years. ...

... extends to nearly 10 years and the loan has a flexible structure, with part of the portfolio being used as security for the banks. This new facility allows Amvest, with its new investors, to safeguard the financing requirements and growth of the Amvest Residential Core fund over the next few years. ...

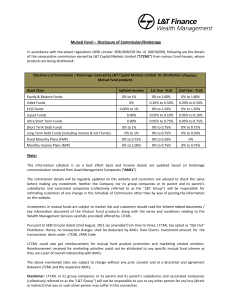

Mutual Fund – Disclosure of Commission/Brokerage Note:

... The commission details will be regularly updated on this website and customers are advised to check the same before making any investment. Neither the Company nor its group companies or its parent and its parent’s subsidiaries and associated companies (collectively referred to as the "L&T Group”) wi ...

... The commission details will be regularly updated on this website and customers are advised to check the same before making any investment. Neither the Company nor its group companies or its parent and its parent’s subsidiaries and associated companies (collectively referred to as the "L&T Group”) wi ...

Global Equity Income Fund (Unhedged)

... taxes, and differences in investment strategy and restrictions. The information contained in this update was current at time of publication. This document describes some current internal investment guidelines and processes. These are constantly under review, and may change over time. Consequently, a ...

... taxes, and differences in investment strategy and restrictions. The information contained in this update was current at time of publication. This document describes some current internal investment guidelines and processes. These are constantly under review, and may change over time. Consequently, a ...

US Dollar Currency Fund, a sub-fund of Fidelity Funds II, A-USD

... The Net Asset Values per Share are available at the registered office of the UCITS. They are also published online where other information is available. Our website is www.fidelityworldwideinvestment.com/documents. The tax legislation in Luxembourg may have an impact on your personal tax position. F ...

... The Net Asset Values per Share are available at the registered office of the UCITS. They are also published online where other information is available. Our website is www.fidelityworldwideinvestment.com/documents. The tax legislation in Luxembourg may have an impact on your personal tax position. F ...

chapter 69o-187 professional liability self

... 69O-187.005 Solvency of the Self-Insurance Trust Fund and Trustees’ Responsibilities. The Trustees of the Fund shall be responsible for all operations of the Fund and shall assure the financial stability of the operations of the Fund by taking all necessary precautions to safeguard the assets of the ...

... 69O-187.005 Solvency of the Self-Insurance Trust Fund and Trustees’ Responsibilities. The Trustees of the Fund shall be responsible for all operations of the Fund and shall assure the financial stability of the operations of the Fund by taking all necessary precautions to safeguard the assets of the ...

Georgia State University Policy 5.10.06 Endowment Funds

... Full Policy Text Endowment funds may be invested in cash and cash equivalents, U.S. Government and Agency securities, certificates of deposit, banker's acceptances, corporate bonds, commercial paper, common stocks, and pooled investment funds. Endowment funds may be invested in the Total Return Fund ...

... Full Policy Text Endowment funds may be invested in cash and cash equivalents, U.S. Government and Agency securities, certificates of deposit, banker's acceptances, corporate bonds, commercial paper, common stocks, and pooled investment funds. Endowment funds may be invested in the Total Return Fund ...