Franklin Bissett Core Plus Bond Fund

... • First C$200,000 to under $2.5M – 0.60% • Next C$2.5M to under $5M – 0.50% • C$5M and over – 0.40% Certain institutional investors may negotiate the management and administration fee by written agreement with Franklin Templeton. ...

... • First C$200,000 to under $2.5M – 0.60% • Next C$2.5M to under $5M – 0.50% • C$5M and over – 0.40% Certain institutional investors may negotiate the management and administration fee by written agreement with Franklin Templeton. ...

JPMorgan Funds - Emerging Markets Local Currency

... Past performance is not indicative of future performance and investors may not get back the full or any part of the amount invested. Dividend distributions if any are not guaranteed and are made at the manager's discretion. Fund's net asset value may likely have high volatility due to its investment ...

... Past performance is not indicative of future performance and investors may not get back the full or any part of the amount invested. Dividend distributions if any are not guaranteed and are made at the manager's discretion. Fund's net asset value may likely have high volatility due to its investment ...

Policy Statement The SET Code of Best Practice for Directors of

... The Stock Exchange of Thailand’s (SET) Code of Best Practice for the Directors of Listed Companies’ are not a legal requirement but should be considered guidelines for all board members concerning their behavior while holding such appointments. The SET believes that management under these guidelines ...

... The Stock Exchange of Thailand’s (SET) Code of Best Practice for the Directors of Listed Companies’ are not a legal requirement but should be considered guidelines for all board members concerning their behavior while holding such appointments. The SET believes that management under these guidelines ...

Ph - Edelweiss Financial Services

... In the preparation of the material contained in this document, Edelweiss has used information that is publicly available, including information developed in‐house Information gathered & material used in this document is believed to be from reliable sources and is given in good faith. Edelweiss howev ...

... In the preparation of the material contained in this document, Edelweiss has used information that is publicly available, including information developed in‐house Information gathered & material used in this document is believed to be from reliable sources and is given in good faith. Edelweiss howev ...

Goldman Sachs Emerging Markets CORE® Equity Portfolio

... This material is a financial promotion and has been issued by Goldman Sachs International, authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Furthermore, this information should not be construed as financial rese ...

... This material is a financial promotion and has been issued by Goldman Sachs International, authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Furthermore, this information should not be construed as financial rese ...

United Kingdom: Gateway to Royalty

... Source: GMI Ratings (formerly, GovernanceMetrics International) — Country Rankings as of September 27, 2010 ...

... Source: GMI Ratings (formerly, GovernanceMetrics International) — Country Rankings as of September 27, 2010 ...

Changes to your fund line up

... To help ensure that the Bechtel Canada Retirement Plan continues to meet the needs of its members, the plan’s funds, features, and design are reviewed regularly. As a result of the most recent review, changes are being made to the funds in the program. New fund now available ...

... To help ensure that the Bechtel Canada Retirement Plan continues to meet the needs of its members, the plan’s funds, features, and design are reviewed regularly. As a result of the most recent review, changes are being made to the funds in the program. New fund now available ...

Document in Word format - Hong Kong Monetary Authority

... managed by their respective managers, and investors should consider all risks before investing in these funds, as with other investment products. The trading price of the PAIF and other funds may rise or fall according to the demand and supply of the units of the funds in the market, while the net a ...

... managed by their respective managers, and investors should consider all risks before investing in these funds, as with other investment products. The trading price of the PAIF and other funds may rise or fall according to the demand and supply of the units of the funds in the market, while the net a ...

Columbia Contrarian Core Fund

... Expense ratios are generally based on the fund's most recently completed fiscal year and are not adjusted for current asset levels or other changes. In general, expense ratios increase as net assets decrease. See the fund's prospectus for additional details. Sector weightings are as of the date give ...

... Expense ratios are generally based on the fund's most recently completed fiscal year and are not adjusted for current asset levels or other changes. In general, expense ratios increase as net assets decrease. See the fund's prospectus for additional details. Sector weightings are as of the date give ...

Solvay Business School

... (4.1) Explain why beta is the relevant measure of risk in this model. Why not use the standard deviation of the return on that stock. (4.2) What is the market portfolio? Why does this portfolio play an central role in the CAPM? (4.3) Draw a graph showing how the expected return varies with beta. (4. ...

... (4.1) Explain why beta is the relevant measure of risk in this model. Why not use the standard deviation of the return on that stock. (4.2) What is the market portfolio? Why does this portfolio play an central role in the CAPM? (4.3) Draw a graph showing how the expected return varies with beta. (4. ...

Empirical Research: The Discontinuity in Pooled Distribution

... months that fund returns are positive. So the desire to consistently achieve positive returns in any market environment may induce mutual fund managers not to report losses. They may report small positive returns when they actually suffer losses. 3.2. Further Empirical Evidence Before accepting the ...

... months that fund returns are positive. So the desire to consistently achieve positive returns in any market environment may induce mutual fund managers not to report losses. They may report small positive returns when they actually suffer losses. 3.2. Further Empirical Evidence Before accepting the ...

coronation global managed fund

... to macroeconomic, settlement, political, tax, reporting or illiquidity risk factors that may be different to similar investments in the South African markets. Fluctuations or movements in exchange rates may cause the value of underlying investments to go up or down. Coronation reserves the right to ...

... to macroeconomic, settlement, political, tax, reporting or illiquidity risk factors that may be different to similar investments in the South African markets. Fluctuations or movements in exchange rates may cause the value of underlying investments to go up or down. Coronation reserves the right to ...

EMBARGOED UNTIL 9AM GMT 19.3.2015 European investors

... Exclude high-carbon projects from funding consideration. The EU’s 2030 framework must guide all investment support provided through the EFSI. All projects should be assessed according to their fit with a low-carbon economy. Consider an EU-level mechanism to mitigate risk from retroactive policy chan ...

... Exclude high-carbon projects from funding consideration. The EU’s 2030 framework must guide all investment support provided through the EFSI. All projects should be assessed according to their fit with a low-carbon economy. Consider an EU-level mechanism to mitigate risk from retroactive policy chan ...

COMMISSION ON AUDIT CIRCULAR NO. 89-313

... A monthly trial balance of the Fund shall be prepared and submitted to the Resident Auditor of the NAMRIA for verification and audit. A copy of the Quarterly and Year-end trial balances/together with the Status Report of the Fund, shall be submitted to the Accountancy Office of this Commission not l ...

... A monthly trial balance of the Fund shall be prepared and submitted to the Resident Auditor of the NAMRIA for verification and audit. A copy of the Quarterly and Year-end trial balances/together with the Status Report of the Fund, shall be submitted to the Accountancy Office of this Commission not l ...

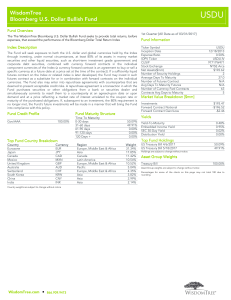

WisdomTree Bloomberg U.S. Dollar Bullish Fund

... Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. While the Fund attempts ...

... Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. While the Fund attempts ...

BEPS Action 6 – Discussion Draft on non-CIV examples

... Example [XX]: PAF, a Private Asset Fund is a State C based partnership treated as fiscally transparent under the domestic tax law of State C. RCo, a company resident of State R, is a wholly-owned subsidiary of PAF and operates exclusively to generate an investment return as the regional investment p ...

... Example [XX]: PAF, a Private Asset Fund is a State C based partnership treated as fiscally transparent under the domestic tax law of State C. RCo, a company resident of State R, is a wholly-owned subsidiary of PAF and operates exclusively to generate an investment return as the regional investment p ...

Investing in Bond Funds

... Hedge funds are investment vehicles that started to gain recognition in the late 1980s and experienced significant growth in the 1990s. They are “funds” in the sense that their managers pool money from investors and invest it, but their investment strategies are quite different from those of traditi ...

... Hedge funds are investment vehicles that started to gain recognition in the late 1980s and experienced significant growth in the 1990s. They are “funds” in the sense that their managers pool money from investors and invest it, but their investment strategies are quite different from those of traditi ...

6020 - Mansfield School District

... transfer surplus investment earnings from the DSF to any other school district fund; provided that, such investment earnings are spent only for instructional supplies, equipment or capital outlay purposes. The district may transfer such investment earnings to other school district funds unless the r ...

... transfer surplus investment earnings from the DSF to any other school district fund; provided that, such investment earnings are spent only for instructional supplies, equipment or capital outlay purposes. The district may transfer such investment earnings to other school district funds unless the r ...

LU0028118809

... views and opinions, these may change and are not to be construed as investment advice. If investors are unsure if this product is suitable for them, they should seek advice from a financial adviser. The distribution and the offering of the fund or its share classes in certain jurisdictions may be re ...

... views and opinions, these may change and are not to be construed as investment advice. If investors are unsure if this product is suitable for them, they should seek advice from a financial adviser. The distribution and the offering of the fund or its share classes in certain jurisdictions may be re ...

FCA 2017/3 ALTERNATIVE INVESTMENT FUND MANAGERS

... the convenience of readers but does not form part of the legislative text. ...

... the convenience of readers but does not form part of the legislative text. ...

ab global high yield portfolio

... described in the Fund’s prospectus. Prospective investors should read the prospectus carefully and discuss risk and the fund’s fees and charges with their financial adviser to determine if the investment is appropriate for them. This financial promotion is directed solely at persons in jurisdictions ...

... described in the Fund’s prospectus. Prospective investors should read the prospectus carefully and discuss risk and the fund’s fees and charges with their financial adviser to determine if the investment is appropriate for them. This financial promotion is directed solely at persons in jurisdictions ...

Banque de Luxembourg

... "One distinguishing characteristic of family businesses is that they are not driven by short-term financial objectives. Because of the family’s commitment to the next generation, the company naturally develops a long-term strategy with an underlying desire for continuity and resilience over time. Of ...

... "One distinguishing characteristic of family businesses is that they are not driven by short-term financial objectives. Because of the family’s commitment to the next generation, the company naturally develops a long-term strategy with an underlying desire for continuity and resilience over time. Of ...

Risk Management and Financial Institutions

... Risk Management and Financial Institutions 2e, Chapter 4, Copyright © John C. Hull 2009 ...

... Risk Management and Financial Institutions 2e, Chapter 4, Copyright © John C. Hull 2009 ...

Investment Policy Statement Employees

... MB may provide the IC the necessary guidance from time to time, in relation to the composition of securities, the maturity structure of the portfolio and risk-return profile of the investment portfolio. In accordance with such guidance, the IC would assess the market conditions and investment climat ...

... MB may provide the IC the necessary guidance from time to time, in relation to the composition of securities, the maturity structure of the portfolio and risk-return profile of the investment portfolio. In accordance with such guidance, the IC would assess the market conditions and investment climat ...

Chapter 3

... • Serve as “watchdogs” for fund shareholders • Key role: negotiate and approve annual management contact with fund’s investment adviser – Rarely fire a fund’s adviser – May negotiate for lower fees and better services ...

... • Serve as “watchdogs” for fund shareholders • Key role: negotiate and approve annual management contact with fund’s investment adviser – Rarely fire a fund’s adviser – May negotiate for lower fees and better services ...