1 - Member and Committee Information

... underweight its customised benchmark and its peers in the best performing asset groups (Property & Alternatives) and overweight in Equities which performed much poorer. The above graph also shows the difference in returns between the average fund and Teesside Fund. As well as asset allocation decisi ...

... underweight its customised benchmark and its peers in the best performing asset groups (Property & Alternatives) and overweight in Equities which performed much poorer. The above graph also shows the difference in returns between the average fund and Teesside Fund. As well as asset allocation decisi ...

Fidelity® VIP Growth Portfolio — Service Class 2

... Investment Strategy from investment’s prospectus The investment seeks to achieve capital appreciation. The fund primarily invests in common stocks. It invests in companies that the adviser believes have above-average growth potential (stocks of these companies are often called "growth" stocks). The ...

... Investment Strategy from investment’s prospectus The investment seeks to achieve capital appreciation. The fund primarily invests in common stocks. It invests in companies that the adviser believes have above-average growth potential (stocks of these companies are often called "growth" stocks). The ...

Measuring Risk Adjusted Return (Sharpe Ratio) of the Selected

... players for business. Gradually, almost all sectors of Indian economy were opened one by one and many are in pipeline. Financial sector was also one of the part of it. Indian capital market has observed so many fundamental changes by SEBI. In earlier times there were only few investment options avai ...

... players for business. Gradually, almost all sectors of Indian economy were opened one by one and many are in pipeline. Financial sector was also one of the part of it. Indian capital market has observed so many fundamental changes by SEBI. In earlier times there were only few investment options avai ...

HERMES GLOBAL HIGH YIELD BOND FUND

... If you are in any doubt about the contents of this Supplement, you should consult your stockbroker, bank manager, solicitor, accountant or other independent financial adviser. The Directors of the Company, whose names appear under the heading “Management and Administration” in the Prospectus dated 1 ...

... If you are in any doubt about the contents of this Supplement, you should consult your stockbroker, bank manager, solicitor, accountant or other independent financial adviser. The Directors of the Company, whose names appear under the heading “Management and Administration” in the Prospectus dated 1 ...

Investment Companies Insights

... benefits of active management and a long term investment horizon. The total return on assets in 2016 was 17.1 percent and over 10 and 20 years the return were 8.3 percent and 9.5 percent. The return was helped by weightings to global equities, property, private equity and timber. As well as a long-t ...

... benefits of active management and a long term investment horizon. The total return on assets in 2016 was 17.1 percent and over 10 and 20 years the return were 8.3 percent and 9.5 percent. The return was helped by weightings to global equities, property, private equity and timber. As well as a long-t ...

Investment Update February 2011

... We estimate that the Australian Enhanced Income Fund’s total return will be approximately 13.0% per annum over the next 12 months and beyond. Our estimates are based on an average credit term of the Fund, assumes no defaults on coupon and principal payments and that discounts (i.e the difference bet ...

... We estimate that the Australian Enhanced Income Fund’s total return will be approximately 13.0% per annum over the next 12 months and beyond. Our estimates are based on an average credit term of the Fund, assumes no defaults on coupon and principal payments and that discounts (i.e the difference bet ...

winfield police pension fund

... markets should also move higher and give the Winfield equity portfolio a “boost.” Bonds yields are still at historic low yield levels and if interest rates rise, bond prices will produce yields in the 1% to 2% range for the foreseeable future. Carl Sorgatz questioned the loss of money due to gold be ...

... markets should also move higher and give the Winfield equity portfolio a “boost.” Bonds yields are still at historic low yield levels and if interest rates rise, bond prices will produce yields in the 1% to 2% range for the foreseeable future. Carl Sorgatz questioned the loss of money due to gold be ...

Investor Brochure - Mackenzie Global Low Volatility Fund

... Irish Life Investment Managers (ILIM) has approximately $80 billion in assets under management and a client base of more than 3,000 employer-sponsored pension plans and 700,000 individuals. ILIM focuses on delivering a market return for clients while reducing volatility and minimizing the portfolio ...

... Irish Life Investment Managers (ILIM) has approximately $80 billion in assets under management and a client base of more than 3,000 employer-sponsored pension plans and 700,000 individuals. ILIM focuses on delivering a market return for clients while reducing volatility and minimizing the portfolio ...

NBI Municipal Bond Plus Private Portfolio - Series

... The fund's investment objective is to provide high income. The fund invests directly, or through investments in securities of other mutual funds, in a portfolio composed mainly of Canadian municipal bonds denominated in Canadian dollars. The fund also invests in other fixed income securities in orde ...

... The fund's investment objective is to provide high income. The fund invests directly, or through investments in securities of other mutual funds, in a portfolio composed mainly of Canadian municipal bonds denominated in Canadian dollars. The fund also invests in other fixed income securities in orde ...

Nuveen Small Cap Value Fund

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund's investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility t ...

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund's investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility t ...

Jersey Listed Funds

... Annual fees are payable in relation to a fund which holds a Fund Certificate. The amount depends on the total number of pools of assets in the fund at the time the fee is payable (this ranges from £3,000 if there is only one pool of assets to £29,860 if there are 200 or more pools of assets). Statut ...

... Annual fees are payable in relation to a fund which holds a Fund Certificate. The amount depends on the total number of pools of assets in the fund at the time the fee is payable (this ranges from £3,000 if there is only one pool of assets to £29,860 if there are 200 or more pools of assets). Statut ...

OCBSFFund1qtr2014 copy

... stimulus we saw the trend of flows reverse and this continued during the past quarter with inflows into global equities, specifically developed market equities, and outflows from global bonds. Global pension funds have increased their allocation towards equities, however it is still below the long t ...

... stimulus we saw the trend of flows reverse and this continued during the past quarter with inflows into global equities, specifically developed market equities, and outflows from global bonds. Global pension funds have increased their allocation towards equities, however it is still below the long t ...

the presentation

... This presentation is made only for informational and academic purpose. This presentation neither constitutes an offer to sell nor a solicitation to invest in any of the funds managed by Andrew Weiss (collectively, the “Funds”). Solicitations to invest in the Funds are made only by means of a confide ...

... This presentation is made only for informational and academic purpose. This presentation neither constitutes an offer to sell nor a solicitation to invest in any of the funds managed by Andrew Weiss (collectively, the “Funds”). Solicitations to invest in the Funds are made only by means of a confide ...

Personal Strategy Balanced Portfolio

... price fluctuates, which means you could lose money by investing in the fund. The fund has partial exposure to a variety of risks in proportion to the amount it invests in stocks, bonds, and money market securities. The principal risks of investing in this fund are summarized as follows: Active manag ...

... price fluctuates, which means you could lose money by investing in the fund. The fund has partial exposure to a variety of risks in proportion to the amount it invests in stocks, bonds, and money market securities. The principal risks of investing in this fund are summarized as follows: Active manag ...

ABP will explicitly integrate extrafinancial information in its regular

... Rob Lake Head of Sustainability Vereniging van Pensioenrecht, 4 March 2008 ...

... Rob Lake Head of Sustainability Vereniging van Pensioenrecht, 4 March 2008 ...

Nuveen High Yield Municipal Bond Fund

... holder of the associated floating rate security, and therefore this presentation may not be fully consistent with generally accepted accounting principles. 3 The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. The Taxable-Equivalent Y ...

... holder of the associated floating rate security, and therefore this presentation may not be fully consistent with generally accepted accounting principles. 3 The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. The Taxable-Equivalent Y ...

No. 11 Guidelines for Endowment Fund–Structure and Operating

... chair annually. The Church Treasurer will be an ex officio member of the Endowment Fund Trustees (from the by-laws). 2. Prior to accepting any endowment, the Endowment Fund Trustees will review all of its terms and conditions. They will then accept, reject, or attempt to renegotiate the terms of the ...

... chair annually. The Church Treasurer will be an ex officio member of the Endowment Fund Trustees (from the by-laws). 2. Prior to accepting any endowment, the Endowment Fund Trustees will review all of its terms and conditions. They will then accept, reject, or attempt to renegotiate the terms of the ...

fund facts - CI Investments

... You may be charged an investment advisory fee, the amount of which is negotiated between you and your representative and collected by us (by redeeming (without charges) a sufficient number of securities from your account on a monthly or quarterly basis). The investment advisory fee must not exceed 1 ...

... You may be charged an investment advisory fee, the amount of which is negotiated between you and your representative and collected by us (by redeeming (without charges) a sufficient number of securities from your account on a monthly or quarterly basis). The investment advisory fee must not exceed 1 ...

New Fund Manager for Bioventures

... The Bioventures Management team of Heather Sherwin and Paul Miot are pleased to announce new shareholders of the Fund Management Company. This company, whose sole responsibility is the management of the Bioventures Fund, was previously owned by Gensec Bank and Real Africa Holdings (RAH). RAH maintai ...

... The Bioventures Management team of Heather Sherwin and Paul Miot are pleased to announce new shareholders of the Fund Management Company. This company, whose sole responsibility is the management of the Bioventures Fund, was previously owned by Gensec Bank and Real Africa Holdings (RAH). RAH maintai ...

the document - Lyxor Asset Management

... The circumstances in which this publication has been produced are such that it is not appropriate to characterize it as indep endent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a research recommendation. This publication ...

... The circumstances in which this publication has been produced are such that it is not appropriate to characterize it as indep endent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a research recommendation. This publication ...

SONORO METALS CORP. (“SONORO” or the “COMPANY

... shareholder value, to ensure that Sonoro meets its obligations on an ongoing basis and that Sonoro operates in a reliable and safe manner. In performing its functions, the Board should also consider the legitimate interests that its other stakeholders may have. In overseeing the conduct of the busin ...

... shareholder value, to ensure that Sonoro meets its obligations on an ongoing basis and that Sonoro operates in a reliable and safe manner. In performing its functions, the Board should also consider the legitimate interests that its other stakeholders may have. In overseeing the conduct of the busin ...

Employing Finders and Solicitors

... effects securities transactions through U.S. jurisdictional means to register with the SEC as a brokerdealer, unless, in the case of an individual, such person is an associated person of a registered brokerdealer. In very limited circumstances, finders who are not registered broker-dealers may be us ...

... effects securities transactions through U.S. jurisdictional means to register with the SEC as a brokerdealer, unless, in the case of an individual, such person is an associated person of a registered brokerdealer. In very limited circumstances, finders who are not registered broker-dealers may be us ...

fund risks - Royal London pensions for employers and trustees

... movements in price than funds which invest in lower risk assets such as UK government bonds and cash. But over the long term higher risk funds would be expected to produce better returns than lower risk funds, although this is not guaranteed. Long-term investments Funds which invest in higher risk a ...

... movements in price than funds which invest in lower risk assets such as UK government bonds and cash. But over the long term higher risk funds would be expected to produce better returns than lower risk funds, although this is not guaranteed. Long-term investments Funds which invest in higher risk a ...

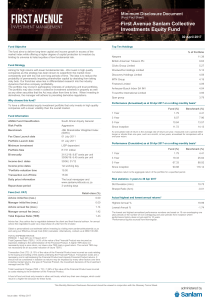

First Avenue Sanlam Collective Investments Equity Fund

... advice should always be sought before making an investment decision. The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium- to long-term investments. Please note that past performance is not necessarily a guide to futur ...

... advice should always be sought before making an investment decision. The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium- to long-term investments. Please note that past performance is not necessarily a guide to futur ...

Financial performance (WORD, 138 KB)

... Conservative Fund - to protect the value of an investor’s capital while achieving a higher return in the medium to longer term than could be achieved by solely investing in interest bearing securities Growth Trust - to provide a fully diversified investment strategy for those seeking long-term i ...

... Conservative Fund - to protect the value of an investor’s capital while achieving a higher return in the medium to longer term than could be achieved by solely investing in interest bearing securities Growth Trust - to provide a fully diversified investment strategy for those seeking long-term i ...