- Advisor To Client

... To make it easier for you to prepare meeting materials, we’ve developed these slides about the 5 types of hedge funds. The presentation is in a Word file to make it simpler to customize content to meet your clients’ information needs. ...

... To make it easier for you to prepare meeting materials, we’ve developed these slides about the 5 types of hedge funds. The presentation is in a Word file to make it simpler to customize content to meet your clients’ information needs. ...

Collective investment schemes regulations

... mutual funds and closed-end funds [2]. Mutual funds are investment companies that must register with the U.S. Securities and Exchange Commission (SEC) and, as such, are subject to rigorous regulatory oversight. Virtually every aspect of a mutual fund's structure and operation is subject to strict re ...

... mutual funds and closed-end funds [2]. Mutual funds are investment companies that must register with the U.S. Securities and Exchange Commission (SEC) and, as such, are subject to rigorous regulatory oversight. Virtually every aspect of a mutual fund's structure and operation is subject to strict re ...

The Hedge Fund Edge

... For such registered investment advisers (RIAs), one important public disclosure required under the Advisers Act is the Form ADV.13 The form has two parts. Part 1 describes the business operations of the adviser and background information about the controlling individuals. Part 2 documents the servic ...

... For such registered investment advisers (RIAs), one important public disclosure required under the Advisers Act is the Form ADV.13 The form has two parts. Part 1 describes the business operations of the adviser and background information about the controlling individuals. Part 2 documents the servic ...

comgest growth mid-caps europe

... for illustrative purposes only and are not indicative of the actual return likely to be achieved. This document is under no circumstances to be used or considered as an offer to buy any security. Under no circumstances shall it be considered as having any contractual value. Nothing herein constitute ...

... for illustrative purposes only and are not indicative of the actual return likely to be achieved. This document is under no circumstances to be used or considered as an offer to buy any security. Under no circumstances shall it be considered as having any contractual value. Nothing herein constitute ...

Frequently Asked Questions:

... analysis seeks to identify profitable companies with superior environmental management capabilities, best-of-class relationships with employees and communities, and outstanding corporate governance. Responsible investors generally seek the lower risk and higher returns over time that such companies ...

... analysis seeks to identify profitable companies with superior environmental management capabilities, best-of-class relationships with employees and communities, and outstanding corporate governance. Responsible investors generally seek the lower risk and higher returns over time that such companies ...

PSG Global Equity Feeder Fund Class A

... We inherently like to buy high-quality companies with attractive growth prospects, at attractive valuations. We do not consider very expensive stocks that are deemed to be defensive as low-risk investment opportunities, and we expect muted long-term performance from such stocks. Rather, we think the ...

... We inherently like to buy high-quality companies with attractive growth prospects, at attractive valuations. We do not consider very expensive stocks that are deemed to be defensive as low-risk investment opportunities, and we expect muted long-term performance from such stocks. Rather, we think the ...

Sprott Bridging Income Fund LP Overview

... memorandum and is only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Fund including its investment objective and strategies, purchase options, appli ...

... memorandum and is only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Fund including its investment objective and strategies, purchase options, appli ...

Qualified Default Investment Alternatives

... a QDIA must receive the same information (i.e., prospectuses) as participants who make their own investment elections. Participants or beneficiaries whose accounts are invested in a QDIA must have the ability to direct investments out of a QDIA at least as frequently as from other plan investments, ...

... a QDIA must receive the same information (i.e., prospectuses) as participants who make their own investment elections. Participants or beneficiaries whose accounts are invested in a QDIA must have the ability to direct investments out of a QDIA at least as frequently as from other plan investments, ...

PHASERX, INC. (Form: 8-K, Received: 08/24/2016

... On August 19, 2016 (the “Effective Date”), Richard J. Ulevitch, Ph.D. submitted his resignation as a member of the board of directors of PhaseRx, Inc. (the “Company”), which resignation became effective immediately. Dr. Ulevitch’s resignation was not in connection with any disagreement with the Comp ...

... On August 19, 2016 (the “Effective Date”), Richard J. Ulevitch, Ph.D. submitted his resignation as a member of the board of directors of PhaseRx, Inc. (the “Company”), which resignation became effective immediately. Dr. Ulevitch’s resignation was not in connection with any disagreement with the Comp ...

Investment Portfolio

... • The gap between assets and liabilities - 2 If liabilities duration is longer than assets’, and if effective duration matters, the duration gap will cause HUGE under-reserve. • Derivative will help – for example, receive fixed IRS could extend assets duration • However, it, to certain extent, did n ...

... • The gap between assets and liabilities - 2 If liabilities duration is longer than assets’, and if effective duration matters, the duration gap will cause HUGE under-reserve. • Derivative will help – for example, receive fixed IRS could extend assets duration • However, it, to certain extent, did n ...

Slaid 1 - Incisive Media Plc

... We believe that… capital markets are not always efficient – especially in underdeveloped CEE region, even more so in Russia and in the CEE mid and small cap arena analyzing stocks by sectors rather than by countries provides better insight in our team we need sub-portfolio managers rather than ...

... We believe that… capital markets are not always efficient – especially in underdeveloped CEE region, even more so in Russia and in the CEE mid and small cap arena analyzing stocks by sectors rather than by countries provides better insight in our team we need sub-portfolio managers rather than ...

MANAGEMENT OF FUND IN SELECTED COUNTRIES Cont

... the resource fund alone; and the fund aims for a 4 percent real rate of return in the long run, based on a strategy of maximizing financial returns with moderate risk • Norway’s Central bank is charged with the responsibility of managing the fund and it also uses the services of external fund manage ...

... the resource fund alone; and the fund aims for a 4 percent real rate of return in the long run, based on a strategy of maximizing financial returns with moderate risk • Norway’s Central bank is charged with the responsibility of managing the fund and it also uses the services of external fund manage ...

CAF DIRECT INVESTMENT SERVICE CAF MANAGED PORTFOLIO

... management. Octopus does not provide investment advice. They design and manage the Investment profiles, and can provide ongoing portfolio management to ensure any assets entrusted to them match the profile you select to best meet your organisation’s requirement. If you invest in the CAF Managed Port ...

... management. Octopus does not provide investment advice. They design and manage the Investment profiles, and can provide ongoing portfolio management to ensure any assets entrusted to them match the profile you select to best meet your organisation’s requirement. If you invest in the CAF Managed Port ...

Your guide to investing for retirement with Fidelity Freedom® Index

... market funds seek to preserve the value of your investment at $1 per share, it is possible to lose money by investing in these funds. *This fund is not directly available to individual investors or retirement plans. In general, the bond market is volatile and bond funds entail interest rate risk (as ...

... market funds seek to preserve the value of your investment at $1 per share, it is possible to lose money by investing in these funds. *This fund is not directly available to individual investors or retirement plans. In general, the bond market is volatile and bond funds entail interest rate risk (as ...

Got a question on where to invest?

... yields will drive more inflows into high-yield funds. That said, our view is that the capital gain story for high yield has played out and 2010 offers coupon returns only. Furthermore, there is a supply wave coming. Specifically, the refinancing of lots of maturing LBO bank debt will keep high-yield ...

... yields will drive more inflows into high-yield funds. That said, our view is that the capital gain story for high yield has played out and 2010 offers coupon returns only. Furthermore, there is a supply wave coming. Specifically, the refinancing of lots of maturing LBO bank debt will keep high-yield ...

Market Effeciency

... Investment Funds (entire industry) appears better than they actually are Industry Indices ...

... Investment Funds (entire industry) appears better than they actually are Industry Indices ...

Why a new investment proposition?

... one requiring analysis before being recommended to our clients. - The increasing use of a wider range of asset classes that is now available under the UCITS III directive, which, whilst being of enormous benefit to investors, has added the complexity of asset allocation and rebalancing. - The consta ...

... one requiring analysis before being recommended to our clients. - The increasing use of a wider range of asset classes that is now available under the UCITS III directive, which, whilst being of enormous benefit to investors, has added the complexity of asset allocation and rebalancing. - The consta ...

Ironbark Waverton Concentrated Global Share Fund

... end of December and June. Distributions are calculated on the last day of each accounting period end (31 December and 30 June), and are normally paid to investors within 14 days of the period end. The Constitution allows up to two months from the end of the relevant distribution period. Subject to t ...

... end of December and June. Distributions are calculated on the last day of each accounting period end (31 December and 30 June), and are normally paid to investors within 14 days of the period end. The Constitution allows up to two months from the end of the relevant distribution period. Subject to t ...

Taiwanese Delegation to Nigeria - Nigeria Investment Promotion

... up a Venture Capital Scheme (VCS); which will promote, finance and develop industries in small scale sectors. It intends to route its various forms of assistance through the state-level institutions viz the banking ...

... up a Venture Capital Scheme (VCS); which will promote, finance and develop industries in small scale sectors. It intends to route its various forms of assistance through the state-level institutions viz the banking ...

Long-Term Investment Policy - American Speech

... Allowable Investments or Investment Managers. 2. The Investment Advisor shall meet as necessary with the ASHA Staff, but no less than quarterly, to review investment results and policy compliance as well as to share the capital markets outlook and other factors to be considered in achieving the Inve ...

... Allowable Investments or Investment Managers. 2. The Investment Advisor shall meet as necessary with the ASHA Staff, but no less than quarterly, to review investment results and policy compliance as well as to share the capital markets outlook and other factors to be considered in achieving the Inve ...

understanding stable value - Galliard Capital Management

... The underlying tier is typically comprised of a diversified portfolio of marketable fixed income securities whose market prices fluctuate (i.e. bonds). Galliard portfolios are broadly diversified by issue and issuer in order to reduce the impact of any one holding in the portfolio. WHAT TYPES OF FIX ...

... The underlying tier is typically comprised of a diversified portfolio of marketable fixed income securities whose market prices fluctuate (i.e. bonds). Galliard portfolios are broadly diversified by issue and issuer in order to reduce the impact of any one holding in the portfolio. WHAT TYPES OF FIX ...

A Guide to Irish Regulated Real Estate Funds

... flexibility in terms of investment and borrowing limits. However, a high minimum initial subscription requirement of Euro 250,000 per investor applies and investors must meet certain net worth tests. An individual investing into a QIF must have a minimum net worth of at least Euro 1.25 million (excl ...

... flexibility in terms of investment and borrowing limits. However, a high minimum initial subscription requirement of Euro 250,000 per investor applies and investors must meet certain net worth tests. An individual investing into a QIF must have a minimum net worth of at least Euro 1.25 million (excl ...

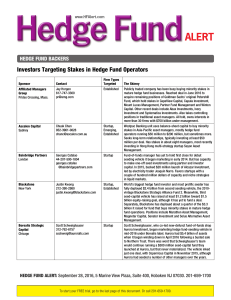

Hedge Fund Backers

... Management with $400 million, on condition that it raised at least that amount from other investors. Folger Hill launched in 2015 with $1 billion, but its assets had dropped to $750 million in mid-2016 due to weak performance. Leucadia also has backed Topwater Capital, which offers “first loss” seed ...

... Management with $400 million, on condition that it raised at least that amount from other investors. Folger Hill launched in 2015 with $1 billion, but its assets had dropped to $750 million in mid-2016 due to weak performance. Leucadia also has backed Topwater Capital, which offers “first loss” seed ...

Set 8 - Matt Will

... Index mutual funds attempt to track the market index It is difficult to track the Market index because the market index… • …pays no taxes • …incurs no transaction costs • …does not experience reinvestment risk ...

... Index mutual funds attempt to track the market index It is difficult to track the Market index because the market index… • …pays no taxes • …incurs no transaction costs • …does not experience reinvestment risk ...

Fact Sheet - ProShares

... The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or h ...

... The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or h ...