Statutory Issue Paper No. 81 Foreign Currency Transactions and

... operations in their statutory statements as if they were U.S. dollar denominated operations. This practice was established at a time when the Canadian and U.S. dollars were at or close to equivalent. The cost of translating each line item for immaterial Canadian operations is perceived to exceed the ...

... operations in their statutory statements as if they were U.S. dollar denominated operations. This practice was established at a time when the Canadian and U.S. dollars were at or close to equivalent. The cost of translating each line item for immaterial Canadian operations is perceived to exceed the ...

Foreign exchange rate

... direction of (T-G) • No strong relationship between NX and the other two balances individually. ...

... direction of (T-G) • No strong relationship between NX and the other two balances individually. ...

No Slide Title

... • A depreciation (fall) in the U.S. real exchange rate means that U.S. goods have become cheaper relative to foreign goods. • This encourages consumers both at home and abroad to buy more U.S. goods and fewer goods from other countries. • As a result, U.S. exports rise, and U.S. imports ...

... • A depreciation (fall) in the U.S. real exchange rate means that U.S. goods have become cheaper relative to foreign goods. • This encourages consumers both at home and abroad to buy more U.S. goods and fewer goods from other countries. • As a result, U.S. exports rise, and U.S. imports ...

Central Banking

... • When many depositors run into a bank at the same time to get their money out, we call that a bank run. • When a bank run that begins at one bank spreads to other banks and causes people to generally distrust banks, we call that a bank panic.” ...

... • When many depositors run into a bank at the same time to get their money out, we call that a bank run. • When a bank run that begins at one bank spreads to other banks and causes people to generally distrust banks, we call that a bank panic.” ...

Early federal banks: Bank of N. America

... decreases. There are all kinds of evidence of this in Japan.” --William R. White, 21 July 2014 ...

... decreases. There are all kinds of evidence of this in Japan.” --William R. White, 21 July 2014 ...

CHAPTER 2 SUGGESTED ANSWERS TO CHAPTER 2 QUESTIONS

... factor is also relevant here. Lower deficits owing to a reduction in spending would convince foreigners that the chances for future inflation in the U.S. had decreased. This would make dollar investments look even better, further strengthening the dollar. As mentioned in the text, if high government ...

... factor is also relevant here. Lower deficits owing to a reduction in spending would convince foreigners that the chances for future inflation in the U.S. had decreased. This would make dollar investments look even better, further strengthening the dollar. As mentioned in the text, if high government ...

The Price of Gold and the Exchange Rates

... The main objective of this paper, as in a previous one, is to identify the effect of major currency exchange rates on the prices of internationally traded commodities.1 For commodities that are traded continuously in organized markets such as the Chicago Board of Trade, a change in any exchange rat ...

... The main objective of this paper, as in a previous one, is to identify the effect of major currency exchange rates on the prices of internationally traded commodities.1 For commodities that are traded continuously in organized markets such as the Chicago Board of Trade, a change in any exchange rat ...

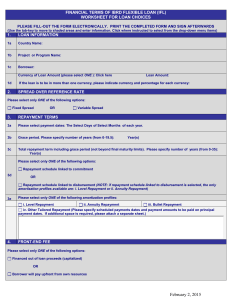

English - World Bank Treasury

... Amount (minimum of USD 3m dollars or 10% of the Loan, whichever is higher) NOTE: The ARF option by amount is not available for IFLs with repayment schedule linked to disbursement. ...

... Amount (minimum of USD 3m dollars or 10% of the Loan, whichever is higher) NOTE: The ARF option by amount is not available for IFLs with repayment schedule linked to disbursement. ...

Chapter No. 6

... Foreign Exchange II • Appreciation: a currency rises in value relative to another currency • Depreciation: a currency falls in value relative to another currency • When a country’s currency appreciates, the country’s goods abroad become more expensive and foreign goods in that country become less e ...

... Foreign Exchange II • Appreciation: a currency rises in value relative to another currency • Depreciation: a currency falls in value relative to another currency • When a country’s currency appreciates, the country’s goods abroad become more expensive and foreign goods in that country become less e ...

Distinguished Lecture on Economics in Government Exchange rate

... Emerging countries are not wiling to allow their exchange rates to float Most policy makers are concerned with the behavior of the nominal and the real exchange rates Changes in the nominal exchange rate affects inflation rate Changes in the real exchange rate affects the wealth of domestic citizens ...

... Emerging countries are not wiling to allow their exchange rates to float Most policy makers are concerned with the behavior of the nominal and the real exchange rates Changes in the nominal exchange rate affects inflation rate Changes in the real exchange rate affects the wealth of domestic citizens ...

SNA1993 Treatment for Monetary Gold

... SNA1993 standards SNA2008 changes Table showing current format SDR allocations and holdings SNA1993 standards SNA2008 changes Table showing current format ...

... SNA1993 standards SNA2008 changes Table showing current format SDR allocations and holdings SNA1993 standards SNA2008 changes Table showing current format ...

The Federal Reserve System and Its Tools

... requirement as an instrument of monetary policy? Changes in the required reserve ratio cause radical or strong changes in the monetary system. It is difficult for financial institutions to adjust to changes in the required reserve ratio. In general, the Fed uses the tools of monetary policy to adjus ...

... requirement as an instrument of monetary policy? Changes in the required reserve ratio cause radical or strong changes in the monetary system. It is difficult for financial institutions to adjust to changes in the required reserve ratio. In general, the Fed uses the tools of monetary policy to adjus ...

exchange rate

... – Makes imports more expensive – Makes exports more affordable Currency appreciation ...

... – Makes imports more expensive – Makes exports more affordable Currency appreciation ...

Financial-Institutions-Markets-and-Money-10th-Edition

... Compare and contrast the “tools of monetary policy” in terms of their relative usefulness. Answer: The discount rate and reserve requirements are both original design features of the Fed; open market operations have evolved as the FOMC has evolved. The discount rate was originally a direct control o ...

... Compare and contrast the “tools of monetary policy” in terms of their relative usefulness. Answer: The discount rate and reserve requirements are both original design features of the Fed; open market operations have evolved as the FOMC has evolved. The discount rate was originally a direct control o ...

Spot Market

... • Suppose in 1996 the British CPI was 156.4 and the US CPI was 154.7. In 2000, the CPI’s were 170.5 and 172.7 respectively. • Based on this, British prices rose 9.0 percent while US prices rose 11.6 percent, a 2.6 difference. • Since the prices of British goods and services rose slower than the pric ...

... • Suppose in 1996 the British CPI was 156.4 and the US CPI was 154.7. In 2000, the CPI’s were 170.5 and 172.7 respectively. • Based on this, British prices rose 9.0 percent while US prices rose 11.6 percent, a 2.6 difference. • Since the prices of British goods and services rose slower than the pric ...

Chap07

... Three Tools of Federal Reserve Monetary Policy (continued) 2. Open market operations affect the level of member bank reserves and the monetary base. – Buying government securities from the private sector, the Fed eventually credits member bank deposits, thus increasing the level of bank reserves an ...

... Three Tools of Federal Reserve Monetary Policy (continued) 2. Open market operations affect the level of member bank reserves and the monetary base. – Buying government securities from the private sector, the Fed eventually credits member bank deposits, thus increasing the level of bank reserves an ...

monetary policy

... the Federal Reserve. The interest rate at which banks can borrow money from the Fed is called the discount rate. ...

... the Federal Reserve. The interest rate at which banks can borrow money from the Fed is called the discount rate. ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.